Nebraska Telecommuting Worksheet

Description

How to fill out Telecommuting Worksheet?

US Legal Forms - one of the most substantial collections of legal documents in the USA - offers an extensive selection of legal templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can find the latest versions of forms such as the Nebraska Telecommuting Worksheet in mere moments.

If you already hold a subscription, Log In and download the Nebraska Telecommuting Worksheet from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously obtained forms within the My documents section of your account.

Proceed with the transaction. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form to your device. Make edits. Complete, modify, print, and sign the downloaded Nebraska Telecommuting Worksheet. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire. Gain access to the Nebraska Telecommuting Worksheet with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- If you are using US Legal Forms for the first time, follow these simple steps to get started.

- Ensure you have chosen the correct form for your city/state.

- Click on the Preview button to examine the contents of the form.

- Review the form description to confirm that you have selected the appropriate document.

- If the form does not meet your needs, utilize the Search field at the top of the screen to locate one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

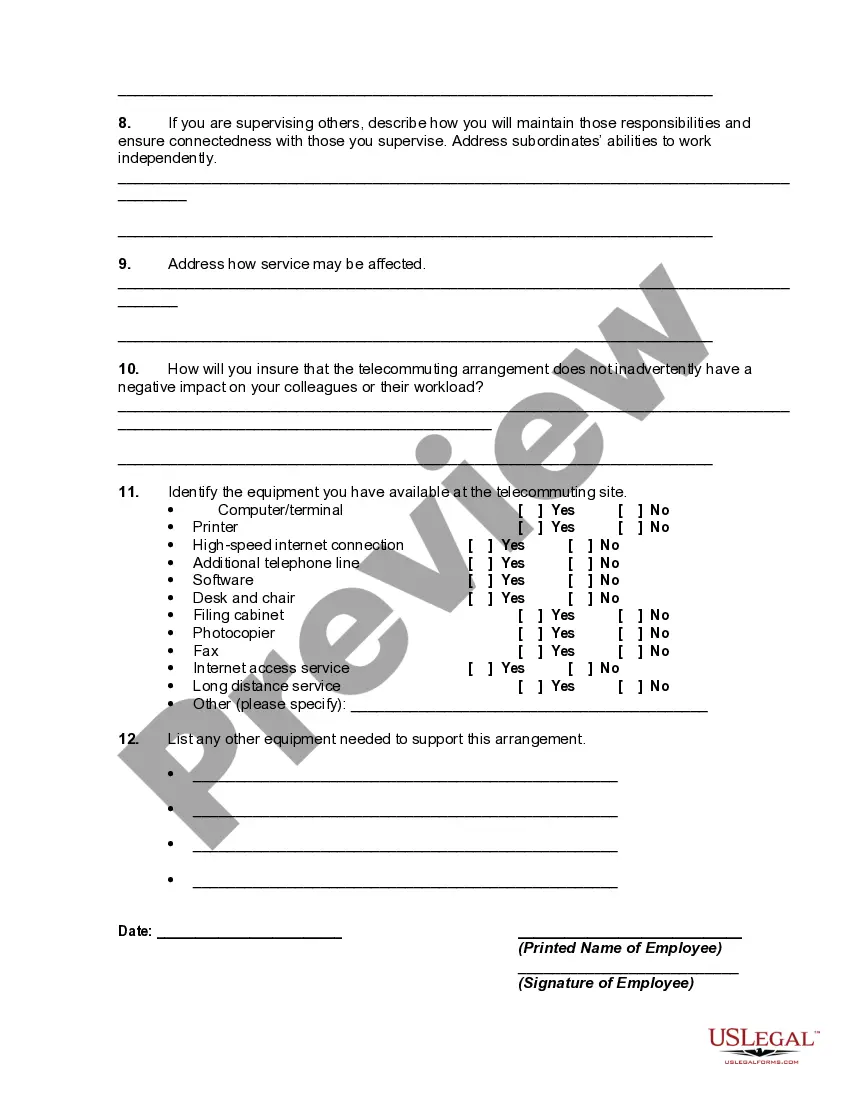

Tips for Developing Telework Agreements Schedule: Specify days of the week and the hours to be worked during telework days. Requirements: Outline any additional requirements (e.g., technology) beyond the prerequisites to telework outlined in the Act (e.g., training, written agreement).

Teleworking staff must adhere to all departmental and institutional policies including, but not limited to policies regarding confidentiality of information, work schedules, work hours, use of equipment, ethics, performance, leave use and tracking of work hours.

Greater flexibility: Telecommuting gives workers greater freedom over their work hours and work location. It also gives the employee more flexibility to balance work and personal obligations, such as school pick-up or caring for an ill family member.

