Nebraska Bill of Transfer to a Trust

Description

How to fill out Bill Of Transfer To A Trust?

You may allocate hours online attempting to locate the legal document template that complies with the state and federal requirements you seek.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

It is easy to access or create the Nebraska Bill of Transfer to a Trust through our platform.

If available, utilize the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and then select the Obtain option.

- Afterward, you can fill out, modify, create, or sign the Nebraska Bill of Transfer to a Trust.

- Every legal document template you purchase is yours to keep indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have chosen the correct document template for your state/region of interest.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

Gifts to a trust may or may not be taxable, depending on the value of the gift and the specific circumstances. Generally, the Nebraska Bill of Transfer to a Trust allows individuals to make gifts without immediate tax liabilities under certain thresholds. It's wise to check the annual gift tax exclusion limits and consult with a tax professional. This will help you navigate any potential tax consequences effectively.

To put your house in a trust in Nebraska, you will need to complete a Nebraska Bill of Transfer to a Trust. This document conveys the property from your name into the trust. After preparing the necessary paperwork, you must record it with the county recorder where the property is located and ensure that the trust is properly funded. Our platform, uslegalforms, can guide you through this process with the right templates and resources for your needs.

Moving your assets into a trust can provide multiple benefits, including asset protection and easier management of your estate. The Nebraska Bill of Transfer to a Trust can help streamline this process, ensuring your assets are organized and efficiently passed on to your beneficiaries. Consider your long-term goals and the specific needs of your estate. A trust can offer peace of mind and clarity for your loved ones.

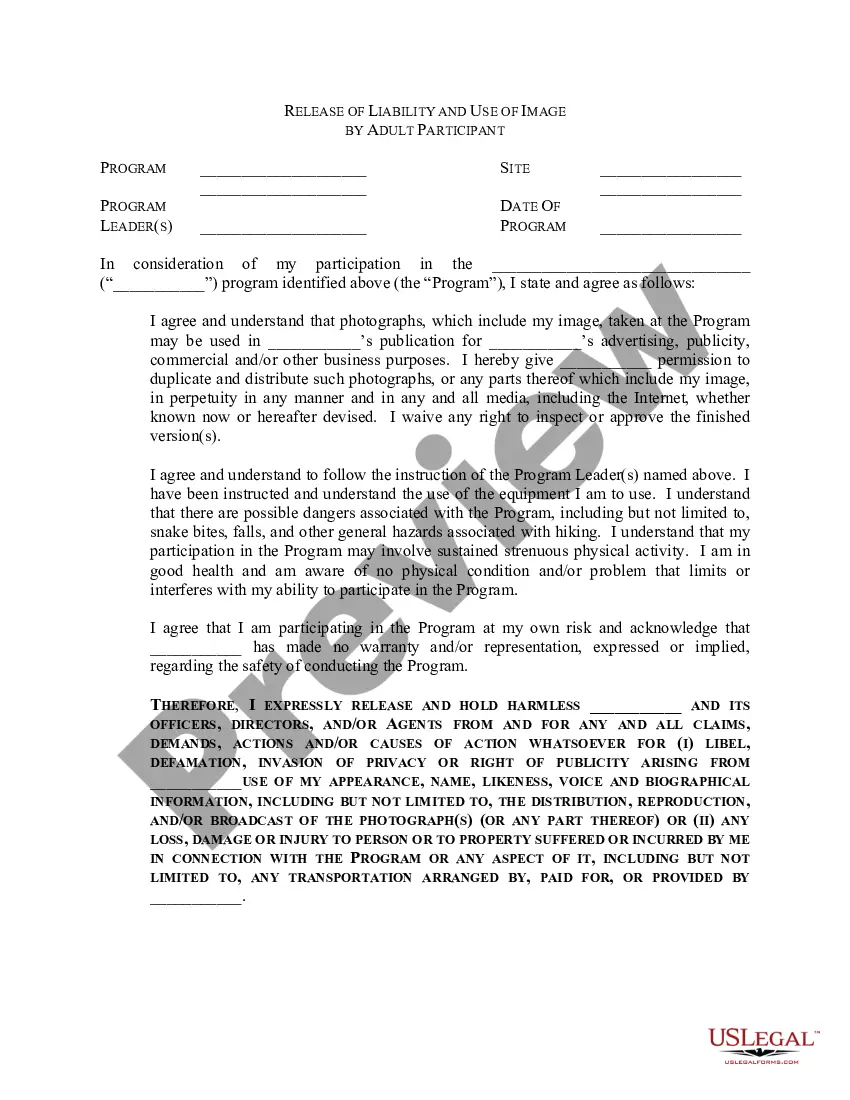

A bill of transfer is a legal document that facilitates the transfer of property or assets into a trust. In the context of the Nebraska Bill of Transfer to a Trust, this document clearly outlines the assets being placed in the trust and the trust’s terms. This process helps ensure the assets are managed according to your wishes. Understanding this document is crucial for effective estate planning.

In general, a transfer to a trust is not taxable. The Nebraska Bill of Transfer to a Trust allows individuals to move their assets into a trust without triggering immediate tax consequences. However, it is essential to consider the nature of the assets and any potential future tax implications. Always consult with a tax advisor to understand your specific situation.

Including bank accounts in a trust can be a smart choice when utilizing a Nebraska Bill of Transfer to a Trust. It allows for seamless management of your finances, especially in the event of incapacity or death. This arrangement can help your beneficiaries avoid the lengthy probate process, ensuring swift access to funds when needed. Exploring this option can lead to peace of mind in your estate planning journey.

Transferring assets to a trust is usually not considered a taxable event under a Nebraska Bill of Transfer to a Trust. This means you can transfer your properties, stocks, or other assets without facing an immediate tax obligation. However, it is vital to recognize that you may incur taxes on any income or gains produced by those assets after the transfer. Engaging with a tax expert can provide clarity and reassurance.

A transfer of assets into a trust is typically not taxable under a Nebraska Bill of Transfer to a Trust, allowing you to protect your assets without an immediate tax burden. However, some situations may trigger taxes, such as when the assets generate income or capital gains after the transfer. Understanding these nuances is crucial, and seeking guidance from a qualified professional can help you navigate these complex issues.

Assets transferred to a trust are generally not subject to tax at the time of transfer if done under a Nebraska Bill of Transfer to a Trust. This means you can move your assets without incurring immediate tax consequences, but it’s essential to understand the trust's tax implications for future income or capital gains. Consult with a tax advisor to ensure compliance with tax regulations and to optimize your financial situation.

Choosing between transfer on death and a trust depends on your specific financial situation and goals. A trust provides greater control over asset distribution and can help avoid probate. On the other hand, a transfer on death allows for a straightforward and quick transfer of certain assets. Exploring the Nebraska Bill of Transfer to a Trust will provide clarity on which option best aligns with your estate planning needs.