Nebraska Herd Health Specialist Agreement - Self-Employed Independent Contractor

Description

How to fill out Herd Health Specialist Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal document templates that you can download or print.

By utilizing the site, you can discover thousands of forms for business and personal needs, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Nebraska Herd Health Specialist Agreement - Self-Employed Independent Contractor in just a few minutes.

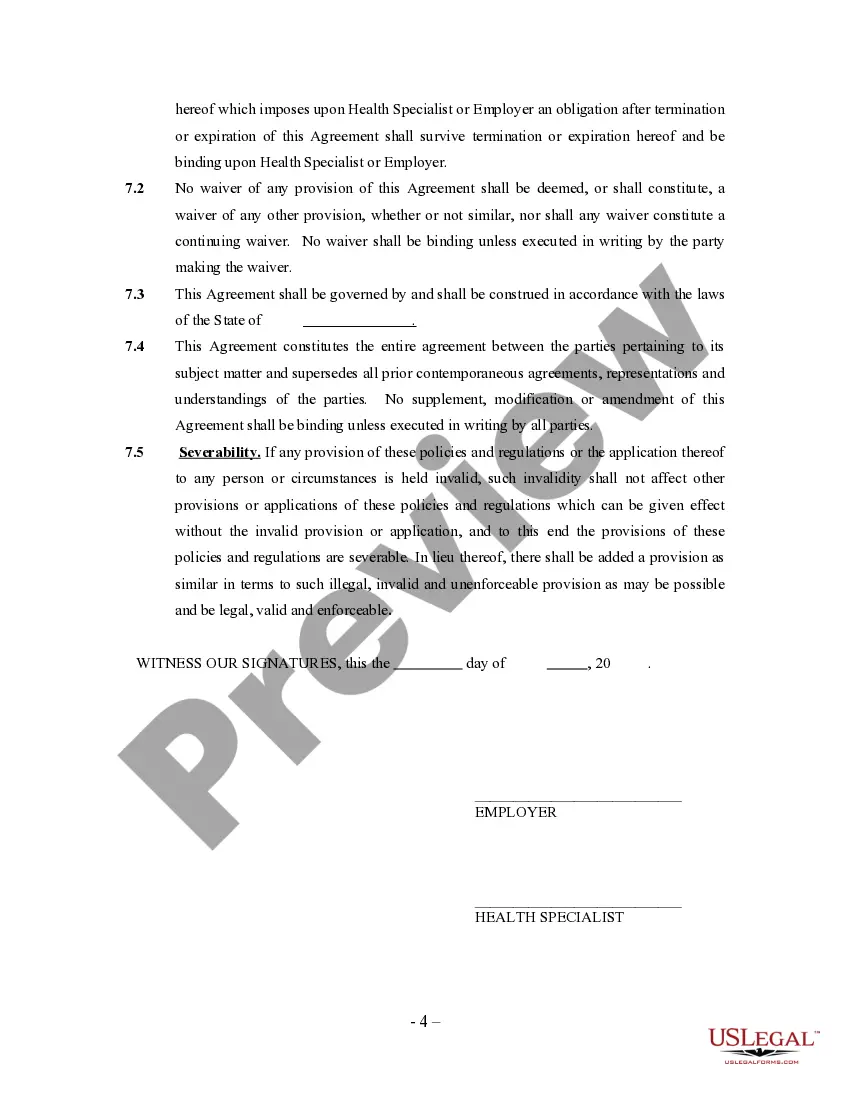

If you already have a monthly subscription, Log In and download the Nebraska Herd Health Specialist Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents section of your profile.

Then, select the pricing plan you prefer and provide your information to register for an account. Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Nebraska Herd Health Specialist Agreement - Self-Employed Independent Contractor. Every template you added to your account has no expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Nebraska Herd Health Specialist Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get you started:

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

- Check the form description to confirm you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are happy with the form, confirm your choice by clicking the Download now button.

