Nebraska Self-Employed Wait Staff Services Contract

Description

How to fill out Self-Employed Wait Staff Services Contract?

If you wish to obtain, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search feature to find the documents you require.

Numerous templates for business and personal use are organized by categories and states, or keywords. Use US Legal Forms to acquire the Nebraska Self-Employed Wait Staff Services Contract in just a few clicks.

Step 6. Choose the format of your legal form and download it to your device.

Step 7. Complete, modify, and print or sign the Nebraska Self-Employed Wait Staff Services Contract. Each legal document template you purchase is yours permanently. You have access to every form you saved in your account. Click on the My documents section and select a form to print or download again. Complete and download, and print the Nebraska Self-Employed Wait Staff Services Contract with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to receive the Nebraska Self-Employed Wait Staff Services Contract.

- You can also access templates you previously saved under the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

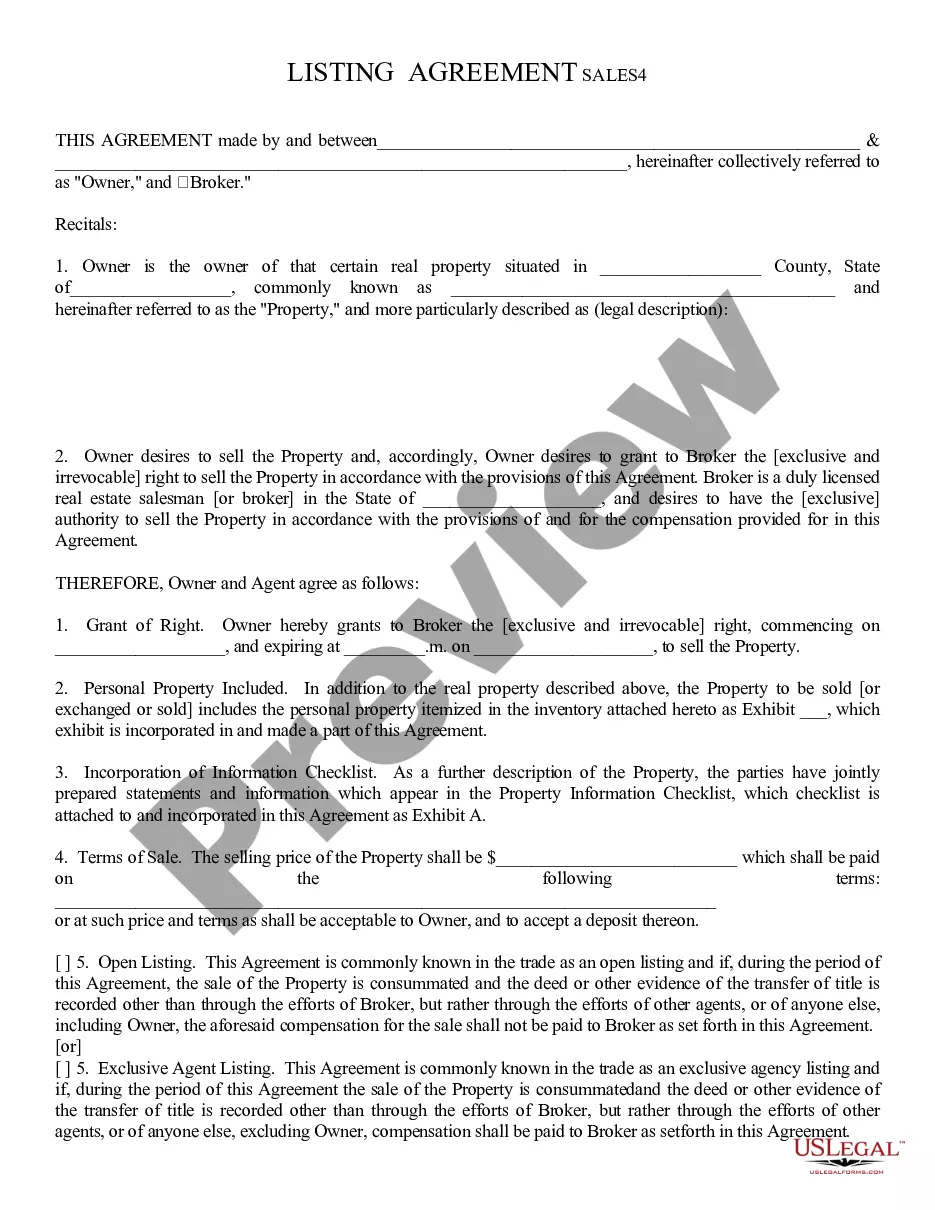

- Step 2. Use the Preview option to review the form's contents. Don't forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Download now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the payment. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

Form popularity

FAQ

To get authorized to perform services as an independent contractor in the US, you first need to determine your business structure and register it as necessary. Next, you should obtain any required licenses or permits specific to your state and industry. For those in Nebraska, using a Nebraska Self-Employed Wait Staff Services Contract can help clarify your relationship with clients and outline your responsibilities. Finally, consider consulting legal resources like USLegalForms to ensure you meet all regulatory requirements.

You can write your own legally binding contract as long as it meets all legal requirements. For a Nebraska Self-Employed Wait Staff Services Contract, ensure that both parties agree to the terms and that the contract includes essential elements such as signatures, dates, and clear terms of service. Consulting resources or legal platforms can enhance the contract’s validity.

Filling out an employment agreement form requires careful attention to detail. First, ensure you correctly enter names, addresses, and job titles. In a Nebraska Self-Employed Wait Staff Services Contract, include specific terms regarding duties and payment methods. Platforms like uslegalforms offer user-friendly formats that guide you through this process.

