Nebraska Purchase Order for Construction Materials

Description

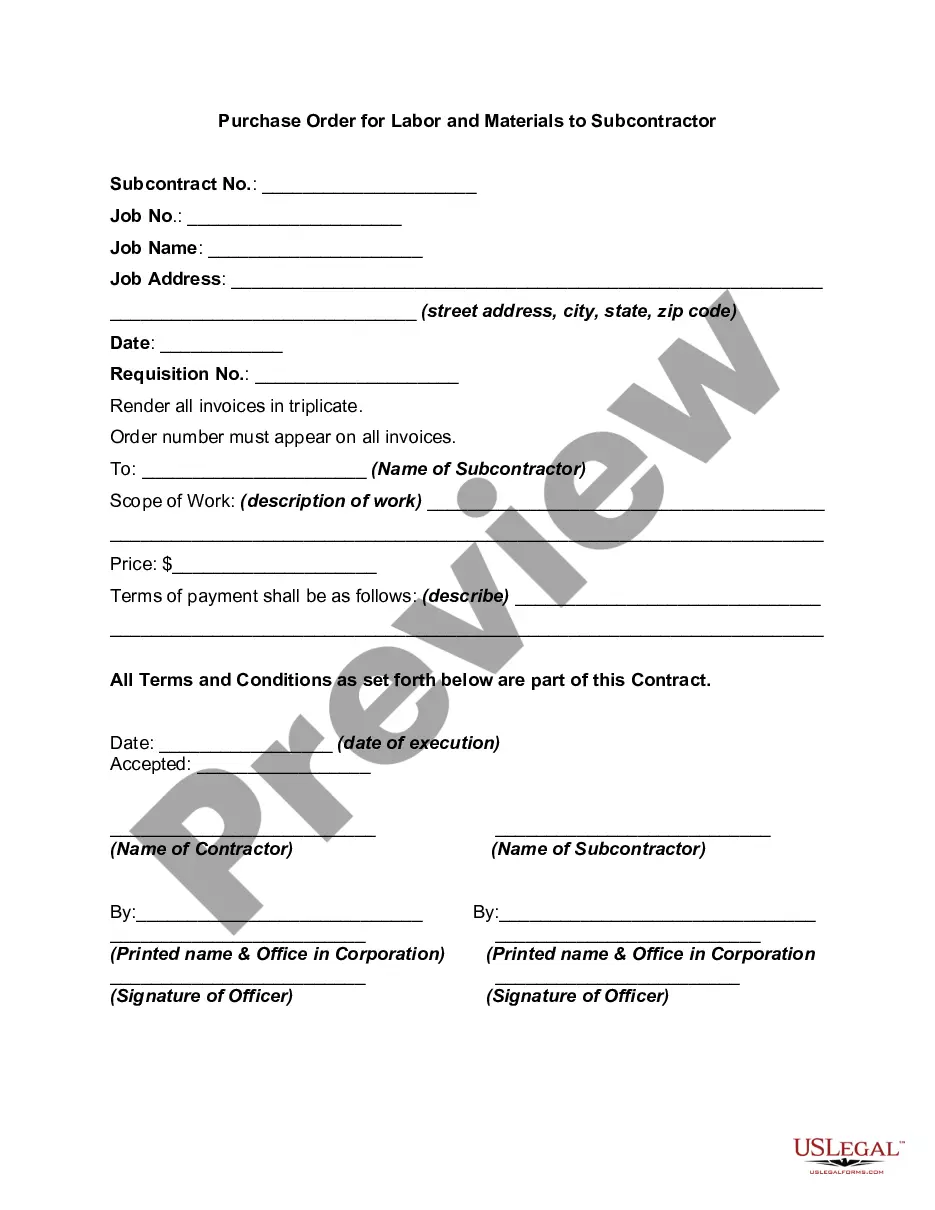

How to fill out Purchase Order For Construction Materials?

Have you ever found yourself in a situation where you need documents for either business or personal reasons almost every day? There are numerous legitimate document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast selection of form templates, such as the Nebraska Purchase Order for Construction Materials, which are designed to comply with state and federal regulations.

