Nebraska Assignment of Commercial Leases as Collateral for Commercial Loan

Description

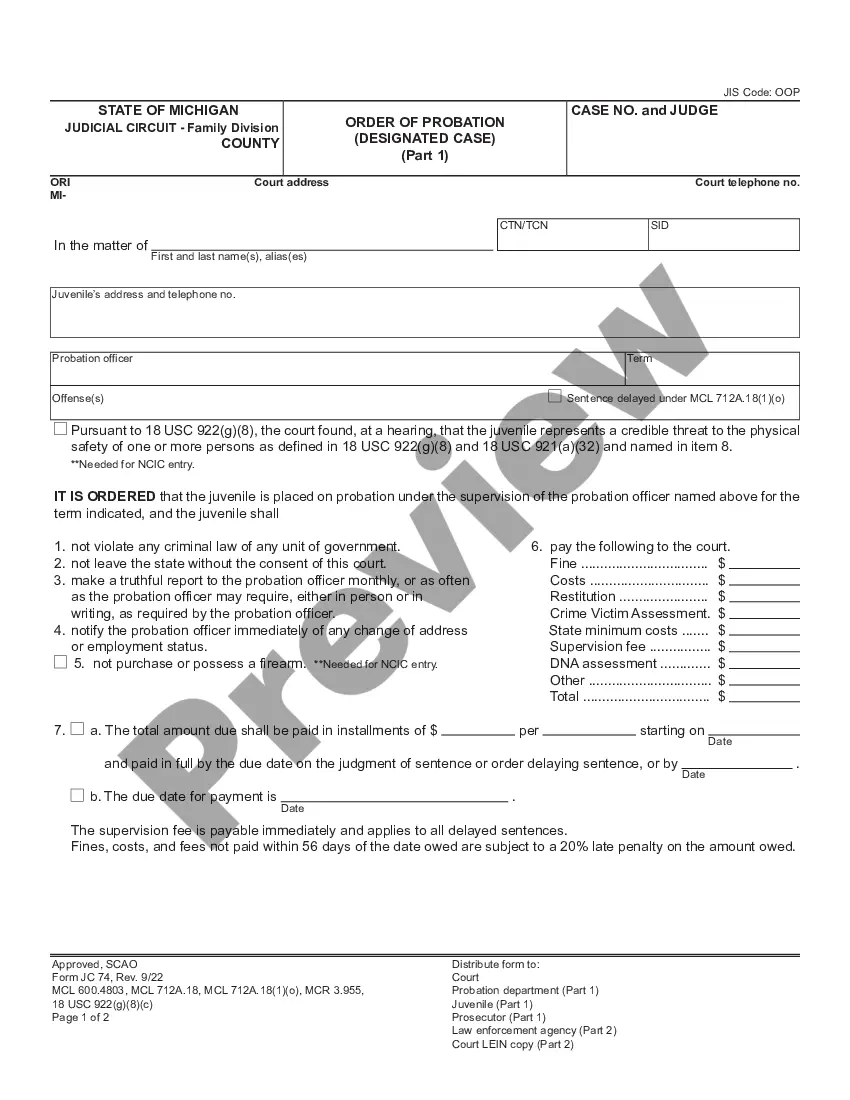

How to fill out Assignment Of Commercial Leases As Collateral For Commercial Loan?

Are you in a place the place you need paperwork for sometimes business or individual purposes virtually every working day? There are a variety of authorized document themes available online, but discovering ones you can depend on isn`t effortless. US Legal Forms gives a large number of develop themes, like the Nebraska Assignment of Commercial Leases as Collateral for Commercial Loan, which can be published in order to meet state and federal demands.

If you are previously informed about US Legal Forms site and get a free account, basically log in. Afterward, you are able to acquire the Nebraska Assignment of Commercial Leases as Collateral for Commercial Loan template.

If you do not come with an bank account and need to begin to use US Legal Forms, adopt these measures:

- Find the develop you need and make sure it is for that appropriate city/state.

- Use the Review switch to check the form.

- See the outline to ensure that you have chosen the right develop.

- If the develop isn`t what you`re searching for, take advantage of the Search discipline to obtain the develop that meets your requirements and demands.

- When you obtain the appropriate develop, just click Get now.

- Select the pricing plan you need, complete the desired information to generate your money, and pay for your order with your PayPal or bank card.

- Select a hassle-free data file structure and acquire your backup.

Discover all of the document themes you may have purchased in the My Forms menus. You may get a further backup of Nebraska Assignment of Commercial Leases as Collateral for Commercial Loan at any time, if needed. Just go through the required develop to acquire or print the document template.

Use US Legal Forms, one of the most extensive collection of authorized kinds, to save lots of time and avoid faults. The assistance gives professionally created authorized document themes which can be used for a selection of purposes. Produce a free account on US Legal Forms and begin making your life easier.

Form popularity

FAQ

A collateral assignment of lease is a legal contract that transfers the rights to rental payments from the asset's owner to a lender to secure funding. In this contract, the lease's rentals are like a loan from the funder to the lessor and the lease acts as security.

Assignment is a legal term whereby an individual, the ?assignor,? transfers rights, property, or other benefits to another known as the ?assignee.? This concept is used in both contract and property law. The term can refer to either the act of transfer or the rights/property/benefits being transferred.

The difference between assignment and transfer is that assign means it's legal to transfer property or a legal right from one person to another, while transfer means it's legal to arrange for something to be controlled by or officially belong to another person.

By contrast, an assignment occurs when you transfer all your space to someone else (called an assignee) for the entire remaining term of the lease. As with a sublet, you are free to choose your assignee and determine the rent unless your lease says otherwise.

The assignment of leases and rents, also known as the assignment of leases rents and profits, is a legal document that gives a mortgage lender right to any future profits that may come from leases and rents when a property owner defaults on their loan.

An assignment is the transfer of one party's entire interest in and obligations under a lease to another party. The new tenant takes on the lease responsibilities, including rent and property maintenance, and the original tenant is released from most (if not all) of its duties.

Transfer by assignment takes place when the holder of a negotiable instrument sells his right to another person without endorsing it. The assignee is entitled to get possession and can recover the amount due on the instrument from the parties thereto.

Unlike a non-exclusive copyright transfer such as a licensing agreement, a copyright assignment is a form of exclusive copyright transfer. Copyright assignments could be made on part or on the entirety of an intellectual work.