Nebraska Sample Letter regarding Judgment Closing Estate

Description

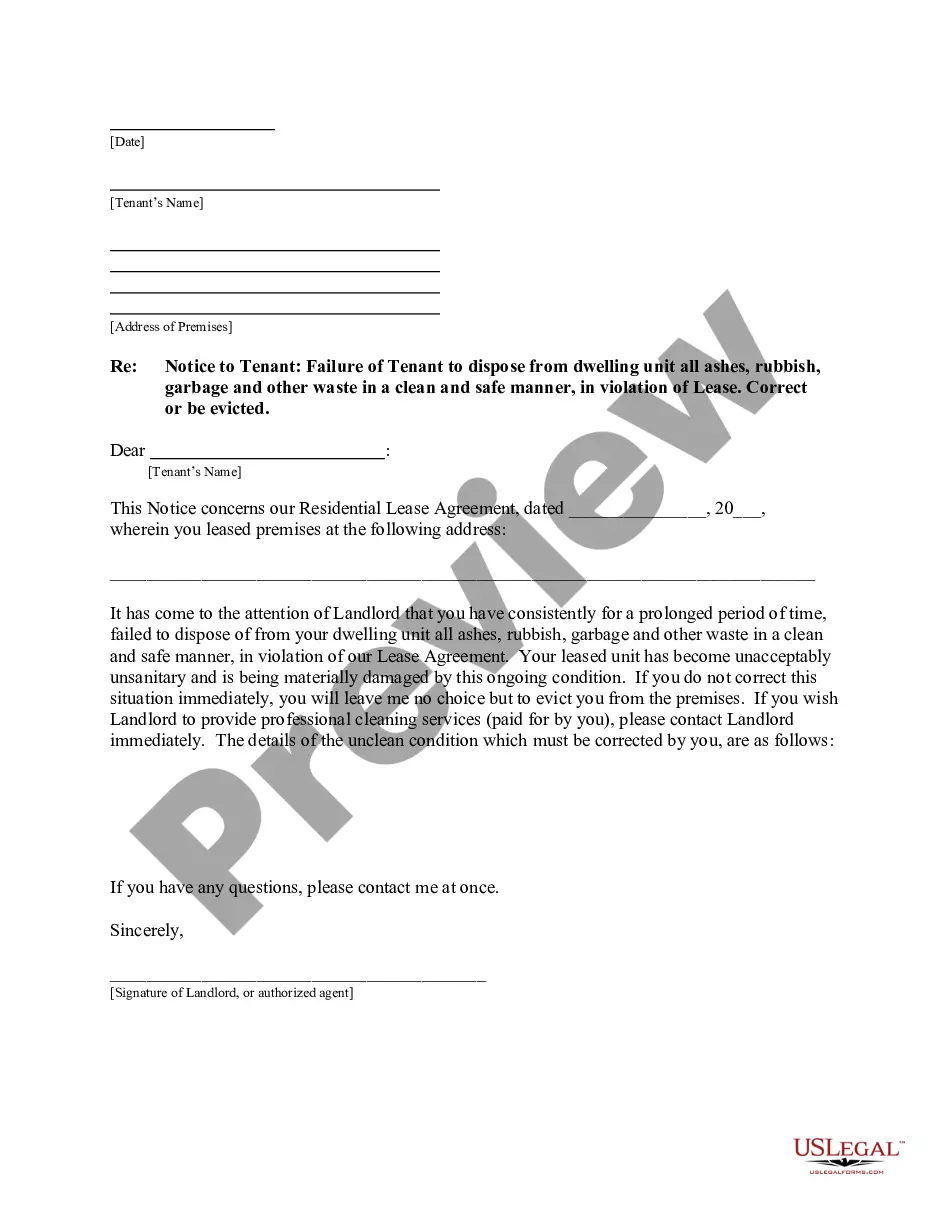

How to fill out Sample Letter Regarding Judgment Closing Estate?

It is possible to spend hrs on the Internet trying to find the authorized file format that meets the state and federal requirements you need. US Legal Forms provides 1000s of authorized kinds which can be examined by professionals. You can actually download or printing the Nebraska Sample Letter regarding Judgment Closing Estate from the support.

If you already have a US Legal Forms bank account, you can log in and click on the Acquire option. Next, you can complete, edit, printing, or indicator the Nebraska Sample Letter regarding Judgment Closing Estate. Every single authorized file format you get is your own permanently. To acquire another duplicate associated with a bought form, visit the My Forms tab and click on the corresponding option.

If you use the US Legal Forms site for the first time, stick to the simple directions listed below:

- Initially, ensure that you have selected the proper file format for the area/town of your choosing. See the form description to make sure you have picked the right form. If offered, take advantage of the Preview option to appear throughout the file format too.

- If you want to discover another model of your form, take advantage of the Search field to find the format that fits your needs and requirements.

- Once you have discovered the format you need, just click Purchase now to move forward.

- Select the pricing program you need, type your accreditations, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your bank card or PayPal bank account to fund the authorized form.

- Select the formatting of your file and download it for your device.

- Make adjustments for your file if possible. It is possible to complete, edit and indicator and printing Nebraska Sample Letter regarding Judgment Closing Estate.

Acquire and printing 1000s of file layouts utilizing the US Legal Forms site, that provides the largest assortment of authorized kinds. Use expert and status-specific layouts to handle your small business or individual requires.

Form popularity

FAQ

If the judge finds that person is in contempt, the judge will sentence that person to a jail sentence; but will allow him/her a chance to be released from jail by following a purge plan. A purge plan gives the person an opportunity to come into compliance with the court order.

The judge enters a default judgment in favor of the plaintiff in cases where the defendant receives a copy of the plaintiff´s claim form but fails to show up in court at the time set for trial.

NE Specifics In Nebraska, creditors have 3 years from the decedent's death to file a claim against the estate. However, if the executor has notified creditors in ance with Task: Publish Notice of Death, then creditors have only 2 months from the date of the first notice publication.

For judgments and written contracts, there is a five-year statute of limitations. The following chart lists additional time limits for various civil actions in Nebraska.

The task of settling a deceased person's estate, also known as probate, falls upon the executor. In Nebraska, this involves several key steps: validating the deceased's will, inventorying their assets, paying off any debts and taxes, and finally, distributing the remaining assets to the designated beneficiaries.

In order to qualify for treatment as a motion to alter or amend a judgment, a motion must be filed no later than 10 days after the entry of judgment and must seek substantive alteration of the judgment.

If a default judgment is entered against you, you can file a Motion to Set Aside, Modify or Vacate that judgment (CC ) with the county court instead of filing an appeal. The motion must be filed within 30 days after the entry of judgment.

In order to obtain Letters Testamentary, an interested party (typically the nominated executor under the will) must petition the Surrogate's Court and provide pertinent information regarding the decedent, relevant parties (spouse, children, etc.), and the decedent's assets.