Nebraska Business Management Consulting or Consultant Services Agreement - Self-Employed

Description

How to fill out Business Management Consulting Or Consultant Services Agreement - Self-Employed?

US Legal Forms - one of the several largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest editions of forms such as the Nebraska Business Management Consulting or Consultant Services Agreement - Self-Employed in moments.

If you already hold a membership, sign in to download the Nebraska Business Management Consulting or Consultant Services Agreement - Self-Employed from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously obtained forms within the My documents tab of your account.

Make modifications. Fill out, edit, and print and sign the downloaded Nebraska Business Management Consulting or Consultant Services Agreement - Self-Employed.

Each template you add to your account does not have an expiration date and remains yours indefinitely. Therefore, to download or print another copy, simply navigate to the My documents section and click on the document you need.

- If you're using US Legal Forms for the first time, here are some simple steps to help you get started.

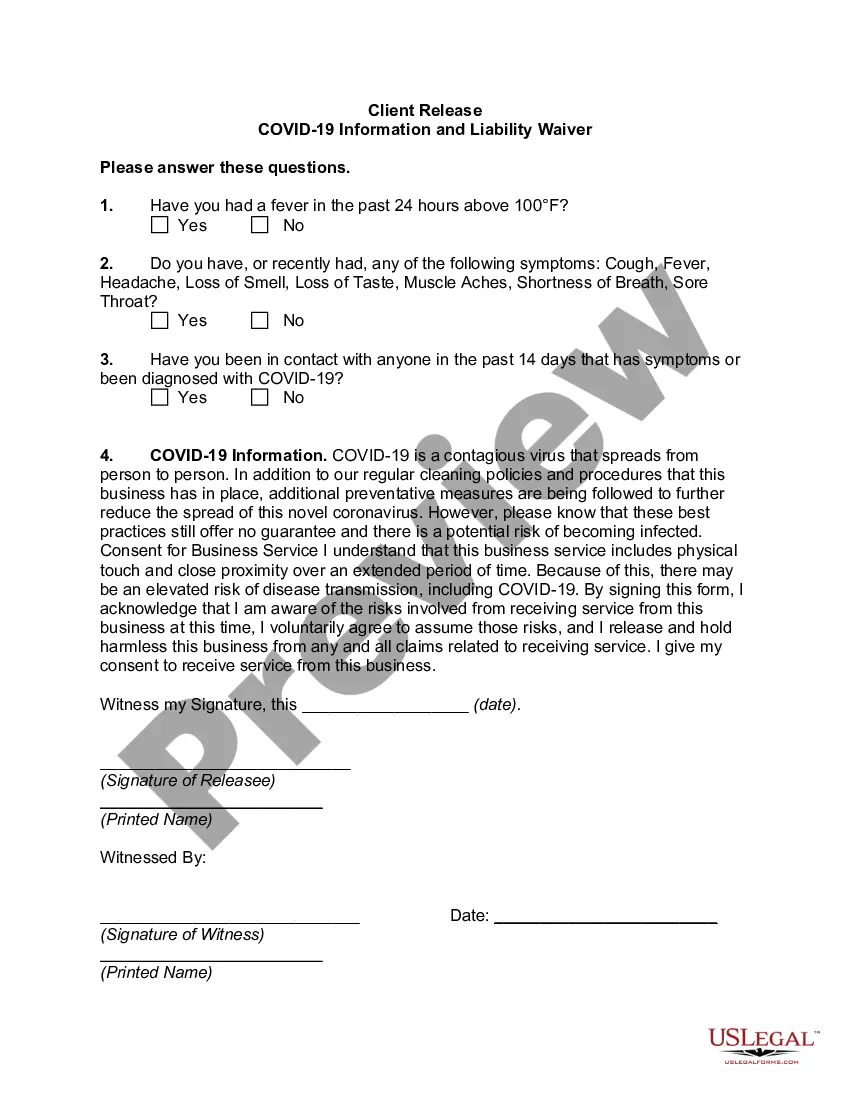

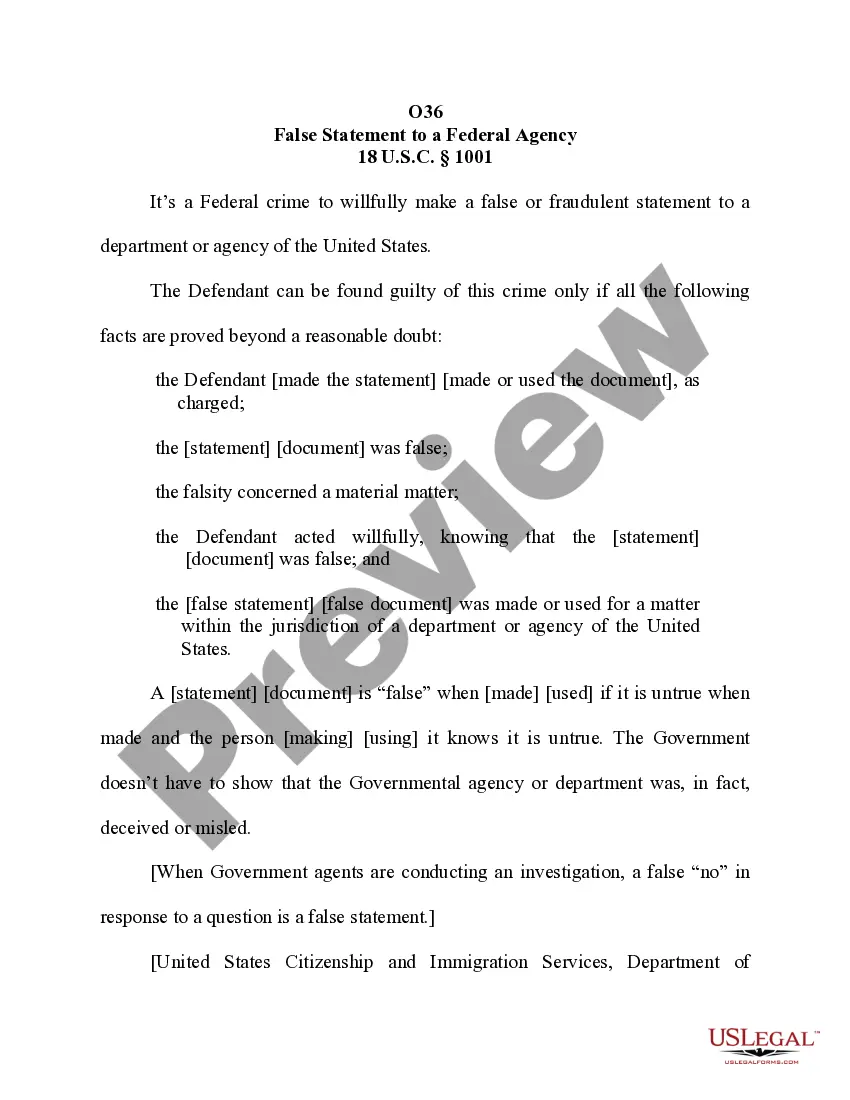

- Ensure you have selected the correct form for your city/state. Click on the Preview button to examine the form's contents. Review the form details to confirm that you have chosen the appropriate document.

- If the form doesn’t meet your requirements, utilize the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button. Next, select the payment plan you prefer and provide your information to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

An operating agreement is not legally required for LLCs in Nebraska, but it is strongly recommended. This document helps clarify the rights and responsibilities of members, thus minimizing conflicts. For a smoother process, look into Nebraska Business Management Consulting or Consultant Services Agreement - Self-Employed, which can assist in creating a well-structured operating agreement.

Yes, an LLC can technically operate without an operating agreement. However, doing so may lead to misunderstandings among members regarding decision-making and profit sharing. To avoid potential issues, consider utilizing a Nebraska Business Management Consulting or Consultant Services Agreement - Self-Employed to draft a clear operating agreement that protects all members.

The approval process for an LLC in Nebraska typically takes about 1 to 2 business days if you file online, while paper filings may take longer. This quick turnaround allows you to start focusing on your business operations sooner rather than later. Nebraska Business Management Consulting or Consultant Services Agreement - Self-Employed can help you navigate the process efficiently.

