Nebraska Financial Statement Form - Individual

Description

How to fill out Financial Statement Form - Individual?

Are you currently in an environment where you require documentation for either professional or personal purposes nearly every day.

There are numerous legal document templates available online, but finding reliable forms can be challenging.

US Legal Forms offers thousands of document templates, including the Nebraska Financial Statement Form - Individual, designed to meet state and federal guidelines.

Once you find the correct form, click on Get now.

Select the pricing plan you want, complete the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Nebraska Financial Statement Form - Individual template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Review button to examine the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search field to locate the form that suits your needs and requirements.

Form popularity

FAQ

Individuals do indeed have financial statements, which are essential tools for understanding personal finances. These statements allow you to see an overview of your financial condition, including income, investments, and debts. By utilizing the Nebraska Financial Statement Form - Individual, creating your financial statement becomes manageable and organized. This way, you can confidently assess your financial health and plan for the future.

Yes, an individual can absolutely have a financial statement. In fact, it's highly beneficial for personal finance management and planning. The Nebraska Financial Statement Form - Individual simplifies this process, providing individuals with a clear template to record their financial data. Having a financial statement enables you to track your progress toward financial goals effectively.

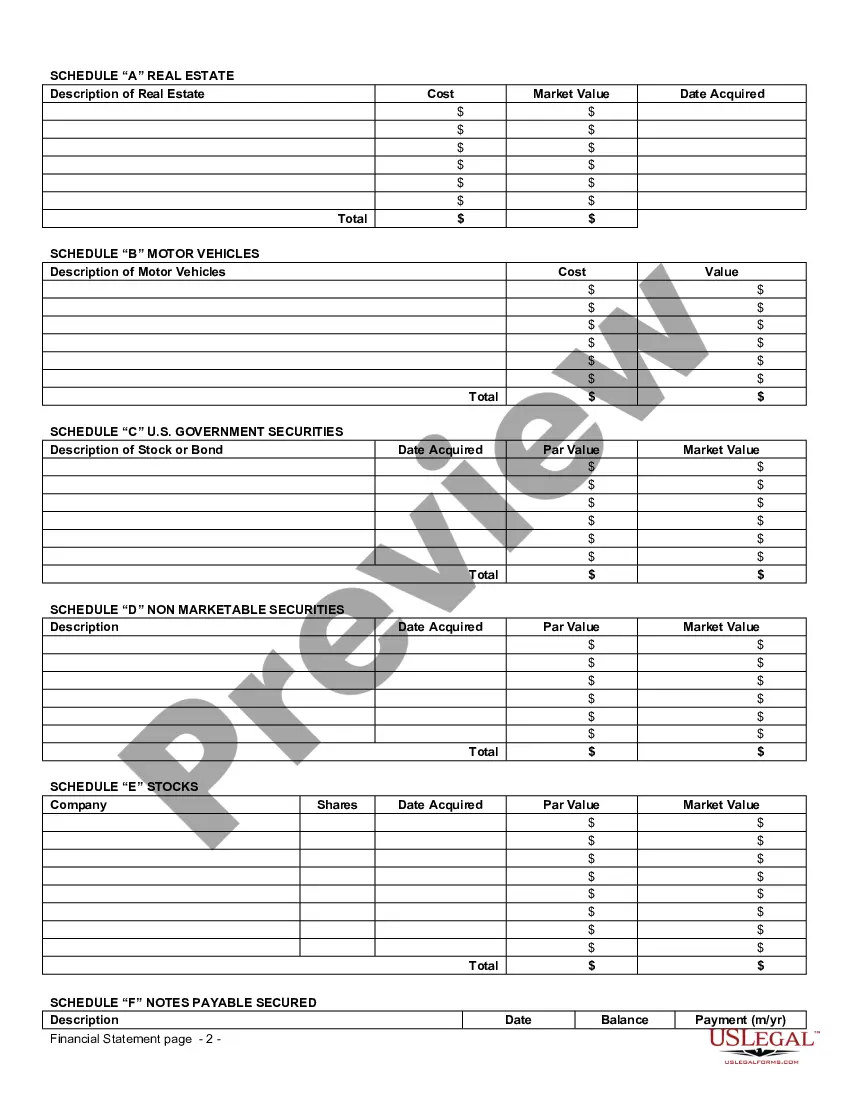

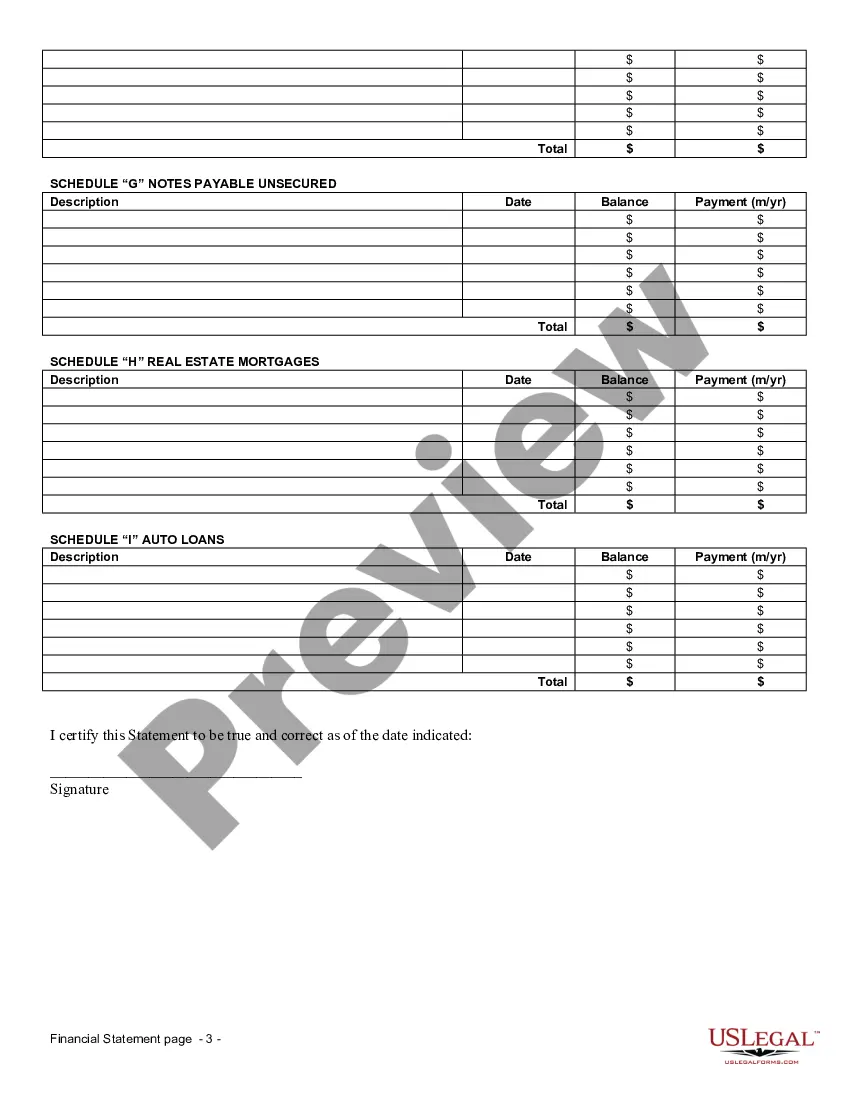

The financial statement of an individual is a comprehensive document that illustrates their financial position at a specific point in time. It showcases your assets, liabilities, and overall net worth, which is essential for personal financial planning. By using the Nebraska Financial Statement Form - Individual, you can effectively compile this information in a straightforward manner. This format not only helps document your finances but also serves as a vital reference.