Form popularity

FAQ

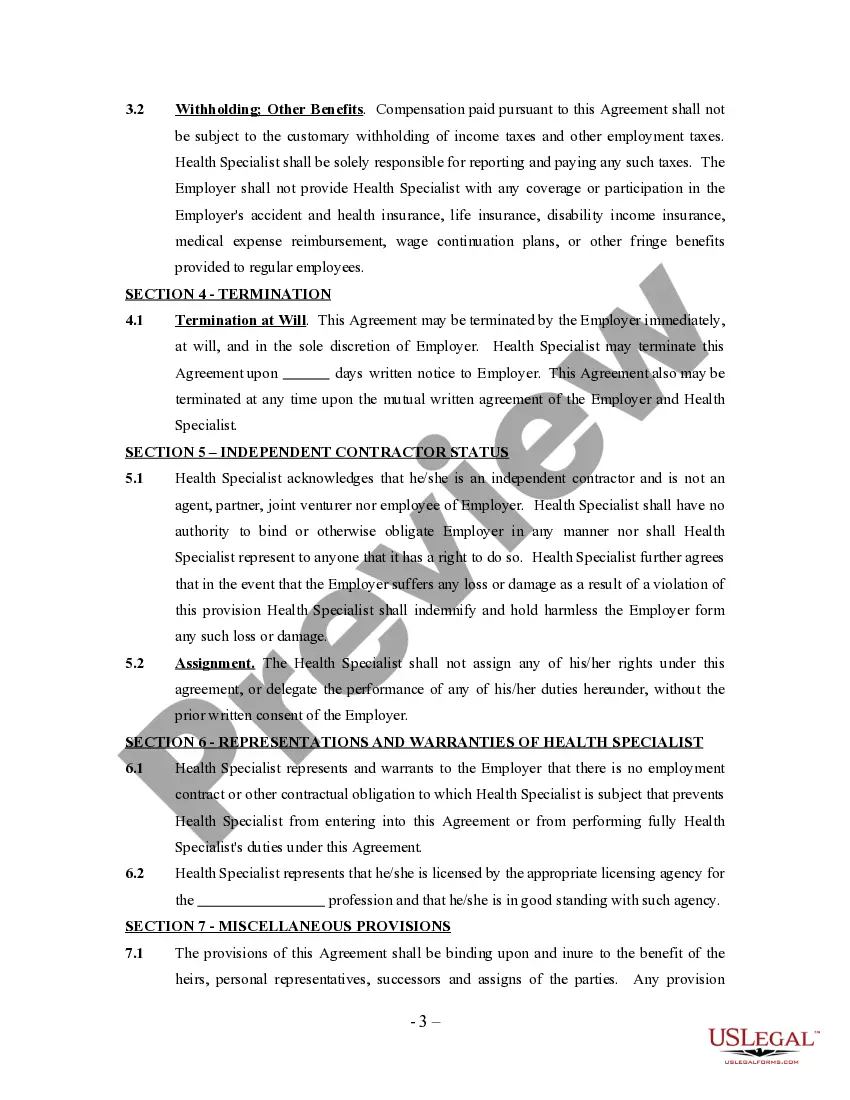

Filling out an independent contractor form requires you to enter your personal details, including your Social Security number or Employer Identification Number. Clearly indicate the services you will provide, along with the payment structure. Ensure that you understand the terms outlined, especially concerning liability and responsibilities. For a comprehensive guide, consider the Nebraska Herd Health Specialist Agreement - Self-Employed Independent Contractor template provided by uslegalforms.

Yes, independent contractors typically file taxes as self-employed individuals. They report their income and expenses on the Schedule C form, included with their personal tax return. It’s important to keep accurate records of all business-related expenses to maximize deductions. Understanding the tax implications of the Nebraska Herd Health Specialist Agreement - Self-Employed Independent Contractor can help you stay compliant.

