Nebraska Check Requisition Worksheet

Description

How to fill out Check Requisition Worksheet?

If you need to sum, obtain, or print approved document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After you find the form you need, click the Buy now button. Select your preferred pricing plan and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Employ US Legal Forms to find the Nebraska Check Requisition Worksheet in just a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and click on the Download button to locate the Nebraska Check Requisition Worksheet.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for the appropriate city/state.

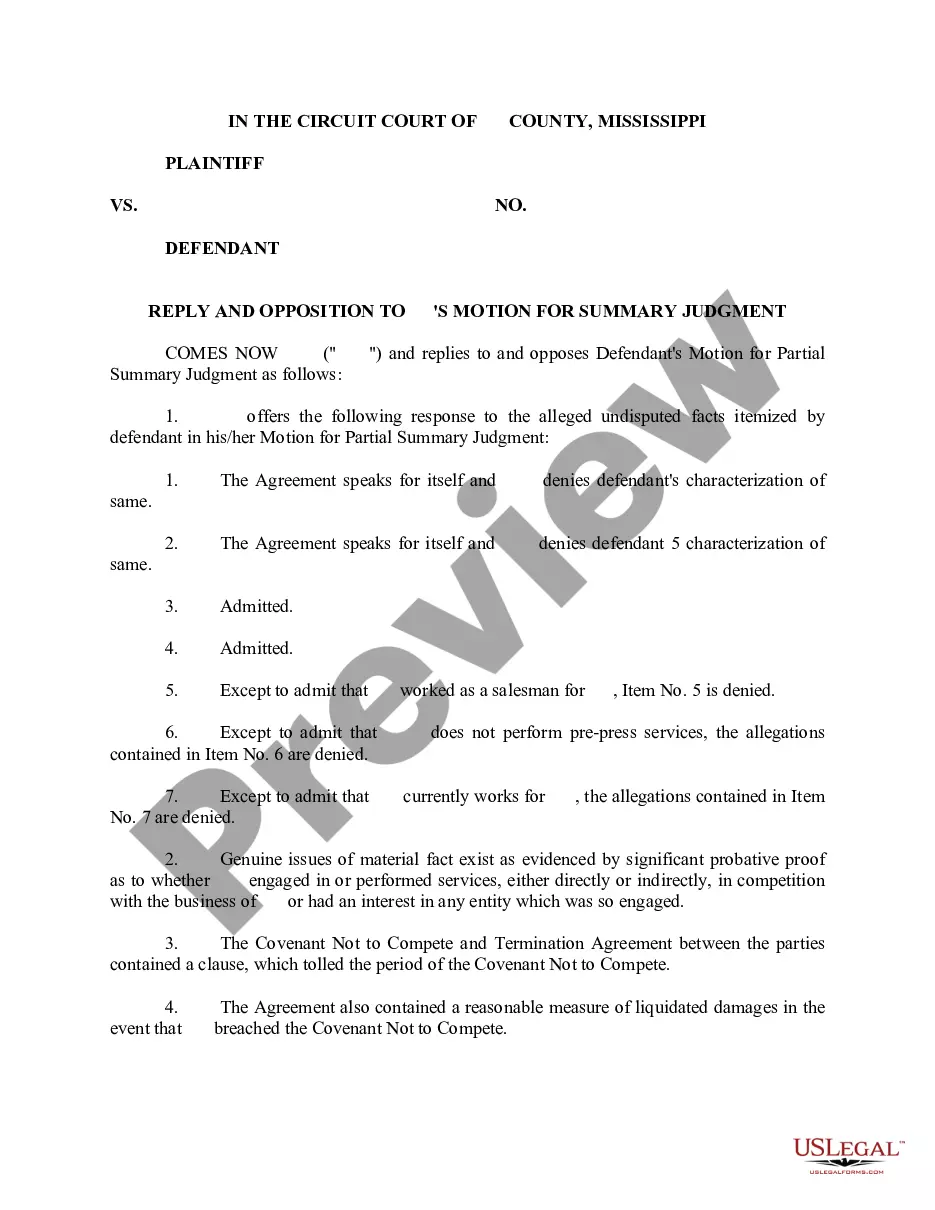

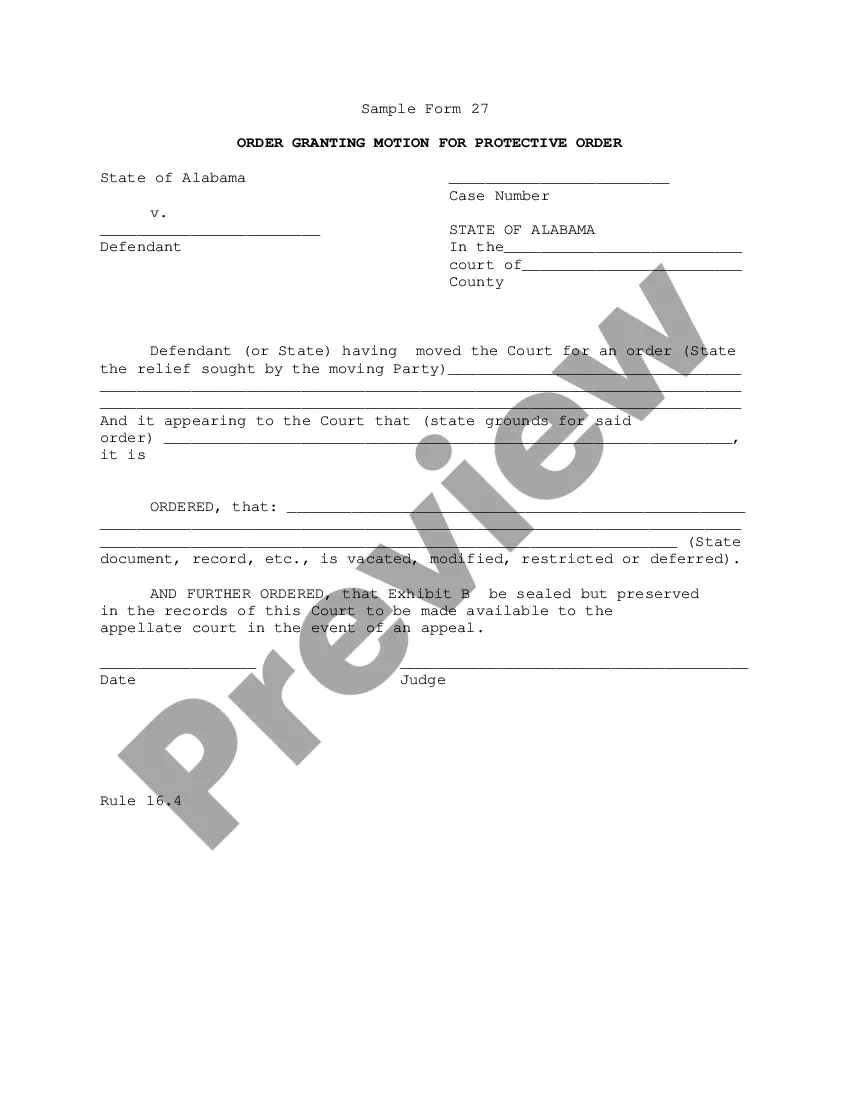

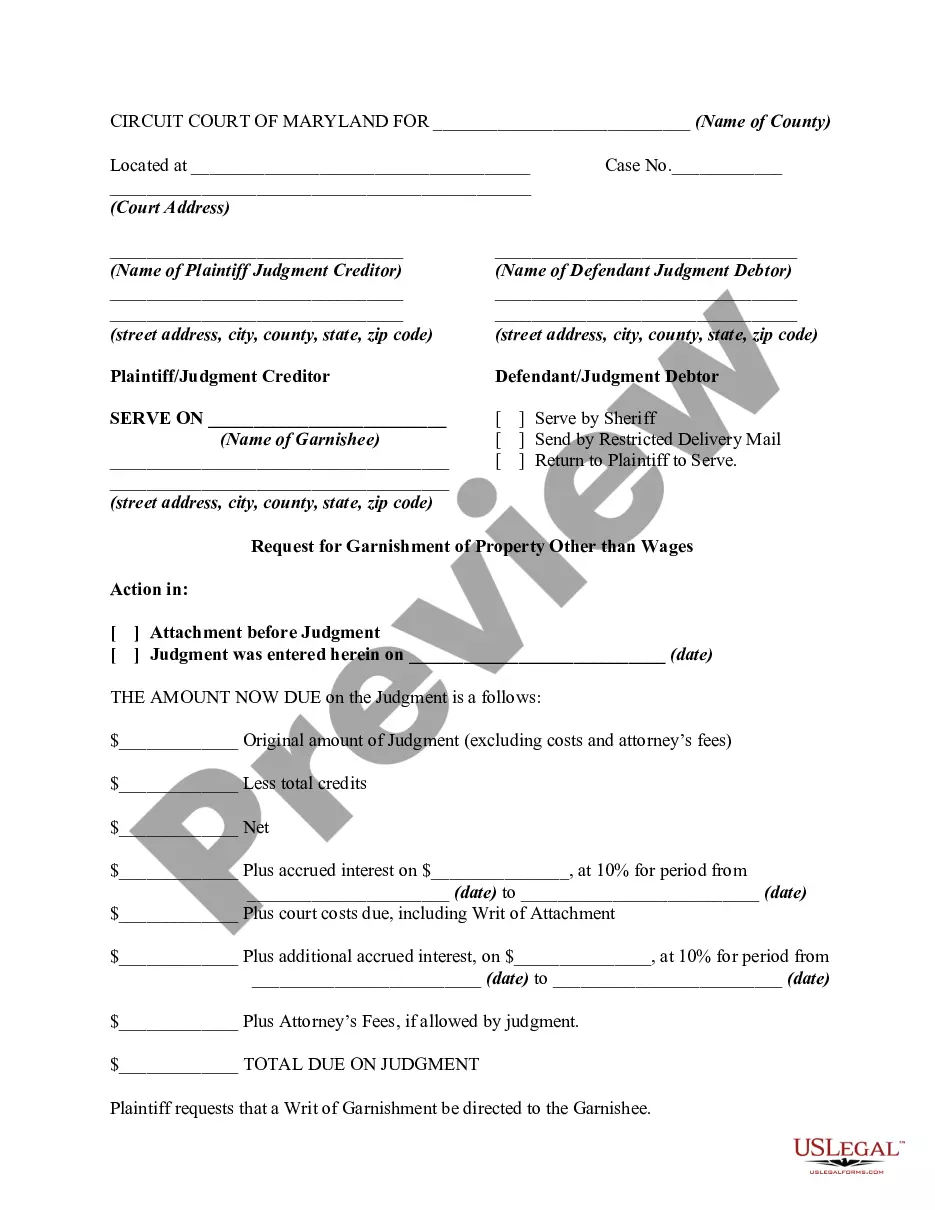

