Nebraska Notice of Disputed Account

Description

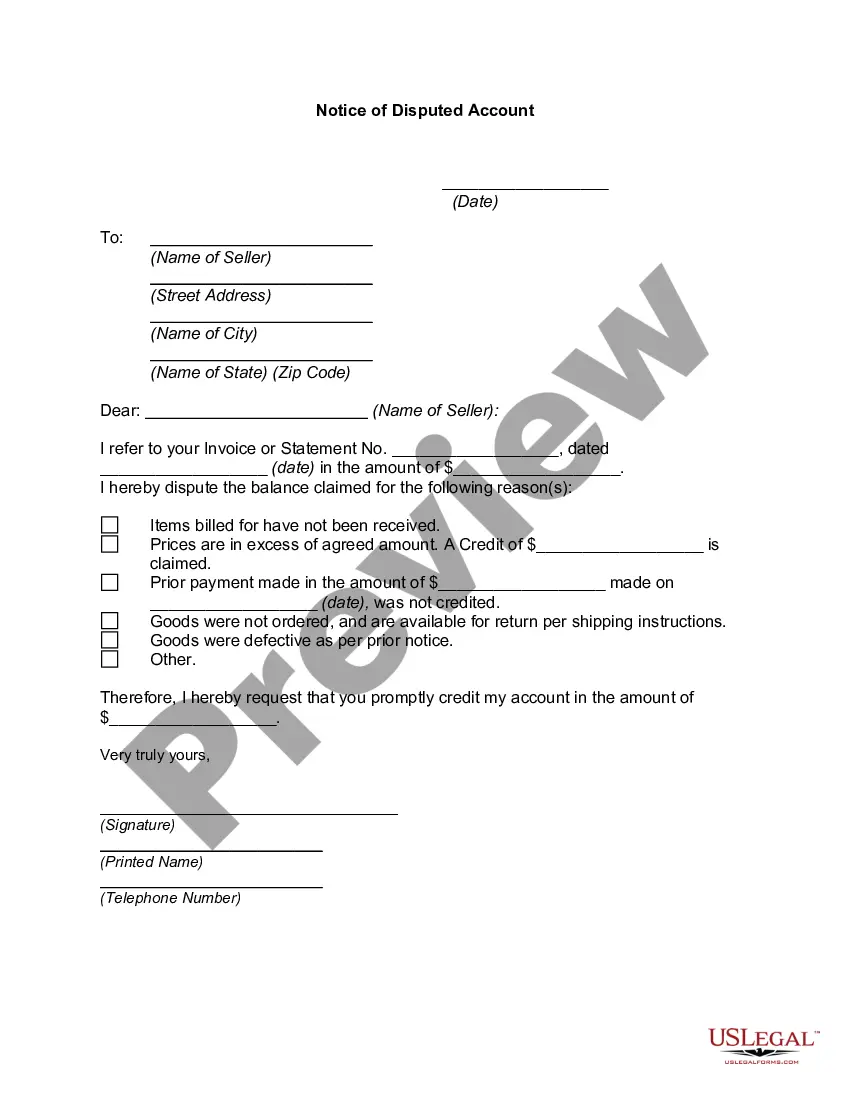

How to fill out Notice Of Disputed Account?

Are you in a circumstance where you require documents for potential organization or particular purposes nearly every day? There are numerous legal form templates accessible online, but finding ones you can rely on is not straightforward.

US Legal Forms offers numerous form templates, including the Nebraska Notice of Disputed Account, designed to satisfy federal and state requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Then, you can download the Nebraska Notice of Disputed Account template.

- Identify the form you need and confirm it is for the correct city/region.