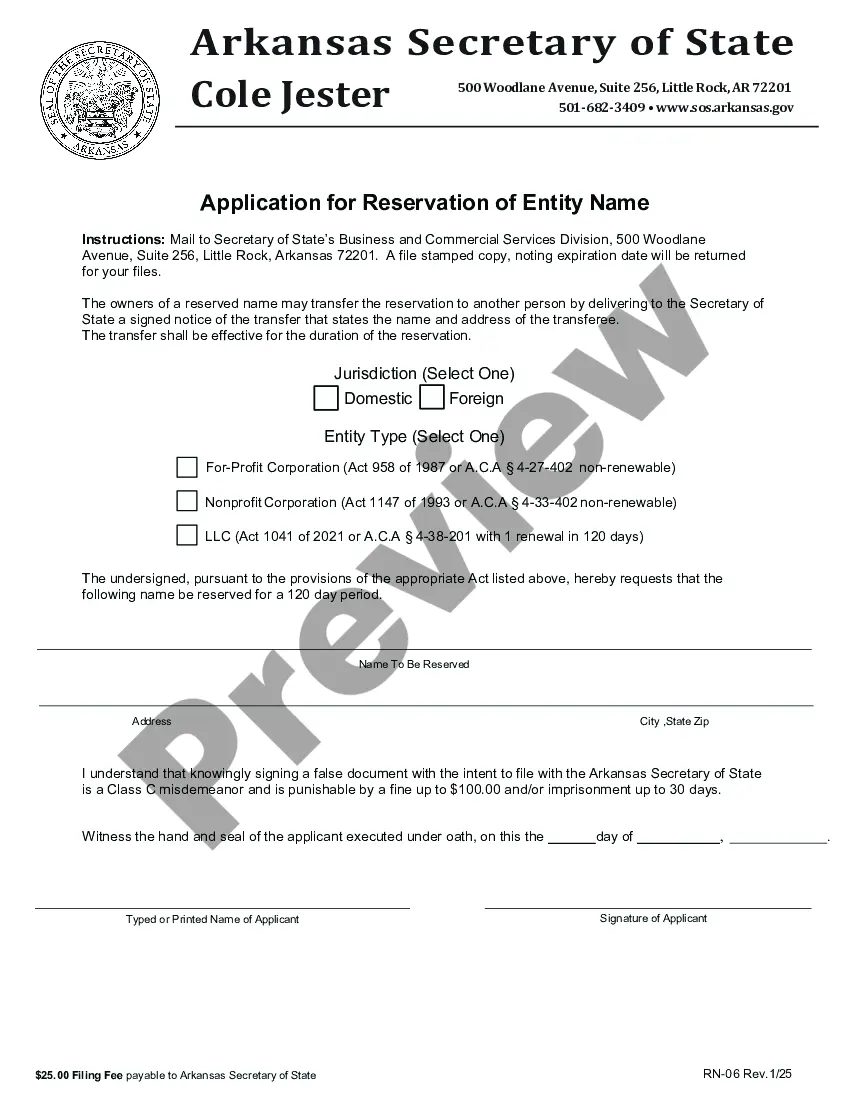

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Afterwards, you can download the Nebraska Purchase Order for Construction Materials template.

- Obtain the form you need and make sure it is for the correct city/area.

- Utilize the Preview button to review the form.

- Examine the description to ensure you have selected the correct form.

- If the form is not what you're looking for, use the Lookup field to find the form that meets your needs.

- Upon finding the appropriate form, click on Get now.

- Choose the pricing plan you prefer, fill out the required details to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

In Nebraska, construction services are generally not subject to sales tax. However, when it comes to materials used in construction, they may be taxable if you do not have a Nebraska Purchase Order for Construction Materials. It is essential for contractors and builders to be aware of these tax regulations to avoid potential liabilities. Working with a platform like uslegalforms can help clarify these tax implications and streamline the process of obtaining necessary documentation.

An option 3 contractor in Nebraska is a contractor who has registered with the state's contracting authority, allowing them to perform work for public projects. This type of contractor is typically involved in projects that may require a Nebraska Purchase Order for Construction Materials. It is crucial for contractors to understand this classification, as it can impact their bidding abilities and compliance with state regulations. Utilizing the correct contractor designation can help ensure that your construction materials and services meet local guidelines.

Filling out a construction contract involves entering essential details such as project scope, timelines, and payment terms. Start by specifying the parties involved, then outline the work to be completed. Include costs associated with materials, such as a Nebraska Purchase Order for Construction Materials, to ensure transparency. You can streamline this process using tools like US Legal Forms, which provide templates to assist you in creating compliant contracts.

A Nebraska Purchase Order for Construction Materials is a formal document used to request specific materials for construction projects. For instance, if a contractor needs bricks, mortar, and steel reinforcements, they would create a purchase order detailing these items, their quantities, and the delivery date. This clear communication helps in managing budgets and tracking orders effectively. By using a purchase order, both buyers and suppliers have a record of the transaction.

In Nebraska, certain items are exempt from sales tax, including some types of food, prescription medications, and specific materials used in manufacturing and construction. When you use a Nebraska Purchase Order for Construction Materials, it’s beneficial to know which materials qualify for these exemptions. Understanding these details can help you optimize your budget and reduce costs associated with your construction projects.

In Nebraska, construction labor is generally taxable unless specific exemptions apply. However, labor related to installing, maintaining, or repairing tangible personal property often falls under taxable services. Utilizing a Nebraska Purchase Order for Construction Materials can aid in tracking and managing expenses, providing clarity on what labor costs may be exempt based on the nature of the construction work.

Yes, contractors in Nebraska must be licensed to ensure compliance with local regulations and quality standards. This requirement applies to various categories of contractors, including those involved in residential and commercial construction. Using a Nebraska Purchase Order for Construction Materials also emphasizes adherence to these regulations, as contractors must demonstrate that they are operating within the law.

In Nebraska, certain services are exempt from sales tax, particularly those related to manufacturing, agriculture, and specific construction activities. For example, when contractors use a Nebraska Purchase Order for Construction Materials to acquire items required for their projects, they may benefit from these exemptions. It’s important to ensure you understand the details, as this can significantly impact your overall project costs.