Nebraska Campaign Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Campaign Worker Agreement - Self-Employed Independent Contractor?

It is feasible to spend hours online trying to locate the valid document template that satisfies the federal and state requirements you need.

US Legal Forms provides thousands of valid templates that are assessed by experts.

You can download or print the Nebraska Campaign Worker Agreement - Self-Employed Independent Contractor from our service.

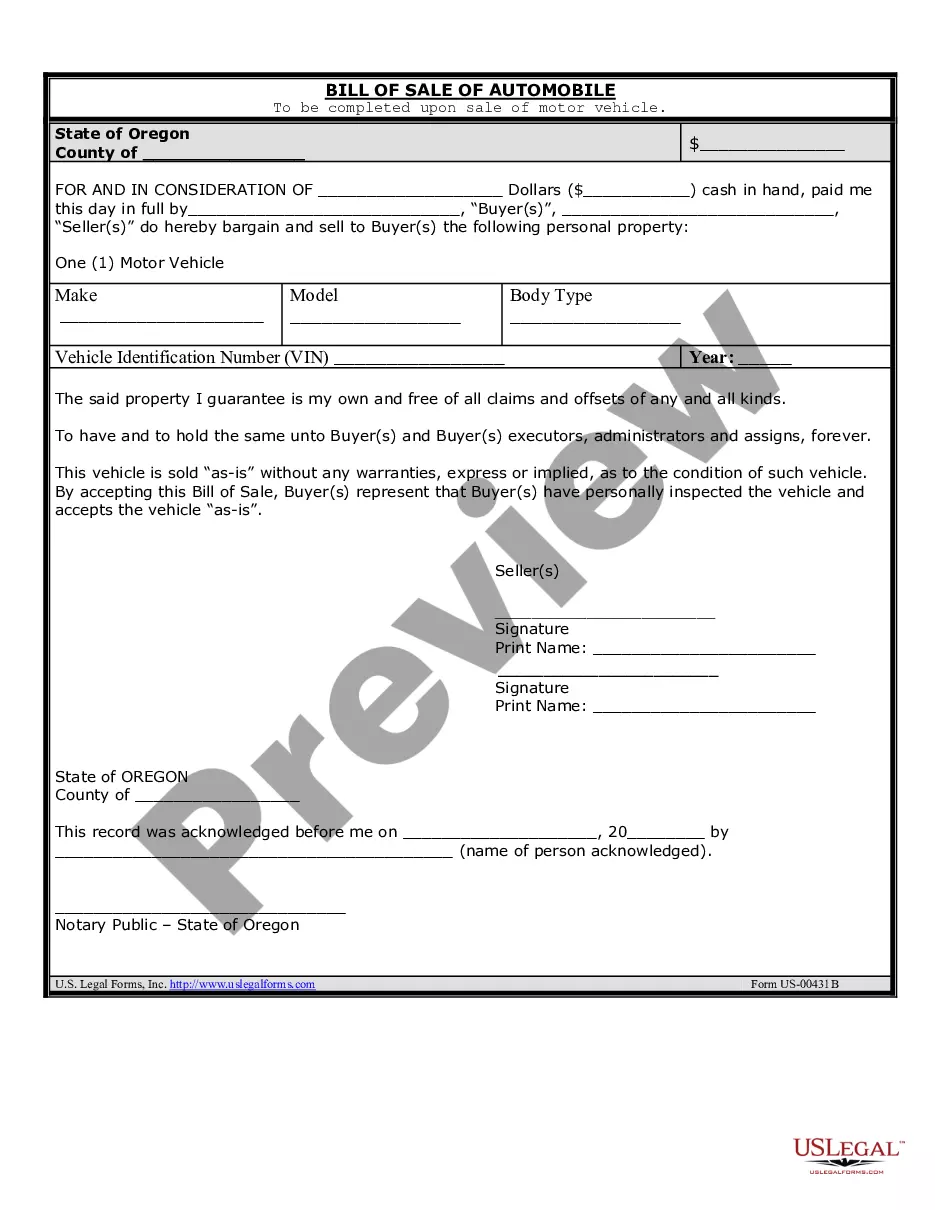

If available, use the Preview button to view the document template as well. If you need to obtain another version of your form, utilize the Search field to find the template that fulfills your needs and requirements. Once you have found the template you desire, click on Obtain now to proceed. Select the pricing plan you prefer, enter your credentials, and register for your account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the valid form. Choose the format of your document and download it to your device. Make edits to your document if possible. You can complete, modify, sign, and print the Nebraska Campaign Worker Agreement - Self-Employed Independent Contractor. Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest collection of valid templates. Utilize professional and state-specific templates to manage your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and select the Obtain button.

