This due diligence form is used to summarize data for each partnership entity associated with the company in business transactions.

Nebraska Partnership Data Summary

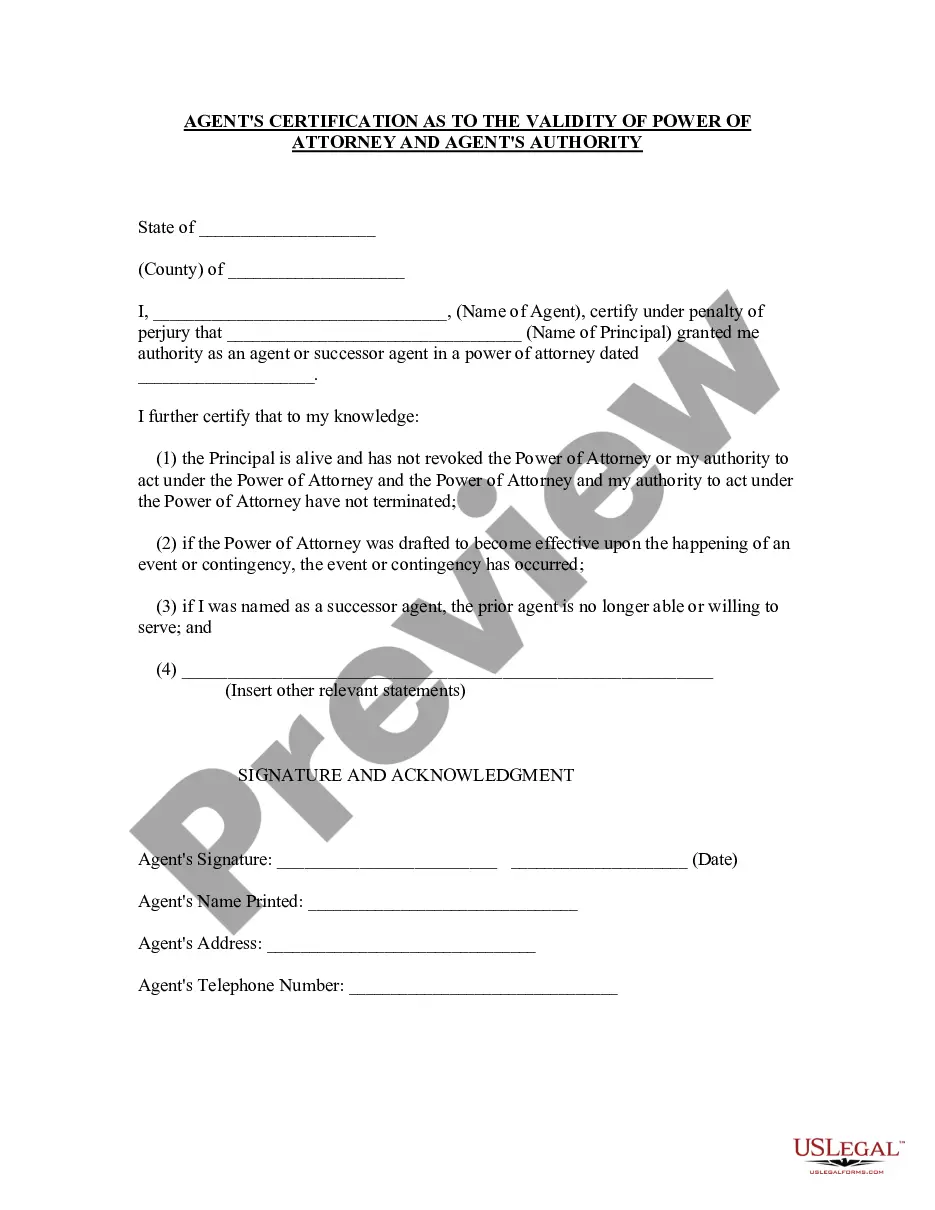

Description

How to fill out Partnership Data Summary?

Finding the appropriate legal document template can be a challenge.

Certainly, there are numerous online templates available, but how can you locate the legal document you require.

Utilize the US Legal Forms website. The platform offers a wide range of templates, such as the Nebraska Partnership Data Summary, suitable for both business and personal needs.

You can preview the form using the Preview button and read the form description to ensure it is suitable for you.

- All templates are reviewed by professionals and comply with state and federal regulations.

- If you're already registered, Log In to your account and hit the Download button to access the Nebraska Partnership Data Summary.

- Use your account to navigate through the legal documents you've previously acquired.

- Go to the My documents section of your account to retrieve another copy of the document you require.

- For new users of US Legal Forms, here are simple steps to follow.

- First, make sure you have selected the correct document for your city/state.

Form popularity

FAQ

Not all partnerships are required to file Schedule K-2. However, it is necessary for partnerships that have international activities or foreign partners. To ensure compliance, it’s beneficial to consult the Nebraska Partnership Data Summary, which offers insights on the different filing obligations for partnerships.

Limited Liability Companies (LLCs) typically file Form 1065 when they have more than one member. However, if the LLC elects to be treated as an S Corporation, it would file Form 1120S. Understanding your LLC's tax classification is key, and the Nebraska Partnership Data Summary can help clarify these options further.

Common mistakes in filing Form 1065 include incorrect reporting of income and expenses, failing to include all necessary schedules, and inaccuracies in partner information. These errors can lead to delays or audits. To avoid these pitfalls, refer to the Nebraska Partnership Data Summary for best practices and systematic filing tips.

Yes, partnerships are required to file Form 1065 jointly, as it reports the total income and deductions for the business. However, individual partners file their respective personal tax returns, using information from their Schedule K-1. Keeping accurate records will simplify this process, and the Nebraska Partnership Data Summary can help guide you through these requirements.

To report partnership distributions on your tax return, you will need to include the information from your Schedule K-1. This form provides details about the distribution you received, which is typically reported on your personal tax return. It's important to reference the Nebraska Partnership Data Summary for clarity on tax implications and filing requirements.

Partnerships must fill out Form 1065 to report their income, deductions, and credits to the IRS. Additionally, each partner will receive a Schedule K-1 that reflects their share of the partnership's income. This is crucial for accurate tax reporting. For more details, refer to the Nebraska Partnership Data Summary provided on our platform.

No, a 1065 and a K-1 serve different purposes in partnership reporting. Form 1065 is the partnership return that reports the income, deductions, and credits for the entire partnership. Meanwhile, a K-1 is issued to each partner, detailing their specific share of the partnership's income and deductions. Understanding this distinction is essential when working with the Nebraska Partnership Data Summary.

You can find the return summary page on the US Legal Forms website. Search for the Nebraska Partnership Data Summary section, which provides a comprehensive overview of partnership returns. The navigation is user-friendly, allowing you to access the summary page easily. This feature helps you understand your partnership's financial standing clearly.

Generally, business tax returns are confidential and not publicly accessible. However, some information about business financials can be gleaned from other public filings, such as annual reports. For more detailed insights into partnerships, the Nebraska Partnership Data Summary can provide valuable data.

To look up businesses, navigate to the Nebraska Secretary of State’s online portal. This user-friendly site allows you to search by business name or registration number. Utilizing the Nebraska Partnership Data Summary can enhance your findings, offering detailed information about partnership activities in the state.