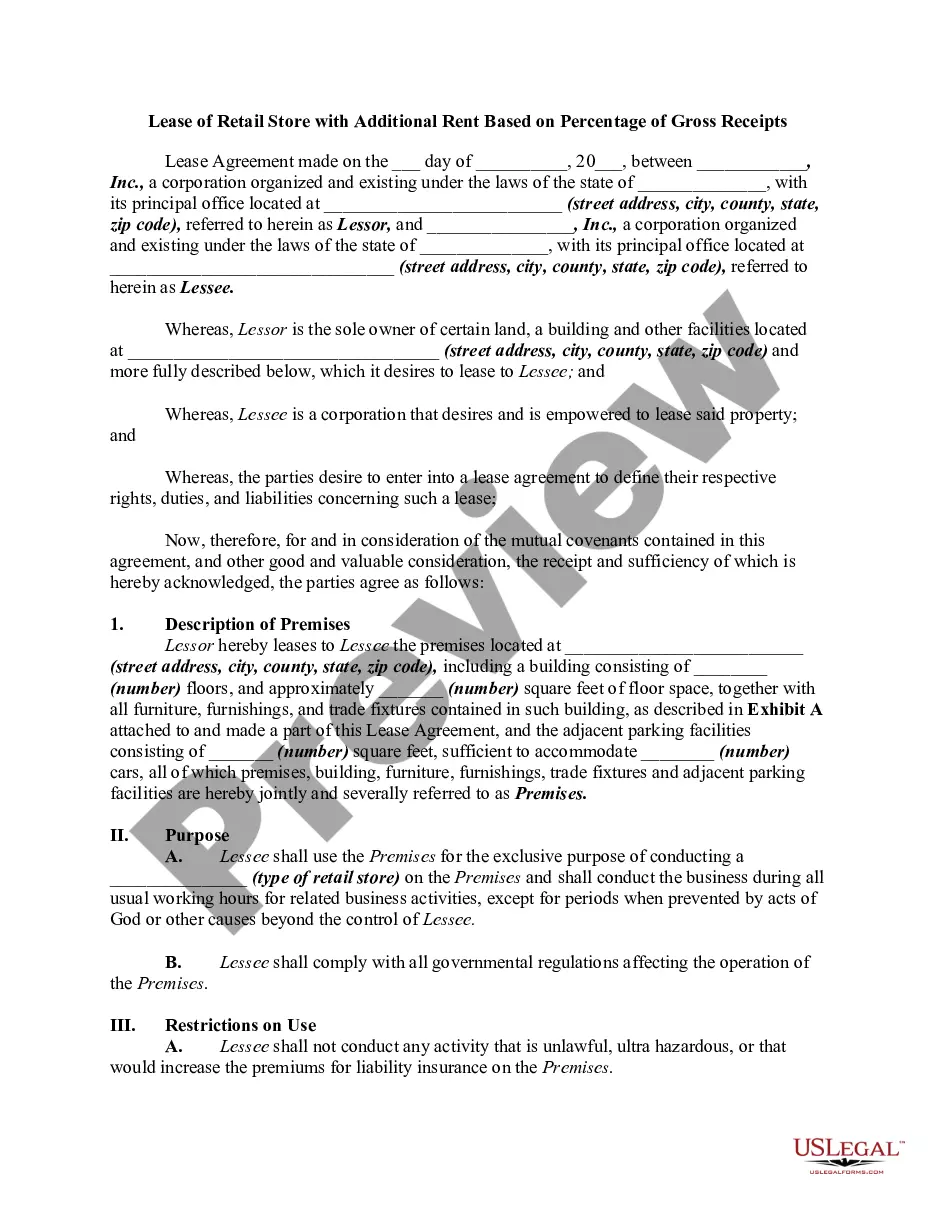

Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

If you wish to acquire, download, or print authentic document templates, utilize US Legal Forms, the most extensive selection of official forms, which are accessible online.

Utilize the site’s user-friendly and efficient search options to obtain the documents you require.

Various templates for business and personal uses are categorized by type and state, or keywords.

Every official document template you acquire is yours permanently. You have access to every form you have acquired in your account. Access the My documents section and select a form to print or download again.

Complete and download, and print the Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate using US Legal Forms. There are thousands of professional and state-specific templates available for your business or personal needs.

- Utilize US Legal Forms to obtain the Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to get the Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- You can also access forms you have previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for your specific city/state.

