Nebraska Option For the Sale and Purchase of Real Estate - Commercial Lot or Land

Description

How to fill out Option For The Sale And Purchase Of Real Estate - Commercial Lot Or Land?

You can invest time online searching for the legal document format that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that can be reviewed by experts.

It is easy to download or print the Nebraska Option For the Sale and Purchase of Real Estate - Commercial Lot or Land from our platform.

If available, utilize the Preview option to verify the document format as well.

- If you already possess a US Legal Forms account, you may Log In and select the Download option.

- Following that, you can complete, modify, print, or sign the Nebraska Option For the Sale and Purchase of Real Estate - Commercial Lot or Land.

- Each legal document format you purchase is yours permanently.

- To obtain another copy of the acquired form, navigate to the My documents tab and click on the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the basic instructions below.

- First, ensure that you have chosen the correct document format for the state/city of your preference.

- Refer to the form details to confirm you have selected the correct template.

Form popularity

FAQ

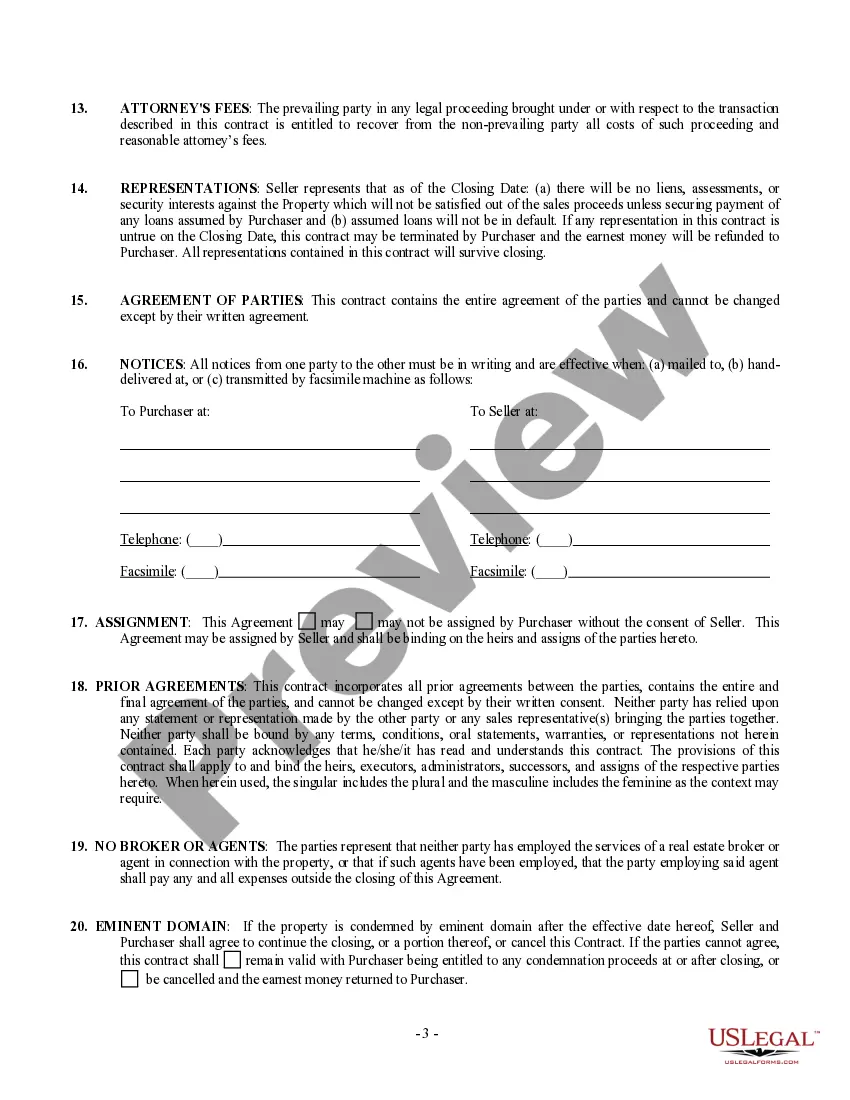

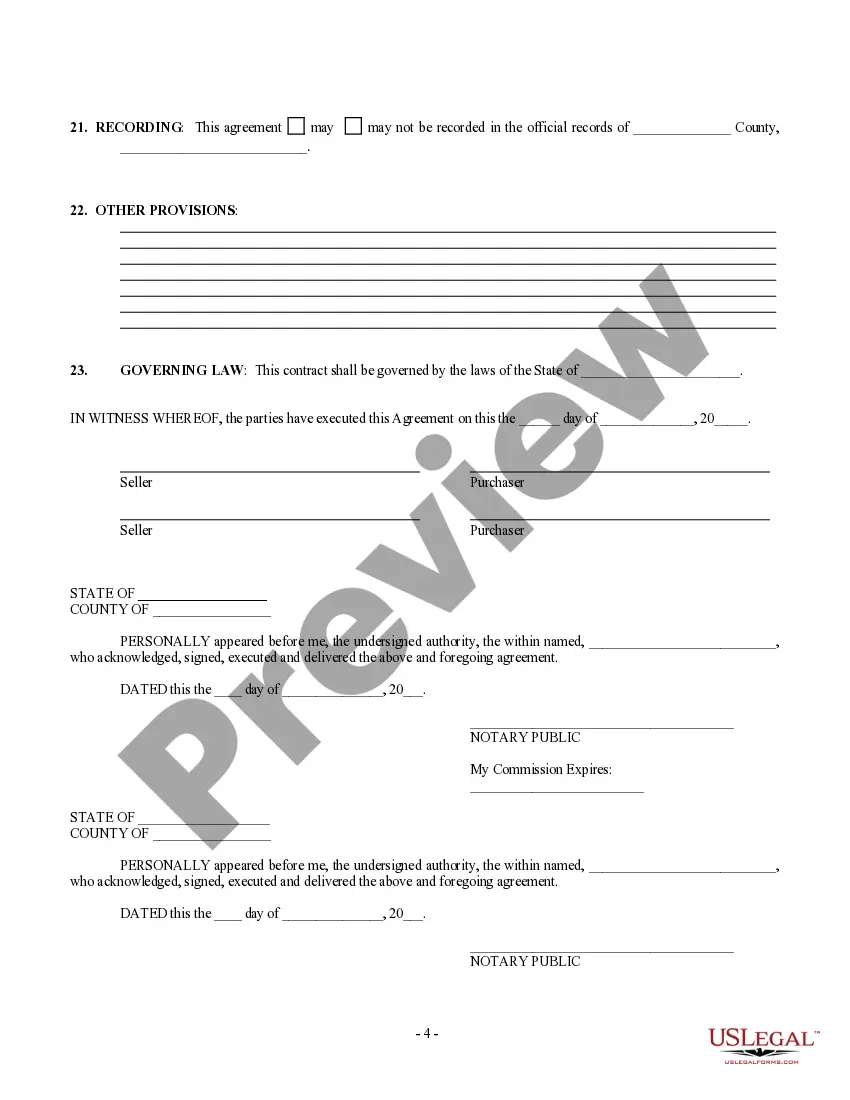

In Nebraska, sales tax generally applies to the sale of tangible personal property and some services. Items such as retail goods and certain digital products are subject to sales tax. However, real estate transactions typically involve exemptions, so it is essential to understand what falls under taxable categories. Using resources like uslegalforms can clarify your obligations regarding sales tax in real estate sales, ensuring compliance with local laws.

