Nebraska Minimum Checking Account Balance - Corporate Resolutions Form

Description

How to fill out Minimum Checking Account Balance - Corporate Resolutions Form?

Are you in a situation where you frequently need documentation for business or particular purposes.

There are numerous legitimate document templates available online, but locating reliable ones isn't simple.

US Legal Forms offers thousands of form templates, including the Nebraska Minimum Checking Account Balance - Corporate Resolutions Form, which can be downloaded to meet state and federal requirements.

Once you find the appropriate form, click Buy now.

Select the pricing plan you prefer, fill in the necessary details to create your account, and complete your purchase using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Once logged in, you can download the Nebraska Minimum Checking Account Balance - Corporate Resolutions Form template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct area/state.

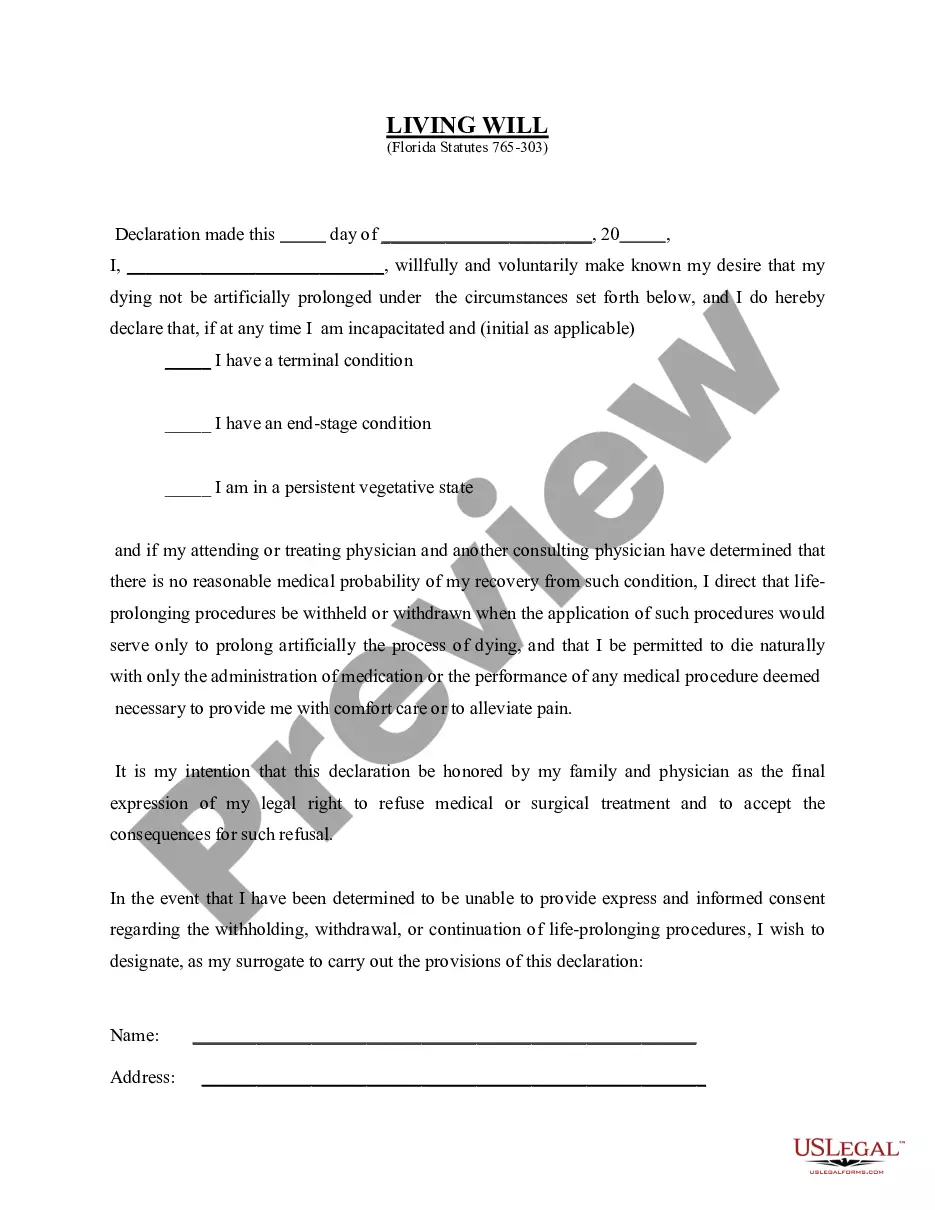

- Utilize the Preview button to review the form.

