US Legal Forms - one of several most significant libraries of legitimate kinds in the United States - offers a wide array of legitimate document themes you are able to down load or produce. While using internet site, you can get a large number of kinds for organization and specific functions, categorized by categories, states, or search phrases.You will find the latest models of kinds much like the Nebraska Pre-incorporation Agreement of Professional Corporation of Attorneys in seconds.

If you already have a subscription, log in and down load Nebraska Pre-incorporation Agreement of Professional Corporation of Attorneys from your US Legal Forms catalogue. The Obtain button will show up on every single kind you look at. You gain access to all formerly downloaded kinds inside the My Forms tab of your bank account.

If you would like use US Legal Forms initially, here are basic guidelines to help you get started off:

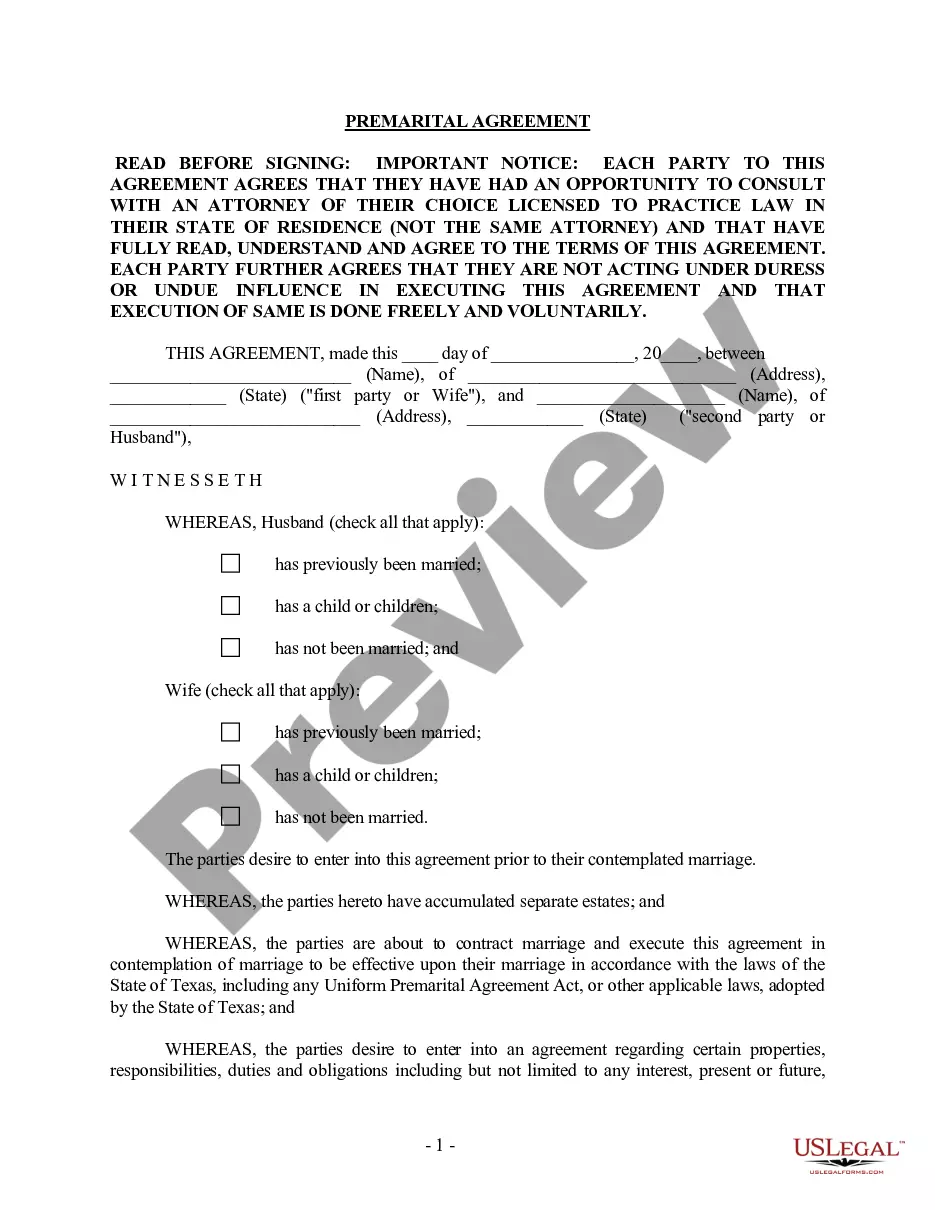

- Ensure you have picked out the best kind to your metropolis/state. Go through the Preview button to review the form`s content material. See the kind explanation to ensure that you have chosen the proper kind.

- In the event the kind does not suit your specifications, utilize the Lookup area towards the top of the screen to obtain the the one that does.

- In case you are pleased with the shape, confirm your choice by visiting the Get now button. Then, choose the pricing plan you want and provide your references to register on an bank account.

- Process the deal. Make use of your charge card or PayPal bank account to complete the deal.

- Choose the format and down load the shape on your own product.

- Make changes. Fill out, revise and produce and signal the downloaded Nebraska Pre-incorporation Agreement of Professional Corporation of Attorneys.

Every single design you included in your bank account lacks an expiration particular date which is the one you have permanently. So, in order to down load or produce yet another copy, just go to the My Forms area and then click around the kind you want.

Get access to the Nebraska Pre-incorporation Agreement of Professional Corporation of Attorneys with US Legal Forms, by far the most comprehensive catalogue of legitimate document themes. Use a large number of professional and express-certain themes that fulfill your company or specific requirements and specifications.