Nebraska Form of Demerger Agreement by Apothekernes Laboratorium A.S and Apothekernes Laboratorium A.S Inc.

Description

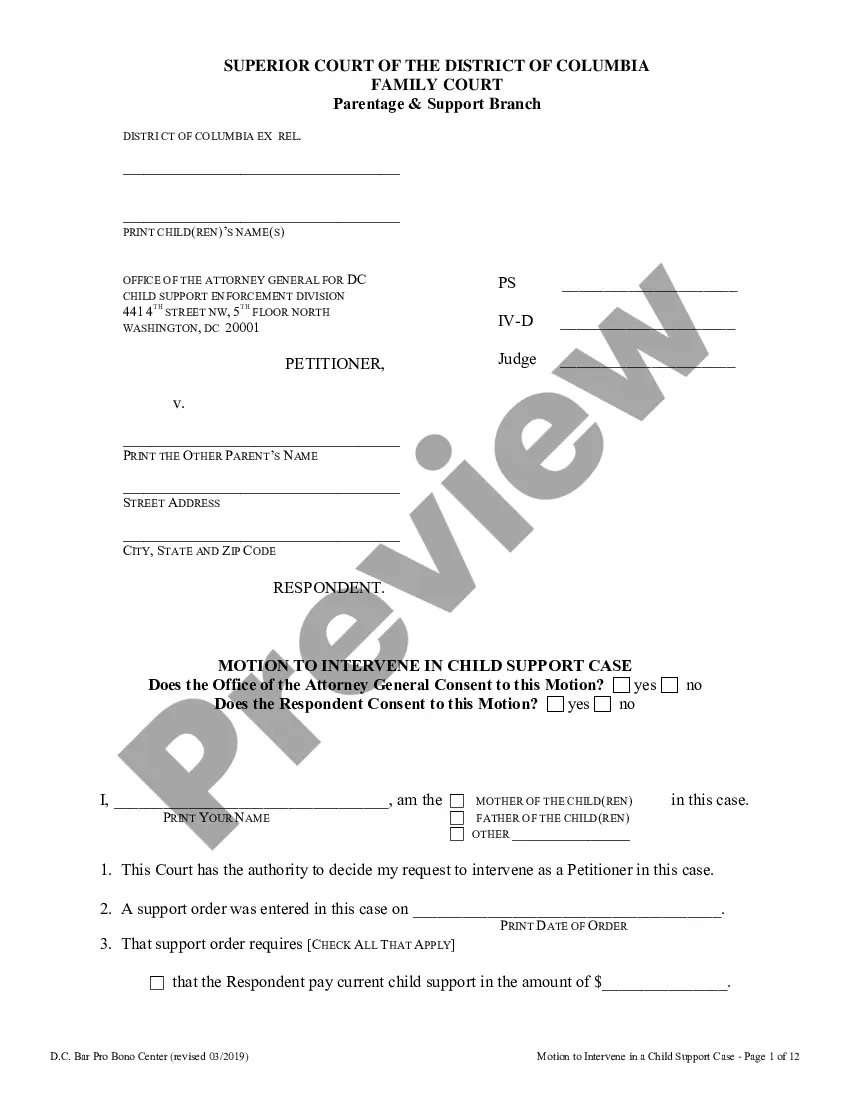

How to fill out Form Of Demerger Agreement By Apothekernes Laboratorium A.S And Apothekernes Laboratorium A.S Inc.?

If you have to complete, download, or print lawful papers themes, use US Legal Forms, the biggest selection of lawful forms, that can be found online. Make use of the site`s simple and hassle-free lookup to get the papers you require. A variety of themes for organization and personal purposes are sorted by groups and says, or keywords. Use US Legal Forms to get the Nebraska Form of Demerger Agreement by Apothekernes Laboratorium A.S and Apothekernes Laboratorium A.S Inc. with a few clicks.

When you are already a US Legal Forms buyer, log in for your account and then click the Obtain button to find the Nebraska Form of Demerger Agreement by Apothekernes Laboratorium A.S and Apothekernes Laboratorium A.S Inc.. You may also access forms you in the past delivered electronically in the My Forms tab of your own account.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form to the correct town/region.

- Step 2. Utilize the Review method to examine the form`s content. Never forget to see the explanation.

- Step 3. When you are not happy together with the kind, make use of the Search field on top of the screen to get other models from the lawful kind format.

- Step 4. Upon having discovered the form you require, click on the Acquire now button. Pick the pricing strategy you choose and add your credentials to sign up to have an account.

- Step 5. Process the transaction. You can utilize your Мisa or Ьastercard or PayPal account to complete the transaction.

- Step 6. Pick the format from the lawful kind and download it in your gadget.

- Step 7. Complete, change and print or indication the Nebraska Form of Demerger Agreement by Apothekernes Laboratorium A.S and Apothekernes Laboratorium A.S Inc..

Every single lawful papers format you acquire is your own eternally. You might have acces to every single kind you delivered electronically within your acccount. Go through the My Forms portion and select a kind to print or download once more.

Contend and download, and print the Nebraska Form of Demerger Agreement by Apothekernes Laboratorium A.S and Apothekernes Laboratorium A.S Inc. with US Legal Forms. There are thousands of specialist and express-specific forms you can utilize for the organization or personal requires.

Form popularity

FAQ

How does a non-profit corporation apply for a sales tax exemption in Nebraska? To apply for a Nebraska sales tax exemption, the nonprofit corporation must apply for a certificate of exemption by submitting a Nebraska Exemption Application for Sales and Use Tax, Form 4, to the Department of Revenue.

A nonresident member of an LLC which has Nebraska income may execute and forward to the LLC a Nebraska Nonresident Income Tax Agreement, Form 12N, which states that the nonresident will file a Nebraska income tax return and pay tax on all income derived from or connected with Nebraska sources.

For an exempt sale certificate to be fully completed, it must include: (1) identification of purchaser and seller; (2) a statement that the certificate is for a single purchase or is a blanket certificate covering future sales; (3) a statement of the basis for exemption, including the type of activity engaged in by the ...

The Nebraska Beginning Farmer Personal Property Tax Exemption Program enables property used in production agriculture or horticulture, valued up to $100,000, to be exempted for the beginning farmer or rancher.

A Nebraska Energy Source Exempt Sale Certificate Form 13E must be filed by every person claiming a sales and use tax exemption when it has been determined that more than 50 percent of the purchase of electricity, coal, gas, fuel, oil, diesel fuel, tractor fuel, coke, nuclear fuel, butane, propane, or compressed natural ...

If Form 12N is Filed. This return must report the nonresident's share of the organization's Nebraska income attributable to his or her interest in the organization during the taxable year, as well as any other income the nonresident has earned from Nebraska sources.

This Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in Nebraska. Also, when owners of an existing business change, a Form 20 needs to be filed.

Form 6XN may be filed at any time after you have filed your original Form 6. This amended form, properly signed and accompanied by remittance, is to be filed with the county treasurer in the county where the original form was filed or with the Nebraska Department of Revenue.