Nebraska Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

Have you ever found yourself in a situation where you need to have documents for personal or business purposes almost daily.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides a vast selection of form templates, including the Nebraska Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets, designed to meet federal and state requirements.

Utilize US Legal Forms, the most extensive range of legal documents, to save time and avoid errors.

The service offers properly crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Nebraska Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

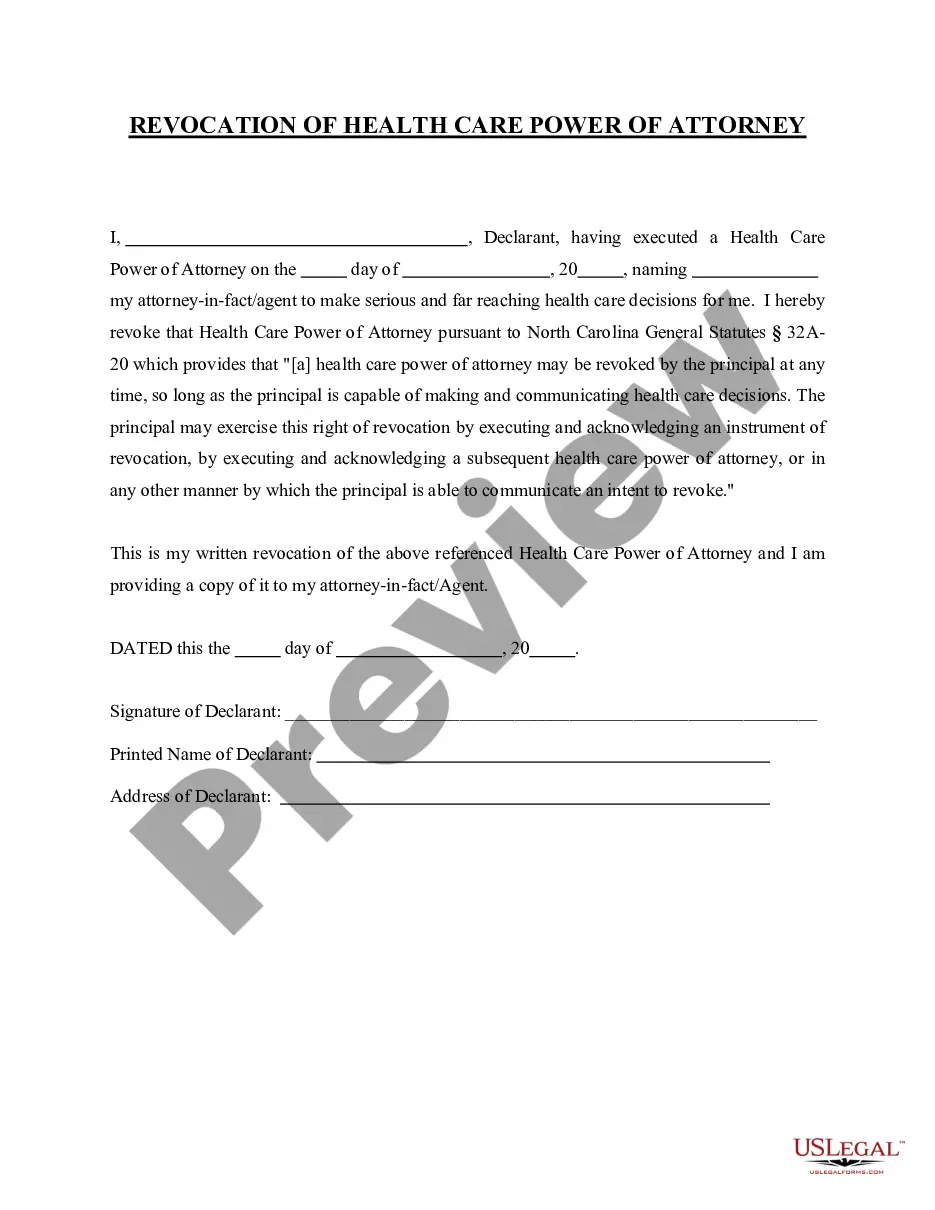

- Utilize the Preview button to view the form.

- Read the description to ensure you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs.

- Once you find the right form, click Get now.

- Select the payment plan you wish, fill in the required details to create your account, and complete the payment using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Nebraska Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets whenever needed. Just click the desired form to download or print the document template.

Form popularity

FAQ

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

If you decide to create a partnership in Nebraska, there are a few steps to go through in order to properly establish the business.Step 1: Select a name for your partnership.Step 2: Register business name.Step 3: File organizational documents with the Secretary of State.More items...?

Less...Hold a Board of Directors meeting and record a resolution to Dissolve the Nebraska Corporation.Hold a Shareholder meeting to approve Dissolution of the Nebraska Corporation.File all required Biennial Reports with the Nebraska Secretary of State.Clear up any business debts.More items...

To dissolve an LLC in Nebraska, simply follow these three steps: Follow the Operating Agreement....Step 1: Follow Your Nebraska LLC Operating Agreement. For most LLCs, the steps for dissolution will be outlined in the operating agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.08-Dec-2021

In the dissolution process, any partner may dissolve the partnership at any time by providing a notice of dissolution. The partnership is then required to wind up its business activities and distribute its assets.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

To dissolve an LLC in Nebraska, you are required to submit a complete Article of Dissolution to the Secretary of State. Before submitting the Article of Dissolution, one must follow the operating agreement. If you have a Nebraska LLC (domestic or foreign) you must have an operating agreement.