District of Columbia Checklist - Sale of a Business

Description

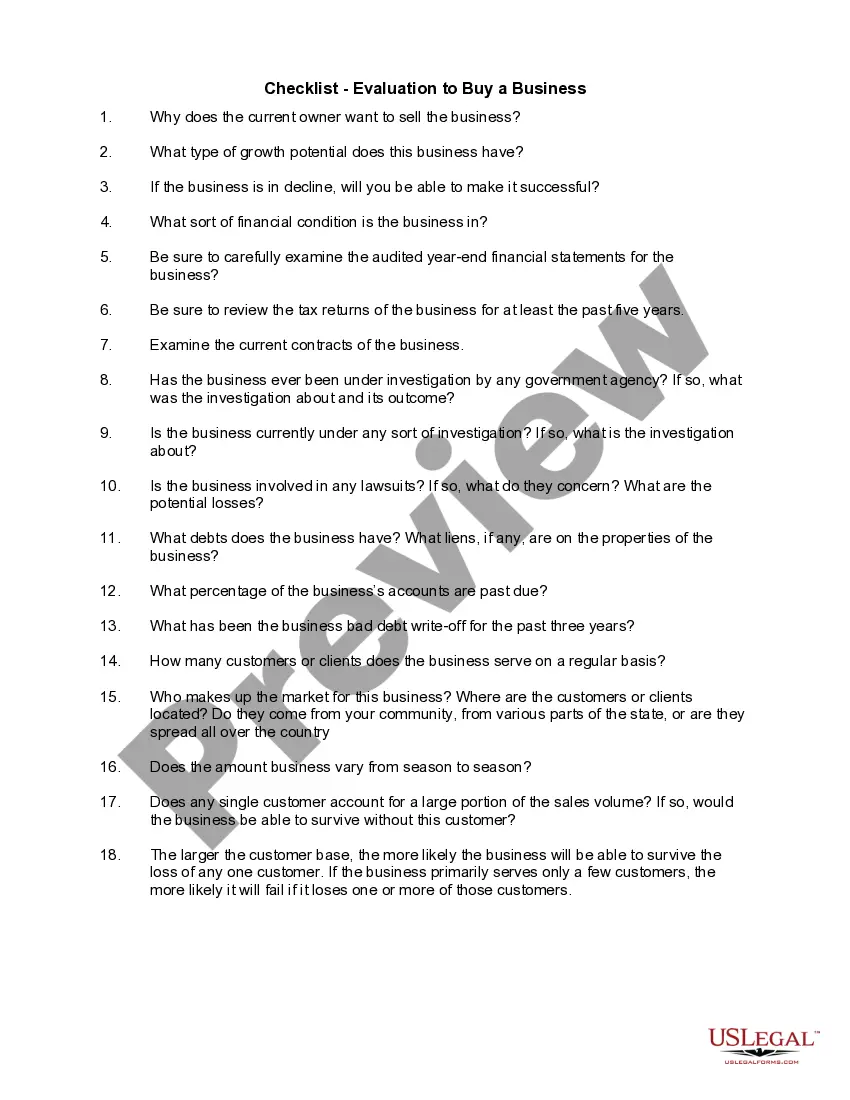

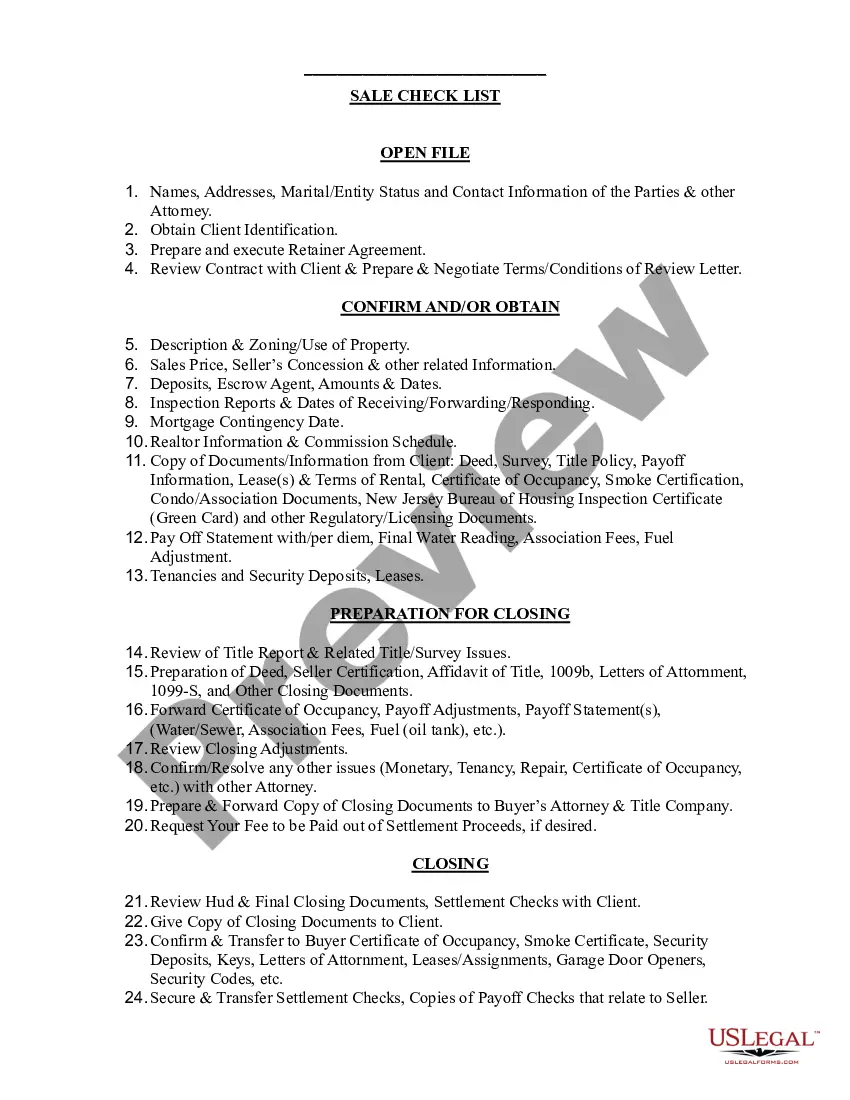

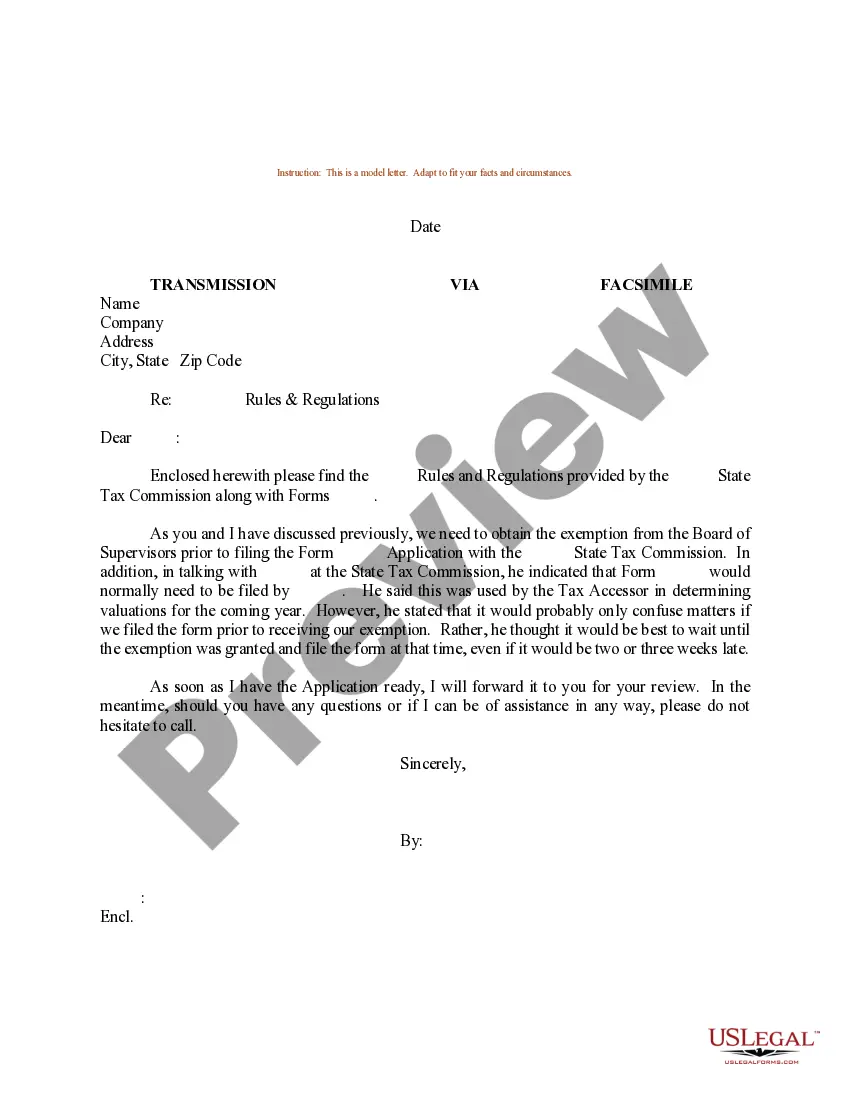

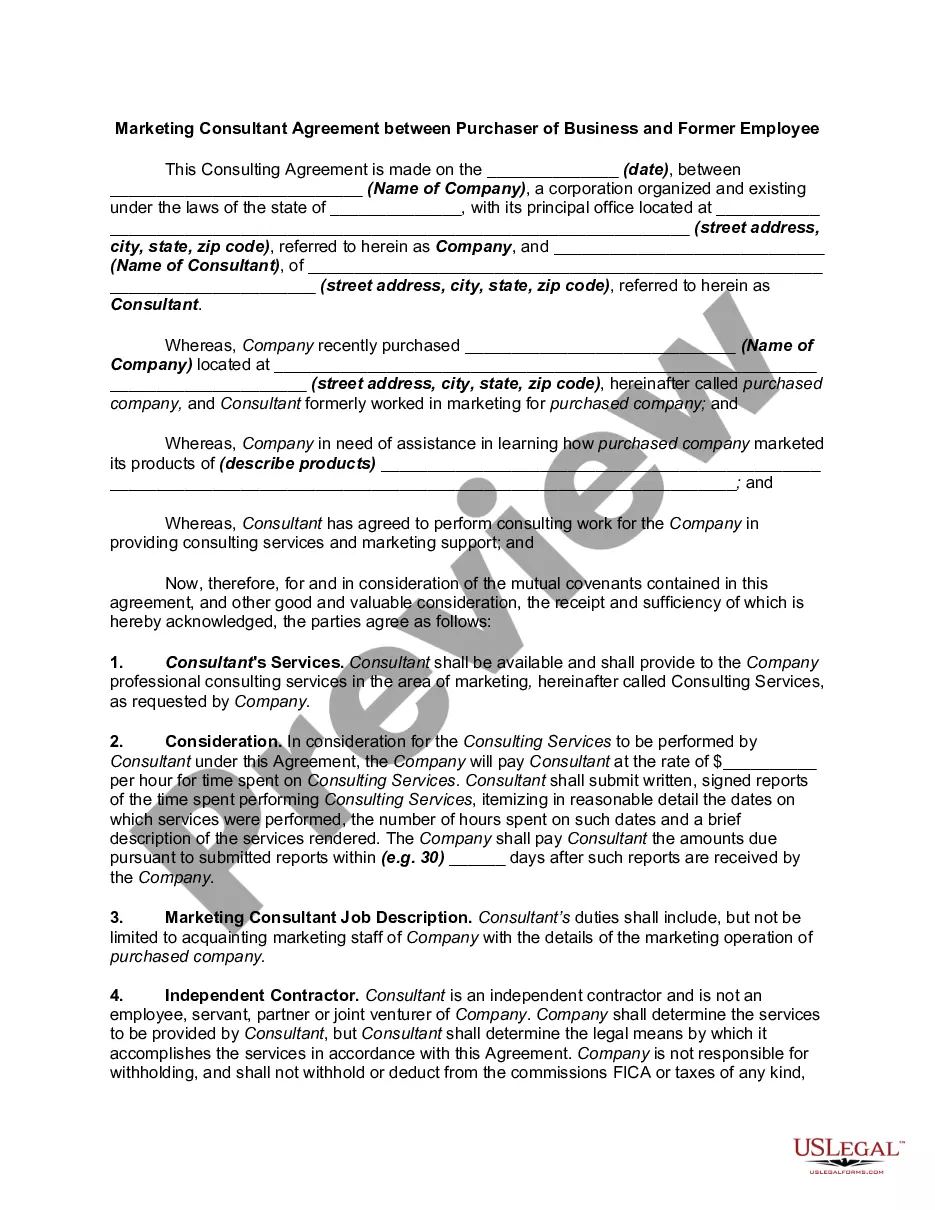

How to fill out Checklist - Sale Of A Business?

If you want to finalize, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Use the site’s straightforward and efficient search feature to locate the documents you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Step 4. Once you have found the form you need, click on the Acquire now button. Choose your preferred pricing plan and provide your credentials to register for an account.

- Utilize US Legal Forms to access the District of Columbia Checklist - Sale of a Business in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download option to retrieve the District of Columbia Checklist - Sale of a Business.

