Are you currently in the position that you will need documents for both organization or personal purposes just about every day time? There are tons of lawful papers templates available on the Internet, but locating kinds you can rely on isn`t simple. US Legal Forms offers a huge number of develop templates, such as the Nebraska Affidavit in Support of Slow Pay Motion, which are published to satisfy state and federal needs.

Should you be already familiar with US Legal Forms website and also have a free account, basically log in. After that, you may acquire the Nebraska Affidavit in Support of Slow Pay Motion web template.

Unless you come with an account and need to begin using US Legal Forms, follow these steps:

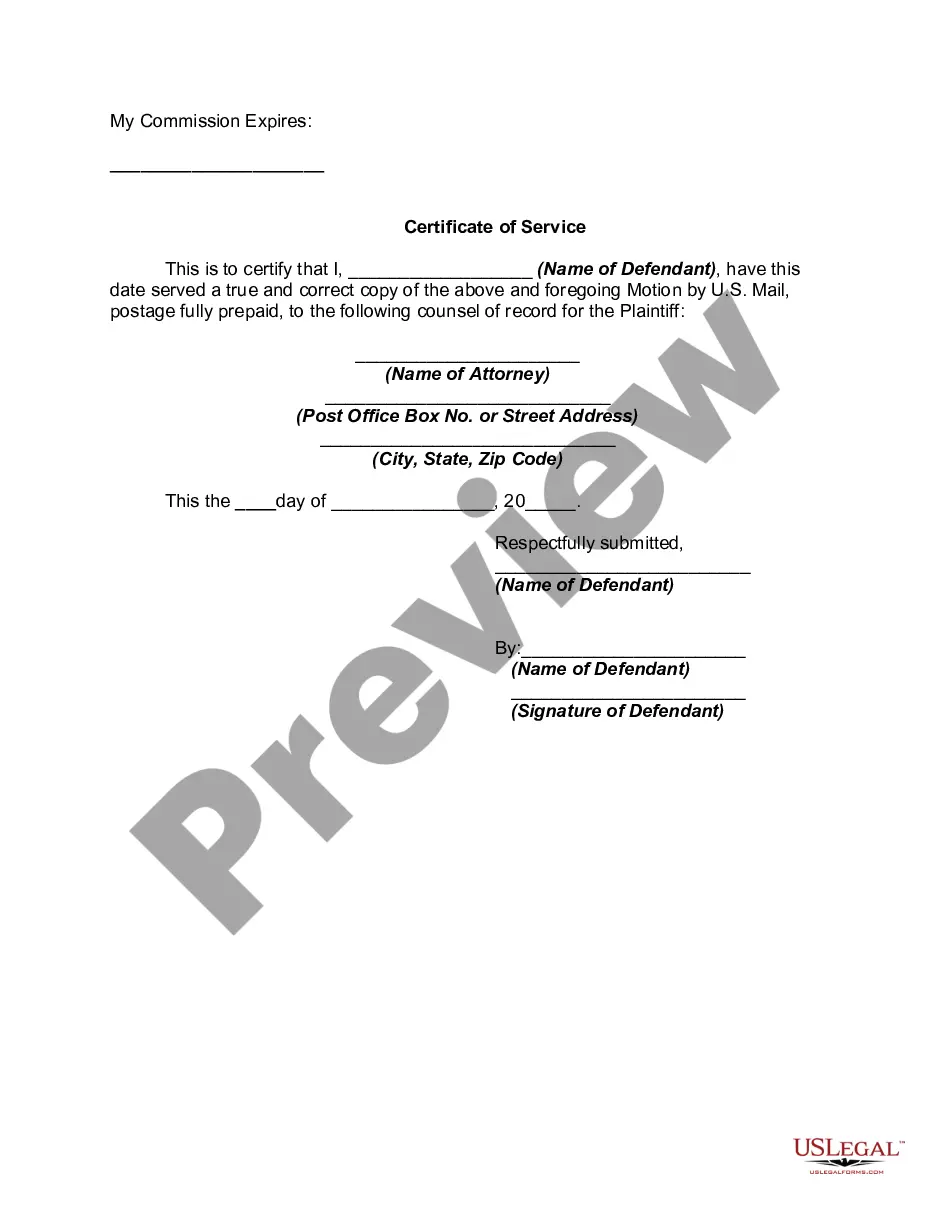

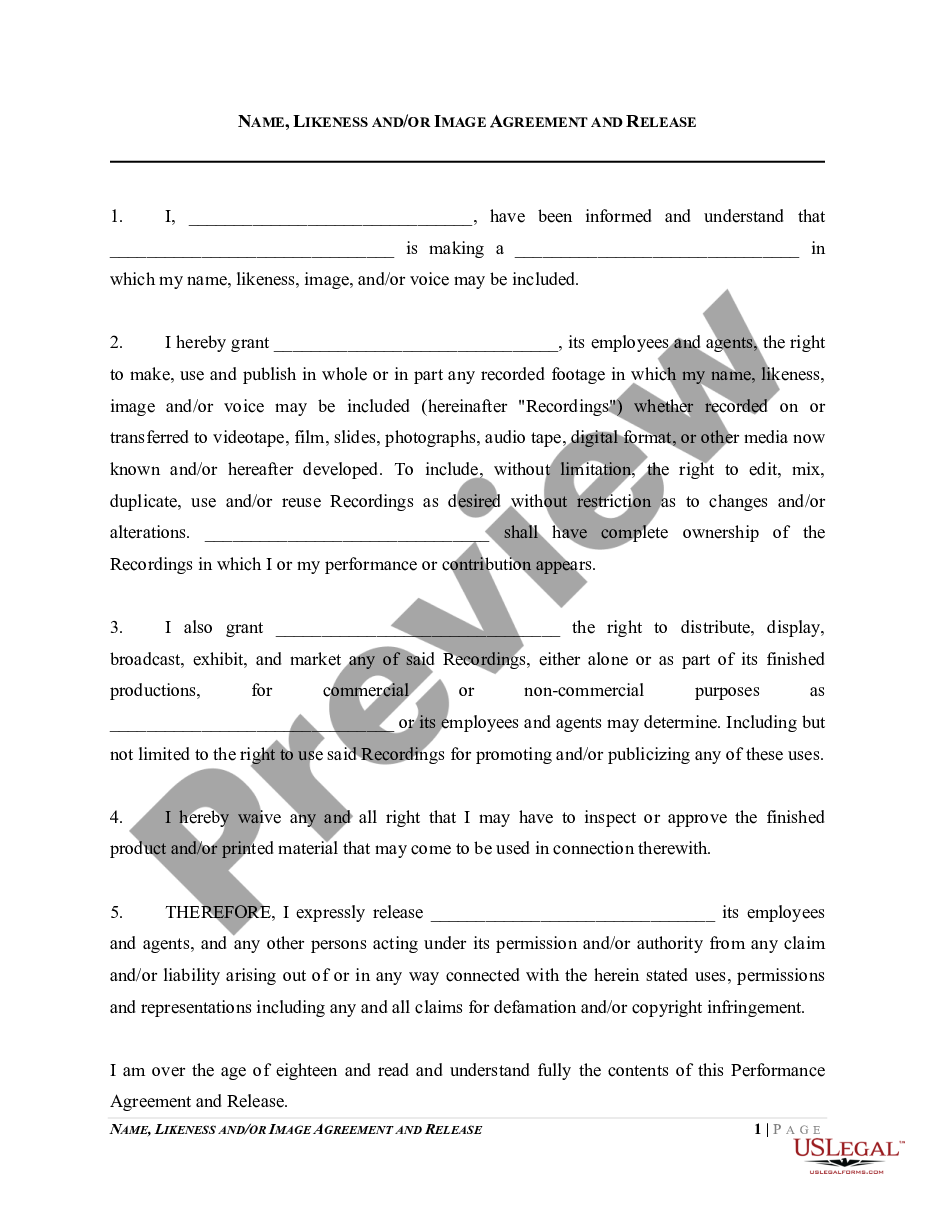

- Discover the develop you will need and make sure it is for that right metropolis/state.

- Utilize the Review switch to review the shape.

- See the outline to actually have chosen the proper develop.

- In the event the develop isn`t what you`re trying to find, utilize the Search discipline to get the develop that meets your needs and needs.

- If you obtain the right develop, click Buy now.

- Pick the costs strategy you desire, submit the desired information and facts to create your money, and buy the order with your PayPal or charge card.

- Pick a practical document format and acquire your copy.

Locate every one of the papers templates you possess purchased in the My Forms menu. You can aquire a additional copy of Nebraska Affidavit in Support of Slow Pay Motion anytime, if possible. Just go through the necessary develop to acquire or produce the papers web template.

Use US Legal Forms, the most comprehensive assortment of lawful kinds, to conserve time as well as avoid faults. The services offers appropriately manufactured lawful papers templates that can be used for a range of purposes. Generate a free account on US Legal Forms and initiate producing your lifestyle a little easier.