Nebraska Hauling Services Contract - Self-Employed

Description

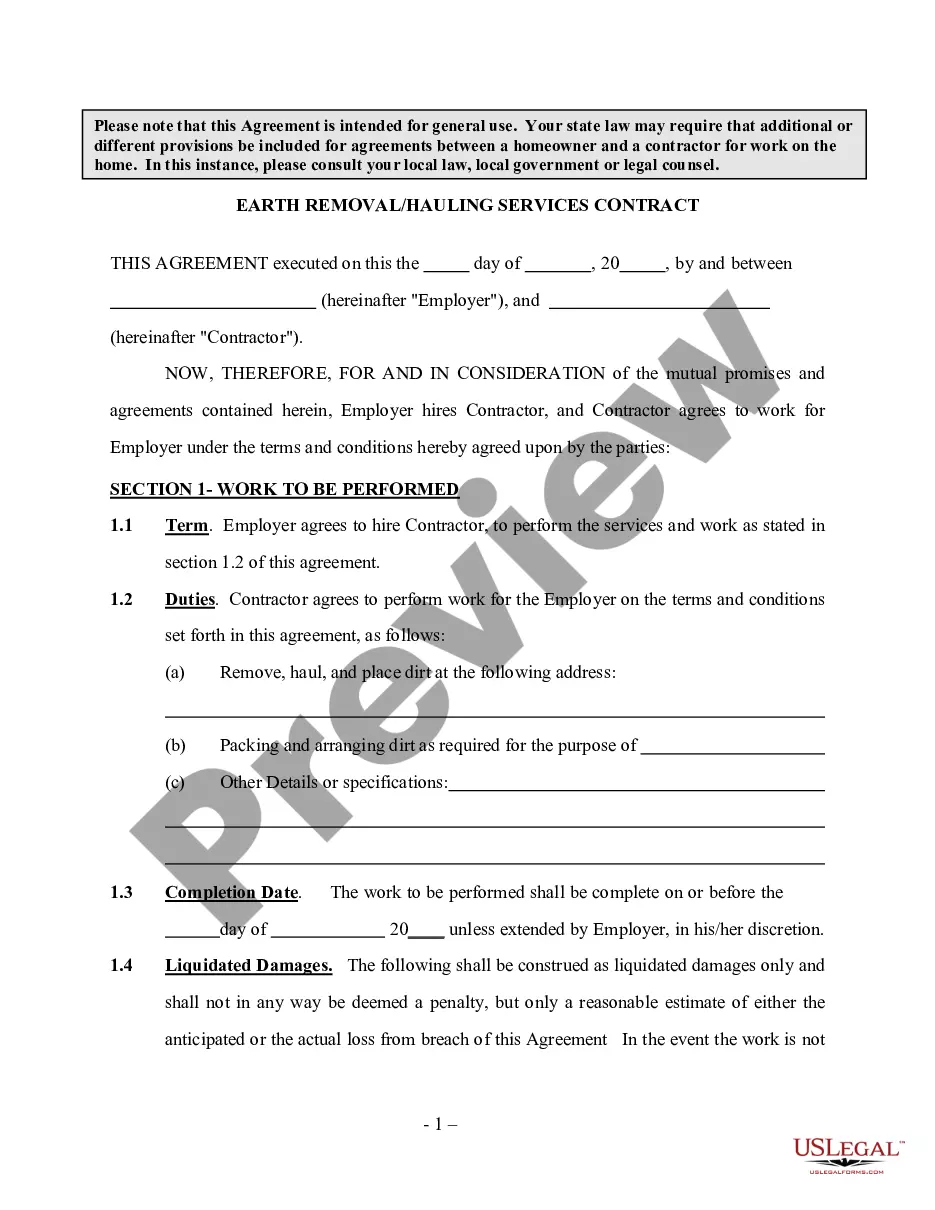

How to fill out Hauling Services Contract - Self-Employed?

