Nebraska Withdrawal of Partner

Description

How to fill out Withdrawal Of Partner?

In case you need to total, obtain, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms available on the web.

Employ the website's straightforward and user-friendly search to find the documents you require.

A wide range of templates for business and personal purposes are categorized by types and regions, or keywords.

Every legal document template you download is yours to keep indefinitely.

You can access any form you've acquired in your account. Go to the My documents section and choose a form to print or download again.

- Use US Legal Forms to acquire the Nebraska Withdrawal of Partner with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to access the Nebraska Withdrawal of Partner.

- You can also view forms you have previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct state/region.

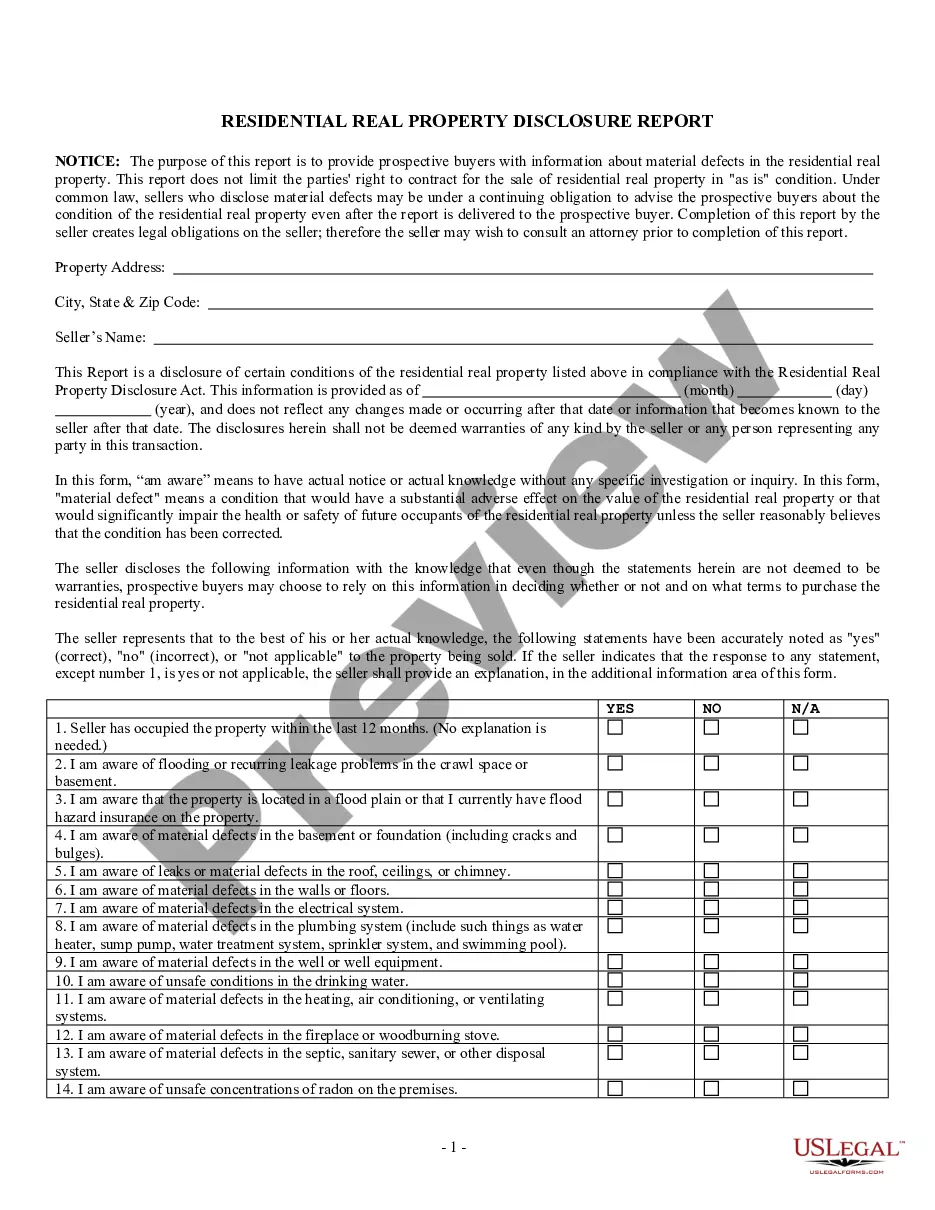

- Step 2. Use the Preview option to review the form's contents. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you find the form you want, click on the Acquire now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the Nebraska Withdrawal of Partner.

Form popularity

FAQ

To dissolve an LLC in Nebraska, start by filing the Articles of Dissolution with the Secretary of State. Ensure all business affairs are settled, including debts and notifications to partners. This is especially important if a partner is withdrawing, as it ensures clarity during the Nebraska Withdrawal of Partner process.

Dissolving an LLC refers to the formal end of the business entity through legal processes, while cancelling typically refers to withdrawing a registered agent or a business name. When you dissolve an LLC, you're completing the legal steps to end the business, which can be interconnected with the Nebraska Withdrawal of Partner if ownership changes.

No, the registered agent does not need to be the owner of the LLC in Nebraska. A registered agent can be an individual or a company designated to receive legal documents on behalf of your business. It’s vital that the agent understands their role, especially during scenarios like the Nebraska Withdrawal of Partner.

Yes, you can be your own registered agent for your LLC in Nebraska as long as you have a physical address in the state. This option can save costs but requires you to be available during business hours to receive documents. Consider the implications of being your own registered agent if partners are withdrawing under the Nebraska Withdrawal of Partner.

Dissolving an LLC can be straightforward when the steps are followed correctly. It requires filing the required paperwork, settling debts, and notifying stakeholders. Understanding the process can minimize complications, especially if you're addressing the Nebraska Withdrawal of Partner, making it an easier transition.

In Nebraska, registering a DBA (Doing Business As) typically costs around $100. This allows you to operate your business under a different name from your LLC. If you are considering a DBA during the process of a Nebraska Withdrawal of Partner, it’s a good idea to ensure all forms are correctly filed with the state.

If you cancel your registered agent, it can lead to significant legal implications for your LLC. Your company may be unable to receive important legal documents, exposing it to penalties and potential dissolution. It's important to have an active registered agent to manage your LLC in the context of the Nebraska Withdrawal of Partner.

To officially close an LLC, also known as dissolving it, you will need to file the Articles of Dissolution with the Nebraska Secretary of State. It’s essential to settle all debts and notify any stakeholders before proceeding. If a partner is withdrawing, ensure all agreements reflect this as part of the Nebraska Withdrawal of Partner process.

To change the registered agent of your LLC in Nebraska, file a Statement of Change with the Nebraska Secretary of State. This document requires details about both the existing and new registered agents. It’s crucial to ensure that your new registered agent is compliant with the requirements to avoid issues related to the Nebraska Withdrawal of Partner.

To change ownership of an LLC in Nebraska, you will need to follow a few steps. First, you should review your operating agreement for any requirements regarding ownership changes. Next, file the appropriate forms with the Nebraska Secretary of State, making sure to include any necessary details about the Nebraska Withdrawal of Partner.