Nebraska Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

You can spend several hours online seeking the legal document template that satisfies the state and federal requirements you have.

US Legal Forms offers hundreds of legal documents that have been reviewed by experts.

It is easy to download or print the Nebraska Unrestricted Charitable Contribution of Cash from our platform.

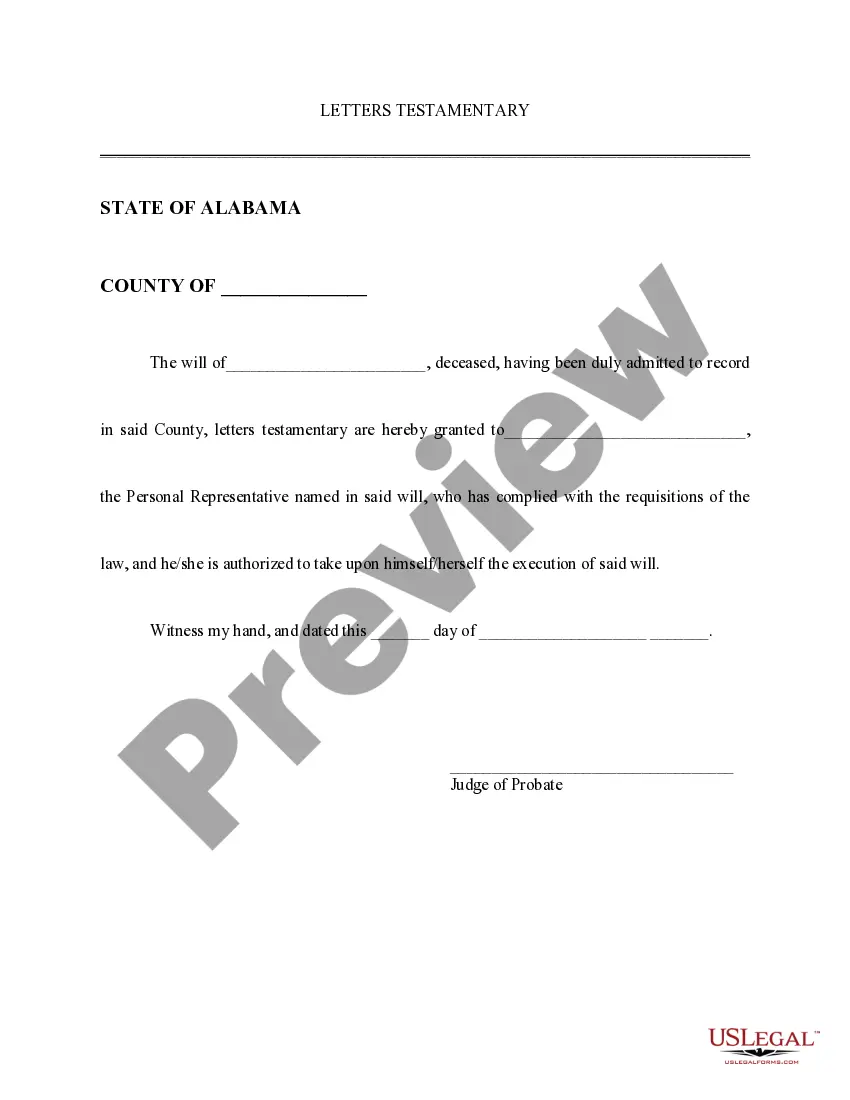

If available, utilize the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can complete, modify, print, or sign the Nebraska Unrestricted Charitable Contribution of Cash.

- Every legal document template you purchase is your property indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Check the form details to confirm you have selected the appropriate document.

Form popularity

FAQ

Yes, you can deduct Nebraska Unrestricted Charitable Contribution of Cash without itemizing. The IRS has allowed certain taxpayers to claim a deduction for these contributions directly on their tax return. This provision makes it easier for individuals to support charitable organizations while still benefiting from tax deductions. If you are unsure of how to proceed, consider using uslegalforms, which offers resources to help you navigate these deductions effectively.

The highest amount you can deduct for charitable donations often depends on your adjusted gross income and the type of organization you donate to. For cash contributions, the IRS typically allows deductions up to 60% of your adjusted gross income. Therefore, if you engage in a Nebraska Unrestricted Charitable Contribution of Cash, you should consult a tax professional to maximize your benefits and ensure compliance.

Yes, charitable donations are generally tax deductible in Oregon, much like in other states. However, you need to verify that the organization you’re donating to qualifies under IRS rules. If you make a Nebraska Unrestricted Charitable Contribution of Cash, you can often deduct this amount, helping you reduce your taxable income while supporting a good cause.

Yes, you can claim charitable contributions on your tax return as long as you meet certain criteria. If you make a Nebraska Unrestricted Charitable Contribution of Cash to a qualified charity, you should keep your receipts and any documentation. This ensures you can accurately report your contributions and potentially receive a tax deduction.

Classifying charitable contributions can seem complex, but it really comes down to understanding the different types. When you make a Nebraska Unrestricted Charitable Contribution of Cash, you generally classify it as a cash donation made directly to an eligible charitable organization. These contributions must be documented properly to meet IRS requirements and ensure you get the tax benefits you deserve.

The maximum you can write off for charitable donations typically depends on your adjusted gross income (AGI). For cash donations, you can generally deduct up to 60% of your AGI if you make Nebraska Unrestricted Charitable Contributions of Cash to qualifying charities. It’s important to calculate your deduction accurately and maintain proper documentation for any contributions made above the limits, especially if you plan to maximize your tax benefits.

The maximum donation you can claim on taxes without proof is $300 for individuals and $600 for married couples filing jointly for the tax year 2021 and beyond. This allows you to make Nebraska Unrestricted Charitable Contributions of Cash without needing receipts, simplifying the process. Keep in mind that this limit applies only to cash donations made to qualified charities, so ensure your contributions are directed to eligible organizations.