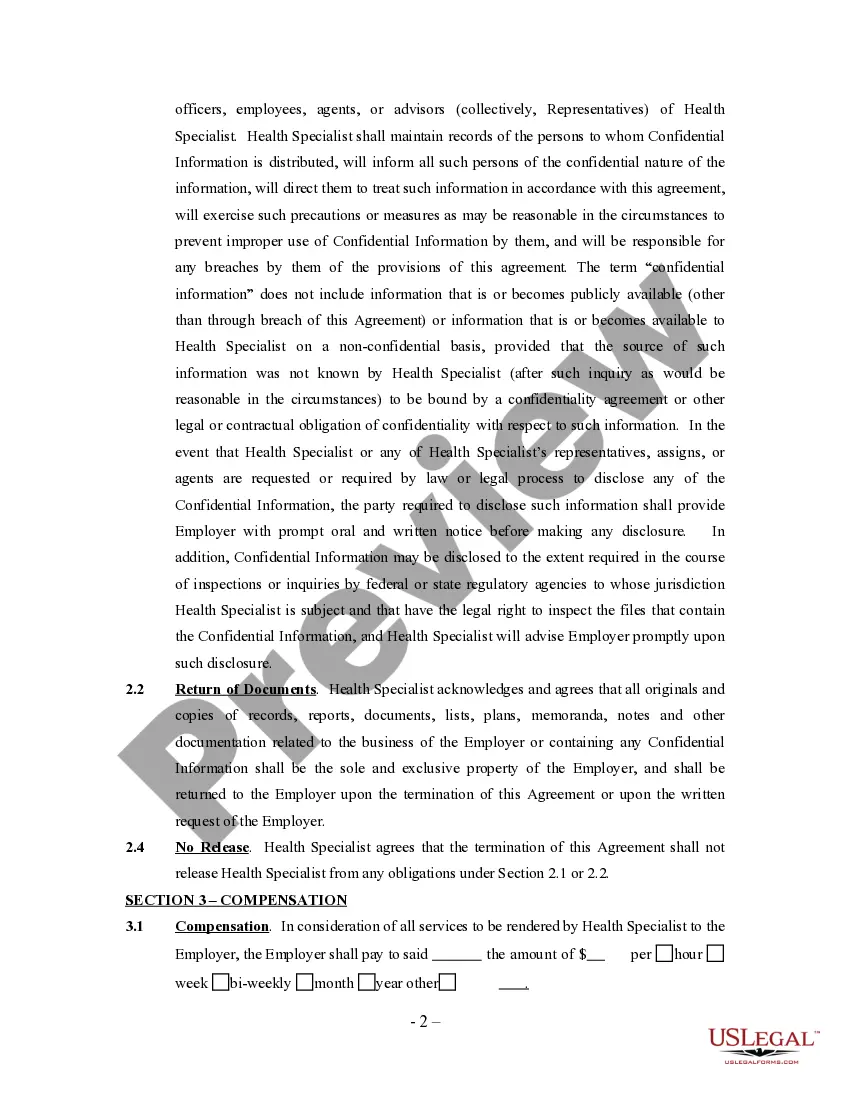

Writing an independent contractor agreement involves outlining the roles, responsibilities, and expectations clearly. Start by defining the scope of work, including specific tasks and deliverables. Additionally, include compensation details, termination conditions, and confidentiality clauses if necessary. A structured approach can be achieved by using the Nebraska Herd Health Specialist Agreement - Self-Employed Independent Contractor template available at uslegalforms.

To fill out an independent contractor agreement, you start by providing basic information such as your name, address, and the services you will offer. Next, specify the payment terms, including rates and deadlines. It’s also vital to include details about the duration of the agreement and any applicable tax information. Utilizing the Nebraska Herd Health Specialist Agreement - Self-Employed Independent Contractor template from uslegalforms can simplify this process.

