The following form is a general form for a declaration of a gift of property.

Nebraska Declaration of Gift

Description

How to fill out Declaration Of Gift?

Are you presently in a situation where you require documentation for both organizations or specific roles frequently.

There are numerous authentic document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms provides a vast array of form templates, including the Nebraska Declaration of Gift, which are designed to comply with federal and state regulations.

Once you obtain the appropriate form, click on Get now.

Select the pricing plan you want, complete the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Next, you will be able to download the Nebraska Declaration of Gift template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct location/state.

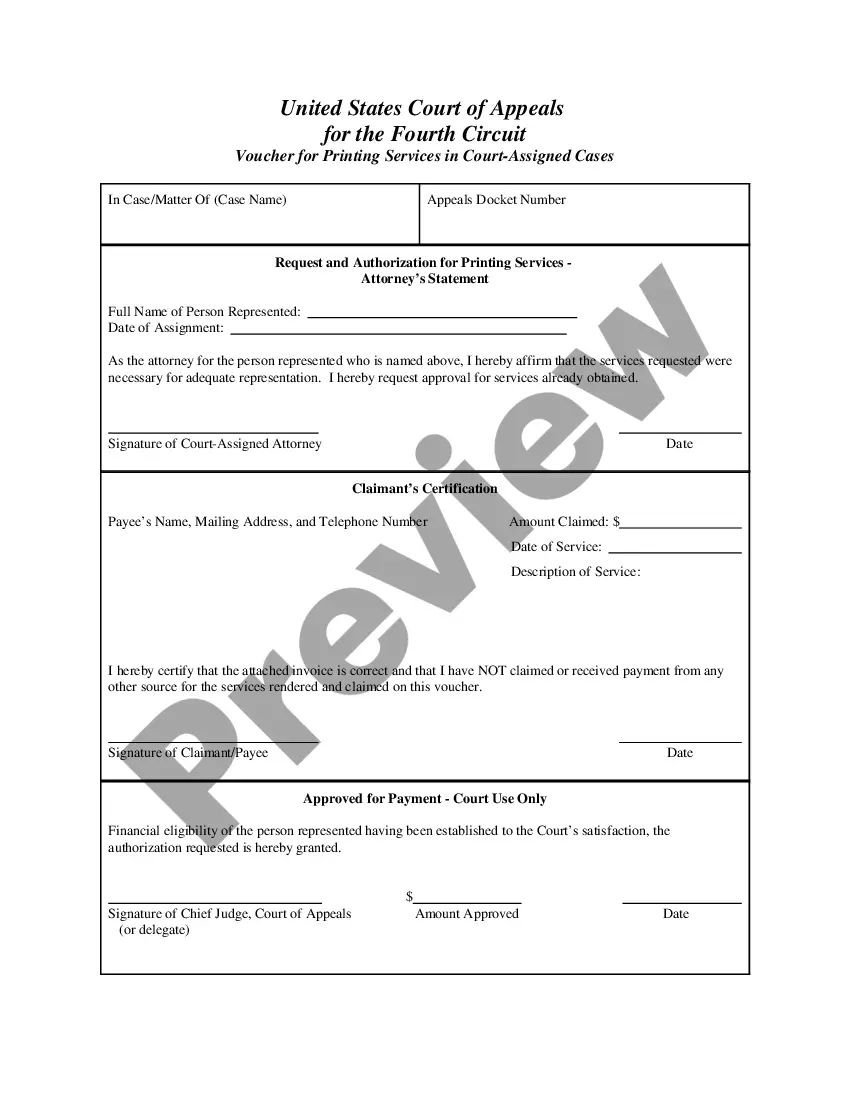

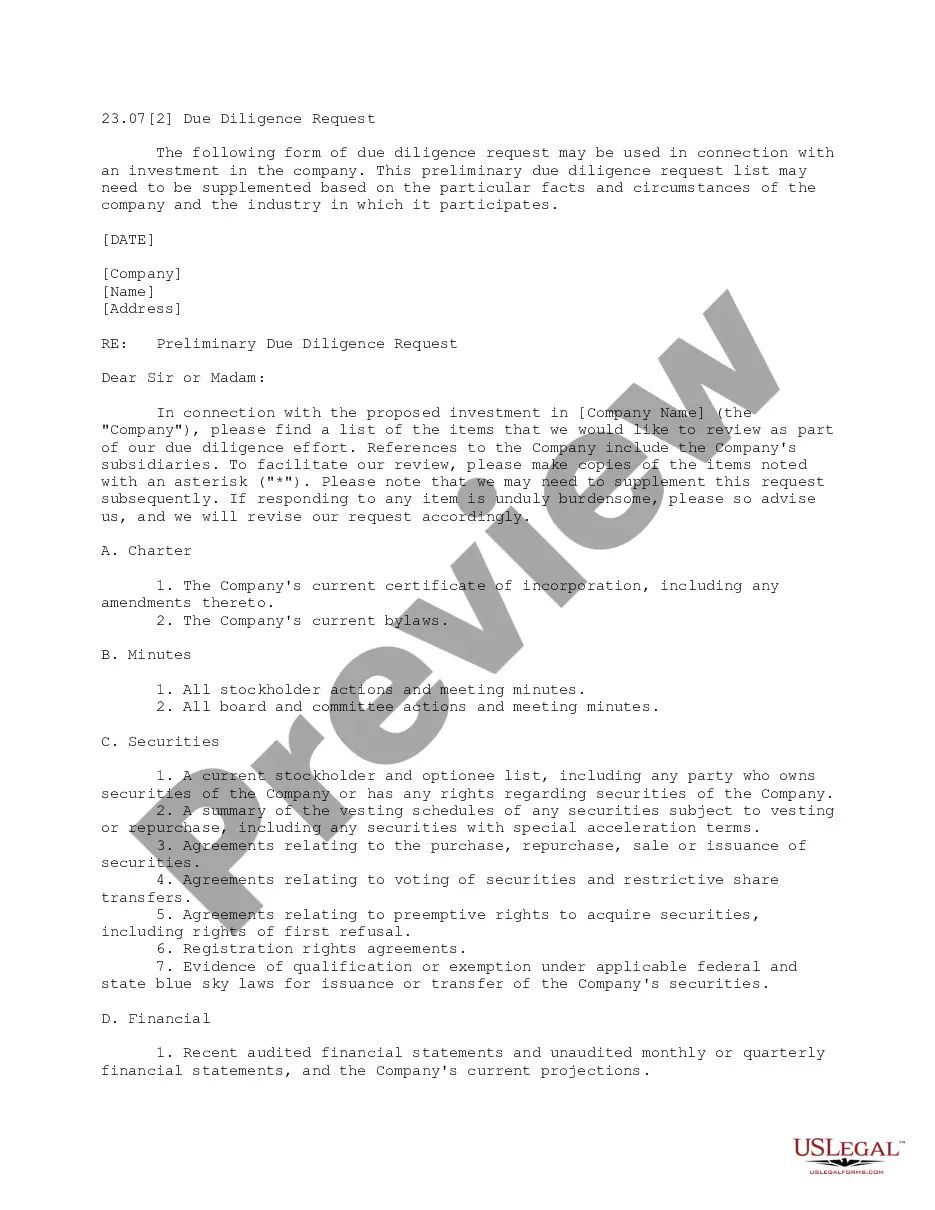

- Use the Preview button to review the form.

- Check the details to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs and specifications.

Form popularity

FAQ

Transferring a deed in Nebraska involves creating a Nebraska Declaration of Gift if you are not receiving payment for the transfer. Start by drafting a deed that includes the legal description of the property and identifying the grantor and grantee. After properly executing the deed, you must record it with the County Clerk or Register of Deeds to make the transfer official. Utilizing USLegalForms can help you find the right forms and instructions to ensure a smooth process.

To declare gift income, you must understand that a Nebraska Declaration of Gift serves as a formal statement documenting the transfer of a gift. First, ensure that the amount meets the IRS annual exclusion limit. You'll need to report the gift if it exceeds this limit, but gifts under this amount generally do not require reporting. Using platforms like USLegalForms can simplify the process by providing templates that guide you through the necessary steps.

The format of a gift declaration typically includes the donor's information, recipient details, a description of the gift, and a statement of intent. It is important to write it clearly and precisely to avoid any disputes. A well-structured gift declaration helps streamline the process of creating a Nebraska Declaration of Gift.

