Nebraska Reimbursement for Expenditures - Resolution Form - Corporate Resolutions

Description

How to fill out Reimbursement For Expenditures - Resolution Form - Corporate Resolutions?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By using the site, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Nebraska Reimbursement for Expenses - Resolution Form - Corporate Resolutions in just minutes.

If you already have a monthly subscription, Log In and retrieve the Nebraska Reimbursement for Expenses - Resolution Form - Corporate Resolutions from your US Legal Forms library. The Download option will appear on every form you view. You have access to all your previously saved forms in the My documents section of your account.

Proceed with the payment. Use your credit card or PayPal account to complete the transaction.

Find the format and download the form to your device. Make edits. Fill out, revise, print, and sign the saved Nebraska Reimbursement for Expenses - Resolution Form - Corporate Resolutions. Each template you added to your account has no expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Nebraska Reimbursement for Expenses - Resolution Form - Corporate Resolutions with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have selected the correct form for your city/state.

- Check the Review option to verify the content of the form.

- Browse the form description to ensure you have chosen the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

State tax generally refers to taxes levied on income, sales, or property within a state, while franchise tax is specific to the privilege of operating a business. In Nebraska, you focus on state taxes due to the absence of a franchise tax. Consequently, when you prepare your Nebraska Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, you only need to consider corporate income taxes and other state obligations.

No, Nebraska does not impose a franchise tax on corporations. This absence of a franchise tax can benefit businesses operating in the state, as they only need to focus on corporate income tax. For effective financial planning, leverage the Nebraska Reimbursement for Expenditures - Resolution Form - Corporate Resolutions to document any business expenses.

The Nebraska corporate tax rate is structured progressively. As of 2023, it ranges from 5.58% to 7.81% based on the taxable income of the corporation. Understanding this tax rate is crucial when filing your Nebraska Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, as it impacts your overall financial obligations.

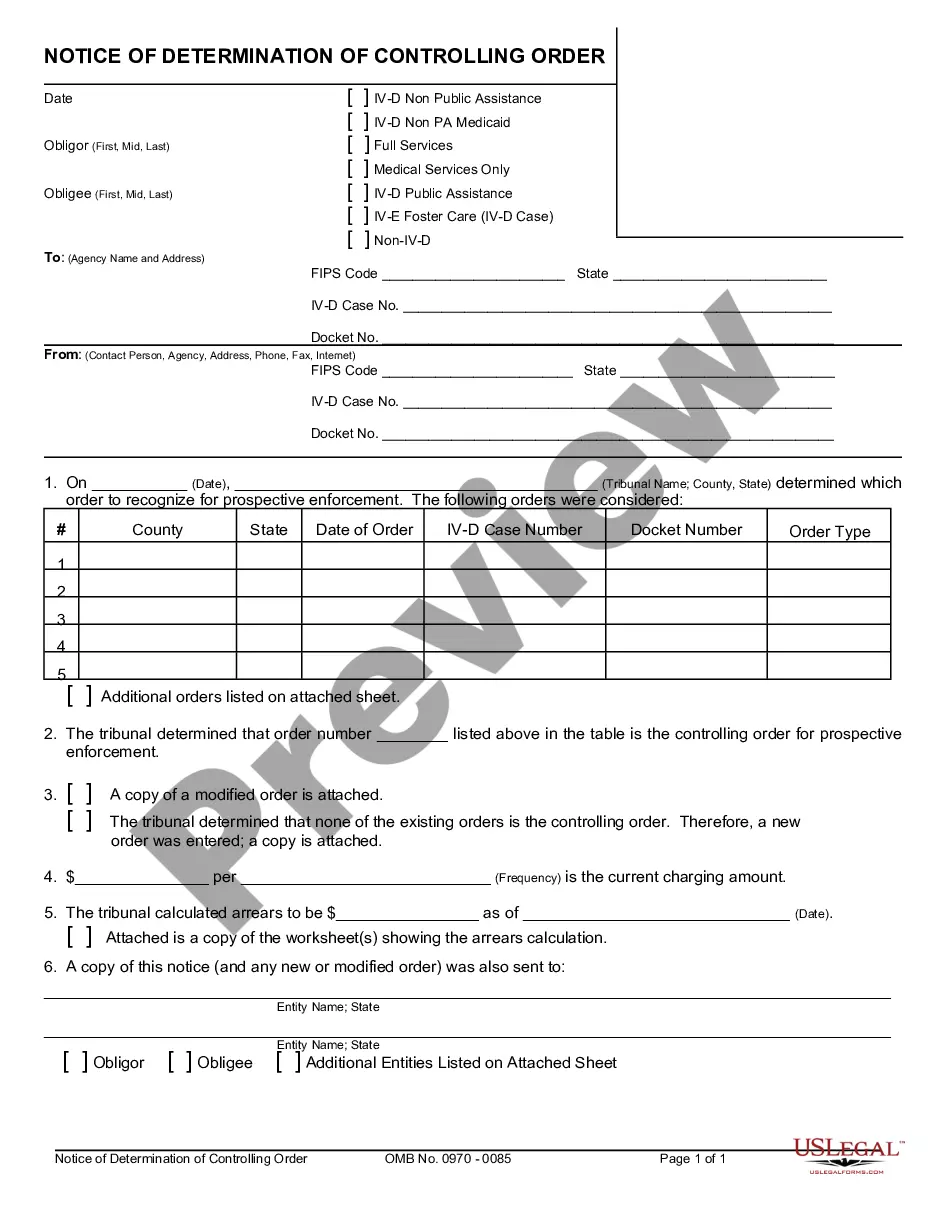

To process a reimbursement claim, first gather all completed Nebraska Reimbursement for Expenditures - Resolution Forms - Corporate Resolutions submitted. Check for accuracy, including all required signatures and attached documentation. Once validated, submit them for approval to your accounting team to ensure timely reimbursement.

For a successful reimbursement process, collect relevant documentation that includes receipts, invoices, and any additional proof of payment. Each Nebraska Reimbursement for Expenditures - Resolution Form - Corporate Resolutions should accompany this documentation. These materials provide the necessary evidence to substantiate your claims.

Filling out an expense reimbursement form requires attention to detail. Begin with your personal information and the date, then itemize each expense on the Nebraska Reimbursement for Expenditures - Resolution Form - Corporate Resolutions. Make sure to include amounts, descriptions, and attach all supporting documents for faster processing.

To efficiently process reimbursement forms, start by reviewing each Nebraska Reimbursement for Expenditures - Resolution Form - Corporate Resolutions for completeness. Confirm that all expenses are legitimate and supported by valid documentation. After validation, submit the approved forms to the designated accounting personnel for reimbursement disbursement.

Processing reimbursement forms begins with collecting all submitted Nebraska Reimbursement for Expenditures - Resolution Forms - Corporate Resolutions. Verify that each form has been properly filled out and signed. Then, cross-check the attached documentation and forward the forms to your finance department for approval.

To complete a Nebraska Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, start by clearly entering your name and the date. Next, list each expense with corresponding details, such as the amount and the purpose. Ensure you attach any necessary receipts or documentation to support your claim.