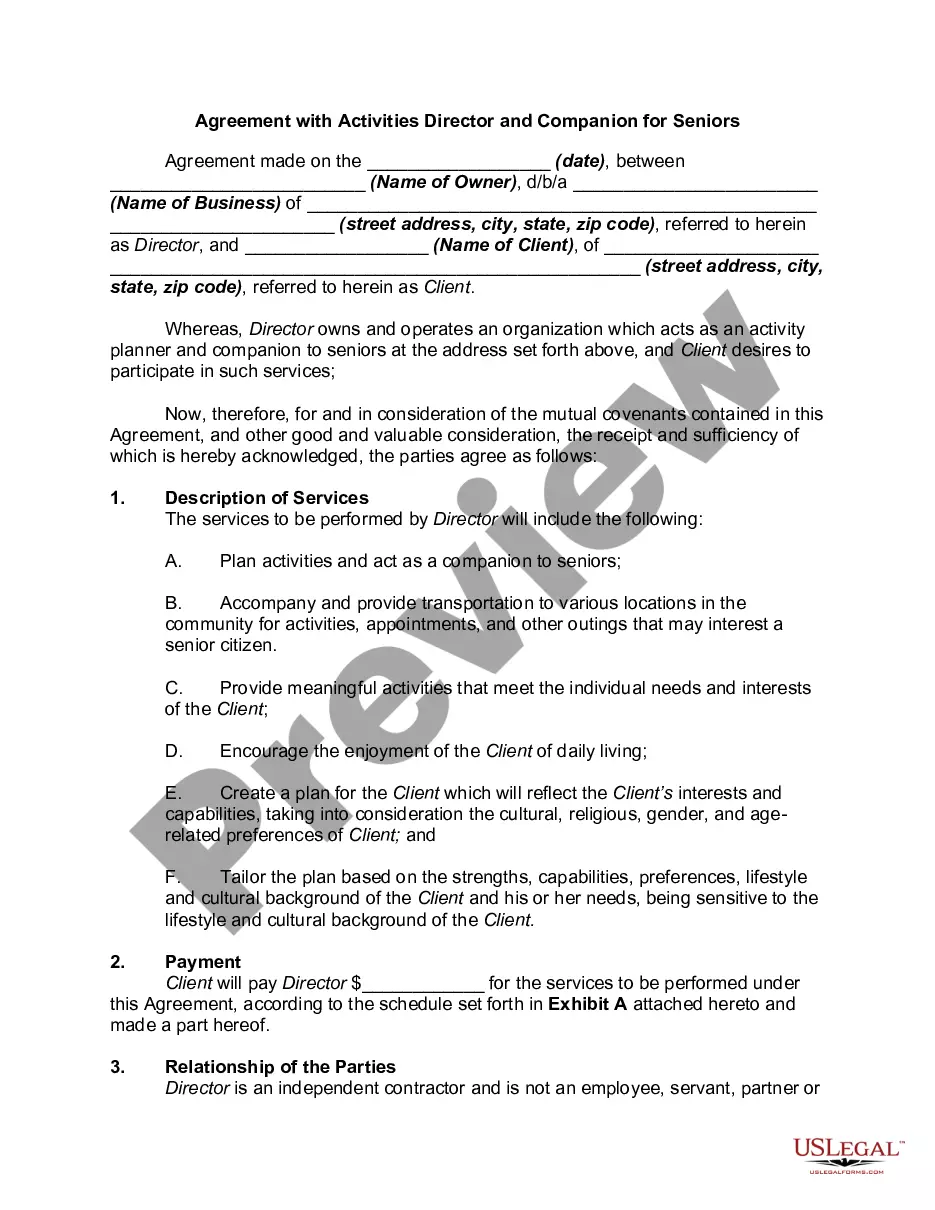

Yes, you can have a contract even if you are self-employed. In fact, a contract is crucial for outlining the terms of your arrangement, especially in the context of a Nebraska Herd Health Specialist Agreement - Self-Employed Independent Contractor. This agreement can clarify responsibilities and prevent misunderstandings with clients. Utilizing resources such as US Legal Forms can aid in creating a solid contract that protects your interests.

To write a contract for a 1099 employee, start by clearly defining the scope of work and expectations. Include payment terms, deadlines, and any specific duties related to the Nebraska Herd Health Specialist Agreement - Self-Employed Independent Contractor. Ensure both parties understand their rights and obligations. Using platforms like US Legal Forms can help simplify the process, providing templates tailored for independent contractors.

The new federal rule on independent contractors changes how the classification of these workers is determined. This rule impacts the Nebraska Herd Health Specialist Agreement - Self-Employed Independent Contractor by emphasizing the need for a detailed examination of the relationship between the worker and the employer. Understanding this rule is crucial for compliance and maintaining proper classifications. It's advisable to consult reliable resources like uslegalforms for guidance on navigating these important changes.

Creating an independent contractor agreement, especially for a Nebraska Herd Health Specialist Agreement - Self-Employed Independent Contractor, involves a few essential steps. Start by defining the scope of work clearly, including tasks and responsibilities. Next, outline payment terms and deadlines to prevent misunderstandings. Finally, make sure to include necessary legal language and signatures for both parties, which you can easily find on platforms like uslegalforms.