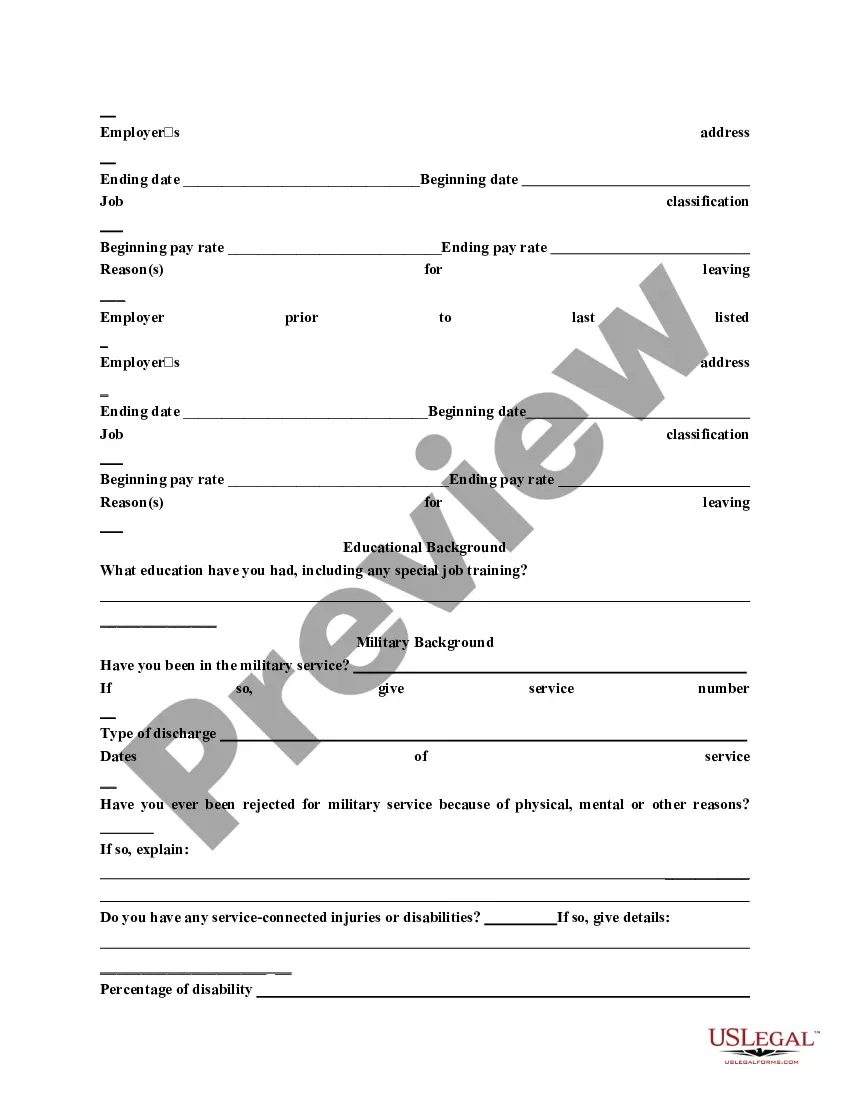

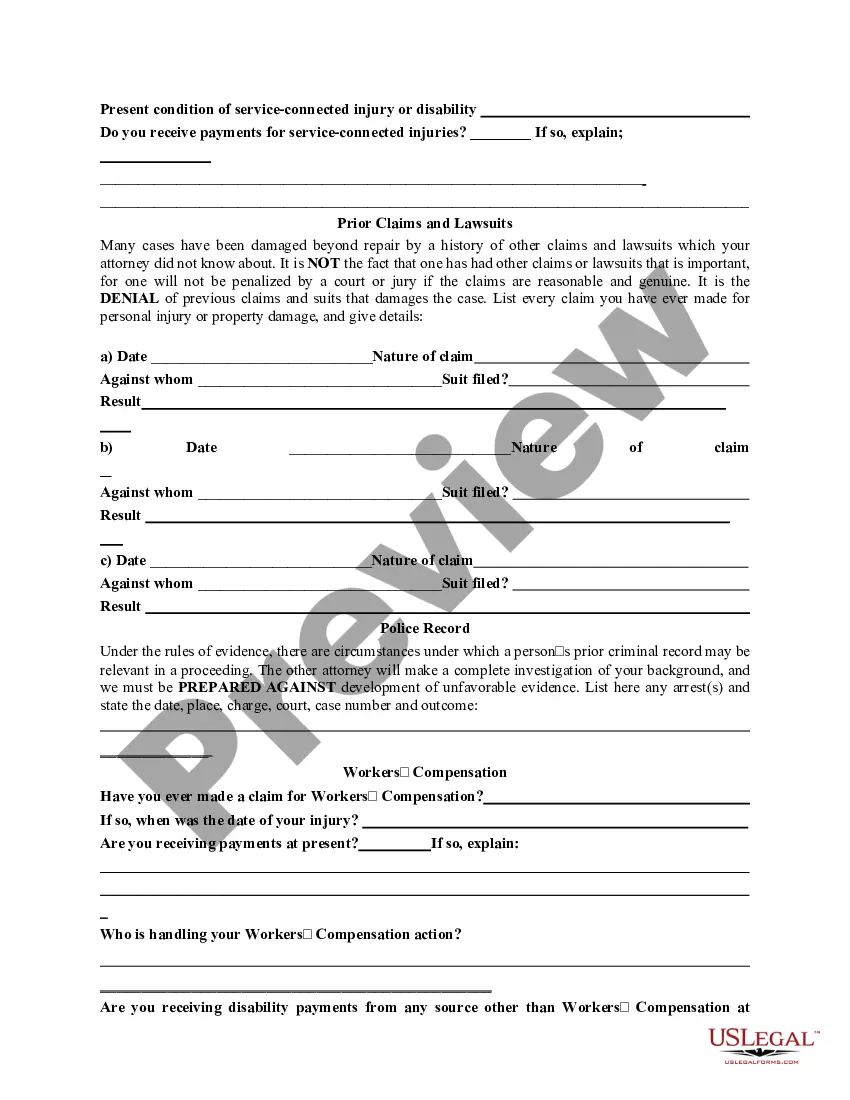

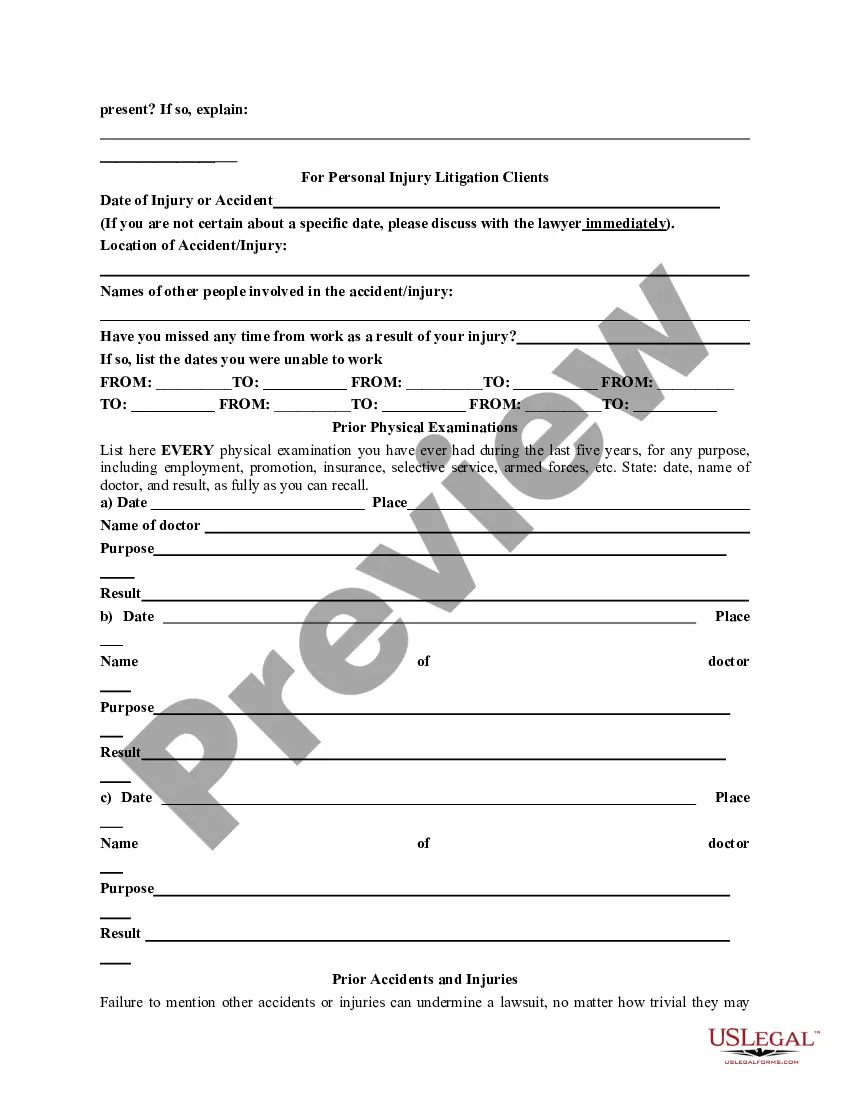

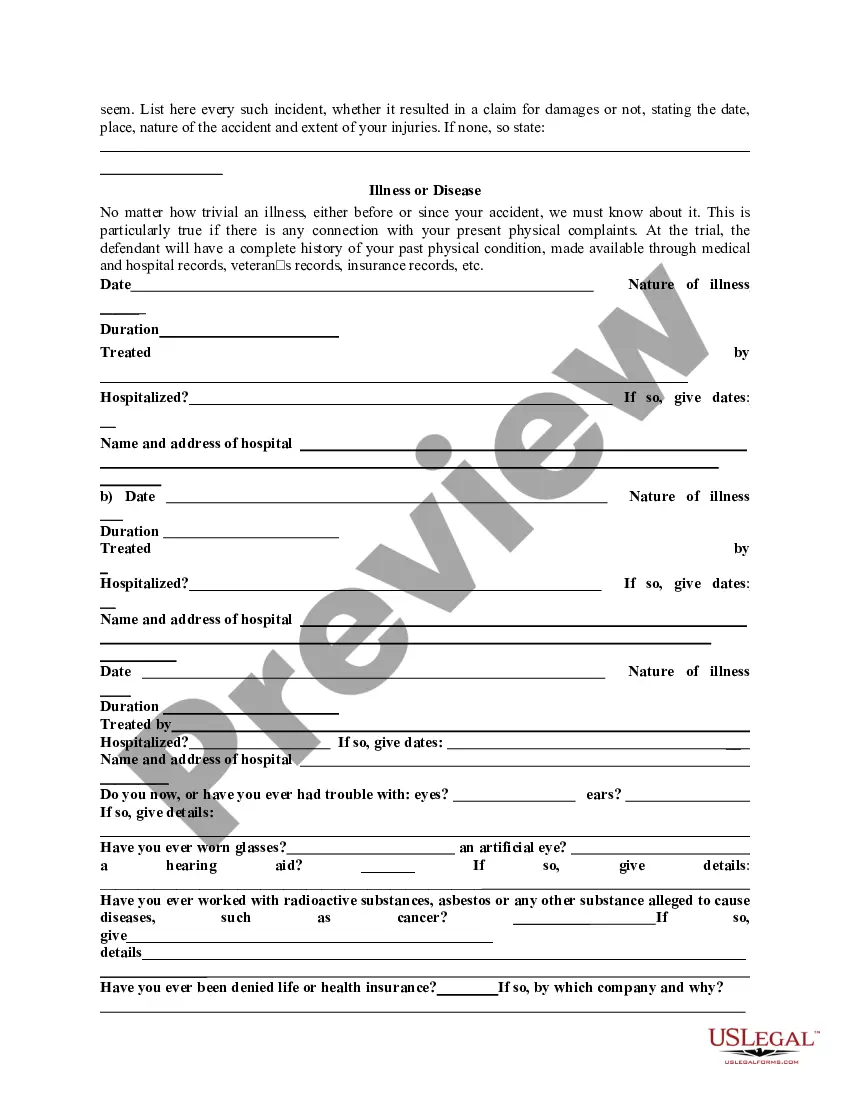

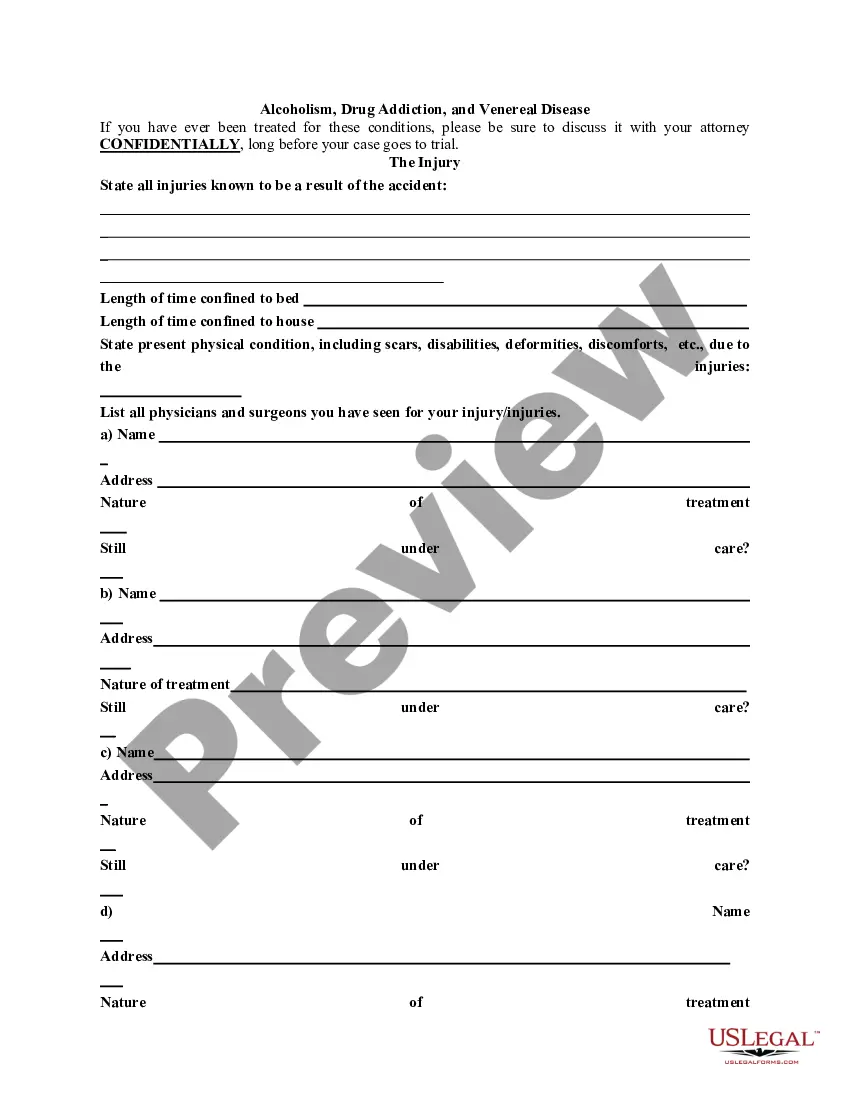

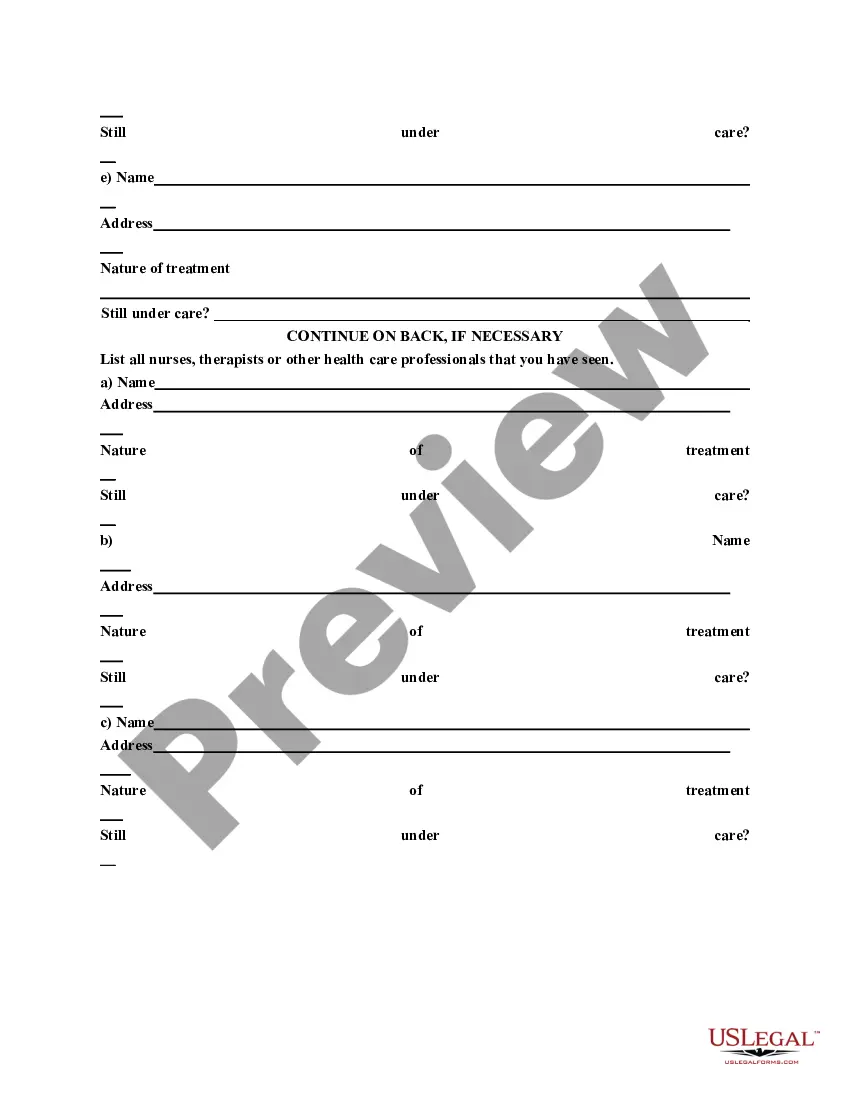

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Nebraska General Information Questionnaire

Description

How to fill out General Information Questionnaire?

Selecting the optimal legitimate document format can be a challenge.

Clearly, there are numerous templates available online, but how do you locate the legitimate form you require.

Use the US Legal Forms website. The service offers a vast array of templates, including the Nebraska General Information Questionnaire, which can be utilized for both business and personal purposes.

