Nebraska Hand Check Request Form

Description

How to fill out Hand Check Request Form?

Are you currently in a circumstance where you need documents for either business or personal purposes on a daily basis.

There are numerous legal document templates available online, but finding reliable forms can be challenging.

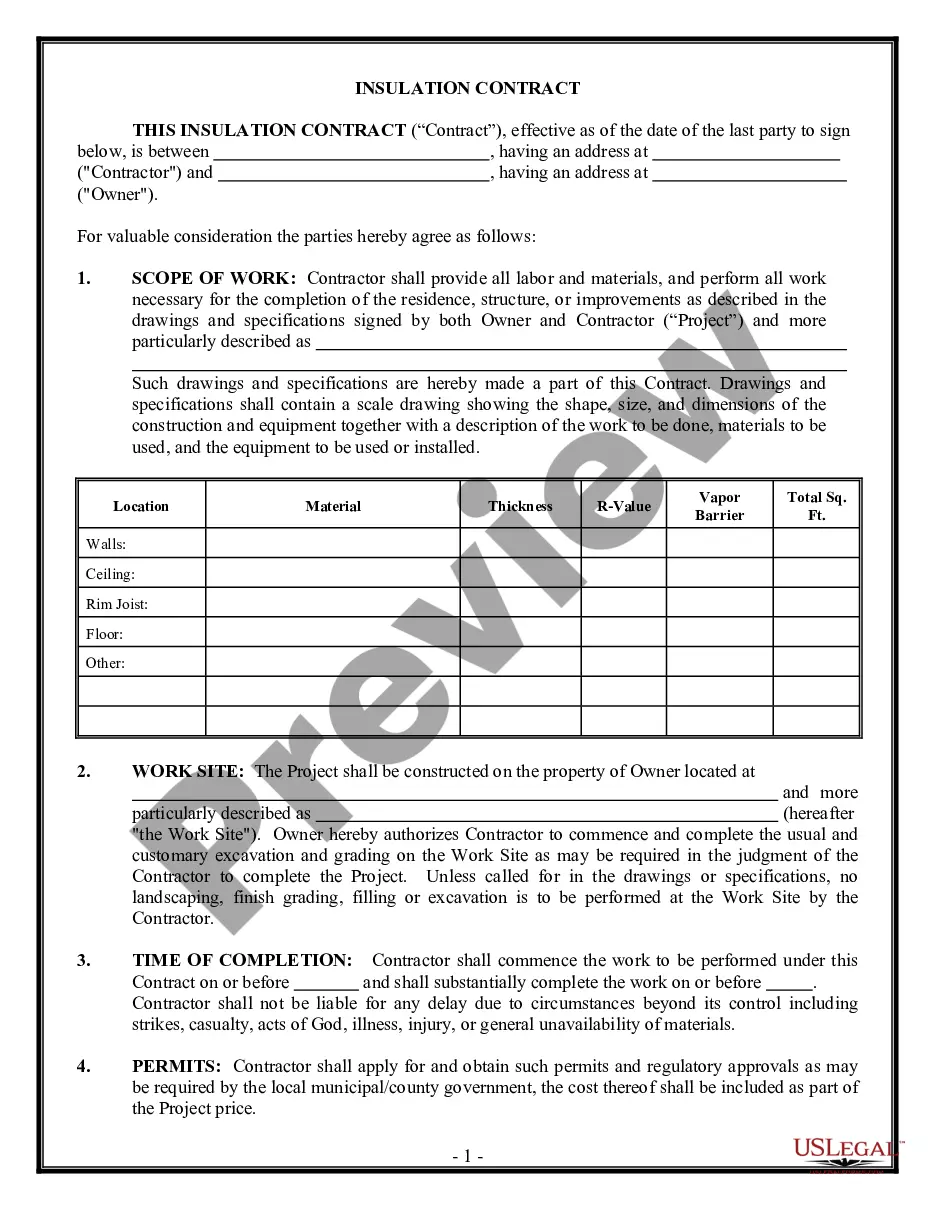

US Legal Forms offers thousands of form templates, such as the Nebraska Hand Check Request Form, designed to meet state and federal requirements.

Once you acquire the right form, click Buy now.

Select the pricing plan you desire, enter the necessary details to process your payment, and pay for your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Nebraska Hand Check Request Form template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and confirm it is for the correct city/county.

- Use the Review option to examine the form.

- Check the overview to ensure you have selected the correct form.

- If the form does not meet your needs, utilize the Search section to find the appropriate form.

Form popularity

FAQ

Employers generally must withhold federal income tax from employees' wages. To figure out how much tax to withhold, use the employee's Form W-4, the appropriate method and the appropriate withholding table described in Publication 15-T, Federal Income Tax Withholding Methods. You must deposit your withholdings.

If an employee can not document the number of allowances on the Federal W20114 and the documentation supports a lesser number, which number of allowances should be used for Nebraska income tax withholding purposes? The law specifies a withholding rate of 1.5%.

You will be issued an income tax withholding certificate by the Nebraska Department of Revenue (DOR). If you are licensed for income tax withholding, you must file a Form W-3N, even if no payments were made that were subject to income tax withholding, or if the license was cancelled during the year.

You must give your employer a new Nebraska Form W-4N by February 15 each year to continue your exemption. You cannot claim exemption from withholding if another person can claim you on their tax return; and your total income exceeds $1,100 and includes more than $350 of unearned income.

A Form 941N is required even if no payments were made that were subject to income tax withholding. Paper filers should mail this return with payment to the Nebraska Department of Revenue, PO Box 98915, Lincoln, Nebraska 68509-8915.

The new 2021 Form W-4 remains relatively unchanged after a major overhaul in December 2019. The only notable updates include a few adjustments to taxable wage & salary tables on page 4. For employers, this means that current employees won't face a learning curve when updating withholdings.