Connecticut Checklist - Sale of a Business

Description

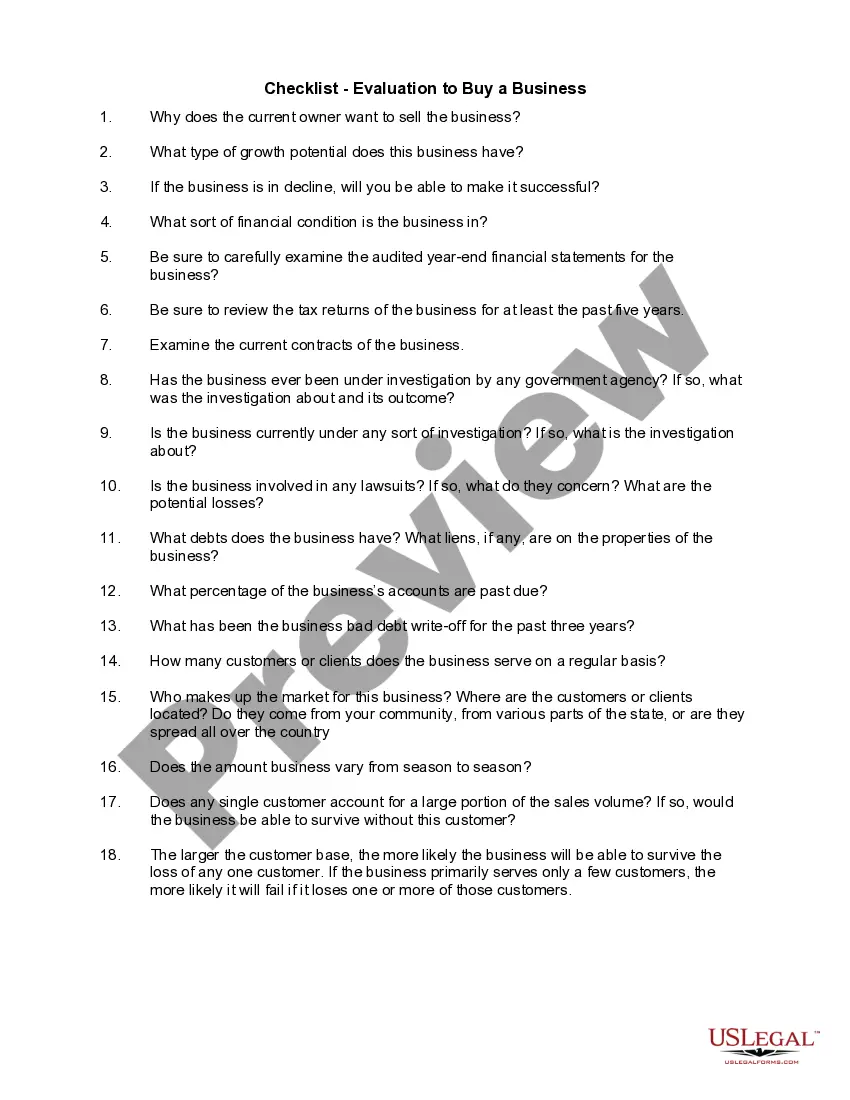

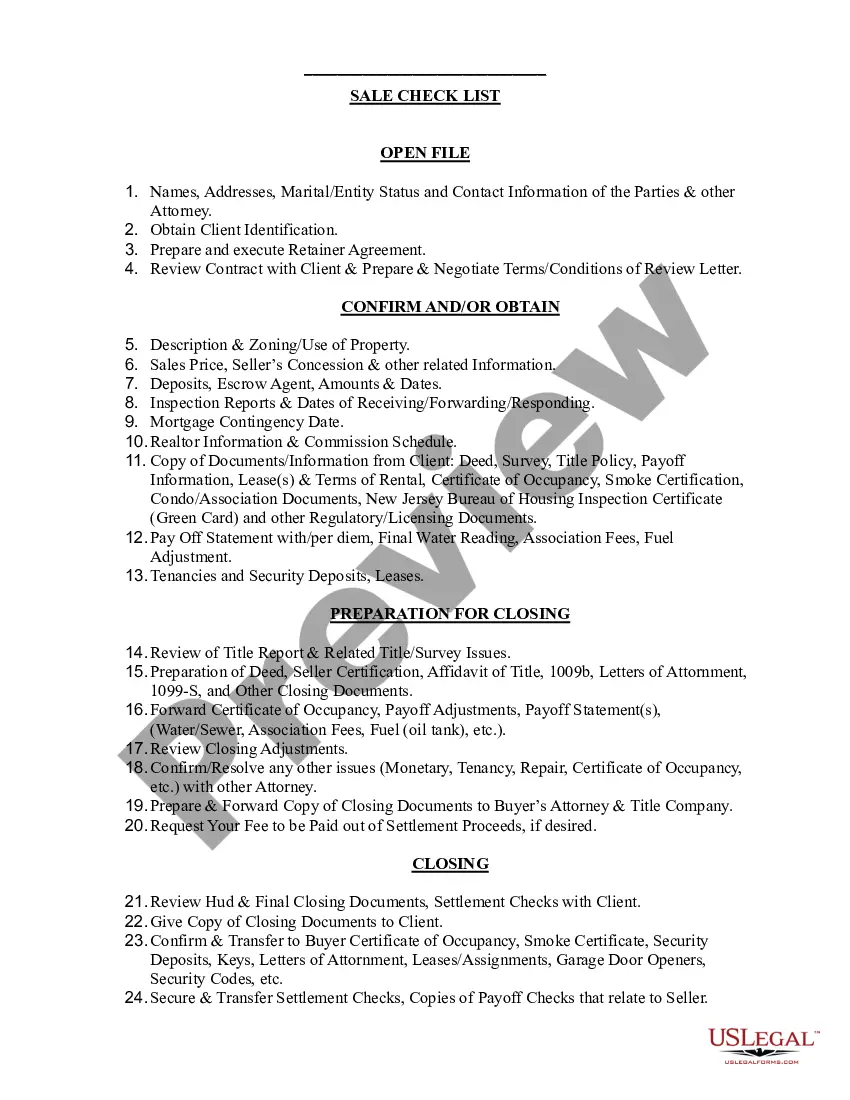

How to fill out Checklist - Sale Of A Business?

If you want to be thorough, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to find the documents you need. Various templates for business and personal use are categorized by types and states, or keywords.

Utilize US Legal Forms to grab the Connecticut Checklist - Sale of a Business with just a couple of clicks.

Every legal document template you acquire is yours permanently. You have access to every form you obtained through your account. Select the My documents section and choose a form to print or download again.

Be proactive and download, and print the Connecticut Checklist - Sale of a Business with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download option to find the Connecticut Checklist - Sale of a Business.

- You can also access forms you've previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you want, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Connecticut Checklist - Sale of a Business.

Form popularity

FAQ

When presenting this certificate to your vendor, make sure it is fully filled out with the following info:Your business information (name, address, etc.)The types of products you sell.A general description of the products you are purchasing with the certificate.Your signature, title and the date of the purchase.

All business entities registered in Connecticut are available to search on Connecticut's Secretary of State's website. Enter the name for which you are searching into the search bar, then click search. A list of entities will appear showing the status, filing number, address, and business name.