You can view the form using the Review option and check the form description to confirm it is suitable for you. If the form does not meet your requirements, use the Search area to find the appropriate form. Once you are confident that the form is correct, click the Purchase Now option to obtain the form. Choose the pricing plan you desire and enter the necessary information. Create your account and complete your order using your PayPal account or Visa or Mastercard. Select the file format and download the legal document template to your device. Fill out, modify, print, and sign the completed Nebraska General Information Questionnaire. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to download professionally crafted documents that comply with state requirements.

- All forms are reviewed by professionals and meet federal and state standards.

- If you are already registered, Log Into your account and click the Download option to obtain the Nebraska General Information Questionnaire.

- Use your account to review the legal forms you have previously purchased.

- Visit the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

Nebraska Contractor Registration Information The Nebraska Contractor Registration Act requires contractors and subcontractors doing business in Nebraska to register with the Nebraska Department of Labor. While the registration is a requirement, it does not ensure quality of work or protect against fraud.

Option 3 contractors are consumers of all manufacturing machinery and equipment purchased and annexed by them. Option 3 contractors must pay tax on purchases of machinery and equipment even if the machinery and equipment will be used by a manufacturer.

017.06D(1) Option 2 contractors are retailers for any sales of building materials or other property that is not annexed. Option 2 contractors must collect sales tax on the total amount charged unless the sale is otherwise exempt.

FORM.

Nebraska considers a seller to have physical nexus if you have any of the following in the state: An office or place of business. Employees, agents, sales people, contractors, etc. present in the state.

All businesses (Corporation, S-Corporation, Trust, LLC, Partnership & Sole Proprietorships) earning more than $5,000 annually who are performing construction work or arranging for construction work in Nebraska must be registered. Annual registration fee is $25.

This Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in Nebraska. Also, when owners of an existing business change, a Form 20 needs to be filed.

Nebraska has a 5.50 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 6.95 percent. Nebraska's tax system ranks 29th overall on our 2023 State Business Tax Climate Index.