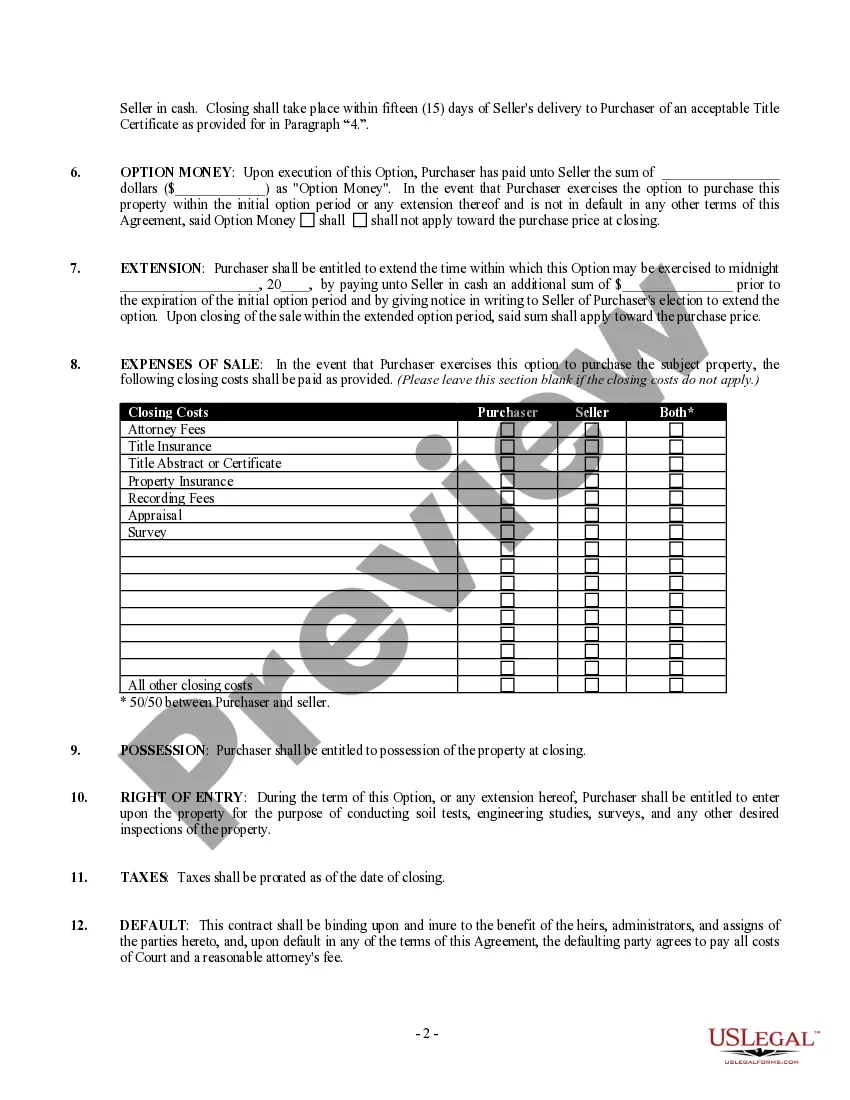

In Nebraska, you'll pay about 0.7% of your home's final sale price in closing costs, not including realtor fees. Keep in mind that this is only an estimate. While closing costs will always have to be paid, your real estate agent can often negotiate who pays them you or the buyer.

If audited, the Nebraska Department of Revenue requires the seller to have a correctly filled out Form 13 Resale Certificate. Without it correctly filled out, the seller could end up owing sales taxes that should have been collected from the buyer in addition to penalties and interest.

Closing costs are paid according to the terms of the purchase contract made between the buyer and seller. Usually the buyer pays for most of the closing costs, but there are instances when the seller may have to pay some fees at closing too.

If audited, the Nebraska Department of Revenue requires the seller to have a correctly filled out Form 13 Resale Certificate. Without it correctly filled out, the seller could end up owing sales taxes that should have been collected from the buyer in addition to penalties and interest.

Official Form 13 is used in chapter 11 reorganization cases to provide certain parties in interest with notice of the court's approval of the disclosure statement, their opportunity to file acceptances or rejections of the plan, and an order and notice of a hearing to consider the approval of the plan of reorganization

Closing Costs for Nebraska Homes: What to Expect Generally, as a buyer, you should expect to pay somewhere between 2% and 5% of the purchase price in closing costs. If you purchased a home for $240,000, the median listing price in Omaha, you could expect to pay between $4,800 and $12,000.

Mortgage closing costs are fees and expenses you pay when you secure a loan for your home, beyond the down payment. These costs are generally 3 to 5 percent of the loan amount and may include title insurance, attorney fees, appraisals, taxes and more.

Closing costs in Nebraska are, on average, $2,007 for a home priced at $165,050, according to a 2021 report by ClosingCorp, which provides research on the U.S. real estate industry. That price tag makes up 1.22 percent of the home's price tag.

Nebraska Resale or Exempt Sale Certificate. FORM. Name and Mailing Address of Seller.