While many states recommend an operating agreement, few actually mandate it. States like California and Delaware require businesses to have an operating agreement for LLCs. Regardless of the legal requirements, consider a Nebraska Business Management Consulting or Consultant Services Agreement - Self-Employed to understand how this document can benefit your business in any state.

Nebraska does not strictly require LLCs to have an operating agreement, but it is highly advisable to create one. This document outlines the ownership and management structure of your LLC, helping prevent disputes in the future. Utilizing a Nebraska Business Management Consulting or Consultant Services Agreement - Self-Employed can assist you in drafting an effective operating agreement.

Yes, you can serve as your own registered agent in Nebraska. This means you are responsible for receiving important legal documents on behalf of your business. However, it's essential to have a reliable system in place to ensure you receive these documents in a timely manner. Nebraska Business Management Consulting or Consultant Services Agreement - Self-Employed can provide you with guidance on this aspect.

A consultant agreement typically focuses on providing expert advice or strategic advice, while a contractor agreement generally relates to the provision of specific services or labor. Both agreements have distinct terms and may differ in scope, responsibilities, and billing practices. Understanding these distinctions can help you frame your Nebraska Business Management Consulting or Consultant Services Agreement - Self-Employed more effectively.

Choosing between a statement of work (SOW) and a consulting agreement depends on your project needs. An SOW provides detailed descriptions of deliverables and timelines for a specific project, while a consulting agreement sets the general terms of the consulting relationship. For a comprehensive approach in Nebraska Business Management Consulting or Consultant Services Agreement - Self-Employed, combining both might be beneficial.

A consulting agreement is specific to a particular project or service, while a master services agreement (MSA) serves as a broad framework for multiple engagements. The MSA allows for flexibility, covering various projects without the need to create new agreements for each one. When establishing a Nebraska Business Management Consulting or Consultant Services Agreement - Self-Employed, recognizing these differences can guide your choice.

A consulting agreement is a legal document that outlines the relationship and responsibilities between a consultant and their client. It details the scope of work, payment terms, and any confidentiality requirements. Utilizing a clear Nebraska Business Management Consulting or Consultant Services Agreement - Self-Employed helps protect both parties and ensures a mutual understanding.