Nebraska Approval of Incentive Stock Option Plan

Description

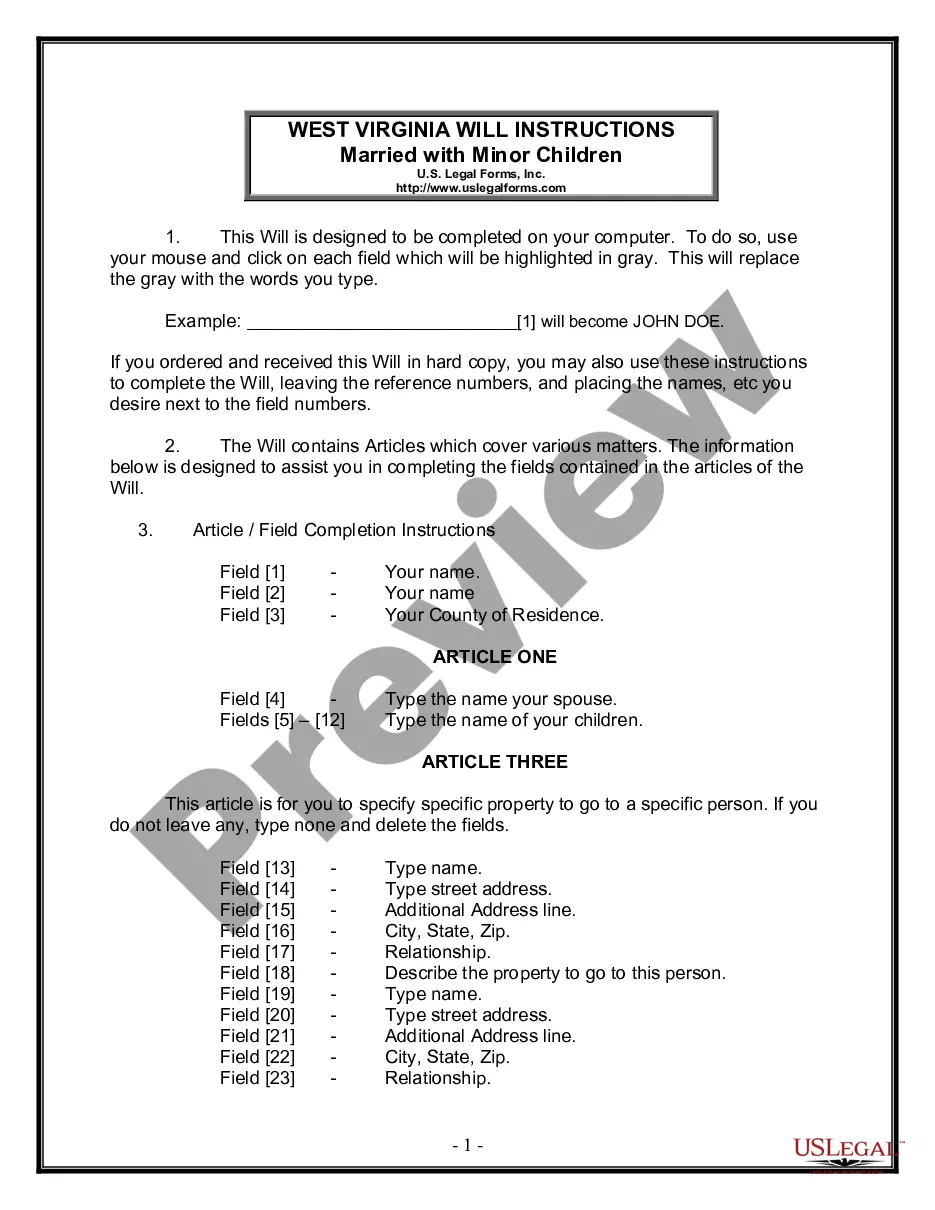

How to fill out Approval Of Incentive Stock Option Plan?

You are able to spend hours on the Internet trying to find the legitimate record web template which fits the state and federal demands you require. US Legal Forms provides a huge number of legitimate types that are reviewed by experts. It is possible to download or print the Nebraska Approval of Incentive Stock Option Plan from your services.

If you already possess a US Legal Forms profile, you may log in and click on the Download switch. After that, you may total, edit, print, or signal the Nebraska Approval of Incentive Stock Option Plan. Each and every legitimate record web template you buy is your own property forever. To obtain one more version associated with a purchased form, proceed to the My Forms tab and click on the related switch.

If you are using the US Legal Forms web site initially, stick to the simple instructions beneath:

- Initially, be sure that you have selected the best record web template for that area/town of your choice. Read the form description to make sure you have chosen the appropriate form. If accessible, use the Review switch to look from the record web template as well.

- If you would like get one more edition of your form, use the Research field to discover the web template that fits your needs and demands.

- Once you have identified the web template you want, just click Buy now to continue.

- Pick the pricing strategy you want, type your credentials, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You can utilize your charge card or PayPal profile to fund the legitimate form.

- Pick the file format of your record and download it to the gadget.

- Make modifications to the record if necessary. You are able to total, edit and signal and print Nebraska Approval of Incentive Stock Option Plan.

Download and print a huge number of record web templates utilizing the US Legal Forms website, which provides the biggest selection of legitimate types. Use specialist and express-particular web templates to deal with your business or individual requirements.

Form popularity

FAQ

How much is the credit? The credit is equal to the percentage announced by the state each year multiplied by the amount of School District Property Tax paid during the year. For 2022, the percentage is 30%.

The Nebraska Department of Revenue announced Tuesday that the real property tax credit for tax year 2023 will amount to $220.76 for the owner of a $200,000 home, and $264.90 for the owner of $200,000 worth of farmland.

The Nebraska Advantage Act allows a taxpayer involved in a qualified business to earn and use tax benefits based on investment and employment growth.

No matter your income tax situation ? if you pay property taxes, you are eligible for the income tax credit. For tax year 2022, the credit equals 30% of property taxes paid to schools and community colleges.

The Nebraska Advantage Package is Nebraska's comprehensive economic development incentive. It provides 3-10% investment credits, 3-6% wage credits and sales tax refunds to qualified businesses based on job creation and investment levels.

The credit is available for both school district and community college property taxes paid. An individual or entity may claim the credit by filing the appropriate Nebraska tax return together with a Nebraska Property Tax Credit, Form PTC (Form PTC). Credit for Property Taxes paid in 2021.

The so-called ?convenience of the employer? rule means that if a worker previously commuted into Nebraska for work, and then stopped commuting into Nebraska and stayed in Iowa, that worker still owes taxes to Nebraska.

Valuation is the function of assessing property and the improvements thereon. ing to Nebraska State Law, the assessed value of property is based on 100% of the actual market value of the property during the year in which it is assessed, not the year it was purchased.