Nebraska Self-Employed Ceiling Installation Contract

Description

How to fill out Self-Employed Ceiling Installation Contract?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates you can download or print.

By using the site, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can discover the latest versions of forms like the Nebraska Self-Employed Ceiling Installation Contract in moments.

If you already have a subscription, Log In and download the Nebraska Self-Employed Ceiling Installation Contract from the US Legal Forms library. The Download option will appear on each form you view. You have access to all previously saved forms in the My documents tab of your account.

Complete the payment. Use your Visa or Mastercard or PayPal account to finish the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the saved Nebraska Self-Employed Ceiling Installation Contract. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another version, just go to the My documents section and click on the form you need. Access the Nebraska Self-Employed Ceiling Installation Contract with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/region.

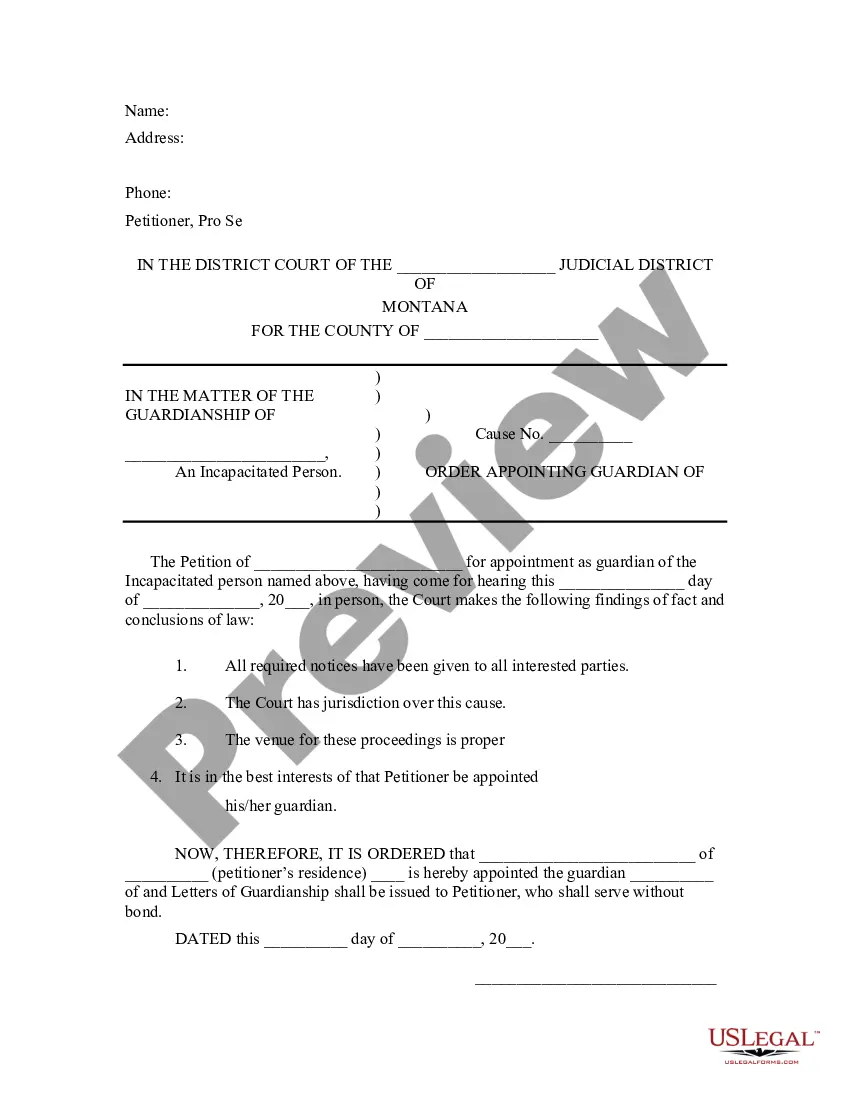

- Click the Preview option to review the form's details.

- Examine the form summary to verify that you have chosen the correct form.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Yes, in Nebraska, installation labor is generally subject to sales tax. When you perform work under a Nebraska Self-Employed Ceiling Installation Contract, it's important to understand how tax applies to your services. Consulting with a tax professional or using platforms like UsLegalForms can help clarify your tax obligations and keep you compliant.

In Nebraska, handymen do not always need a license, but this can vary by city or county. Some areas may require handymen to obtain a contractor's license, especially for larger projects. If your work falls under a Nebraska Self-Employed Ceiling Installation Contract, make sure to research local regulations to ensure compliance.

Yes, contractors in Nebraska typically need to be licensed, depending on the type of work they perform. General contractors must obtain a license from the state, while specialized contractors may have specific requirements. If you are entering into a Nebraska Self-Employed Ceiling Installation Contract, it's wise to verify that you meet all licensing requirements to ensure a smooth project.

In Nebraska, roofing contractors do not need a specific roofing license. However, they must comply with local regulations and obtain necessary permits for roofing projects. If you are completing a Nebraska Self-Employed Ceiling Installation Contract, ensure that you check local requirements to avoid any issues.

Creating an independent contractor agreement is essential for outlining the relationship between you and your contractor. Start by clearly defining the scope of work, payment terms, and deadlines. You can utilize a Nebraska Self-Employed Ceiling Installation Contract template from US Legal Forms, which simplifies the process and ensures you include all necessary legal elements. This approach not only protects your interests but also fosters clear communication with your contractor.

Nebraska does not universally require a contractor license, but some specific trades may have licensing requirements. It’s crucial to verify local laws and regulations related to your specific services. Using a Nebraska Self-Employed Ceiling Installation Contract can help clarify your role and responsibilities with clients, regardless of licensing status.

Establishing yourself as an independent contractor involves building a strong portfolio, networking, and marketing your services effectively. Start by showcasing your previous work and collecting testimonials from satisfied clients. A Nebraska Self-Employed Ceiling Installation Contract can serve as a valuable tool to communicate your professionalism and commitment to quality.

Choosing between an LLC and working as an independent contractor depends on your business goals and risk tolerance. An LLC offers personal liability protection and can help with tax flexibility, while being an independent contractor may be simpler and less expensive to maintain. If you plan to use a Nebraska Self-Employed Ceiling Installation Contract, you can still enjoy the benefits of both structures.

In Nebraska, some contracting work does not require a license, but specific projects may have different rules. For ceiling installation, it's essential to check local regulations to see if a license is necessary. Using a Nebraska Self-Employed Ceiling Installation Contract can help outline your responsibilities and protect your rights, regardless of licensing requirements.

To become an independent contractor in Nebraska, start by defining your services and determining your target market. Next, register your business with the state and obtain any necessary permits. Consider using a Nebraska Self-Employed Ceiling Installation Contract to formalize your agreements with clients, ensuring clear expectations and legal protection.