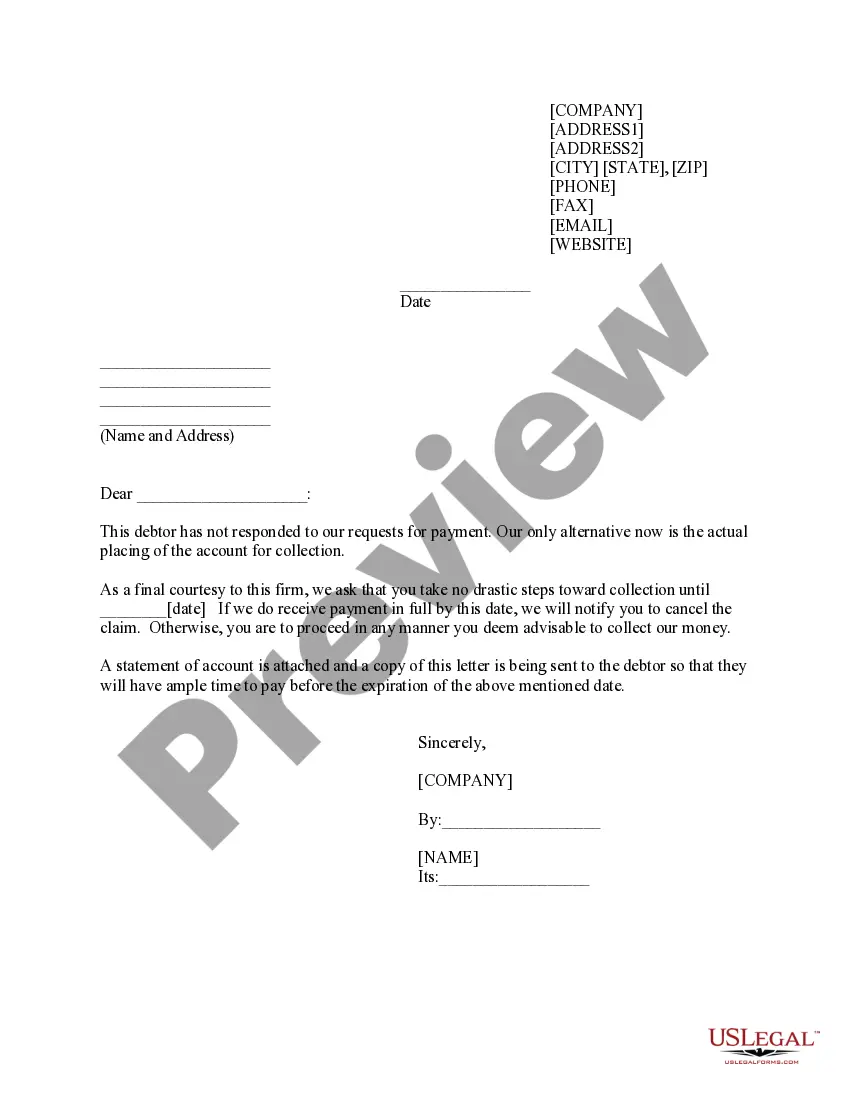

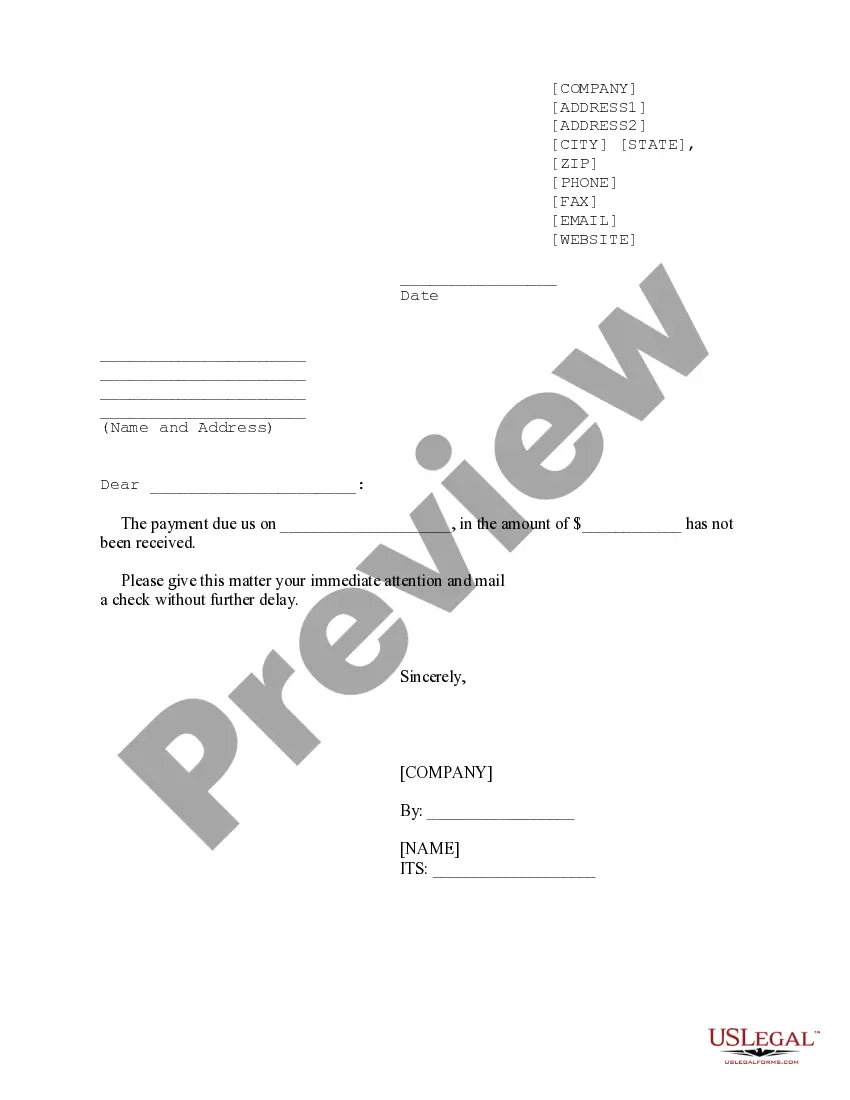

- Use the Preview button to inspect the form.

- Verify the information to ensure you have selected the right form.

- If the form is not what you want, utilize the Search box to find the form that suits your requirements.

- Once you locate the correct form, click Buy now.

- Select the pricing plan you desire, fill in the necessary details to create your account, and complete the purchase using your PayPal or credit card.

- Choose a suitable document format and download your copy.

Form popularity

FAQ

The Prompt Payment Act in Nebraska is legislation designed to ensure timely payments to contractors by public bodies. This act aims to protect contractors from payment delays and fosters a fair business environment. If you encounter issues regarding a Nebraska Notice of Disputed Account, understanding this act can empower you to advocate for your rights and ensure compliance with payment obligations.

Nebraska statute 28-620 addresses the issue of fraudulent misrepresentation and its penalties. This statute outlines the legal definitions and consequences for individuals who intentionally mislead others for personal gain. If you find yourself needing to address a Nebraska Notice of Disputed Account, understanding this statute can provide insights into the legal landscape surrounding your situation.

The due process clause in Nebraska guarantees that individuals will receive fair treatment through the judicial system before any legal rights are taken away. This clause ensures that debts are pursued according to established legal standards and procedures. If you are involved in a Nebraska Notice of Disputed Account, this clause protects your rights, allowing you to respond and defend your position.

To stop a garnishment in Nebraska, you can file a motion with the court that issued the garnishment order. Providing valid reasons, such as financial hardship or a dispute regarding the debt, is crucial. If you need assistance, utilizing the Nebraska Notice of Disputed Account can streamline the process and help you effectively communicate your concerns.

