Nebraska Catering Services Contract - Self-Employed Independent Contractor

Description

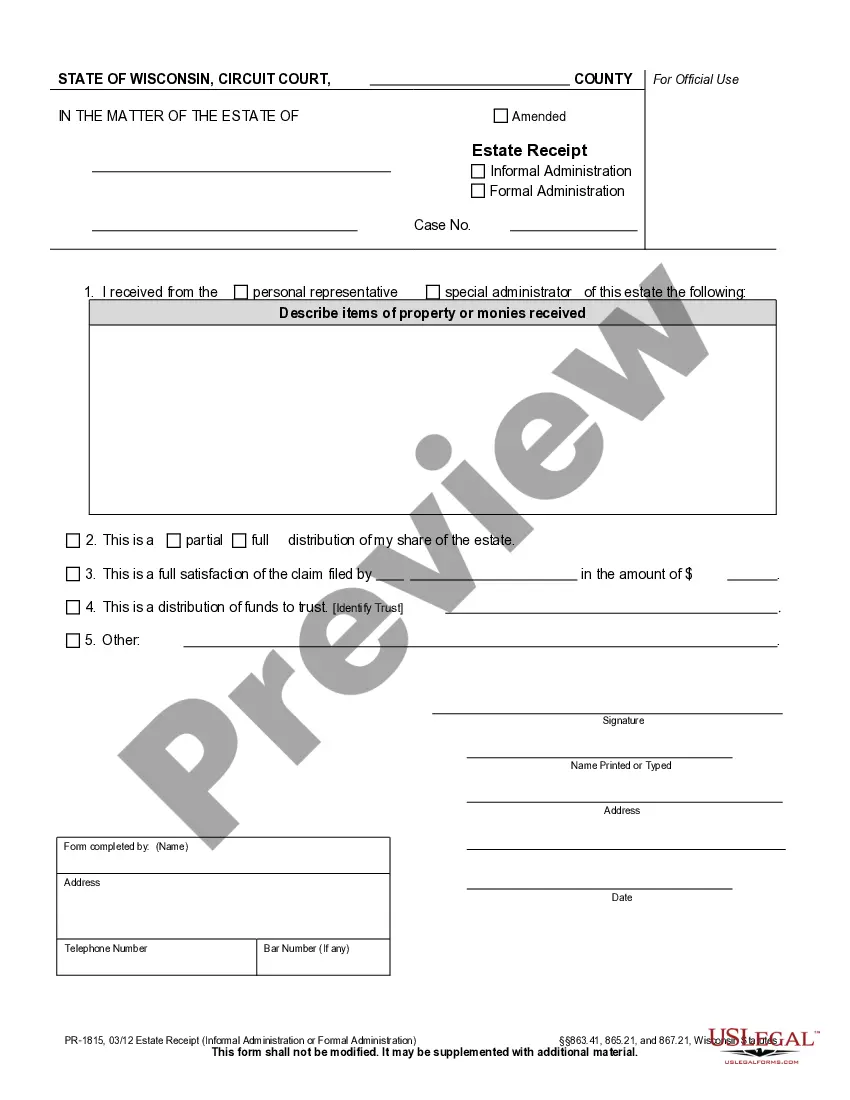

How to fill out Catering Services Contract - Self-Employed Independent Contractor?

You can spend several hours online searching for the legal document format that matches the state and federal criteria you need.

US Legal Forms offers thousands of legal forms that have been evaluated by professionals.

You can conveniently acquire or print the Nebraska Catering Services Contract - Self-Employed Independent Contractor from the service.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Nebraska Catering Services Contract - Self-Employed Independent Contractor.

- Every legal document format you obtain is yours indefinitely.

- To get an additional copy of a purchased form, visit the My documents tab and click the relevant button.

- In case you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the county/city of your choice.

Form popularity

FAQ

To write an independent contractor agreement, begin by outlining the basic information, including the contractor's and client’s names and contact details. Define the specifics of the work, payment structure, deadlines, and other terms. Special clauses, such as confidentiality and indemnification, may enhance the agreement’s effectiveness. Using a Nebraska Catering Services Contract - Self-Employed Independent Contractor can help you cover all necessary areas and protect both parties' interests.

Filling out an independent contractor form involves providing personal and business information, such as your name, address, and Social Security number. You will also need to describe the nature of your work and the compensation terms. Ensuring clarity in these details helps set expectations. Consider using a Nebraska Catering Services Contract - Self-Employed Independent Contractor to cover all key aspects clearly, and make the process smoother.

To fill out an independent contractor agreement, start by inserting the names and addresses of both the contractor and the client. Next, detail the scope of work, payment terms, and deadlines. Be sure to include both parties' signatures at the end to validate the agreement. Utilizing a Nebraska Catering Services Contract - Self-Employed Independent Contractor can streamline this process and ensure all necessary elements are included.

An independent contractor typically fills out a W-9 form to provide their taxpayer identification information to the hiring party. This form is essential for tax reporting purposes. Additionally, depending on the specific services, a Nebraska Catering Services Contract - Self-Employed Independent Contractor can be beneficial in outlining the agreement between the parties. Always check local requirements to ensure compliance.

To write a self-employed contract, begin by clearly identifying the parties involved, including names and contact information. Next, describe the services to be provided, along with the payment terms and schedule. Incorporate important clauses, such as the duration of the contract and conditions for termination. Using a Nebraska Catering Services Contract - Self-Employed Independent Contractor template can simplify this process.

Absolutely, having a contract is vital for independent contractors. A Nebraska Catering Services Contract - Self-Employed Independent Contractor lays out the terms of your engagement, helping prevent misunderstandings. It acts as a safety net for your rights, ensuring that both you and your client know what to expect from the business relationship.

If you find yourself working without a contract, your rights can become unclear. You may still have some legal protections under state law, but proving your claims without a document like the Nebraska Catering Services Contract - Self-Employed Independent Contractor can be challenging. To avoid confusion, it’s best to formalize your agreements through a written contract.

Yes, having a contract is crucial when you are self-employed. A Nebraska Catering Services Contract - Self-Employed Independent Contractor outlines the specifics of your arrangement with your client, ensuring both parties are clear about their obligations. This legal document helps safeguard your interests and provides a reference point should any disagreements arise.

Technically, you can receive a 1099 without a formal contract, but it is not advisable. A well-drafted Nebraska Catering Services Contract - Self-Employed Independent Contractor clarifies the terms of your work, payment expectations, and other legal protections. Not having a contract can lead to misunderstandings and potential disputes with clients.

To operate as a self-employed independent contractor in Nebraska, you must comply with various legal requirements. Generally, you need to register your business, obtain valid permits or licenses, and report your income accurately for tax purposes. It’s essential to have a clear understanding of the Nebraska Catering Services Contract - Self-Employed Independent Contractor to protect your rights and ensure compliance with state laws.