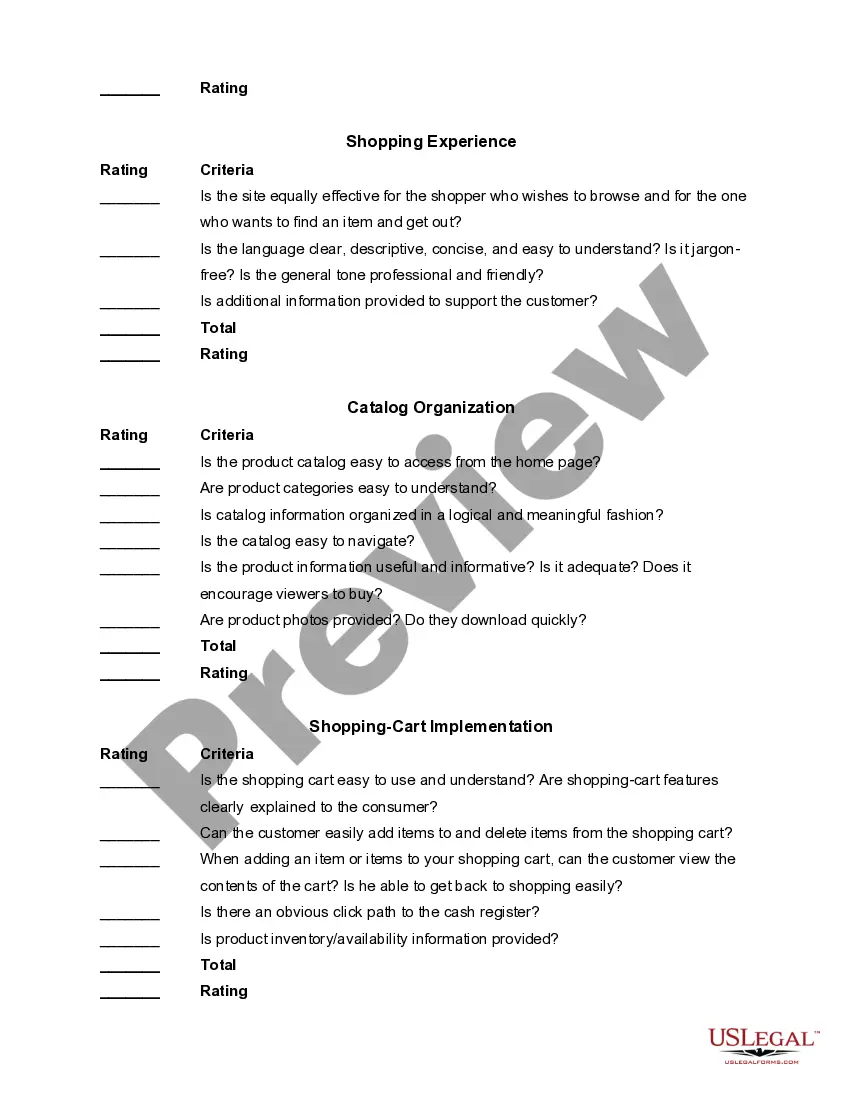

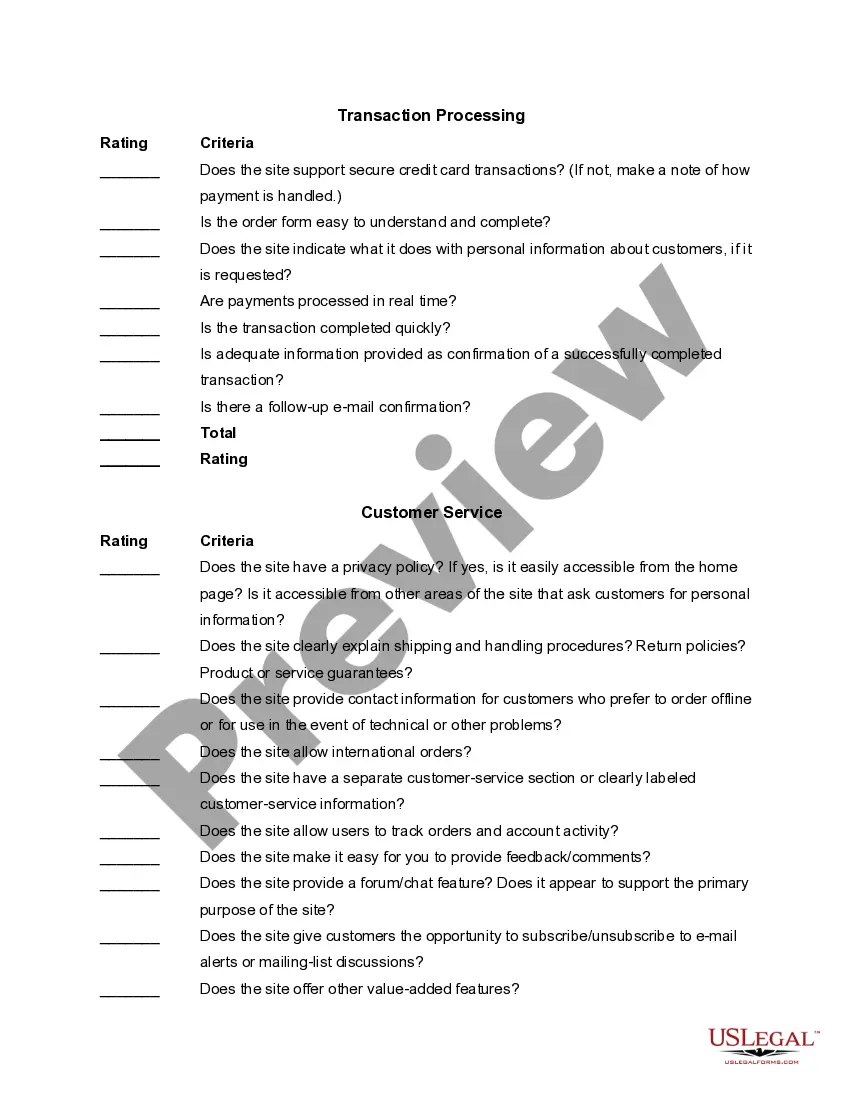

Nebraska Web-Site Evaluation Worksheet

Description

How to fill out Web-Site Evaluation Worksheet?

Have you ever found yourself in a situation where you require documents for either professional or personal purposes almost daily.

There are numerous legal document samples available online, but locating ones you can trust is challenging.

US Legal Forms provides a vast array of form templates, such as the Nebraska Web-Site Evaluation Worksheet, designed to comply with federal and state regulations.

Once you have the appropriate form, click Purchase now.

Select the payment plan you prefer, enter the necessary information to create your account, and finalize the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nebraska Web-Site Evaluation Worksheet template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and confirm it is for the correct city/state.

- Use the Preview button to review the form.

- Examine the details to ensure you have selected the right form.

- If the form does not meet your needs, use the Search field to find the document that fits your requirements.

Form popularity

FAQ

In Nebraska, a homestead exemption is available to the following groups of persons: 2022 Persons over the age of 65; 2022 Qualified disabled individuals; or 2022 Qualified disabled veterans and their widow(er)s. Some categories are subject to household income limitations and residence valuation requirements.

Nebraska is among the least tax-friendly states for retirees in the country. Unlike most other states, it does not exempt Social Security benefits from taxation. Nor does it provide any exemption or deduction for other types of retirement income, with the exception of military retirement income.

In Nebraska, a homestead exemption is available to the following groups of persons: 2022 Persons over the age of 65; 2022 Qualified disabled individuals; or 2022 Qualified disabled veterans and their widow(er)s. Some categories are subject to household income limitations and residence valuation requirements.