In Nebraska, the statute of limitations for debt collection is typically four years, starting from the date the payment was last made. This means that creditors have a limited time to pursue legal action to recover debts. If you face an issue related to a Nebraska Notice of Disputed Account, understanding this time frame can help you protect your rights and avoid unnecessary legal troubles.

To officially close an LLC, begin by filing the Articles of Dissolution with your state’s Secretary of State. Next, settle all debts and distribute remaining assets among members. Crucially, ensure that you address any outstanding communications, including a Nebraska Notice of Disputed Account. This process safeguards you from future legal or financial issues.

Yes, you must notify the IRS when you close your LLC by filing the final tax return. This ensures that all tax obligations are settled appropriately. You should also check for any outstanding notices, such as a Nebraska Notice of Disputed Account. Proper documentation during this process can prevent future complications.

If you receive a notice of deficiency in Nebraska, you can file a protest with the Nebraska Department of Revenue. Be sure to provide clear evidence and documentation supporting your case. Acting quickly is essential, as there are deadlines for filing protests. If there's a Nebraska Notice of Disputed Account involved, addressing it promptly can help clarify your financial status.

To officially close your LLC in Nebraska, you need to file the Articles of Dissolution with the Secretary of State. Follow this by notifying any relevant parties, and handle all lingering obligations. This step is important to prevent complications, especially if you have received a Nebraska Notice of Disputed Account regarding your business activities.

Choosing between dissolving your LLC or leaving it inactive depends on your future plans. If you believe you will not return to business activities, dissolving the LLC is often the best option. This process helps prevent potential legal issues and unwanted fees. Additionally, addressing any Nebraska Notice of Disputed Account is crucial to ensure closure of financial matters.