To declare a gift, you typically use a gift declaration form specific to your state. In Nebraska, it’s essential to use a form that meets legal requirements to ensure validity. You can find an appropriate gift declaration form on platforms like US Legal Forms, tailored for creating a Nebraska Declaration of Gift.

A gift declaration is a statement that officially communicates the intention to transfer ownership of an item or property. This legal document ensures that the transfer is recognized and provides proof of the gift. To ensure clarity, many individuals choose to create a Nebraska Declaration of Gift.

A gift declaration form is a legal document used to formalize the act of giving a gift. This form outlines essential details, such as the donor's name, the recipient's details, and a description of the gift. Utilizing a properly crafted gift declaration form is vital for those wishing to execute a Nebraska Declaration of Gift successfully.

A gift statement illustrates the intent to give a present without expecting anything in return. For instance, a parent may write, 'I hereby declare that I gift my vintage car to my son, John Doe.' Using a clear and specific gift statement is crucial in executing a Nebraska Declaration of Gift.

To avoid gift tax in Nebraska, it is essential to stay informed about annual gift limits set by the IRS. For 2023, you can give up to $17,000 per recipient without triggering gift tax implications. Utilizing the Nebraska Declaration of Gift allows you to formally document your gifts, ensuring compliance and simplifying your financial planning. Additionally, strategic tax planning with a qualified professional can help you maximize your gifts while minimizing potential tax liabilities.

In Nebraska, the maximum amount you can inherit without incurring taxes is influenced by federal regulations. For 2023, the federal estate tax exemption is $12.92 million per individual. This means that if your inheritance falls below this threshold, you typically do not need to worry about taxes. However, understanding the nuances of the Nebraska Declaration of Gift can provide clarity on any specific circumstances related to your situation.

To draft a gift, begin by identifying all parties involved, such as the donor and the recipient. Next, outline the description of the gift and its value. It's essential to include any stipulations regarding the gift. With platforms like US Legal Forms, you can access templates for your Nebraska Declaration of Gift to ensure everything is properly documented.