Creating a personal financial statement involves compiling all relevant financial information, including income, expenses, assets, and liabilities. Start by collecting your financial records, then fill out the Nebraska Financial Statement Form - Individual, which guides you through the process. This structured approach can help you clarify your financial status and set future goals. Moreover, it can be a useful tool for securing loans or managing personal budgets.

To create a financial statement for an individual, start by gathering accurate records of your income and expenses. You can then list your assets and liabilities to provide a comprehensive view of your financial standing. Utilizing the Nebraska Financial Statement Form - Individual helps streamline this process, allowing you to fill in the necessary details efficiently. This form is especially useful for ensuring nothing important is overlooked.

Individual or separate financial statements are documents that detail an individual's financial position. They typically include information about income, expenses, assets, and liabilities. When preparing these documents, one can utilize the Nebraska Financial Statement Form - Individual to ensure all essential components are covered. This form simplifies the process, making it easier for you to present your financial situation.

Yes, form 1041 can indeed be filed electronically. This feature streamlines the process for estate and trust tax returns, making it smoother for you. When completing your Nebraska Financial Statement Form - Individual, consider using electronic options to facilitate timely and precise submissions.

Individuals typically use the IRS Form 1040 to file their federal taxes. Depending on your state residency, you may also need to complete a state-specific form, such as the 1040N for Nebraska. Understanding these forms is crucial for accurately preparing your Nebraska Financial Statement Form - Individual.

Generally, Illinois does allow for electronic filing of form IL 1041. Similar to Nebraska, this method can save time and reduce the risk of errors. When managing your Nebraska Financial Statement Form - Individual, it can be beneficial to stay informed about e-filing options across different states.

Yes, you can electronically file estate tax returns in Nebraska. Electronic filing is encouraged for its efficiency and reliability. Using the Nebraska Financial Statement Form - Individual in this manner can help expedite processing and ensure that your submissions are accurate.