Nebraska Irrevocable Trust Agreement Setting up Special Needs Trust for Benefit of Multiple Children

Description

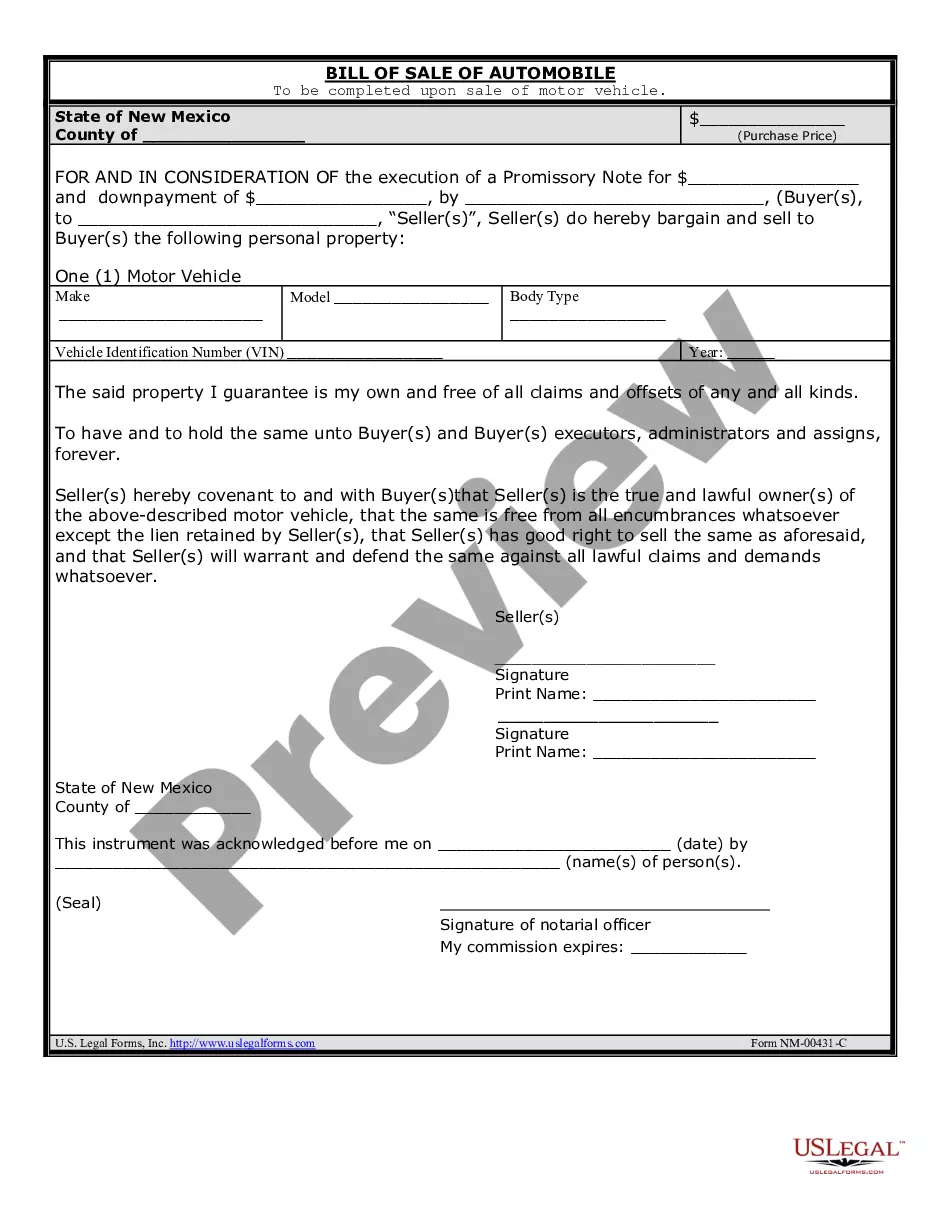

How to fill out Irrevocable Trust Agreement Setting Up Special Needs Trust For Benefit Of Multiple Children?

If you desire to be thorough, obtain, or print legitimate document formats, utilize US Legal Forms, the largest collection of lawful forms available online.

Employ the site’s straightforward and user-friendly search to find the documents you require.

A variety of templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click on the Purchase now button. Choose the pricing option you prefer and enter your details to register for an account.

Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Nebraska Irrevocable Trust Agreement Establishing Special Needs Trust for the Benefit of Multiple Children in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Nebraska Irrevocable Trust Agreement Establishing Special Needs Trust for the Benefit of Multiple Children.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct region/state.

- Step 2. Use the Review feature to check the form’s details. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

If you use your assets to establish a trust on or after January 1, 2000, generally, the trust will count as your resource for SSI. In the case of a revocable trust, the whole trust is your resource.

Disadvantages to SNTCost. Annual fees and a high cost to set up a SNT can make it financially difficult to create a SNT The yearly costs to manage the trust can be high.Lack of independence.Medicaid payback.

Using a will trust can help you to look after a disabled relative in the future so that it does not affect their benefits. If your loved one is vulnerable or lacks capacity, a will trust can also help: protect them from the risk of financial abuse. support them if they need someone to manage their money.

Social Security must be paid directly to the beneficiary. It cannot be paid to a trust. If you are receiving Social Security by direct deposit, you should leave the account that receives the payments outside of your trust.

There are a variety of assets that you cannot or should not place in a living trust. These include: Retirement Accounts: Accounts such as a 401(k), IRA, 403(b) and certain qualified annuities should not be transferred into your living trust. Doing so would require a withdrawal and likely trigger income tax.

According to the 2021 annual report of the Social Security Board of Trustees, the surplus in the trust funds that disburse retirement, disability and other Social Security benefits will be depleted by 2034.

To establish a Third Party Special Needs Trust, the family member needs to sign the trust document and then transfer the assets to the Trustee. The trust document is provided by an attorney who provides legal representation and writes all the necessary documents.

The term special needs trust refers to the purpose of the trust to pay for the beneficiary's unique or special needs. In short, the name is focused more on the beneficiary, while the name supplemental needs trust addresses the shortfalls of our public benefits programs.

To establish a Third Party Special Needs Trust, the family member needs to sign the trust document and then transfer the assets to the Trustee. The trust document is provided by an attorney who provides legal representation and writes all the necessary documents.

A trust provision that directs the payment of past-due, current or future Title II and/or Title XVI benefits directly into a trust and not to the individual or his or her representative payee is prohibited because it violates the assignment of benefits provision of section 207 of the Social Security Act.