- Step 2. Use the Preview option to review the contents of the form. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Taxable income not subject to withholding Interest, dividends, capital gains, self-employment and gig economy income and IRA (including certain Roth IRA) distributions.

How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for 2019. As you may know, Form W-4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your pay.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

What Is Withholding? Withholding is the portion of an employee's wages that is not included in their paycheck but is instead remitted directly to the federal, state, or local tax authorities. Withholding reduces the amount of tax employees must pay when they submit their annual tax returns.

Nebraska State Payroll Taxes The 2022 tax rates range from 2.46% to 6.84%. There are no local taxes, so all of your employees will pay the same state income tax no matter where they live.

941N Nebraska Income Tax Withholding Return.

According to Section 7720112753(5), "Wages and other payments subject to withholding shall mean payments that are subject to withholding under the Internal Revenue Code of 1986 and are (a) payments made by employers to employees, except such payments subject to 26 U.S.C.

Allowances claimed on the Form W-4N are used by your employer or payor to determine the Nebraska state income tax withheld from your wages, pension, or annuity to meet your Nebraska state income tax obligation.

What Pay is Subject to WithholdingYour regular pay, commissions and vacation pay.Reimbursements and other expense allowances paid under a non-accountable plan.Pensions, bonuses, commissions, gambling winnings and certain other income.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.