Annual Value (AV) x Property Tax Rate = Property Tax Payable For example, if the AV of your property is $30,000 and your tax rate is 10%, you would pay $30,000 x 10% = $3,000. You may also consider using the IRAS property tax calculator.

2756 The maximum exempt value of the homestead is the greater of $40,000 or 100% of the county average assessed value of a single family residential property in the county. In this case, the maximum exempt amount is $75,000 ($75,000 x 100% = $75,000, which is greater than $40,000).

The tax rates are expressed as a percent of $100 dollars of taxable value. Property taxes are determined by multiplying the property's taxable value by the total consolidated tax rate for the tax district in which the property is located.

The reason they're so high is that Nebraska needs the money to fund public schools. The Goss report shows that the average Midwestern state uses property taxes to fund about 35% of public schools' total revenue. For Nebraska, public school revenues are funded about 55% from property taxes.

It's on line 36 of the Nebraska Individual Income Tax Return. It gives property owners an income tax rebate on a portion of the real estate tax they paid to their local school district. It's been in effect for two years. The first year it was 6%, this year it's over 25%.

To be eligible, the maximum assessed value on the homestead is $110,000 or 225% of the average assessed value of single family residential property in the county, whichever is greater. The exempt value will be reduced by 10% for every $2,500 that the assessed value exceeds the maximum value.

2756 The maximum exempt value of the homestead is the greater of $40,000 or 100% of the county average assessed value of a single family residential property in the county. In this case, the maximum exempt amount is $75,000 ($75,000 x 100% = $75,000, which is greater than $40,000).