- You can also view forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Verify that you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the contents of the form. Remember to check the description.

Form popularity

FAQ

Taxpayers who wish to register a new business in the District of Columbia can conveniently complete the Register a New Business: Form FR-500 application online via the Office of Tax and Revenue's (OTR) tax portal, MyTax.DC.gov.

There is a $220 filing fee to dissolve your Limited Liability Company in the District of Columbia. You can pay an additional $50 expedite fee to have the form processed in three days.

500, or Combined Tax Registration Form, is used by businesses to register all their tax requirements on one simple form. Whether registering for sales tax, franchise tax, unemployment tax, etc., the business person completes all areas applicable to their business activity either in hardcopy or online.

To dissolve an LLC in DC, simply follow these three steps: Follow the Operating Agreement....Step 1: Follow Your Washington D.C. LLC Operating Agreement. For most LLCs, the steps for dissolution will be outlined in the operating agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

No. If you are conducting the same business activity, but from different locations in the District of Columbia, a Basic Business License (BBL) is required for each location.

If your company is a DC corporation, DC partnership, or DC limited liability company, you need to be registered and in good standing with the DCRA Corporation Division. All business entities registered are required to have a Washington DC registered agent and office.

Tax registration is required for your Basic Business License Once your LLC is registered with OTR, they will mail you a Notice of Business Tax Registration. In the upper-right hand corner of this letter will be your LLC's Notice Number. You'll need this Notice Number in order to apply for your Basic Business License.

Officially dissolving a corporation in AlbertaFile the Articles of Dissolution with Alberta registries and pay the fee (Owner) Close your GST account and payroll account (Owner or accountant) File final corporate tax return and GST return (Accountant) Pay any final balances owing (if any) (Owner)

Close Your BusinessDissolve your business entity with the Corporations Division, (202) 442-4400, Option #5, 1100 4th Street, SW, 2nd Floor, Washington, DC 20024;Cancel your Basic Business License with the Business Licensing Division, (202) 442-4400, Option #4, 1100 4th Street, SW, 2nd Floor, Washington, DC 20024.More items...

Cancel Your Basic Business License If you are no longer conducting the business activity for which your Basic Business License was issued, you are required to formally notify the Department of Consumer and Regulatory Affairs by submitting a Business License Cancellation request.