How to Dissolve an LLCConfirm the Company Is in Good Standing.Hold a Vote to Dissolve the Business.File LLC Articles of Dissolution.Notify the Company's Stakeholders.Cancel Business Licenses and Permits.File the LLC's Final Payroll Taxes.Pay Final Sales Tax.File Final Income Tax Returns.More items...?19-Oct-2021

All business entities registered in Connecticut are available to search on Connecticut's Secretary of State's website. Enter the name for which you are searching into the search bar, then click search. A list of entities will appear showing the status, filing number, address, and business name.

Corporation & Business Entity Search You can find information on any corporation or business entity in Connecticut or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

There is a $50 fee to file the articles. Your filing usually will be processed within 3-5 business days. You can get expedited processing if you pay an additional $50 fee and use the requisite expedited service request form.

Closing a Sales and Use Taxes AccountClose the account by logging into myconneCT and open the More2026 menu, then locate the Taxpayer's Updates group and select Close Accounts and follow the prompts.All your sales and use tax returns must be filed through the date of closure.Destroy your Sales and Use Tax Permit.

To dissolve your Connecticut LLC, you submit Articles of Dissolution to the Connecticut Secretary of the State, Commercial Recording Division (SOTS). You are not required to use the SOTS form, you may draft your own articles of dissolution.

Closing an LLC is not as simple as locking the door and walking away. There are several steps you must take to protect yourself from liability and withdraw remaining assets from the company. by Brette Sember, J.D. Making the decision to close a business can be stressful.