Nebraska Appraisal Agreement - Self-Employed Independent Contractor

Description

How to fill out Appraisal Agreement - Self-Employed Independent Contractor?

You may commit hrs on-line looking for the legitimate document web template that suits the federal and state requirements you require. US Legal Forms offers 1000s of legitimate forms which are analyzed by professionals. It is possible to down load or print out the Nebraska Appraisal Agreement - Self-Employed Independent Contractor from our services.

If you currently have a US Legal Forms bank account, you are able to log in and click the Acquire switch. After that, you are able to full, modify, print out, or indicator the Nebraska Appraisal Agreement - Self-Employed Independent Contractor. Every single legitimate document web template you purchase is your own permanently. To obtain yet another backup for any bought kind, go to the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms site for the first time, adhere to the straightforward directions under:

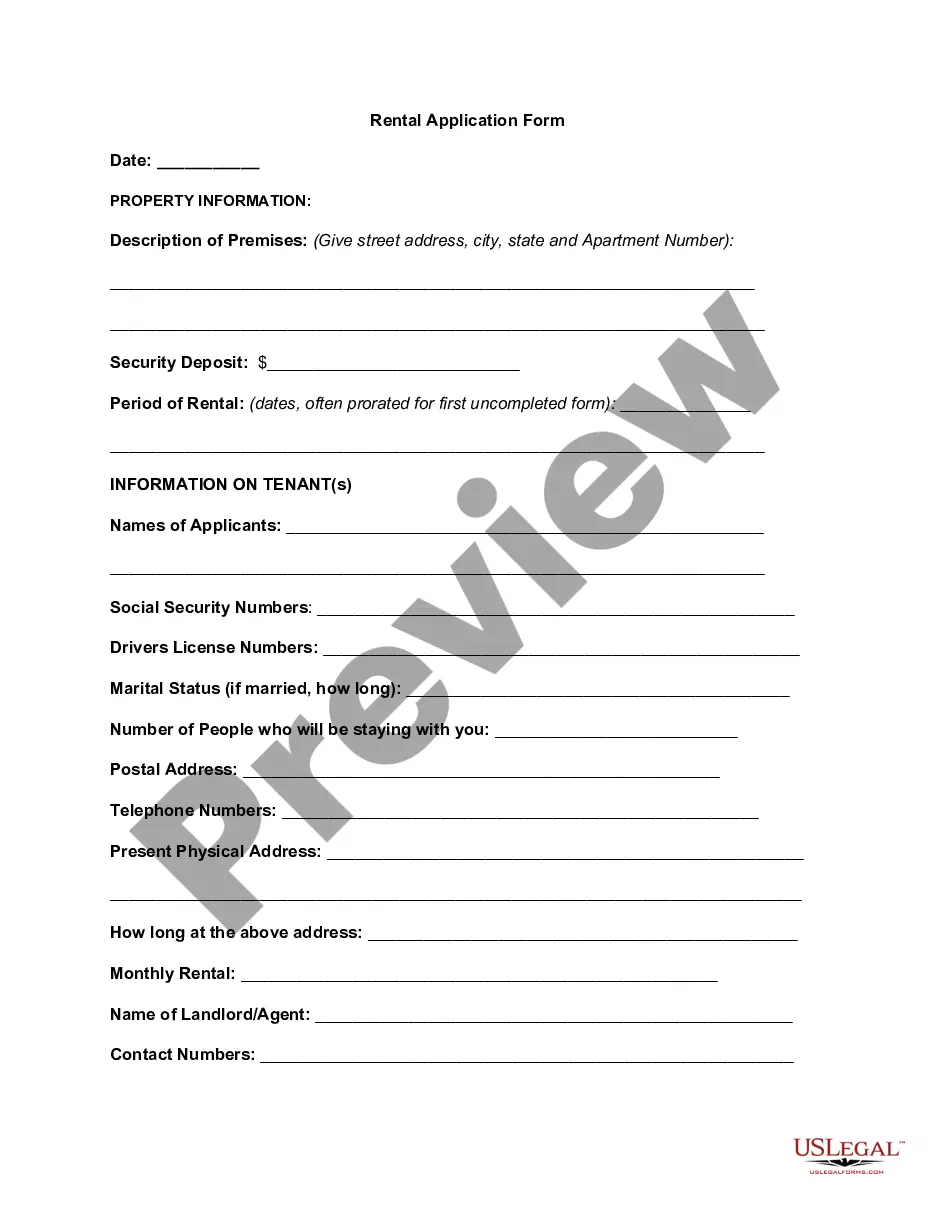

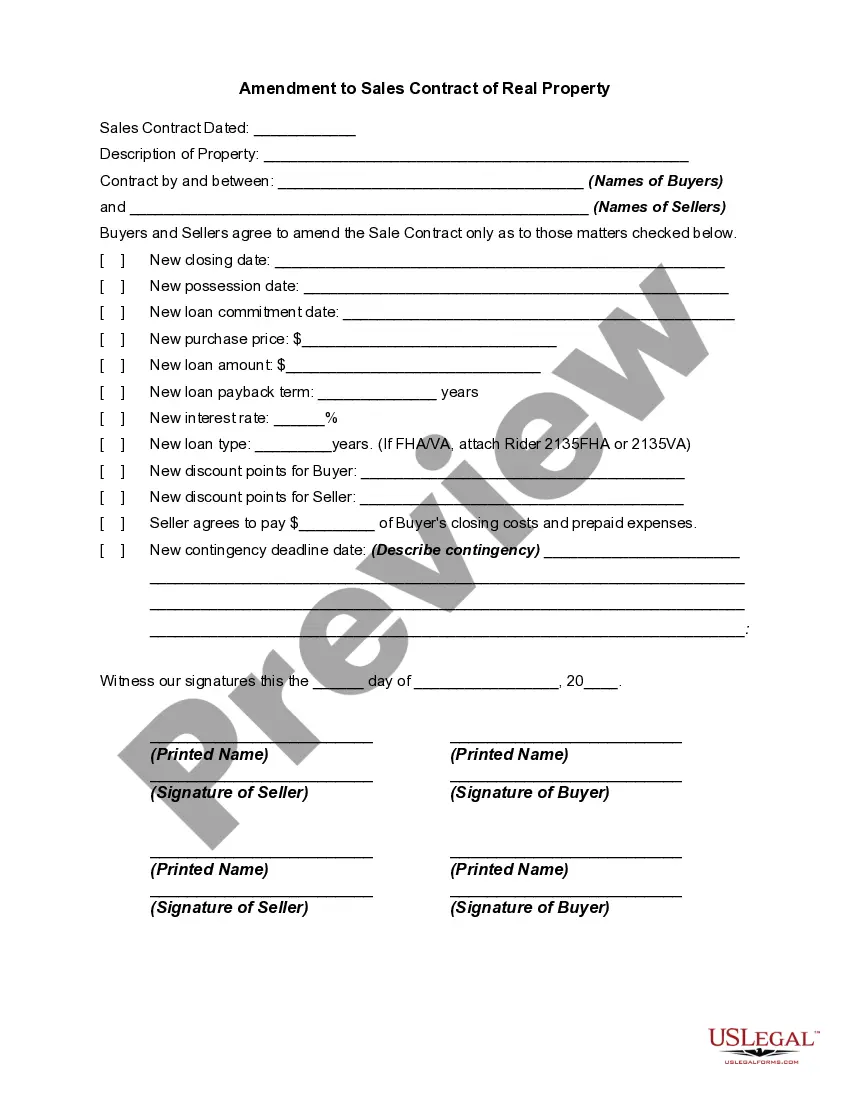

- Initially, be sure that you have chosen the best document web template for your county/city that you pick. Read the kind description to make sure you have chosen the right kind. If offered, make use of the Preview switch to appear through the document web template as well.

- If you want to find yet another model of your kind, make use of the Search field to discover the web template that fits your needs and requirements.

- After you have discovered the web template you want, just click Acquire now to continue.

- Find the rates program you want, key in your credentials, and register for an account on US Legal Forms.

- Total the purchase. You should use your Visa or Mastercard or PayPal bank account to cover the legitimate kind.

- Find the formatting of your document and down load it to the system.

