Nebraska Underwriter Agreement - Self-Employed Independent Contractor

Description

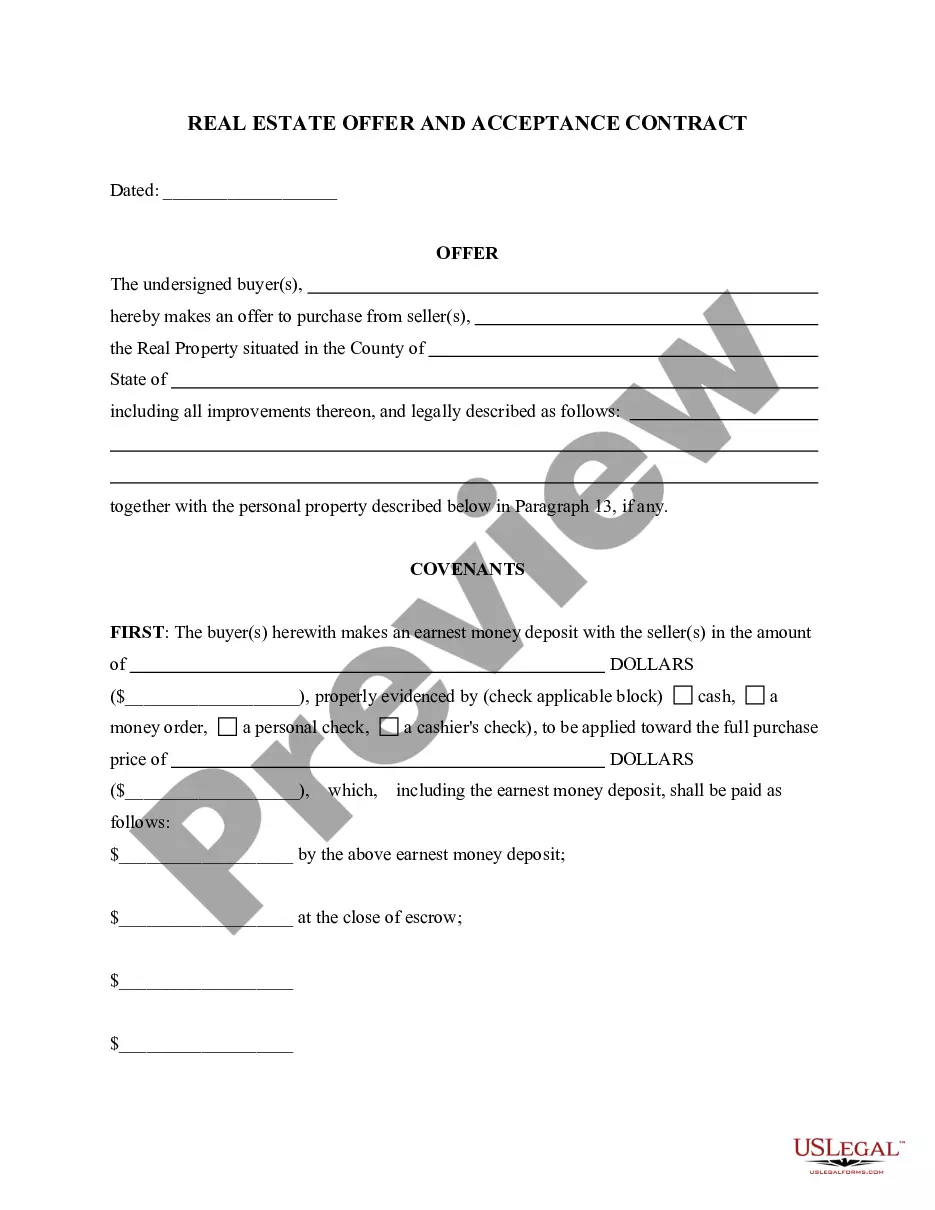

How to fill out Underwriter Agreement - Self-Employed Independent Contractor?

You can dedicate several hours online searching for the appropriate legal document template that meets the federal and state specifications you need. US Legal Forms provides a wide array of legal forms that are reviewed by professionals.

It is easy to download or print the Nebraska Underwriter Agreement - Self-Employed Independent Contractor from the service. If you already possess a US Legal Forms account, you can Log In and click the Download button. Afterwards, you can complete, modify, print, or sign the Nebraska Underwriter Agreement - Self-Employed Independent Contractor.