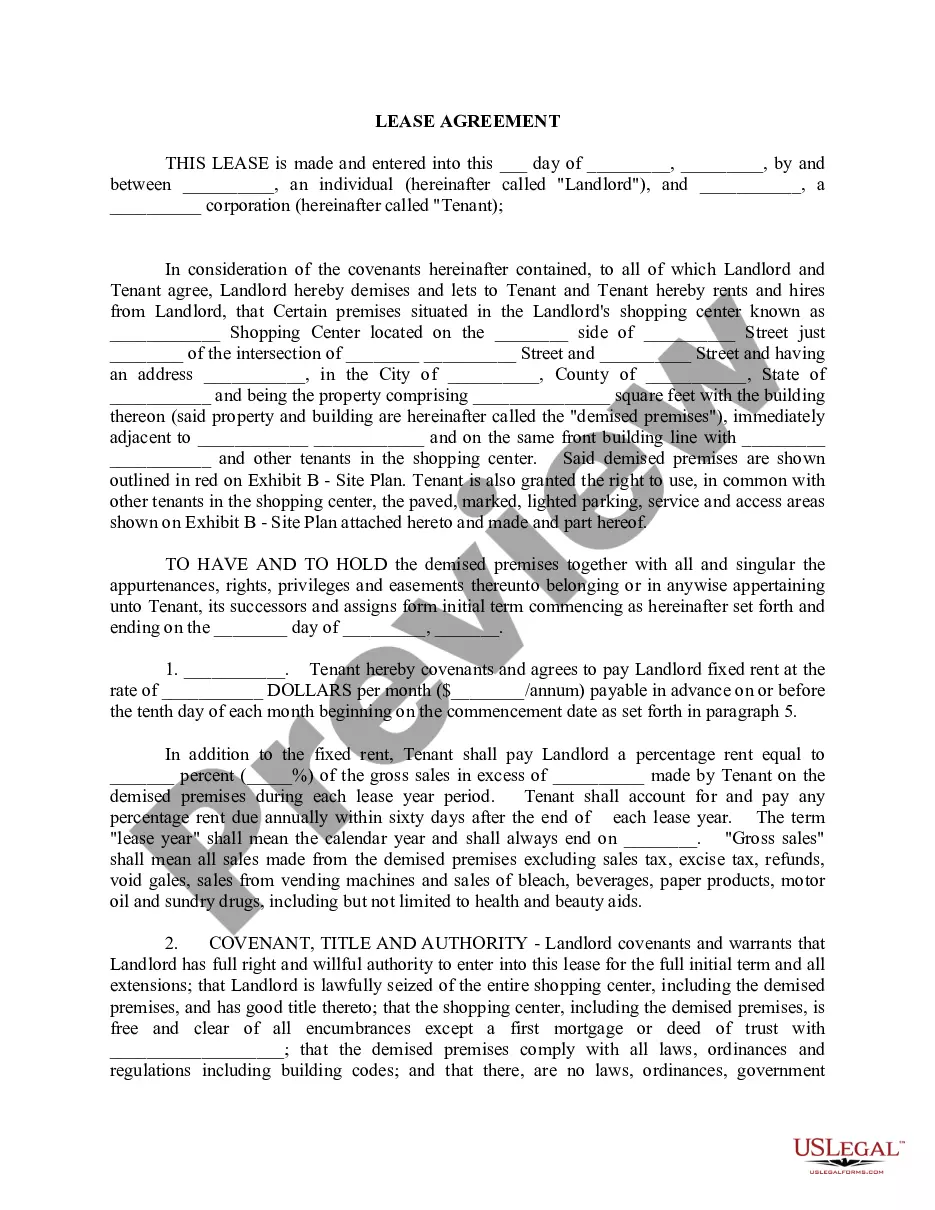

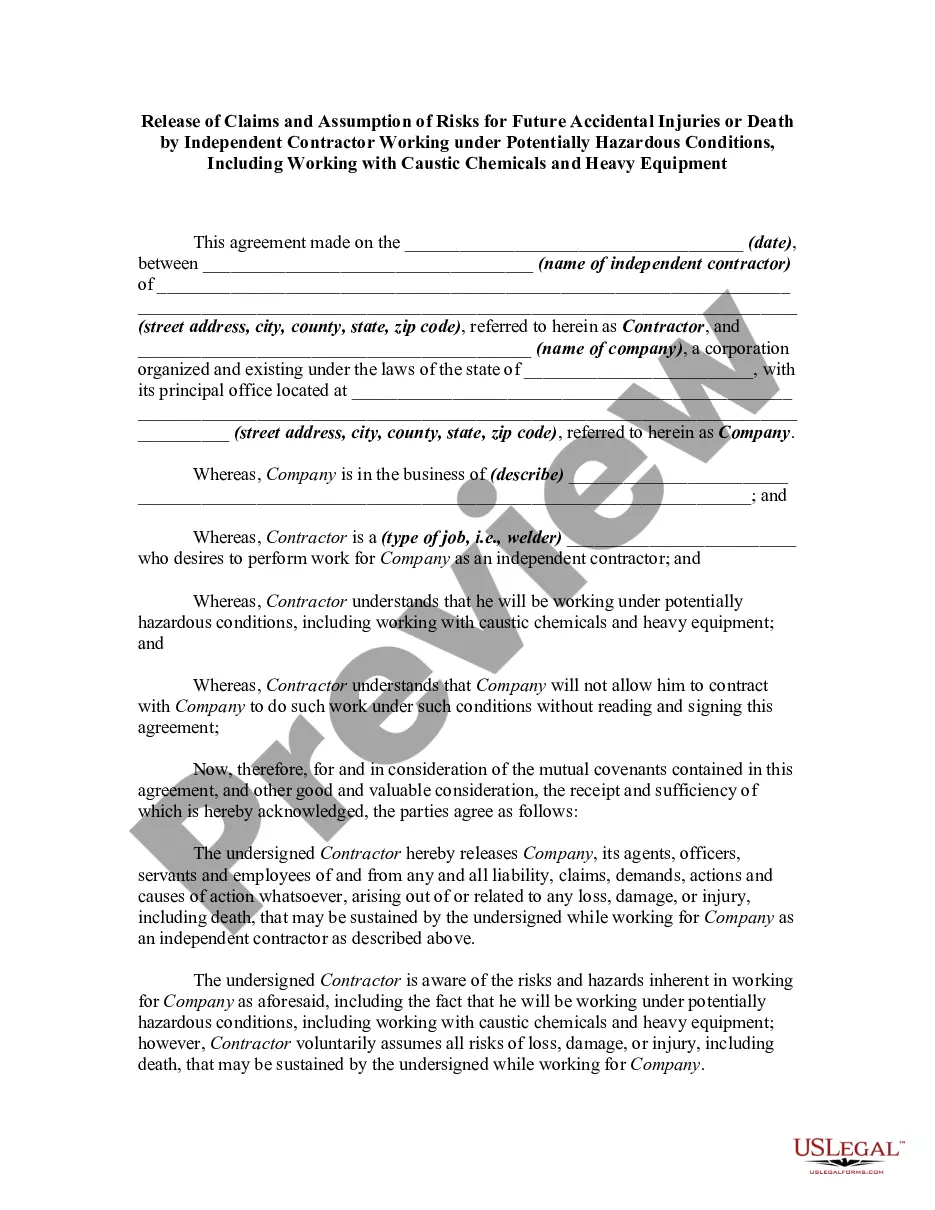

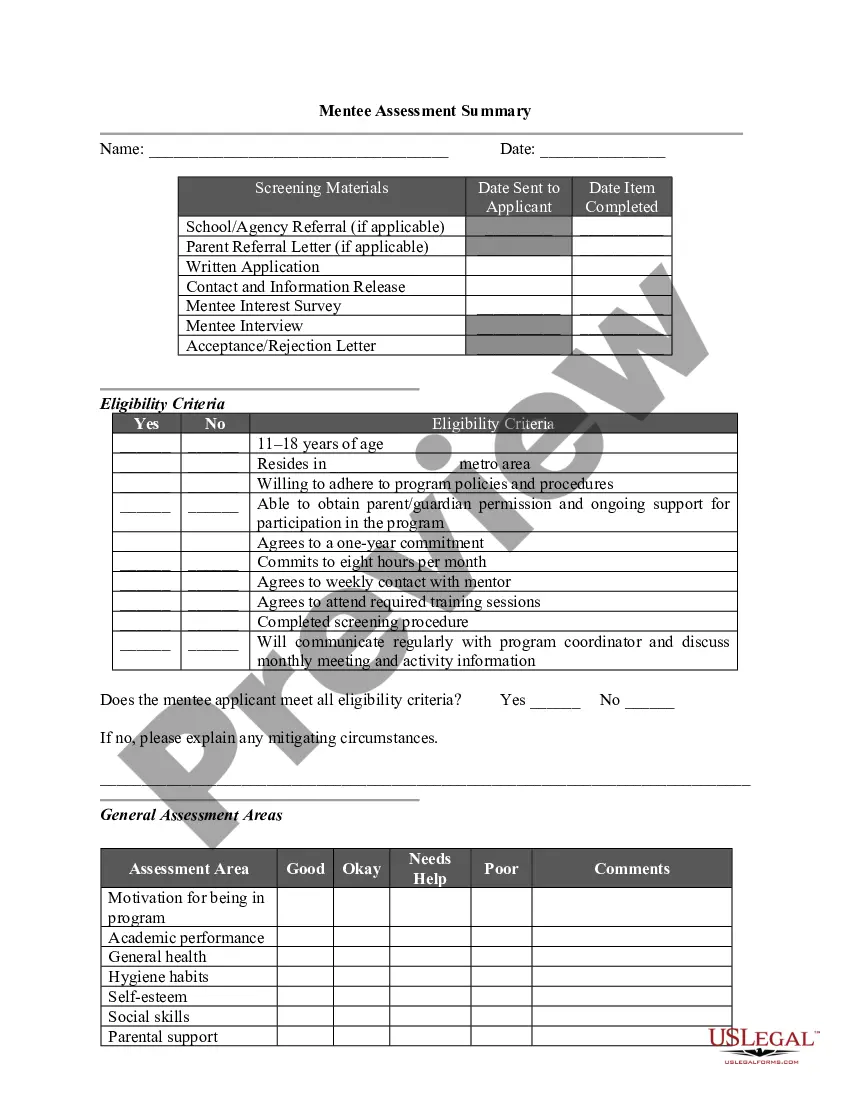

- Step 2. Use the Preview option to review the form’s content. Remember to read the instructions.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative templates of the official form.

- Step 4. Once you locate the necessary form, click on the Purchase now button. Choose the pricing plan that suits you and add your details to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the official form and download it to your device.

- Step 7. Complete, edit, and print or sign the Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

Form popularity

FAQ

Both landlords and tenants can benefit from a percentage lease, though each party gains differently. Tenants, especially new businesses, manage risk better since their rent scales with their sales performance. On the other hand, landlords with a Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate may attract high-quality tenants who are confident in their sales potential. Understanding these dynamics can lead to successful long-term relationships and financial growth.

In Nebraska, personal property tax is levied on tangible assets owned by businesses, such as equipment and inventory. This tax is assessed annually and is generally based on the property's value. If you have a Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, it’s critical to account for personal property taxes in your overall financial planning. Accurate valuation and timely reporting are key to managing this obligation effectively.