- Verify the information to ensure you have selected the right form.

- If the form isn’t what you need, use the Search field to find a form that suits your requirements.

Form popularity

FAQ

Any individual or business entity earning income in Nebraska must file a Nebraska income tax return. This includes S Corporations, partnerships, and sole proprietors. Understanding the filing requirements and maintaining your Nebraska Minimum Checking Account Balance - Corporate Resolutions Form is essential to ensure compliance and manage your business finances effectively.

Nebraska Form 1120 SN is the state tax return required for S Corporations operating in Nebraska. This form allows S Corporations to report income, deductions, and credits correctly. Filing this form accurately is vital to fulfilling your state tax obligations, alongside maintaining the Nebraska Minimum Checking Account Balance - Corporate Resolutions Form for financial accountability.

Yes, Nebraska has a corporate income tax that applies to all corporations conducting business in the state. This tax affects how S Corporations, among others, are structured and taxed. It is crucial for business owners to keep track of their financial records, including adherence to the Nebraska Minimum Checking Account Balance - Corporate Resolutions Form.

Absolutely, Nebraska recognizes S Corporations, allowing them to pass income directly to shareholders, avoiding double taxation. This allows business owners to manage their financial obligations more effectively. Ensuring that you maintain the Nebraska Minimum Checking Account Balance - Corporate Resolutions Form is essential for smooth operations and financial clarity.

Yes, Nebraska imposes a corporate income tax on businesses operating within the state. The tax rate varies based on income levels and is structured progressively. Businesses, including S Corporations, must understand these requirements to maintain compliance while managing their finances, which includes keeping the Nebraska Minimum Checking Account Balance - Corporate Resolutions Form active.

To set up an S Corp in Nebraska, you first need to choose a unique business name and file your Articles of Incorporation with the Nebraska Secretary of State. Next, you must apply for an Employer Identification Number (EIN) through the IRS. Finally, to elect S Corporation status, file Form 2553 with the IRS, ensuring that your Nebraska Minimum Checking Account Balance - Corporate Resolutions Form is in place for your business needs.

In banking, a resolution refers to a formal decision or declaration made by a company's board or management. This document specifies who can perform actions on behalf of the company regarding its banking affairs. It is particularly relevant when dealing with official documents like the Nebraska Minimum Checking Account Balance - Corporate Resolutions Form, which governs how the company interacts with its bank and ensures proper delegation of financial responsibilities.

A corporate bank resolution is a formal authorization by a company's governing body that permits specific actions relating to banking. It is critical for establishing who has the authority to make financial decisions, including signing checks or accessing accounts. In many cases, this includes stipulations related to the Nebraska Minimum Checking Account Balance - Corporate Resolutions Form. Such clarity is vital for seamless banking operations.

A corporate resolution for a bank account is a written document that details the authorities granted to certain individuals for managing a business's bank transactions. This document is often required by banks to open an account, ensuring compliance with regulatory standards, such as maintaining the Nebraska Minimum Checking Account Balance - Corporate Resolutions Form. It enhances operational efficiency by clarifying roles in financial dealings.

A company resolution for a bank account is a formal document that authorizes specific individuals within a company to manage its banking activities. This includes opening accounts, making deposits, and withdrawing funds. It is essential for financial institutions to verify who can act on behalf of the business, particularly when adhering to the Nebraska Minimum Checking Account Balance - Corporate Resolutions Form. Such resolutions provide clarity and mitigate risks.