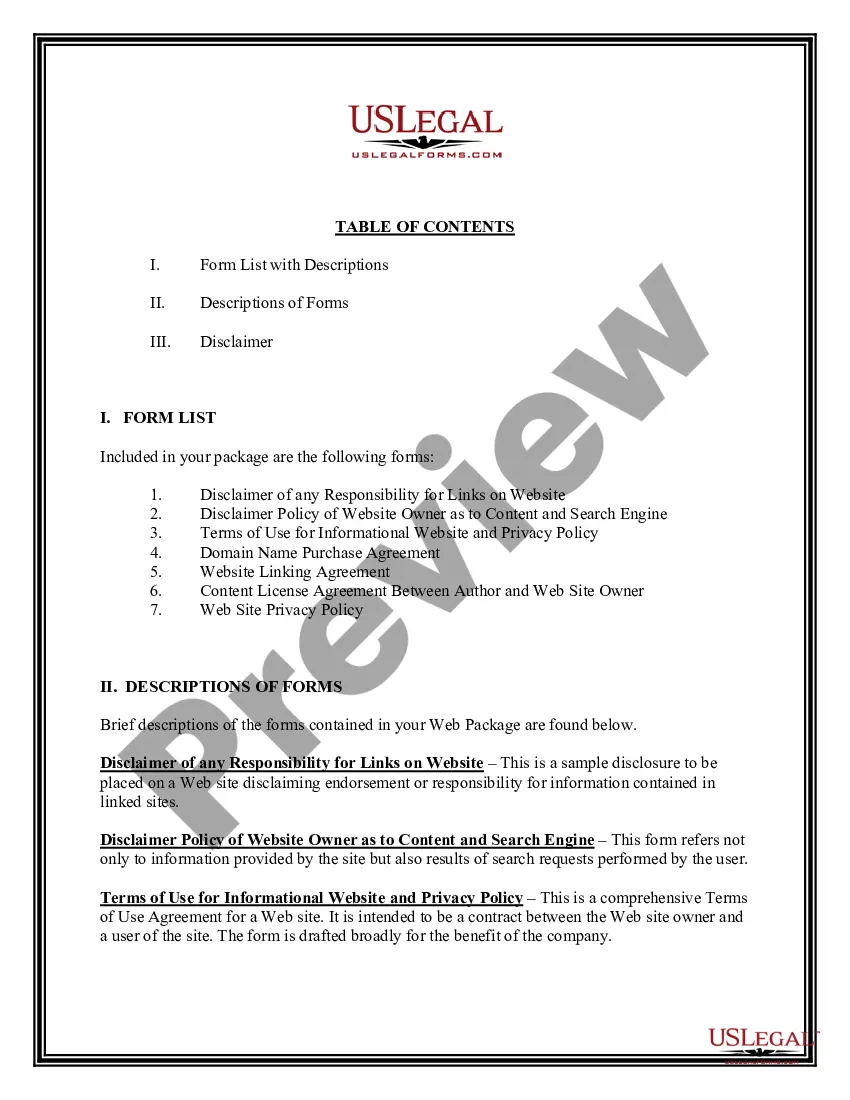

Nebraska Web Package

Description

How to fill out Web Package?

If you want to total, obtain, or produce legitimate papers web templates, use US Legal Forms, the greatest collection of legitimate kinds, that can be found online. Take advantage of the site`s simple and easy handy research to get the paperwork you require. Different web templates for enterprise and individual functions are categorized by types and states, or key phrases. Use US Legal Forms to get the Nebraska Web Package within a couple of clicks.

In case you are previously a US Legal Forms consumer, log in for your profile and click on the Acquire switch to find the Nebraska Web Package. You can also entry kinds you previously delivered electronically inside the My Forms tab of your respective profile.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the form for that right metropolis/region.

- Step 2. Utilize the Review option to look through the form`s content. Never overlook to read the information.

- Step 3. In case you are unhappy with all the form, take advantage of the Search discipline near the top of the display screen to get other versions of the legitimate form design.

- Step 4. After you have discovered the form you require, select the Acquire now switch. Select the prices plan you choose and include your accreditations to sign up for an profile.

- Step 5. Method the financial transaction. You may use your Мisa or Ьastercard or PayPal profile to complete the financial transaction.

- Step 6. Pick the format of the legitimate form and obtain it in your product.

- Step 7. Complete, change and produce or sign the Nebraska Web Package.

Each and every legitimate papers design you get is the one you have forever. You have acces to every single form you delivered electronically inside your acccount. Go through the My Forms portion and select a form to produce or obtain again.

Be competitive and obtain, and produce the Nebraska Web Package with US Legal Forms. There are millions of professional and status-particular kinds you can use for your personal enterprise or individual requires.

Form popularity

FAQ

Employers may set up a system to furnish Form W-2, Wage and Tax Statement, electronically and notify employees of all hardware and software requirements to receive the form. An employer may not send a Form W-2 electronically to any employee who does not consent or who has revoked consent previously provided.

You must register to use Business Services Online ? Social Security's suite of services that allows you to file W-2/W-2Cs online and verify your employees' names and Social Security numbers against our records.

What are the sales and use tax rates in Nebraska? The Nebraska state sales and use tax rate is 5.5%.

Yes. The wages paid to employees for work done in Nebraska is subject to Nebraska income tax withholding.

Many states require W-2s to be filed with the state and many require their own annual reconciliation form, similar to the Federal W-3. Learn about the requirements for each state but make sure you verify your responsibilities by checking your state's website or speaking with your accountant or bookkeeper.

Go to the . Log in with your State ID number and PIN. Complete all of the required fields (Contact Information ? first name, last name, phone number, and email). Click "Upload W2/1099 Data."