Every legal document template you receive is yours permanently. To obtain an additional copy of the purchased form, go to the My documents tab and click the corresponding button. If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

Select the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, alter, sign, and print the Nebraska Underwriter Agreement - Self-Employed Independent Contractor. Download and print numerous document layouts using the US Legal Forms Website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- First, ensure that you have selected the correct document template for your county/town of choice.

- Examine the form description to confirm you have chosen the right form.

- If available, use the Review button to view the document template as well.

- To find another version of the form, use the Search area to locate the template that meets your needs and requirements.

- Once you have found the template you want, click on Acquire now to proceed.

- Choose the pricing plan you want, enter your details, and create an account on US Legal Forms.

- Complete the transaction. You can utilize your Visa or Mastercard or PayPal account to purchase the legal form.

Form popularity

FAQ

Filling out a declaration of independent contractor status form involves several key steps. Begin by providing your personal details, including your name and contact information. Next, clearly state your classification as a self-employed independent contractor and reference the Nebraska Underwriter Agreement - Self-Employed Independent Contractor for clarity. Ensure that all information is accurate and complete, then submit the form to the appropriate agency or client to confirm your status.

As a self-employed independent contractor in Nebraska, you must complete several important documents. Typically, you will need a W-9 form to provide your taxpayer information. Additionally, a Nebraska Underwriter Agreement - Self-Employed Independent Contractor will outline the terms of your working relationship. You may also require contracts or invoices for each client, ensuring clear communication and records.

A 1099 independent contractor agreement is a contract that outlines the terms of work between a business and an independent contractor who will receive a 1099 tax form at the end of the year. This agreement typically includes details on payment, services provided, and timelines for completing work. It's crucial to ensure that this document aligns with the Nebraska Underwriter Agreement - Self-Employed Independent Contractor for consistency, especially for reporting and compliance purposes. Using platforms like uslegalforms can assist you in creating a robust 1099 agreement.

Proving independent contractor status typically involves demonstrating control over how work is performed, which is a key factor in classification. You should keep records showing your autonomy in completing tasks, as well as any agreements that define your rights and responsibilities. The Nebraska Underwriter Agreement - Self-Employed Independent Contractor can serve as evidence of your status, as it clearly outlines the nature of the working relationship, protecting both parties involved.

Creating an independent contractor agreement begins with outlining the scope of work. You should specify the tasks to be completed, deadlines, and payment terms. Additionally, it’s essential to include a clause that describes the relationship between the parties, ensuring clarity on their status as independent contractors. Utilizing a Nebraska Underwriter Agreement - Self-Employed Independent Contractor template can simplify this process by providing ready-made sections that you can tailor to your needs.

To fill out an independent contractor form, start by entering your personal information and business details. Then, specify the services being provided, payment terms, and duration of the engagement. Incorporating elements from the Nebraska Underwriter Agreement - Self-Employed Independent Contractor can enhance accuracy and completeness. Make sure to review the form for any additional requirements unique to your industry.

Yes, independent contractors typically file taxes as self-employed individuals. This means they report their income on Schedule C and may owe self-employment taxes. Understanding how the Nebraska Underwriter Agreement - Self-Employed Independent Contractor impacts your tax situation is crucial for accurate reporting. Consulting with a tax professional can provide additional clarity on your responsibilities.

Writing an independent contractor agreement involves a few important steps. Start by defining the scope of work, payment terms, and deadlines. Utilizing the Nebraska Underwriter Agreement - Self-Employed Independent Contractor as a reference can help ensure you cover all necessary components. Finally, both parties should read the agreement thoroughly before signing to avoid misunderstandings.

Recently, new federal regulations have emerged that affect how independent contractors are classified. These rules aim to provide clearer guidance on what constitutes an independent contractor versus an employee. To navigate these changes effectively, consider the Nebraska Underwriter Agreement - Self-Employed Independent Contractor, as it aligns with the latest legal standards. Keeping informed about these updates is essential for compliance and proper classification.

Filling out an independent contractor agreement begins with gathering all necessary information about both parties involved. Next, clearly outline the terms of the work, including payment structure, deadlines, and responsibilities. Utilizing the Nebraska Underwriter Agreement - Self-Employed Independent Contractor framework can streamline this process, ensuring compliance and clarity. Lastly, both parties should review and sign the agreement to formalize the arrangement.