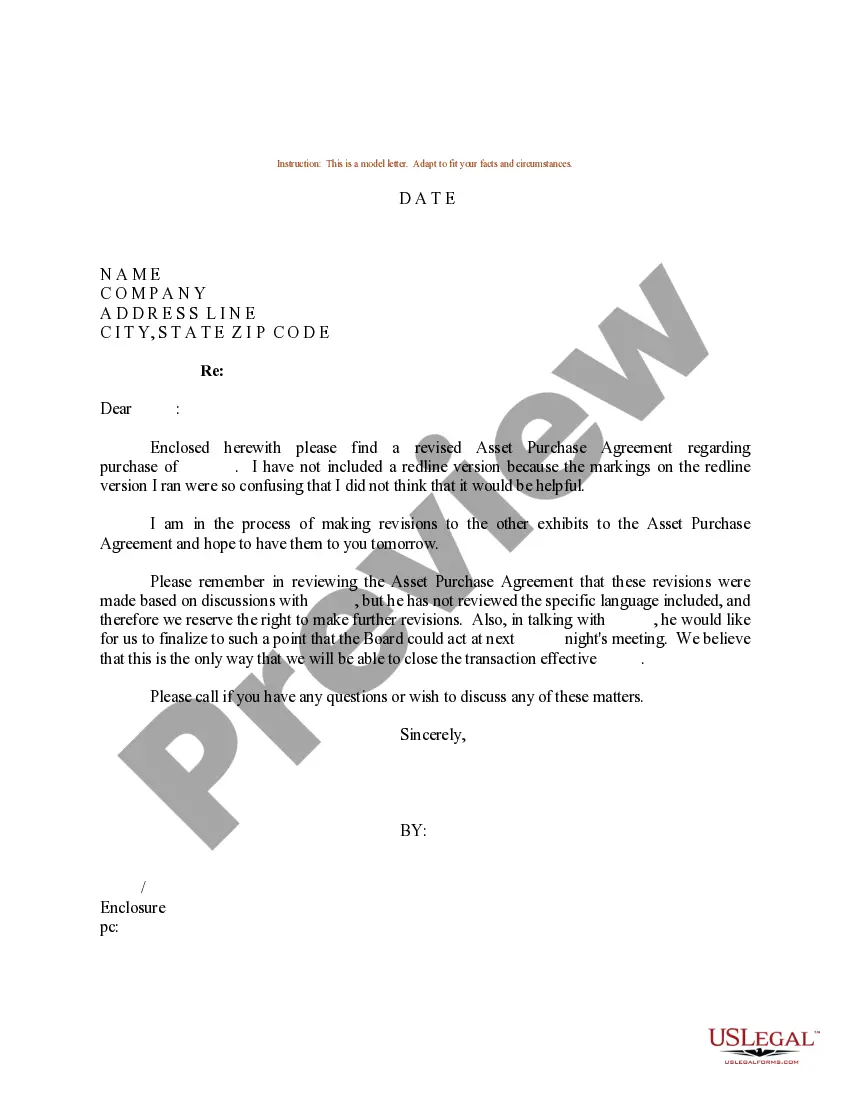

Nebraska Sample Letter regarding Revised Asset Purchase Agreement

Description

How to fill out Sample Letter Regarding Revised Asset Purchase Agreement?

US Legal Forms - among the largest libraries of lawful kinds in the United States - delivers a wide array of lawful file layouts you may down load or print. Making use of the site, you may get a large number of kinds for enterprise and individual purposes, categorized by categories, claims, or key phrases.You will discover the most up-to-date versions of kinds just like the Nebraska Sample Letter regarding Revised Asset Purchase Agreement within minutes.

If you currently have a monthly subscription, log in and down load Nebraska Sample Letter regarding Revised Asset Purchase Agreement from the US Legal Forms collection. The Down load switch can look on every type you look at. You have access to all formerly saved kinds in the My Forms tab of your own profile.

If you wish to use US Legal Forms the very first time, listed below are basic guidelines to obtain began:

- Be sure you have picked the proper type to your area/region. Click the Review switch to examine the form`s content material. Read the type explanation to actually have selected the correct type.

- In case the type does not satisfy your needs, make use of the Lookup field near the top of the monitor to discover the one who does.

- If you are pleased with the form, validate your selection by clicking the Acquire now switch. Then, select the rates plan you want and provide your references to sign up for the profile.

- Process the purchase. Make use of bank card or PayPal profile to perform the purchase.

- Select the format and down load the form on your own product.

- Make alterations. Fill out, revise and print and sign the saved Nebraska Sample Letter regarding Revised Asset Purchase Agreement.

Every single design you included in your account does not have an expiration particular date which is your own property for a long time. So, if you wish to down load or print yet another backup, just go to the My Forms portion and click on the type you want.

Obtain access to the Nebraska Sample Letter regarding Revised Asset Purchase Agreement with US Legal Forms, the most extensive collection of lawful file layouts. Use a large number of expert and condition-specific layouts that fulfill your company or individual demands and needs.

Form popularity

FAQ

The EIN identifies your business to the IRS, the same way a Social Security Number identifies a person. You could also think of the EIN as your ?account number? with the IRS. Note: An EIN is not issued by the Nebraska Secretary of State. It is only issued by the IRS.

A Form 6 is the Nebraska Sales Tax and Use Form. If you purchase something from a Licensed Nebraska Dealer they are required by the State to provide you with this form so that you can register your vehicle in whatever county you reside.

Nebraska LLC Formation Filing Fee: $100 To file your Nebraska Certificate of Organization with the Secretary of State, you'll pay $100 to file online, or, for $110, you can file in-office.

By default, your Nebraska LLC is taxed as a ?pass-through? entity?meaning, the LLC does not pay federal taxes directly. Instead, revenue from the LLC passes through the business to you (plus any other members).

The main difference between an LLC and a sole proprietorship is that an LLC is a separate legal entity from its owner(s). That means the liabilities and debts of the business are usually separate from those of the owners. If the business has to file for bankruptcy, that doesn't mean the individual LLC members do.

Choose a Name for Your LLC. Under Nebraska law, an LLC name must contain the words "Limited Liability Company" or the abbreviations "LLC" or "L.L.C." ... Appoint a Registered Agent. ... File a Certificate of Organization. ... Prepare an Operating Agreement. ... Publication Requirements. ... Obtain an EIN. ... File Biennial Reports.

Single member LLCs are treated the same as sole proprietorships. Profits are reported on Schedule C as part of your individual 1040 tax return. Self-employment taxes on Nebraska LLC net income must be paid just as you would with any self-employment business.