Nebraska Breeder Agreement - Self-Employed Independent Contractor

Description

How to fill out Breeder Agreement - Self-Employed Independent Contractor?

Are you in a location where you need documentation for potentially business or personal tasks every single day? There are numerous legal document templates accessible online, but finding ones you can trust isn't easy.

US Legal Forms provides a vast array of form templates, including the Nebraska Breeder Agreement - Self-Employed Independent Contractor, which can be printed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the Nebraska Breeder Agreement - Self-Employed Independent Contractor template.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Nebraska Breeder Agreement - Self-Employed Independent Contractor anytime, if necessary. Simply click on the desired form to download or print the document template. Use US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

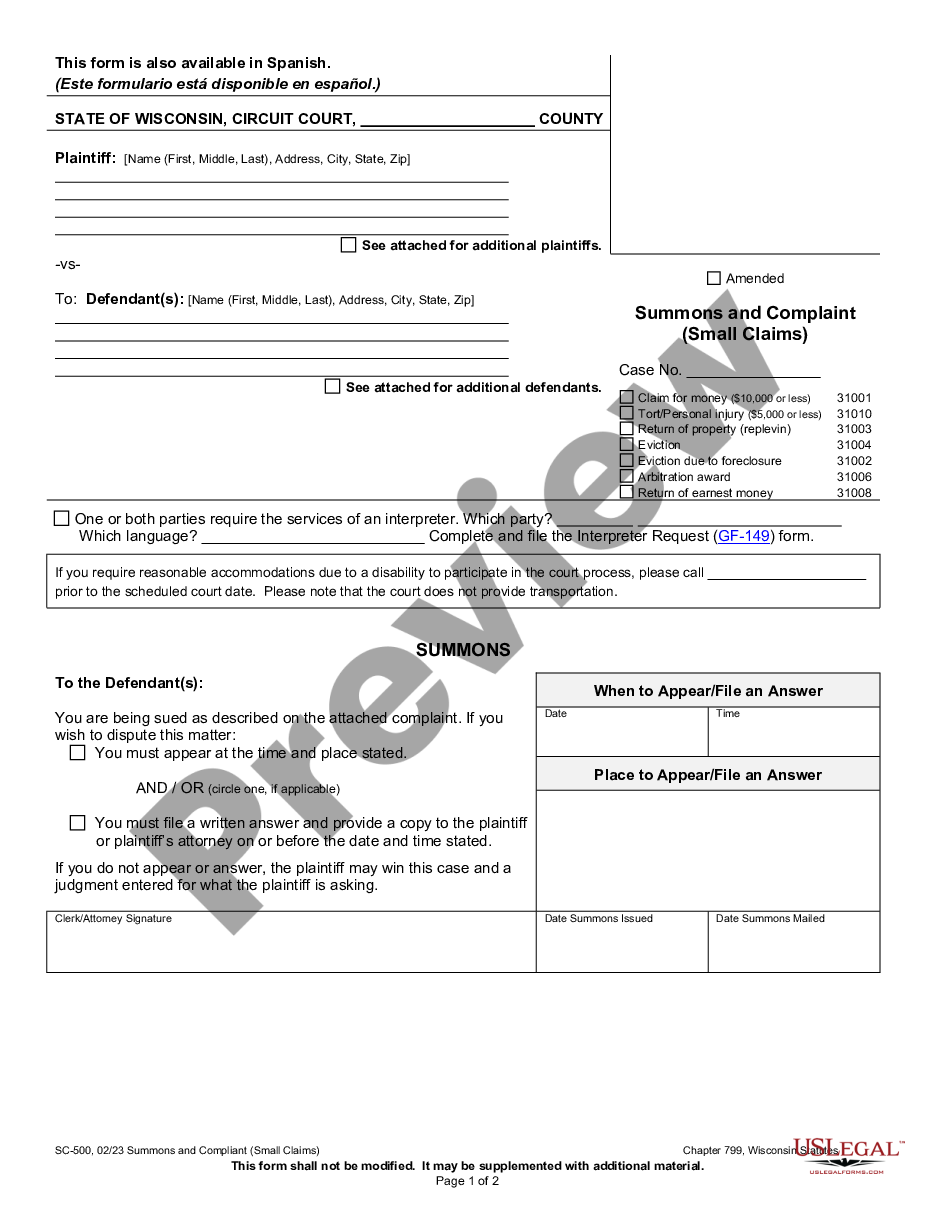

- Use the Review button to evaluate the document.

- Check the summary to confirm you have selected the correct form.

- If the form isn't what you're looking for, use the Search box to find the form that suits your needs.

- Once you locate the appropriate form, click Buy now.

- Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

Yes, independent contractors typically file as self-employed individuals. This means you report your income and expenses directly on your tax return. If you have a Nebraska Breeder Agreement - Self-Employed Independent Contractor, it can help you understand your tax obligations better. Utilizing resources from uslegalforms can further assist you in ensuring compliance and accurate filing.

In Nebraska, you do need a license to breed dogs commercially. This process ensures that breeders meet specific standards for animal care and welfare. If you are self-employed as a dog breeder, you should consider obtaining a Nebraska Breeder Agreement - Self-Employed Independent Contractor to navigate the licensing requirements effectively. Using platforms like uslegalforms can help simplify this process and provide essential legal guidance.

Yes, an independent contractor is indeed considered self-employed. They do not have an employer-employee relationship and run their own operations, which includes negotiating terms like those in a Nebraska Breeder Agreement - Self-Employed Independent Contractor. This classification offers flexibility and freedom but also requires an understanding of tax responsibilities and legal rights.

Both terms can describe similar working arrangements, but they have different implications. 'Self-employed' is a broader term, including any person running their own business. Meanwhile, 'independent contractor' is more specific and refers to individuals contracted to provide services, like those governed by a Nebraska Breeder Agreement - Self-Employed Independent Contractor. Depending on your situation, you may choose one term over the other.

An independent contractor typically falls under the category of self-employed individuals. This means they operate their own business and are responsible for managing their own finances, taxes, and expenses. The Nebraska Breeder Agreement - Self-Employed Independent Contractor clearly outlines the expectations and responsibilities within this relationship. If you are considering this structure, it's important to use the right documentation for clarity.

The rules for independent contractors include maintaining independence in the execution of their work while adhering to tax regulations. Independent contractors should also honor any agreements made with clients, like the Nebraska Breeder Agreement - Self-Employed Independent Contractor, which sets out expectations and responsibilities for both parties.

Creating an independent contractor agreement involves outlining the scope of work, payment terms, and deadlines. It is crucial to include clauses related to confidentiality and dispute resolution. Many find it helpful to use resources like the Nebraska Breeder Agreement - Self-Employed Independent Contractor to ensure all essential elements are covered effectively.

A key requirement for being classified as an independent contractor is demonstrating a significant degree of independence in how you perform your work. This means you should not be subject to comprehensive control by your client regarding how tasks are completed. Evaluating your situation against guidelines found in the Nebraska Breeder Agreement - Self-Employed Independent Contractor will offer clarity.

Setting up as an independent contractor requires several steps. Firstly, you must decide on a business structure, such as a sole proprietorship or LLC, and obtain a Tax Identification Number. Additionally, using a Nebraska Breeder Agreement - Self-Employed Independent Contractor can clarify roles with clients and protect your interests.

Independent contractors must meet specific legal requirements to maintain their status. This includes having the ability to control how they perform their work, providing their own tools, and being responsible for their taxes. Understanding these elements within the context of a Nebraska Breeder Agreement - Self-Employed Independent Contractor is essential for compliance and protection.