Avoiding property tax in Nebraska often requires a clear understanding of available exemptions and tax credits. For example, certain agricultural properties may be eligible for tax breaks. If you are leasing under a Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, knowing these laws can help you negotiate more favorable terms. Additionally, thorough research and potentially consulting legal experts can ensure you maximize your tax advantages.

In Nebraska, certain goods and services are exempt from sales tax, such as groceries, prescription drugs, and some medical equipment. Businesses involved in the Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate should be aware of these exemptions to reduce overall expenses. Understanding these exemptions can help you manage your lease agreements better and optimize your financial strategy. Always check your local regulations for the most accurate and updated information.

Form 20 in Nebraska is used for income tax purposes, specifically by corporations filing for various tax types. If you are managing a Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, understanding this form is crucial. Proper completion ensures accurate reporting and compliance with state tax laws. Always consult the Nebraska Department of Revenue for guidance on form specifics.

Nexus in Nebraska is determined by several factors, including physical presence, employee activities, and economic connections to the state. If your business operates under a Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, understanding nexus is vital for tax purposes. Even minimal activities can establish nexus, leading to tax obligations. Consult with a tax professional to clarify your situation.

A Category 20 employer in Nebraska refers to an employer engaged in the retail industry, particularly affecting those under a Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. These employers must meet specific criteria defined by state law. Understanding your classification ensures compliance with employment regulations and taxation requirements. Working with a knowledgeable advisor can help clarify your obligations.

In Nebraska, certain services are exempt from sales tax, including services related to agriculture, some medical services, and educational services. If your business operates under a Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, understanding these exemptions can impact your tax obligations. Review the Nebraska Department of Revenue's guidelines for specifics. Knowing the exemptions can save significant amounts.

To obtain a tax ID number in Nebraska, you need to complete the appropriate application process through the Nebraska Department of Revenue. This process facilitates your compliance with tax regulations, especially when managing a Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Online applications are typically simple and efficient. This step is critical for tax identification.

Yes, rentals are generally taxable in Nebraska. This applies particularly to leases of commercial properties, including those under a Nebraska Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Certain exceptions may apply, so it's wise to consult the Nebraska tax regulations. This ensures you apply the correct tax treatment.