To write a self-employment contract, start by detailing the services you will provide and the compensation structure. A Nebraska Self-Employed Wait Staff Services Contract should also include confidentiality agreements and liability clauses, which protect both you and your client. Utilizing templates on uslegalforms can streamline this process and ensure you cover all essential points.

When writing a contract for a 1099 employee, it’s important to specify the nature of the work, payment terms, and any deadlines. In a Nebraska Self-Employed Wait Staff Services Contract, clarify that the worker is not an employee but an independent contractor. This distinction helps avoid potential legal issues related to employment classification.

To write a self-employed contract, start by clearly defining the scope of work, payment terms, and duration of the agreement. Include clauses that outline responsibilities and expectations for both parties, particularly in a Nebraska Self-Employed Wait Staff Services Contract. Using templates from platforms like uslegalforms can simplify the process and ensure you include all vital elements.

Yes, you can write your own employment contract. However, when creating a Nebraska Self-Employed Wait Staff Services Contract, it is essential to ensure that it includes all necessary terms and complies with local laws. This approach allows you to tailor the contract to meet your specific needs and expectations, but consider consulting a legal expert for guidance.

The three main rules in contract law include offer, acceptance, and consideration. First, one party must make a clear offer, which the other party can accept. Next, acceptance must be communicated and match the terms of the offer. Lastly, consideration is necessary, meaning something of value must be exchanged. When drafting a Nebraska Self-Employed Wait Staff Services Contract, adhering to these rules helps ensure your agreement is enforceable.

To become an independent contractor in Nebraska, you should start by registering your business name and obtaining any necessary licenses or permits. Understanding the specifics of a Nebraska Self-Employed Wait Staff Services Contract is also crucial, as it outlines your responsibilities and rights. You can then set your rates and market your services to potential clients. Lastly, consider utilizing platforms like USLegalForms to access templates and resources that simplify the process.

For a Nebraska Self-Employed Wait Staff Services Contract to be considered valid, it must meet five essential requirements. First, both parties must have the legal capacity to enter into the agreement. Second, there must be mutual consent, meaning both parties agree on the terms. Third, the contract must have a lawful object, ensuring it is legal and ethical. Fourth, there must be consideration, which refers to something of value exchanged between the parties. Finally, the contract should be in writing if it falls under the Statute of Frauds.