You can utilize hours on the web trying to locate the legal document template that meets the federal and state requirements you require.

US Legal Forms provides thousands of legal templates which can be assessed by professionals.

It is easy to download or print the Nebraska Hauling Services Contract - Self-Employed from my services.

If you wish to find another version of the form, use the Search field to locate the template that suits your needs and requirements. Once you have found the template you desire, click on Get now to proceed. Select the pricing plan you want, enter your credentials, and create an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal document. Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the Nebraska Hauling Services Contract - Self-Employed. Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Use professional and state-specific templates to manage your business or personal needs.

- If you currently have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Nebraska Hauling Services Contract - Self-Employed.

- Each legal document template you purchase is yours forever.

- To obtain another copy of the purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/region of choice.

- Check the form outline to confirm you have chosen the right form.

- If available, utilize the Preview button to review the document template as well.

Form popularity

FAQ

In Nebraska, LLCs are generally treated as pass-through entities for tax purposes, meaning profits and losses flow directly to the owners. If you operate under a Nebraska Hauling Services Contract - Self-Employed as an LLC, this structure can provide beneficial tax advantages. However, it is wise to consult with a tax advisor to fully understand your obligations and options.

Several services are exempt from sales tax in Nebraska, including some janitorial services, educational services, and specific medical services. If you're operating under a Nebraska Hauling Services Contract - Self-Employed, identifying which of your services are exempt can significantly impact your bottom line. Engaging with legal counsel can help clarify these exemptions.

An option 3 contractor in Nebraska generally refers to a specific classification of contractors who may have different requirements and responsibilities compared to other classifications. For those engaged with a Nebraska Hauling Services Contract - Self-Employed, understanding your classification can influence your tax obligations and operational strategies. Make sure to consult the Nebraska Department of Revenue for precise details.

In Nebraska, some services, including professional services and certain personal services, are typically not taxable. However, as a provider operating under a Nebraska Hauling Services Contract - Self-Employed, it is essential to confirm which specific services fall under these guidelines to avoid unexpected tax impacts. Consult your legal advisor or accountant for detailed information.

Certain services may be exempt from service tax in Nebraska. Specifically, services that are not connected to tangible personal property or those explicitly listed as exempt by state law can qualify. When crafting a Nebraska Hauling Services Contract - Self-Employed, you should identify these exemptions to optimize your service offerings and tax liabilities.

In general, Nebraska does not require a contractor license for most independent contractors, including those in hauling services. However, specific regulations might apply to certain types of work or if you operate in certain cities. It's wise to check local laws and consider using a Nebraska Hauling Services Contract - Self-Employed for clarity on your obligations and rights. This contract can serve as a safeguard while you navigate local requirements.

To qualify as an independent contractor in Nebraska, you must meet specific criteria set by the IRS and state laws. These criteria include having control over your work and providing your own tools, as well as working on a project basis without a long-term commitment to a single employer. Utilizing a Nebraska Hauling Services Contract - Self-Employed helps clarify your role and responsibilities, ensuring compliance with relevant regulations.

Deciding whether to form an LLC or operate as an independent contractor depends on your specific needs. An LLC offers liability protection and can be beneficial for tax purposes, while an independent contractor may have simpler reporting requirements. If you choose the latter, using a Nebraska Hauling Services Contract - Self-Employed can still provide you with necessary business structure without formal registration. Be sure to weigh the benefits of both options.

To become an independent contractor in Nebraska, you should start by defining your services and market. Next, you need to complete the necessary registration with the state, which may include obtaining an Employer Identification Number. Additionally, you might consider using a Nebraska Hauling Services Contract - Self-Employed to outline your terms with clients. This contract protects your rights and clarifies your duties.

Having an LLC is not mandatory to work as a contractor, but it can offer various benefits. Forming an LLC can protect your personal assets and provide tax advantages within a Nebraska Hauling Services Contract - Self-Employed. It’s often a wise choice for those wanting to establish credibility and limit personal liability in their business ventures.