Puerto Rico Financial Package

Description

How to fill out Financial Package?

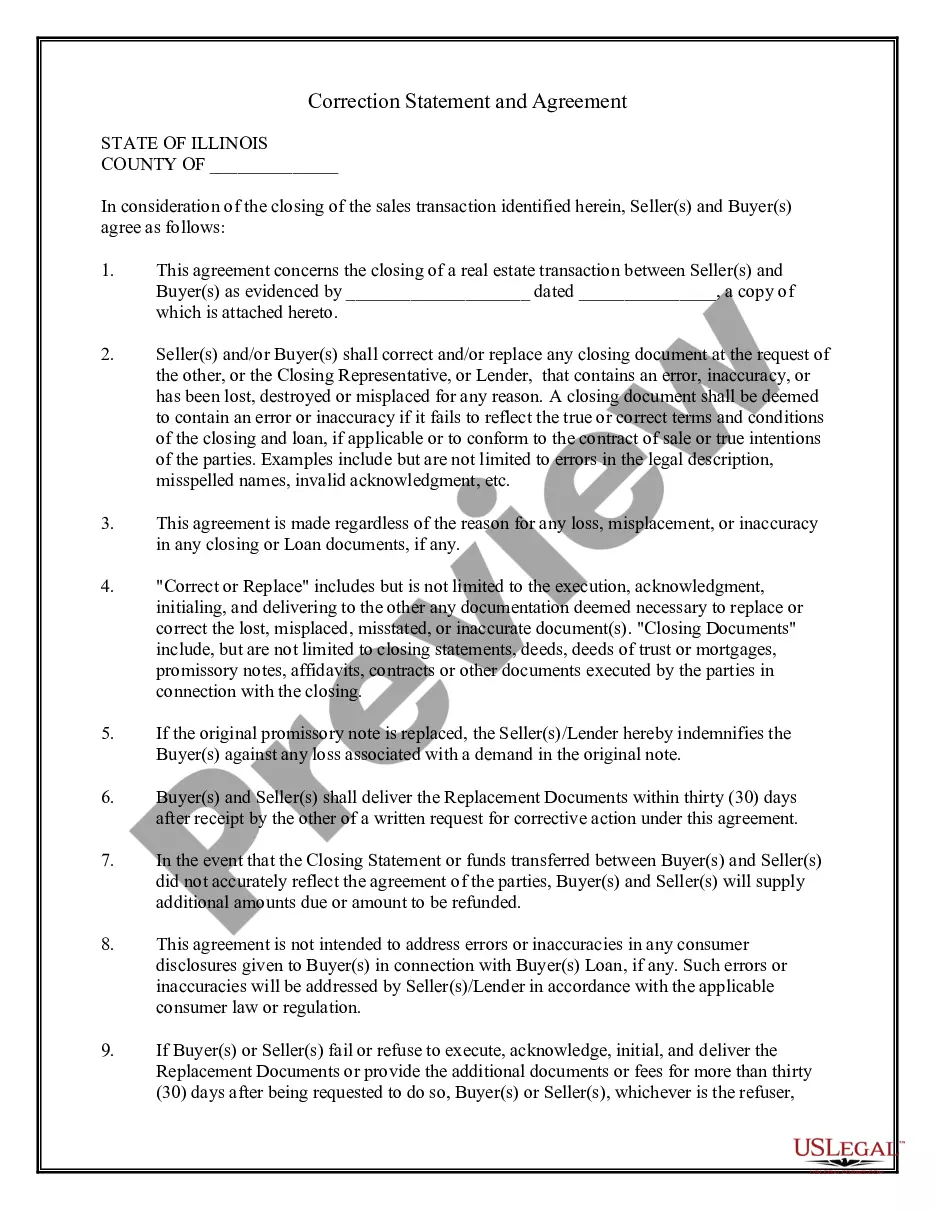

Are you in a situation where you need to have paperwork for both company or personal reasons just about every time? There are a lot of authorized record templates accessible on the Internet, but finding versions you can depend on isn`t simple. US Legal Forms provides 1000s of type templates, much like the Puerto Rico Financial Package, which can be composed to satisfy state and federal demands.

If you are currently familiar with US Legal Forms web site and get an account, basically log in. Afterward, you may download the Puerto Rico Financial Package format.

If you do not come with an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Discover the type you require and make sure it is for your proper city/county.

- Utilize the Review button to check the shape.

- See the description to ensure that you have chosen the correct type.

- If the type isn`t what you`re searching for, use the Search area to get the type that meets your needs and demands.

- When you obtain the proper type, simply click Purchase now.

- Select the costs program you would like, submit the necessary information to produce your bank account, and pay money for an order utilizing your PayPal or Visa or Mastercard.

- Pick a handy data file formatting and download your version.

Find each of the record templates you might have purchased in the My Forms menu. You can obtain a extra version of Puerto Rico Financial Package anytime, if required. Just click the necessary type to download or produce the record format.

Use US Legal Forms, by far the most considerable selection of authorized varieties, in order to save efforts and steer clear of mistakes. The service provides appropriately made authorized record templates that can be used for a range of reasons. Produce an account on US Legal Forms and begin generating your way of life easier.

Form popularity

FAQ

In 2021, Puerto Rico had a population of 3.31M people with a median age of 43.1 and a median household income of $21,967. Between 2020 and 2021 the population of Puerto Rico grew from 3.26M to 3.31M, a 1.71% increase and its median household income grew from $21,058 to $21,967, a 4.32% increase.

Puerto Rico is a U.S. territory, and Puerto Rican citizens can fill out the FAFSA to request federal student aid. Entering your financial information into the FAFSA can help you determine whether you qualify for grants, scholarships, and loans.

The following data are the most current income statistics for Puerto Rico from the US Census Bureau, are in 2021 inflation adjusted dollars and are from the American Community Survey 2021 5-year estimates. Median Household Income: $21,967. Average Household Income: $34,931. Per Capita Income: $14,047.

The poverty rate in this Pacific island territory is staggering 51%. Of that 51%, 1,800 families income does not exceed $5,000 a year. The poverty rate in Puerto Rico is much higher than any all 50 other states. It doubles the next highest state's poverty rate with Mississippi at 24.2% compared to Puerto Rico's 44.9%.

Puerto Rico's second automatic increase in the minimum wage is July 1, 2023, from $8.50 per hour to $9.50 per hour. With limited exceptions, this increase will apply to all non-exempt employees covered by the Fair Labor Standards Act. The Puerto Rico Minimum Wage Act, Act No. 47-2021, was enacted on January 1, 2022.

Table PopulationIncome & PovertyMedian household income (in 2021 dollars), 2017-2021$21,967Per capita income in past 12 months (in 2021 dollars), 2017-2021$14,047Persons in poverty, percent?? 41.7%54 more rows

Earlier this year, Puerto Rico was approved for up to $109 million in State Small Business Credit Initiative (SSBCI) funds, a small business program reauthorized and expanded under the ARP.

Puerto Rico also lacks economic sovereignty. The U.S. dollar is its currency, U.S. federal regulators oversee its businesses, and U.S. laws dictate its trade policy. Residents pay most federal taxes; their contributions totaled more than $4 billion in fiscal year 2021.