- Make changes to the document if needed. You may full, modify and indicator and print out Nebraska Appraisal Agreement - Self-Employed Independent Contractor.

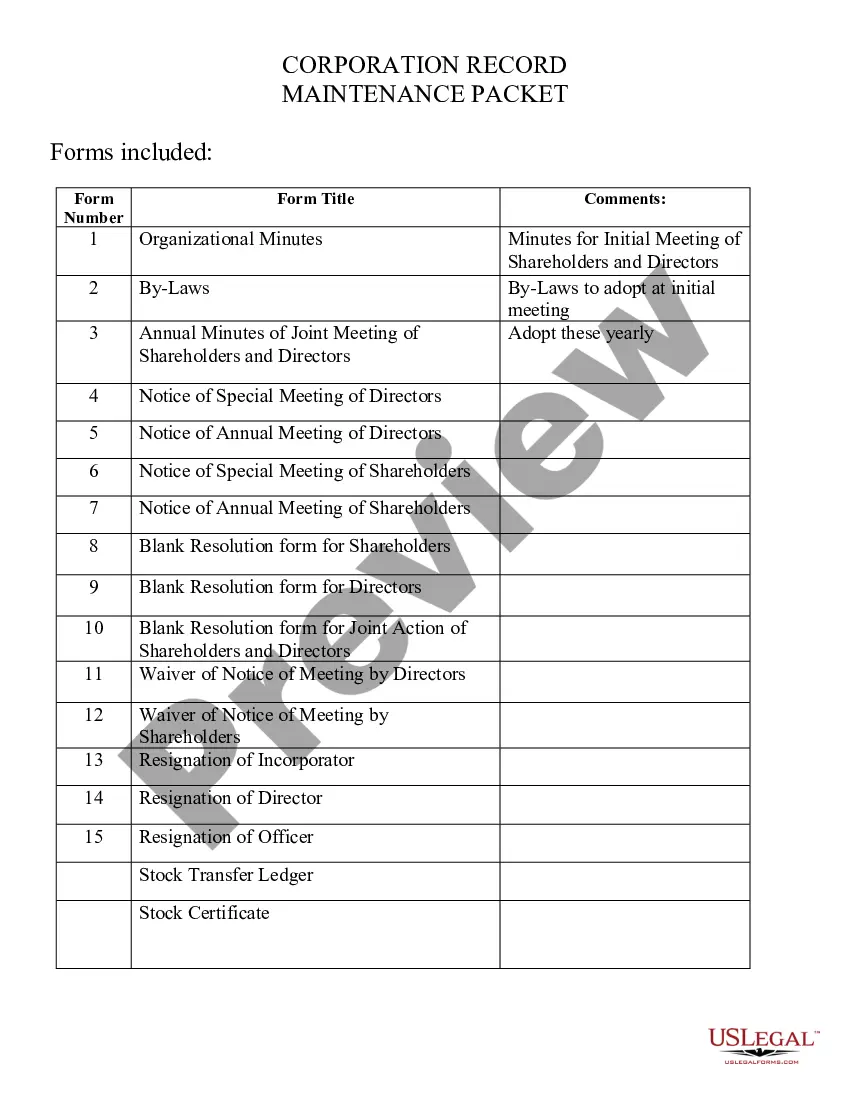

Acquire and print out 1000s of document templates utilizing the US Legal Forms web site, that provides the biggest assortment of legitimate forms. Use expert and status-particular templates to take on your small business or person requirements.

Form popularity

FAQ

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Tests for Independent Contractor StatusThe degree of control. Courts focus on the degree of control the company has over the worker performing the service.The relative investment in facilities.The worker's opportunity for profit and loss.The permanency of the parties' relationship.The skill required.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Upon hiring, HR should make sure the company has a W-9 on file for every independent contractor. The form should be collected at the beginning of the contract. Additionally, independent contractors should take care of invoicing for all services. HR should guarantee this statement is listed in the written contract.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

