Nebraska Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

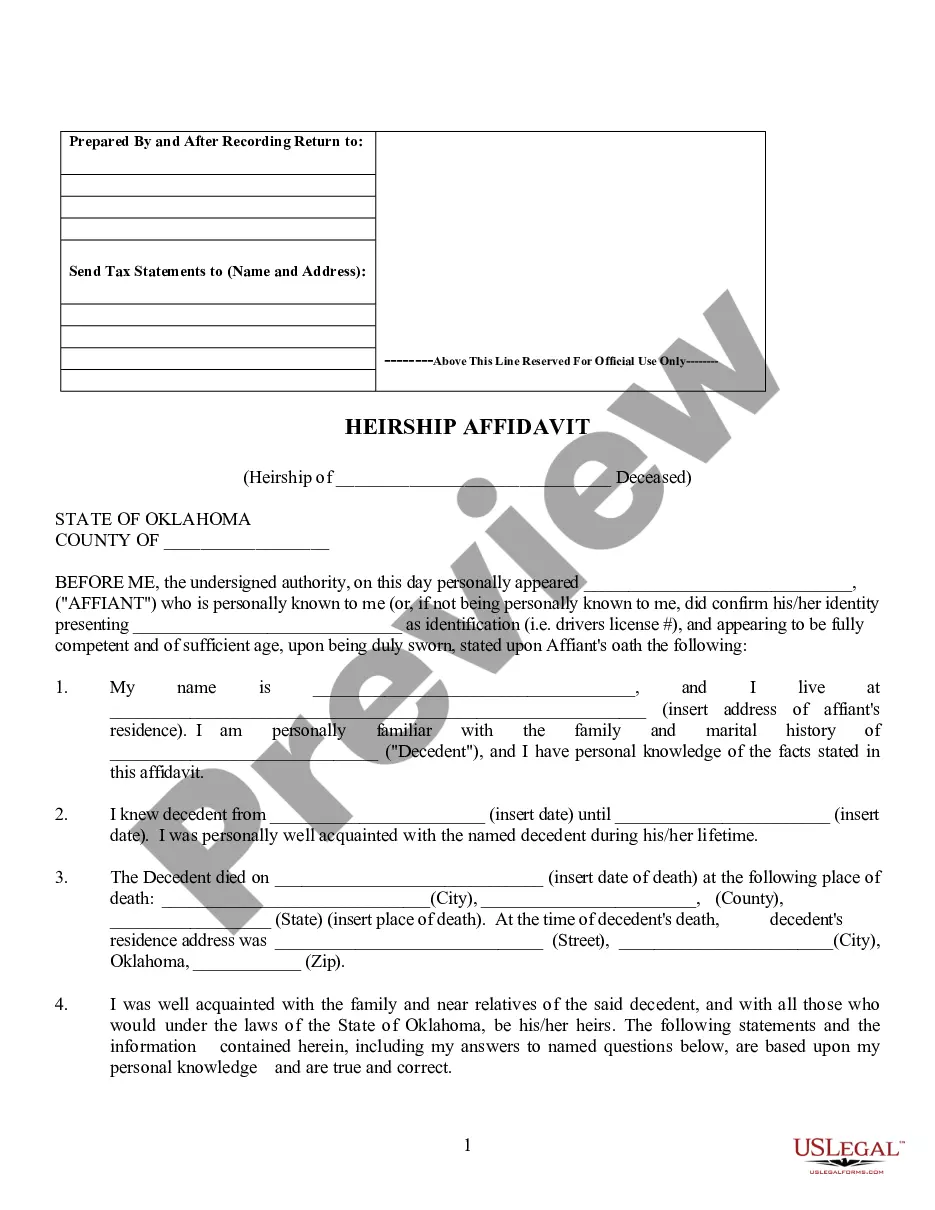

How to fill out Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

US Legal Forms - among the most substantial collections of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By utilizing the website, you can discover countless forms for business and personal purposes, organized by categories, states, or keywords. You will find the most recent versions of forms such as the Nebraska Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock in moments.

If you have a subscription, Log In and retrieve the Nebraska Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock from your US Legal Forms library. The Download button will appear on every template you view. You gain access to all previously downloaded documents within the My documents section of your account.

Process the payment. Use your Visa or MasterCard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Nebraska Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock. Every template you save to your account does not expire and belongs to you permanently. Therefore, if you desire to download or print another copy, simply navigate to the My documents section and click on the form you need. Gain access to the Nebraska Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements and needs.

- If you are using US Legal Forms for the first time, here are some straightforward tips to get you started.

- Ensure you have selected the correct form for your city/state.

- Click on the Preview button to review the form’s details.

- Examine the form information to make certain you have chosen the right document.

- If the form does not suit your needs, use the Search box at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

HW: How are gains from the sale of § 1244 stock treated? losses? The general rule is that shareholders receive capital gain or loss treatment upon the sale or exchange of stock. However, it is possible to receive an ordinary loss deduction if the loss is sustained on small business stock (A§ 1244 stock).

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

In order to qualify as §1244 stock, the stock must be issued, and the consideration paid by the shareholder must consist of money or other property, not services. Stock and other securities are not "other property" for this purpose. However, cancellation of indebtedness may be sufficiently valid consideration.

Form 4797, Sales of Business Property, is used to report an ordinary loss on the sale of Section 1244 stock or a loss resulting from the stock becoming worthless. Attach Form 4797 to Form 1040.

Section 1244 stock is common or preferred stock issued for money or other property by a domestic small business corporation (which can be a C or S corporation) that meets a gross receipts test. Common stock does not include securities convertible into common stock, nor common stock convertible into other securities.

Section 1244 of the Internal Revenue Code is the small business stock provision enacted to allow shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than as a capital loss, which is limited to only $3,000 annually.

Under the current 2020 tax tables, a long-term capital gain that results from the sale of this Section 1244 stock will be taxed at the regular preferential rate of 15% for most individuals or 20% for high-income individuals with taxable income over $441,450. The 3.8% Net Investment Income Tax (NIIT) may also be due.

Under the current 2020 tax tables, a long-term capital gain that results from the sale of this Section 1244 stock will be taxed at the regular preferential rate of 15% for most individuals or 20% for high-income individuals with taxable income over $441,450. The 3.8% Net Investment Income Tax (NIIT) may also be due.

1244 stock is issued to S corporations, such corporations and their shareholders may not treat losses on such stock as ordinary losses. This is so notwithstanding IRC Sec. 1363, which provides that the taxable income of an S corporation must be computed in the same manner as that of an individual.