A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

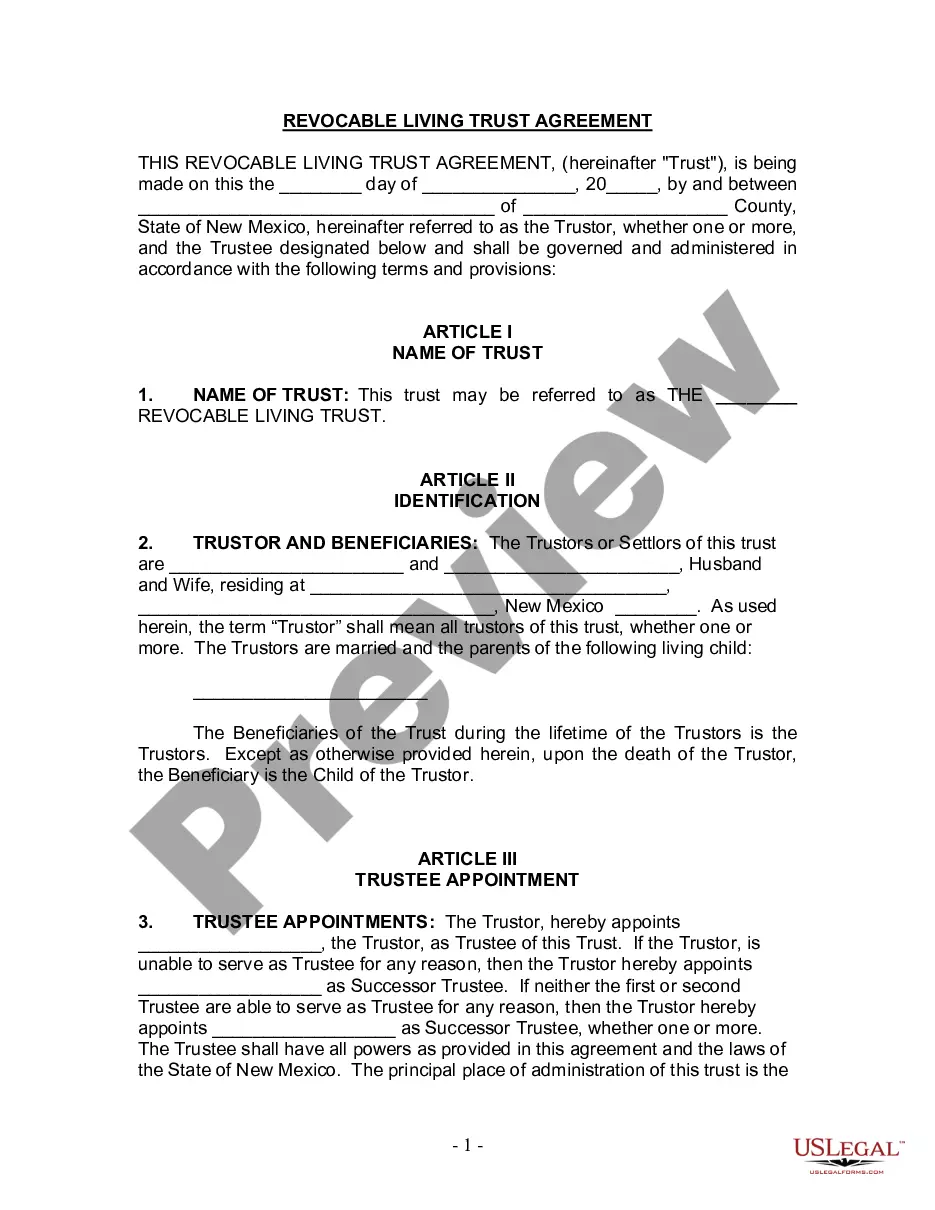

Nebraska Line of Credit Promissory Note

Description

How to fill out Line Of Credit Promissory Note?

If you need to finalize, retrieve, or create authentic form templates, utilize US Legal Forms, the leading collection of legal documents available on the web. Take advantage of the website's user-friendly and convenient search feature to locate the forms you need.

Numerous templates for commercial and personal purposes are categorized by groups and states or keywords. Use US Legal Forms to easily find the Nebraska Line of Credit Promissory Note with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Nebraska Line of Credit Promissory Note. You can also revisit forms you previously downloaded in the My documents section of your account.

Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Visit the My documents section and select a form to print or download again.

Compete and download, then print the Nebraska Line of Credit Promissory Note with US Legal Forms. There are numerous professional and region-specific forms available for your business or personal needs.

- Step 1. Ensure you have chosen the document for the correct city/state.

- Step 2. Use the Preview option to review the content of the document. Remember to check the description.

- Step 3. If you are not satisfied with the document, use the Search box at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you find the document you need, click the Purchase now button. Choose your preferred pricing plan and input your details to create an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Nebraska Line of Credit Promissory Note.

Form popularity

FAQ

When dealing with a Nebraska Line of Credit Promissory Note, you will report interest income on your tax return if you receive interest. Ensure to keep accurate records of payments received and make note of any interest accrued. It’s crucial to consult with a tax professional to ensure you are meeting IRS requirements. They can guide you through the reporting process to avoid any pitfalls.

While you may not be required to have a lawyer for a Nebraska Line of Credit Promissory Note, seeking legal advice can be beneficial. A lawyer can help you understand the terms, and your rights, and ensure your note complies with state laws. They can also assist in drafting the document to make sure it meets all necessary legal requirements. This extra step can provide peace of mind.

To record a promissory note, visit the office of your local county clerk or recorder. Recording your Nebraska Line of Credit Promissory Note can help establish clear ownership and rights. This action provides legal standing should any disputes arise in the future. Always ensure you bring two copies of the note, as one will be returned to you after recording.

Yes, a line of credit typically includes a promissory note once you utilize the funds. The Nebraska Line of Credit Promissory Note serves to formalize your repayment obligation. This document protects both the lender and borrower by clearly outlining the terms of repayment.

Yes, a Home Equity Line of Credit (HELOC) uses a promissory note as part of the borrowing agreement. In this case, the Nebraska Line of Credit Promissory Note outlines your commitment to repay the funds you draw from your home equity. It's important to understand this note is legally binding and spells out terms and conditions.

A credit note is not the same as a promissory note. In the context of the Nebraska Line of Credit Promissory Note, a promissory note represents a borrower's commitment to repay borrowed funds. While both documents relate to financial agreements, they serve different purposes and have distinct functions.

To obtain your Nebraska Line of Credit Promissory Note, you can start by visiting uslegalforms. Our platform provides customizable templates that meet your state's legal requirements. Simply fill out the required details, and you'll have a legally binding document ready for your use in no time.

To fill out a promissory demand note, start by writing the full names of the borrower and lender, along with the date of the note. Clearly state the principal amount, interest rate, and any specific terms related to repayment. When dealing with a Nebraska Line of Credit Promissory Note, ensure all conditions reflect borrowers' access and the lender's rights regarding demand for payment.

A promissory note for a line of credit is a written agreement that outlines the terms of borrowing funds against a specified credit limit. In the case of a Nebraska Line of Credit Promissory Note, it details how much the borrower can draw, the interest rates applicable, and how repayments will be made. This document ensures both parties understand their obligations and provides legal protection.

An on demand promissory note allows the lender to request repayment at any time. For instance, in the context of a Nebraska Line of Credit Promissory Note, a borrower may sign this type of note when securing funds against a revolving line of credit. It provides flexibility for both parties, as the borrower can access funds when needed, and the lender retains the right to demand repayment at their discretion.