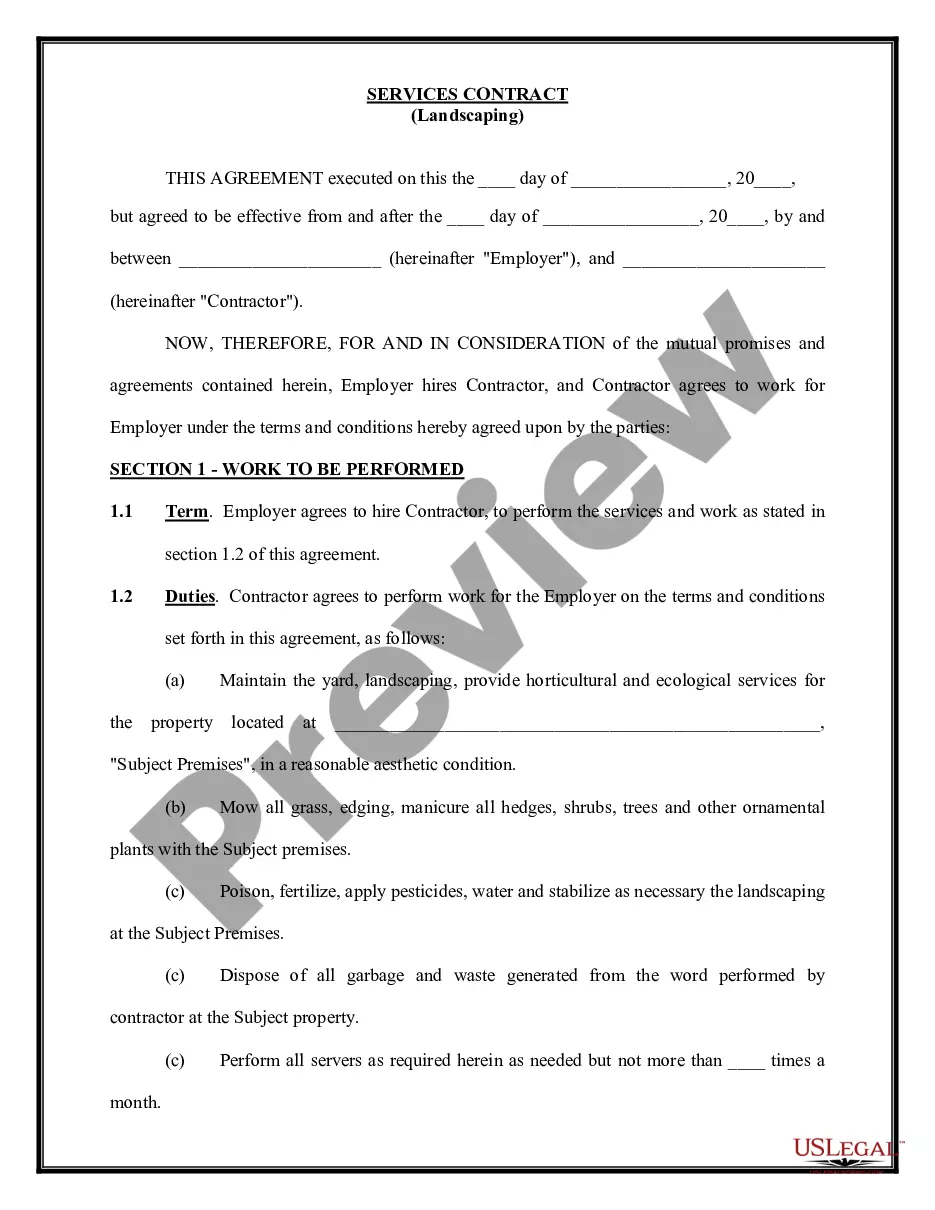

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Under no circumstances should an employer use its employee performance review process to evaluate the work done by an independent contractor. It is also advisable to require independent contrac-tors to provide periodic progress reports and to submit regular invoices as defined tar-gets are met.

Why or why not? Perlman When dealing with independent contractors, companies shouldn't discipline them the same way they would an employee. Instead, the remedy for an independent contractor not complying with company expectations is to terminate or consider terminating the contract.

Final Thoughts. Performance reviews are not only helpful for facilities managers, but they are also useful tools for contractors. Contractors want to be able to provide the best service possible, since this is how they win and retain business.