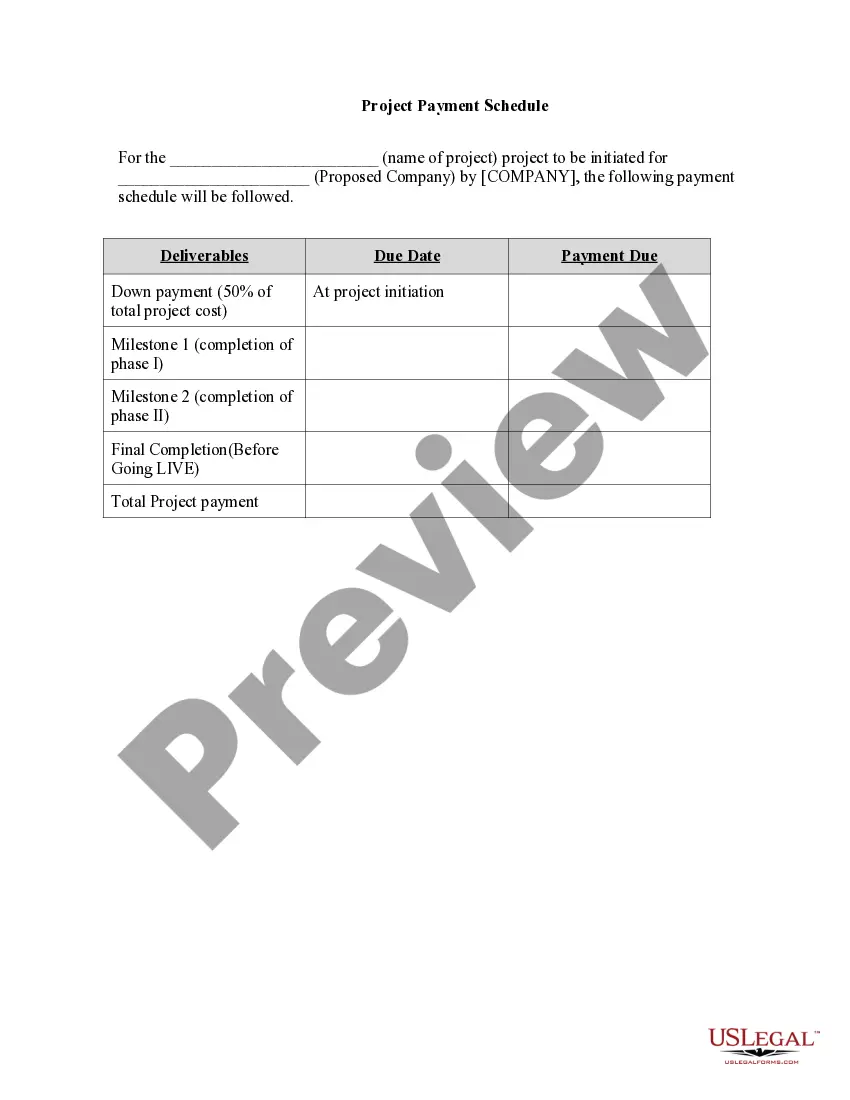

Location of the telework office (e.g., home or another alternative workplace) Equipment inventory (e.g., what the employee is supplying, what the agency is providing, and who is responsible to maintain it) A general list of job tasks that will be performed while teleworking. The telework schedule.

If your home office is used exclusively and regularly for your self-employment, you may be able to deduct a portion of your home-related expenses, such as mortgage interest, property taxes, homeowners insurance, and utilities.

A necessary expense is anything required for the performance of an employees' job. This depends on the work performed, but reasonable reimbursable expenses will likely include: internet services, mobile data usage, laptop computers or tablets, and equipment such as copiers and printers.

Following is a recent CRS white paper on the issue of taking a deduction off their federal taxes for home office expenses. The home office deduction allows certain taxpayers to deduct expenses attributable to the business use of their homes.

Eligible telework expenses means expenses incurred during the taxable year pursuant to a telework agreement, in an amount up to $1,200 for each participating employee, that enable a participating employee to begin to telework, which expenses are not otherwise the subject of a deduction from income claimed by the

Work from home (WFH) tax deductions are business expenses that can be subtracted from revenue, which can help you lower your tax bill. But these deductions almost exclusively apply to those who own their own businesses or have some sort of self-employment income, such as freelancers and gig workers.

(b) Telecommuting refers to a work arrangement that allows an employee in. the private sector to work from an alternative workplace with the use of. telecommunication and/or computer technologies; (C) Telecommuting agreement refers to the mutual consent of the employer.