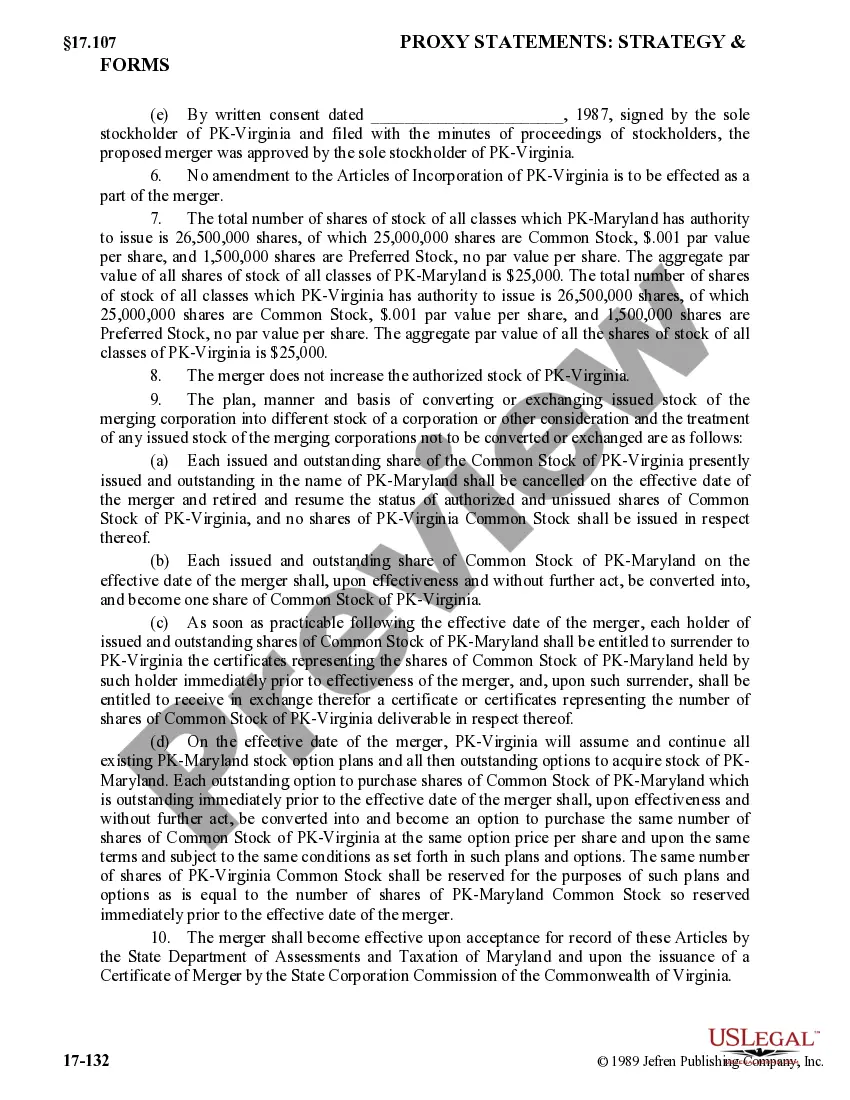

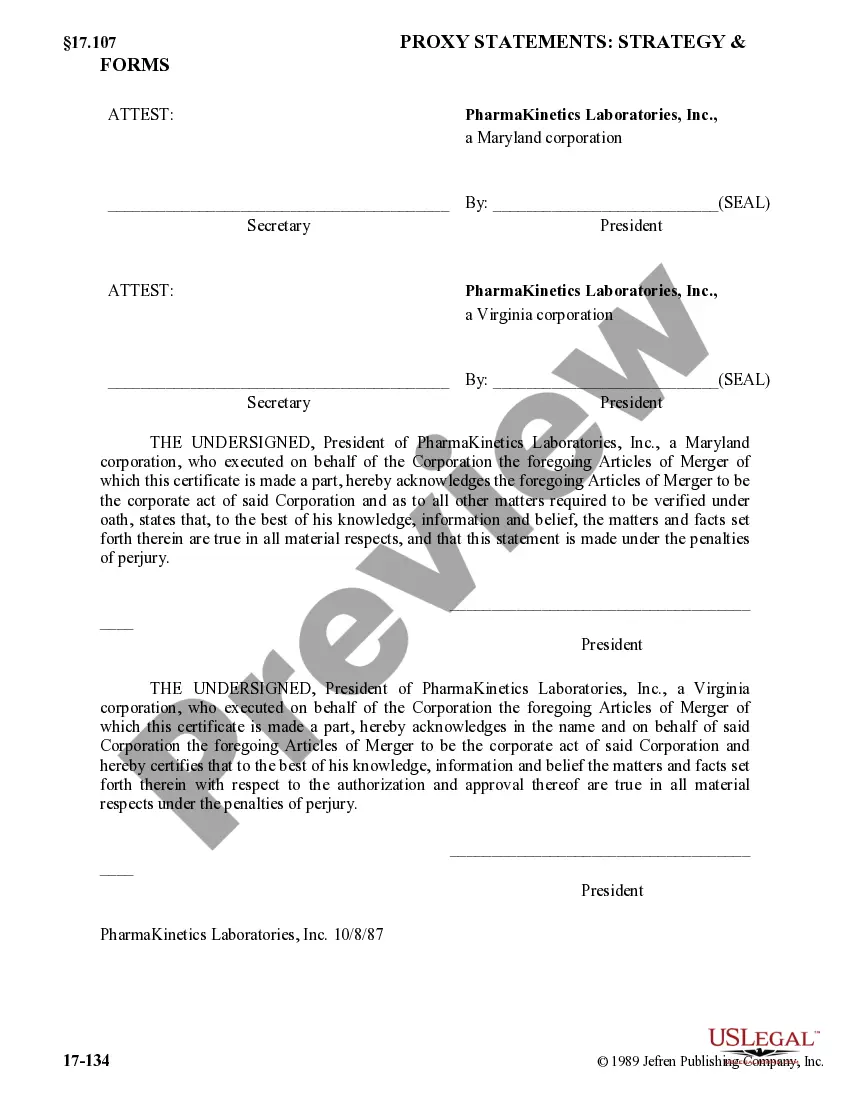

Nebraska Articles of Merger

Description

How to fill out Articles Of Merger?

Choosing the right legitimate papers template could be a battle. Naturally, there are a lot of themes accessible on the Internet, but how do you discover the legitimate develop you need? Use the US Legal Forms site. The service provides a large number of themes, including the Nebraska Articles of Merger, that can be used for organization and private needs. Each of the types are checked out by specialists and satisfy federal and state needs.

When you are previously signed up, log in for your profile and click the Obtain switch to have the Nebraska Articles of Merger. Make use of your profile to check through the legitimate types you have bought earlier. Go to the My Forms tab of your profile and have an additional version of your papers you need.

When you are a whole new user of US Legal Forms, listed below are basic guidelines that you should adhere to:

- Very first, be sure you have selected the proper develop for the metropolis/state. It is possible to examine the shape making use of the Review switch and browse the shape explanation to ensure it will be the best for you.

- When the develop will not satisfy your requirements, take advantage of the Seach field to obtain the appropriate develop.

- When you are positive that the shape is proper, click the Purchase now switch to have the develop.

- Choose the pricing program you need and enter in the essential details. Design your profile and pay for an order using your PayPal profile or charge card.

- Choose the data file formatting and download the legitimate papers template for your device.

- Total, revise and print and indicator the received Nebraska Articles of Merger.

US Legal Forms is definitely the biggest local library of legitimate types for which you can see numerous papers themes. Use the service to download skillfully-produced files that adhere to express needs.

