Nebraska Purchase Agreement by a Corporation of Assets of a Partnership

Instant download

Description

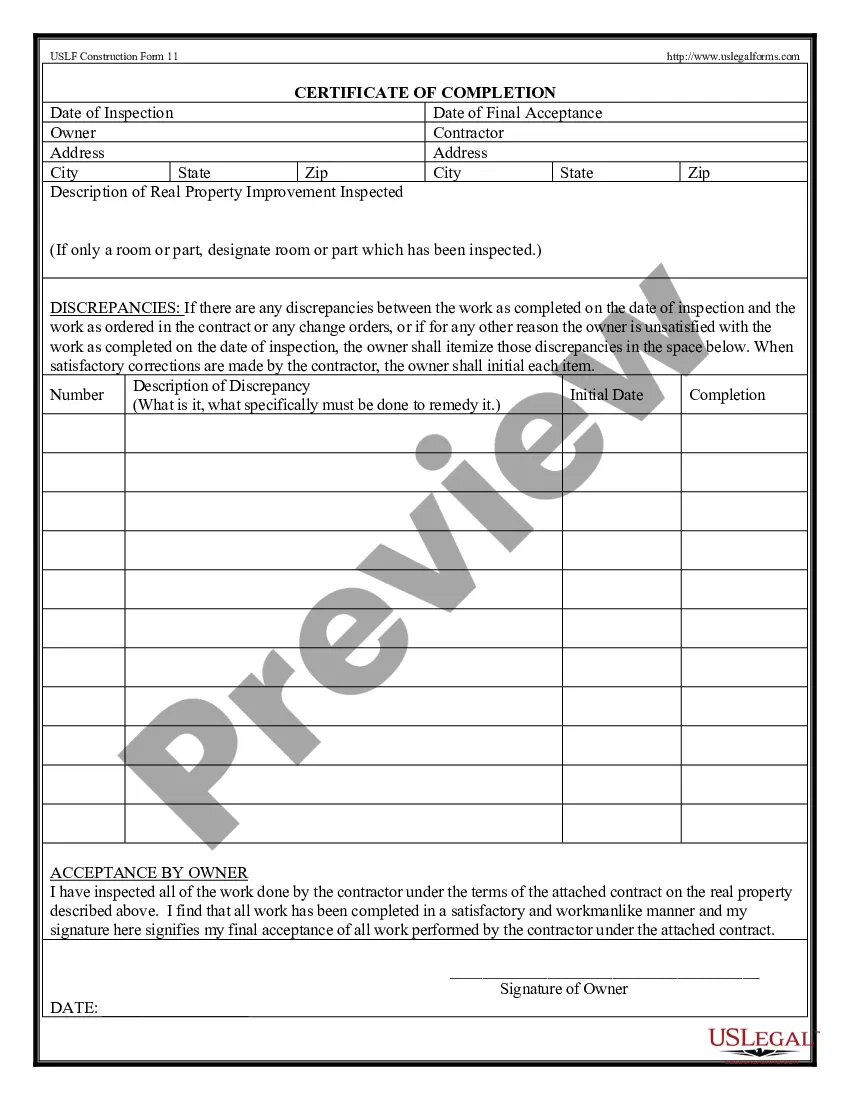

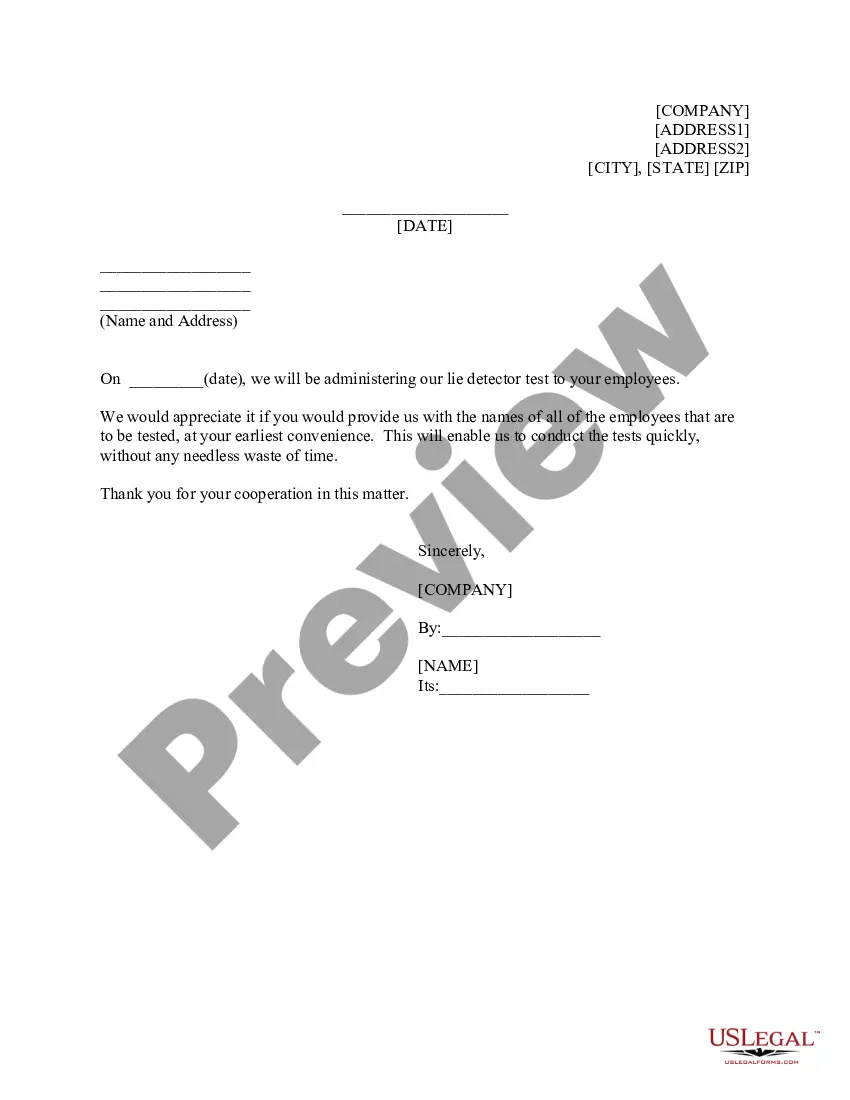

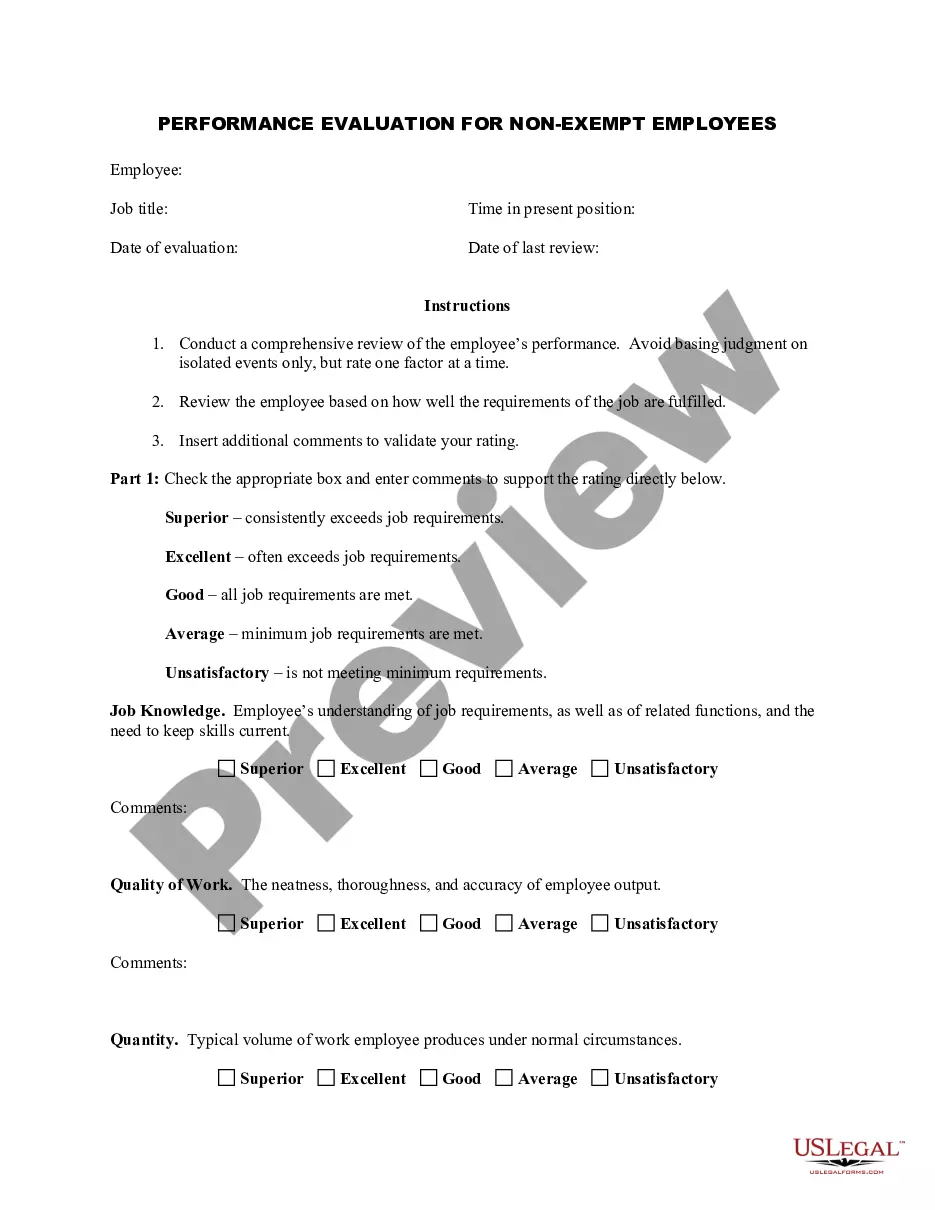

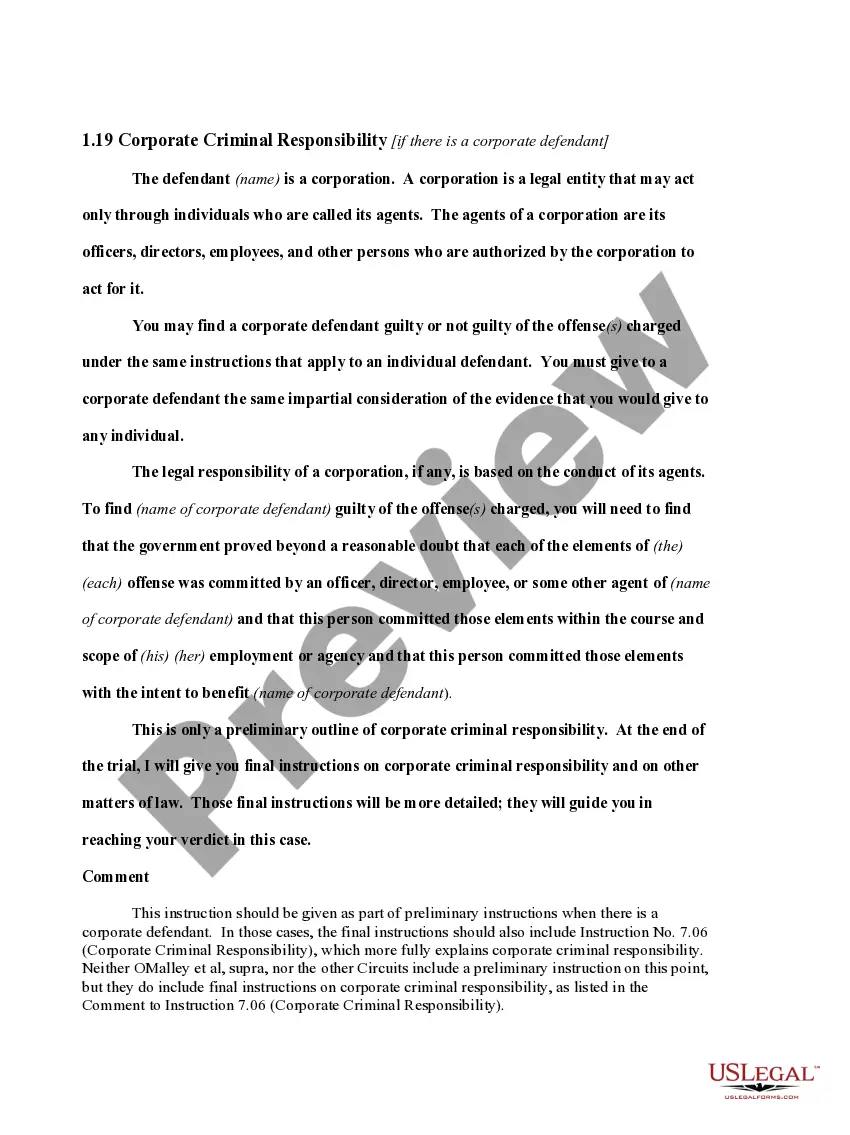

A corporation may purchase the assets of another business. This would not be a merger or consolidation. In an acquisition, the purchaser does not normally become liable for the obligations of the business whose assets are being purchased. This form is

Free preview

How to fill out Purchase Agreement By A Corporation Of Assets Of A Partnership?

US Legal Forms - one of the most important collections of legal documents in the USA - offers a variety of legal paper templates that you can download or create.

By using the site, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of forms like the Nebraska Purchase Agreement by a Corporation of Assets of a Partnership in moments.

Click the Review button to examine the form's content. Check the form details to ensure you have chosen the right form.

If the form does not meet your needs, utilize the Search box at the top of the screen to find the one that does.

- If you have a subscription, Log In to download the Nebraska Purchase Agreement by a Corporation of Assets of a Partnership from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously acquired forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your region/state.