- Afterward, you can complete, modify, print, or sign the Nebraska Campaign Worker Agreement - Self-Employed Independent Contractor.

- Every valid document template you acquire belongs to you indefinitely.

- To obtain an additional copy of a purchased form, go to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Check the form description to confirm you have selected the right one.

Form popularity

FAQ

To create an effective independent contractor agreement, start by gathering key details about the work arrangement. Clearly define the scope of work, payment terms, and the responsibilities of each party. Using a Nebraska Campaign Worker Agreement - Self-Employed Independent Contractor template can simplify this process, ensuring you include all necessary elements. Additionally, consider utilizing platforms like USLegalForms, which offer customizable templates to help you create a solid agreement tailored to your needs.

Independent contractors typically do not qualify for workers' compensation like traditional employees do. However, it is possible to obtain coverage, but this often depends on the specific terms of your agreement and the nature of the work. If you're navigating these waters, consider reviewing a Nebraska Campaign Worker Agreement - Self-Employed Independent Contractor through platforms like uslegalforms to explore your options.

Being self-employed generally means you work for yourself rather than for an employer. Key indicators include running your own business, managing your own finances, and earning income on your terms. If you’re considering a Nebraska Campaign Worker Agreement - Self-Employed Independent Contractor, ensure you understand the qualifications that set you apart from traditional employment.

The terms self-employed and independent contractor are often interchangeable, but they can imply different contexts. 'Self-employed' refers to broader ownership of one’s work, while 'independent contractor' specifies a type of arrangement under a contract. Choosing the right term depends on your business structure and the nature of agreements like a Nebraska Campaign Worker Agreement - Self-Employed Independent Contractor.

Receiving a 1099 form usually indicates that you are self-employed, specifically if it represents income earned as an independent contractor. This tax form differentiates you from traditional employees who receive a W-2. Thus, if you receive a 1099, you are likely working under a Nebraska Campaign Worker Agreement - Self-Employed Independent Contractor. It's important to manage your finances accordingly.

Yes, an independent contractor is indeed considered self-employed. They manage their own taxes, business expenses, and financial responsibilities. This classification provides a level of autonomy that many find appealing. When you’re considering a Nebraska Campaign Worker Agreement - Self-Employed Independent Contractor, it’s crucial to understand your role within this framework.

employed person can absolutely have a contract. In fact, having a written agreement is beneficial as it outlines the terms of the work, payment, and other important details. A Nebraska Campaign Worker Agreement SelfEmployed Independent Contractor serves as a clear framework that protects both the worker and the client. Therefore, make sure to have a solid contract in place.

Yes, an independent contractor is considered self-employed. They operate their own businesses and provide services to clients without an employer-employee relationship. This status allows for greater flexibility and control over their work and financial decisions. Understanding your status is essential when drafting a Nebraska Campaign Worker Agreement - Self-Employed Independent Contractor.

Writing an independent contractor agreement involves outlining the services you will provide, payment terms, and the duration of the engagement. Start with a clear introduction and then specify the parties involved, referencing the Nebraska Campaign Worker Agreement - Self-Employed Independent Contractor as a guideline. Make sure to conclude with a signature line for both parties, which solidifies the agreement legally.

When completing an independent contractor agreement, you should include specific details such as the scope of work, payment terms, and timelines. Ensure that you reference the Nebraska Campaign Worker Agreement - Self-Employed Independent Contractor to align with local regulations. This agreement acts as a legal safeguard for both parties, enhancing clarity and reducing potential disputes.