Form popularity

FAQ

Less... Hold a Board of Directors meeting and record a resolution to Dissolve the Nebraska Corporation. ... Hold a Shareholder meeting to approve Dissolution of the Nebraska Corporation. ... File all required Biennial Reports with the Nebraska Secretary of State. ... Clear up any business debts.

To withdraw or cancel your foreign corporation in Nebraska, you provide the completed form, certificate of withdrawal to transact business in the state of Nebraska in duplicate to the SOS. Corporations can also file online at the Nebraska SOS website, but you have to pay an additional processing fee.

First, file a Statement of Intent to Dissolve. The Nebraska Secretary of State (SOS) requires duplicate originals. The SOS will determine whether the LLC is current on all fees and taxes, if so, they will send the duplicate original back to the company.

The purpose of the Notice of Organization is to inform and notify the public that your LLC has been created in the state of Nebraska. Your Notice of Organization must include certain information about your LLC, as spelled out in section 21-117 (see 'b') of the Nebraska Revised Statutes: The name of your Nebraska LLC.

To reinstate your domestic corporation, please contact our office at sos.corp@nebraska.gov to receive the reinstatement application, report and fee worksheet. Submit the application and report by filing either in-person or by mail. Online filing is not available.

To amend the articles of incorporation, the members of the board of directors of the corporation shall file with the governing body of the local political subdivision an application in writing seeking permission to amend the articles of incorporation and specifying in the application the amendment proposed to be made.

A Nebraska Foreign LLC is a limited liability company that does business in Nebraska but was formed in a state or jurisdiction outside of Nebraska.