A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Nebraska Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

How to fill out Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

Are you presently in a circumstance where you require documents for both professional or personal purposes almost daily.

There is a multitude of legal document templates accessible online, but finding ones you can depend on is challenging.

US Legal Forms offers thousands of document templates, such as the Nebraska Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law, which are crafted to meet both federal and state requirements.

Once you obtain the appropriate form, click Acquire now.

Select the pricing plan you prefer, fill out the necessary information to create your account, and complete the purchase using your PayPal or credit card. Choose a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Nebraska Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is suitable for the correct city/county.

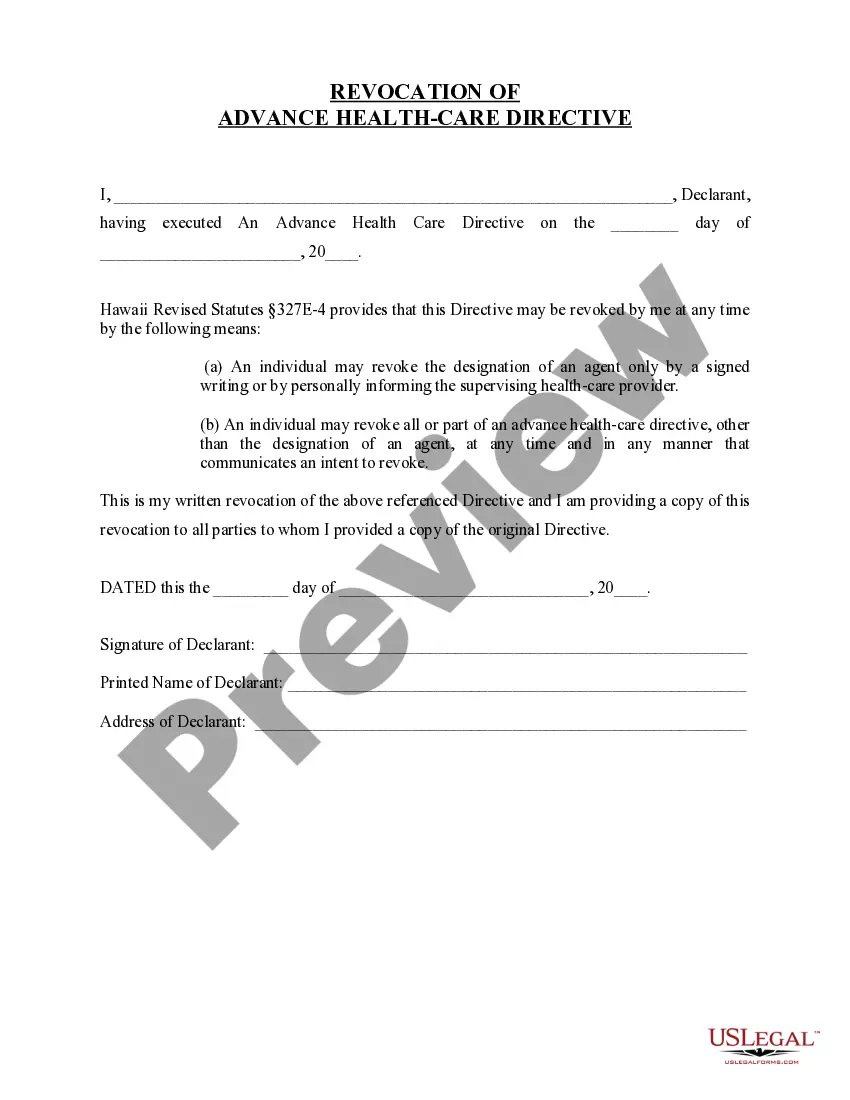

- Utilize the Preview feature to review the document.

- Check the description to confirm you have selected the right form.

- If the form does not meet your needs, use the Search field to find the document that fits your requirements.

Form popularity

FAQ

When it comes to consumer debt in the state of Nebraska, the statute of limitations 5 years from the last payment made. This means that a creditor or debt collector may not sue you for debt after five years have passed. If the agreement was verbal, then that number is reduced to 4 years in the state of Nebraska.

Be aware that collection agencies are forbidden from trying to collect a without first notifying you in writing or making a reasonable attempt to do so. Do not share financial and personal information if you are not certain you are dealing with a real collection agency.

Repeated calls. Threats of violence. Publishing information about you. Abusive or obscene language.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

You are not obliged let a debt collector into your home and they don't have the right to take goods away. It's very important to understand that a debt collector is not the same as an enforcement agent or bailiff. Debt collectors have no special legal powers.

Old (Time-Barred) Debts In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.