Nebraska Investment Management Agreement between Fund, Asia Management and NICAM

Description

How to fill out Investment Management Agreement Between Fund, Asia Management And NICAM?

You are able to spend hrs on-line attempting to find the legitimate papers template that fits the federal and state needs you need. US Legal Forms provides a large number of legitimate types that are analyzed by professionals. It is simple to obtain or produce the Nebraska Investment Management Agreement between Fund, Asia Management and NICAM from your service.

If you already have a US Legal Forms account, you can log in and then click the Obtain button. After that, you can total, revise, produce, or indicator the Nebraska Investment Management Agreement between Fund, Asia Management and NICAM. Each and every legitimate papers template you get is the one you have for a long time. To get another copy of the purchased form, check out the My Forms tab and then click the corresponding button.

If you use the US Legal Forms web site the first time, follow the easy recommendations beneath:

- Initial, be sure that you have selected the proper papers template for the state/town that you pick. See the form explanation to ensure you have picked the correct form. If offered, take advantage of the Review button to appear from the papers template as well.

- If you wish to get another version of your form, take advantage of the Search industry to obtain the template that meets your needs and needs.

- When you have identified the template you need, click on Purchase now to continue.

- Find the prices plan you need, type your references, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You may use your credit card or PayPal account to purchase the legitimate form.

- Find the formatting of your papers and obtain it for your system.

- Make alterations for your papers if required. You are able to total, revise and indicator and produce Nebraska Investment Management Agreement between Fund, Asia Management and NICAM.

Obtain and produce a large number of papers themes making use of the US Legal Forms web site, which offers the greatest selection of legitimate types. Use specialist and condition-distinct themes to deal with your business or individual requirements.

Form popularity

FAQ

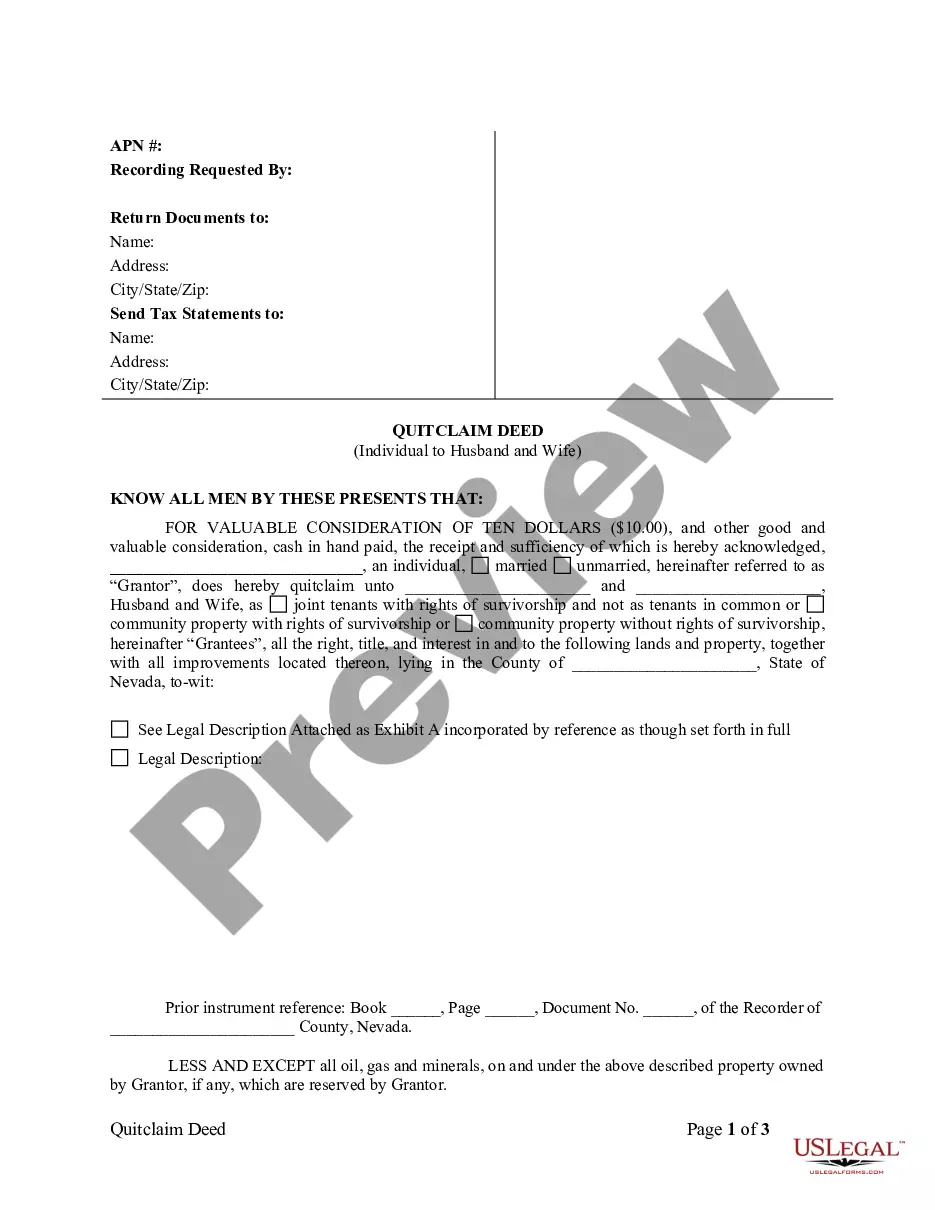

An investment management agreement to be used in connection with a private equity fund's appointment of an investment manager. This agreement sets out the terms and conditions by which a fund vehicle agrees to pay advisory and management services fees and out-of-pocket expenses to an investment manager entity.

Investment management is the maintenance of an investment portfolio, or a collection of financial assets. It can include purchasing and selling assets, creating short- or long-term investment strategies, overseeing a portfolio's asset allocation and developing a tax strategy.

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

The key components of an IMA include identification of parties, scope of services, investment objectives and guidelines, investment restrictions, fees and expenses, performance measurement and reporting, risk management, confidentiality and data protection, termination and dispute resolution, and compliance with ...

It consists of five steps: The transfer of mandate requirements into legal documentation; agreement of terms and conditions between the asset owner and the investment manager; legal review of documentation; the approval process; and the signing of the IMA or equivalent.