New Hampshire Benchmarking Considerations

Description

How to fill out Benchmarking Considerations?

Are you in a situation where you frequently require paperwork for either organizational or specific purposes almost daily.

Numerous official document templates are accessible online, but finding trustworthy ones can be challenging.

US Legal Forms offers a vast array of document templates, including the New Hampshire Benchmarking Considerations, designed to comply with federal and state regulations.

Once you find the correct document, click Acquire now.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the New Hampshire Benchmarking Considerations template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Obtain the necessary document ensuring it is for the correct city/region.

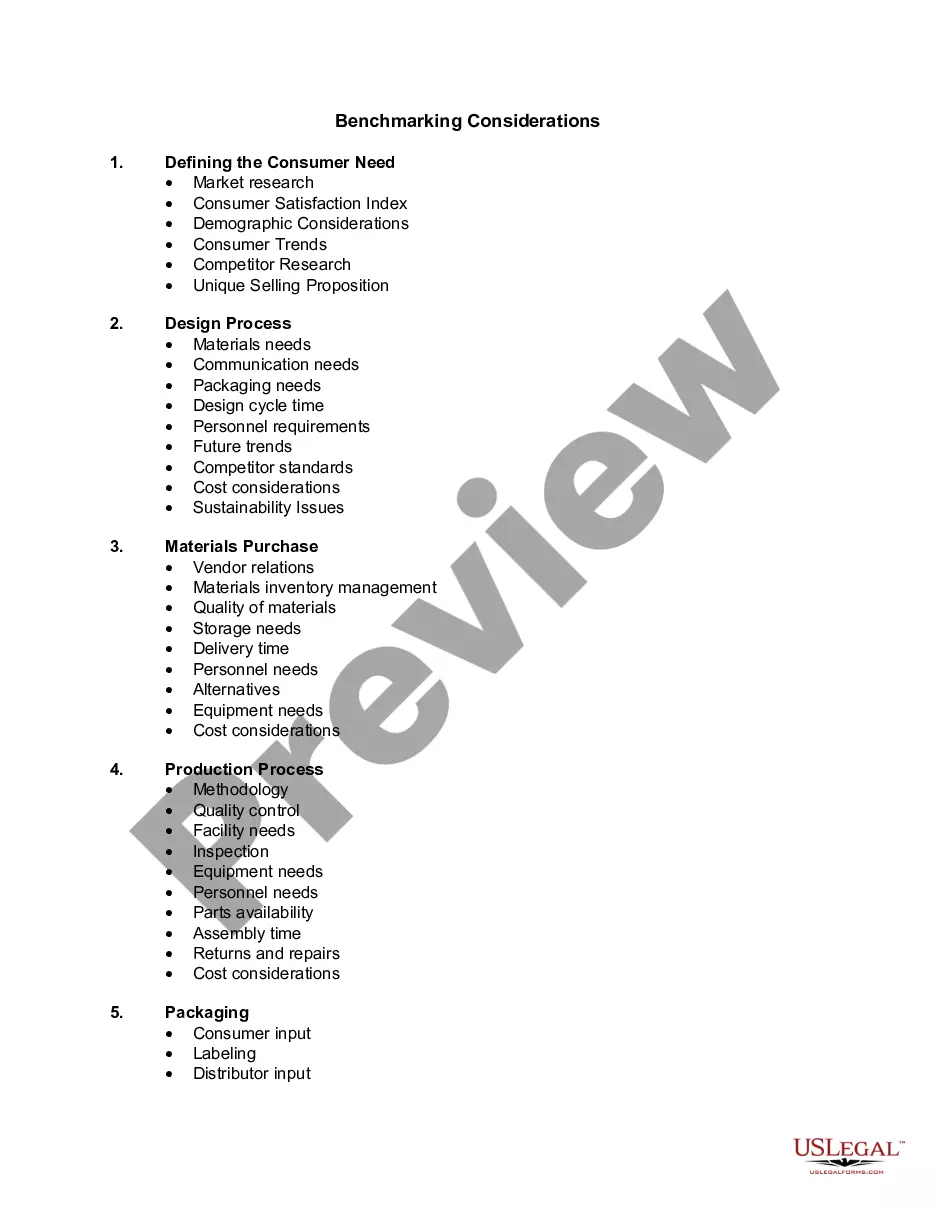

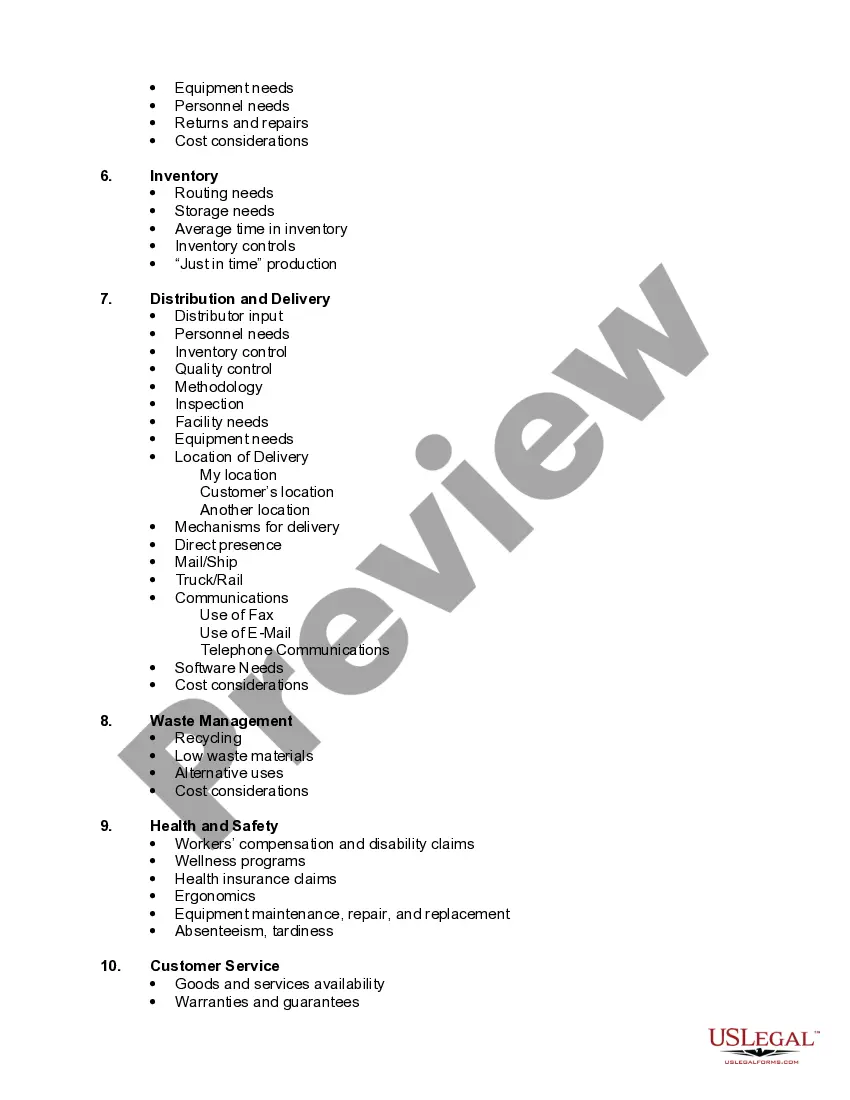

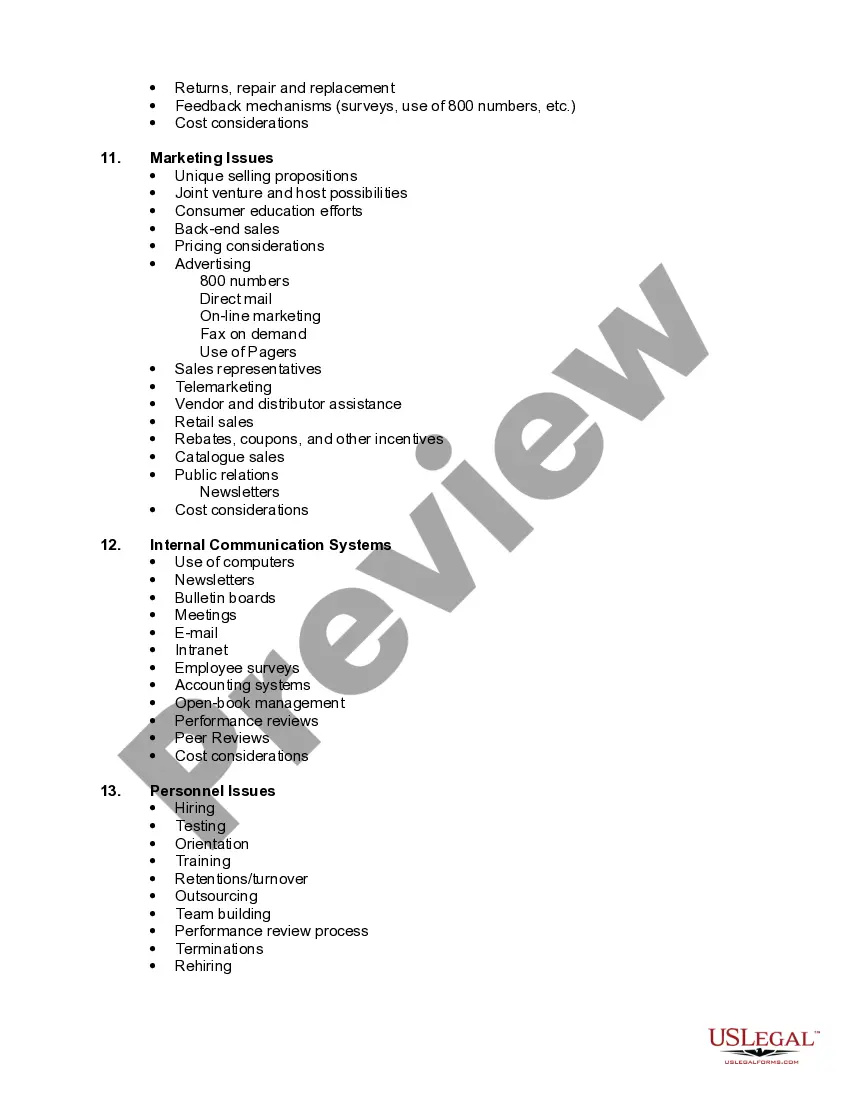

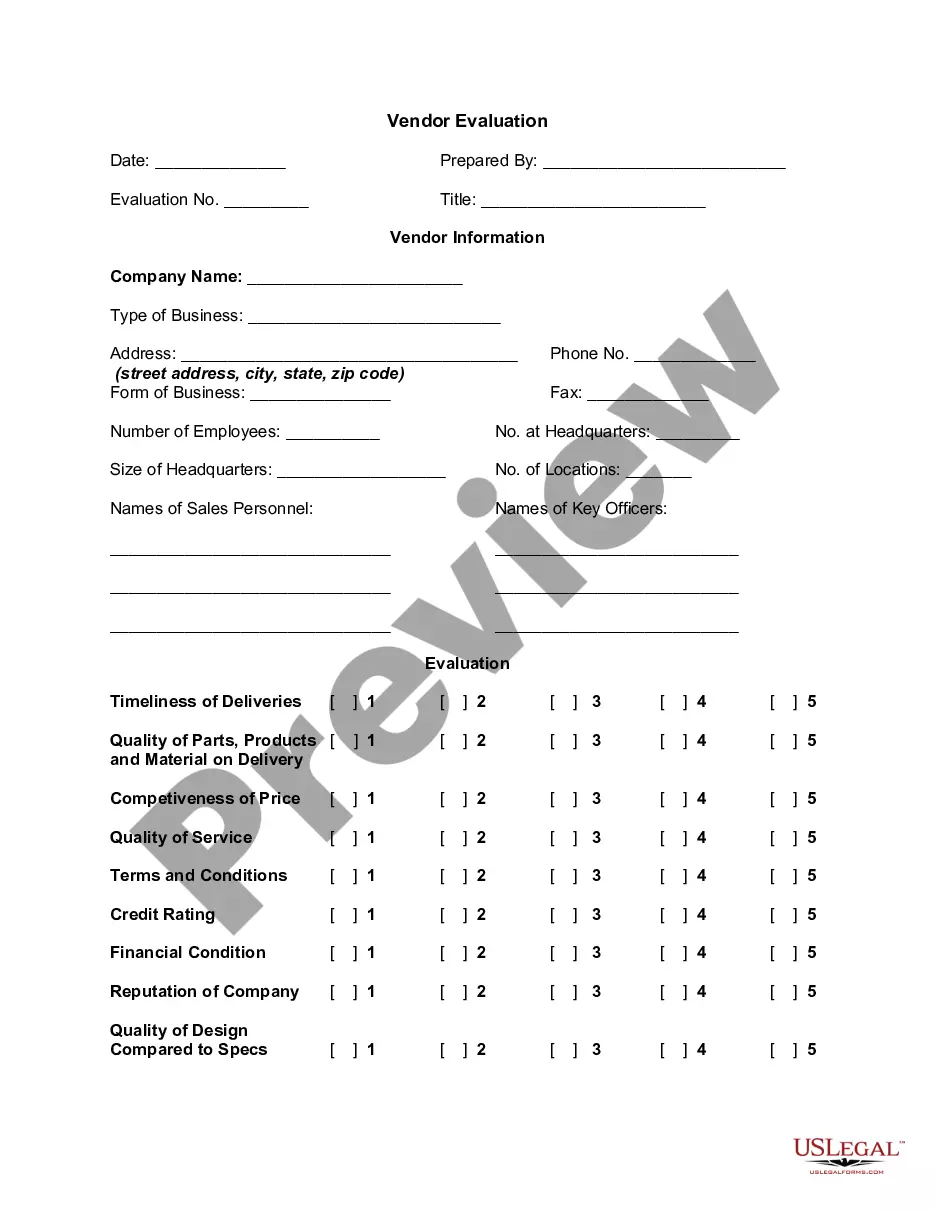

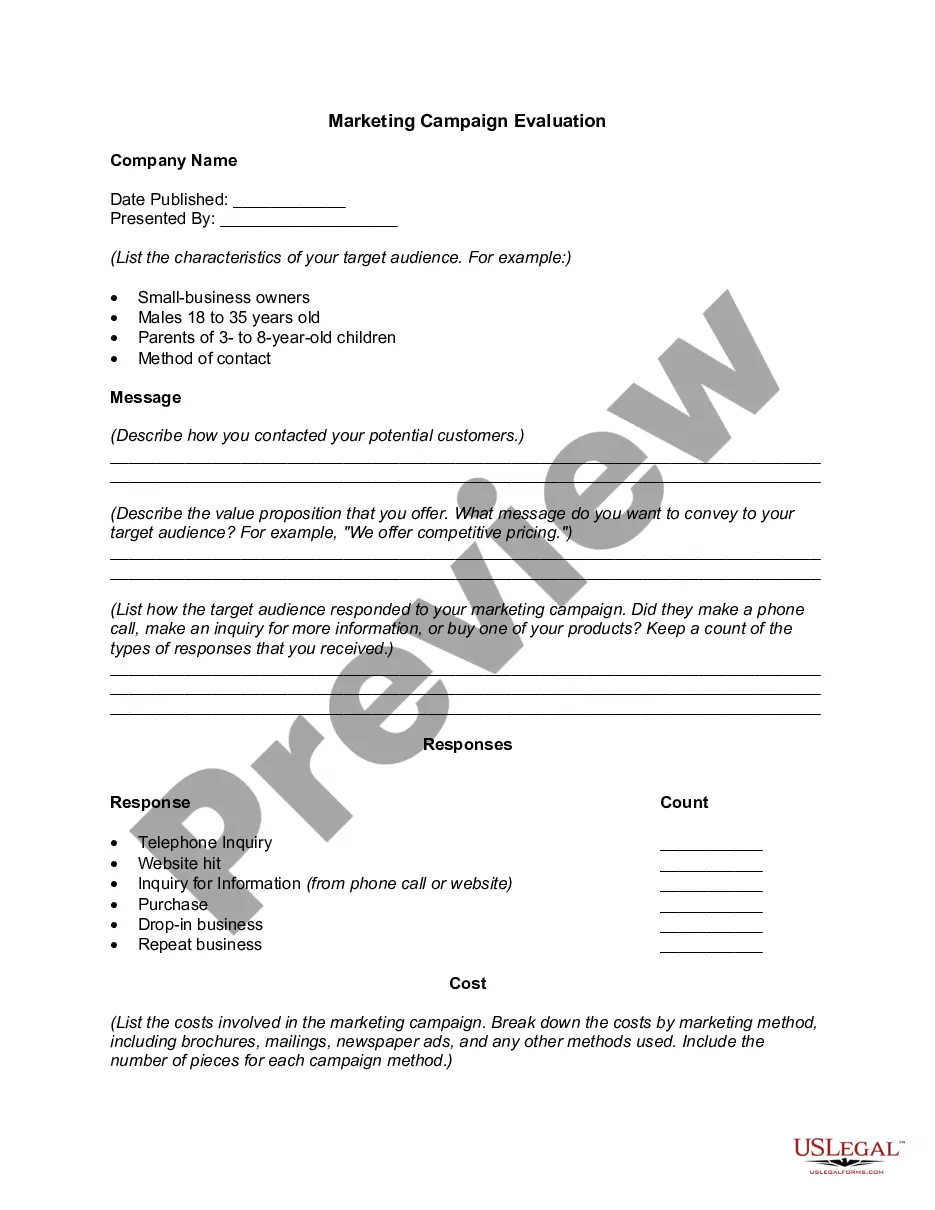

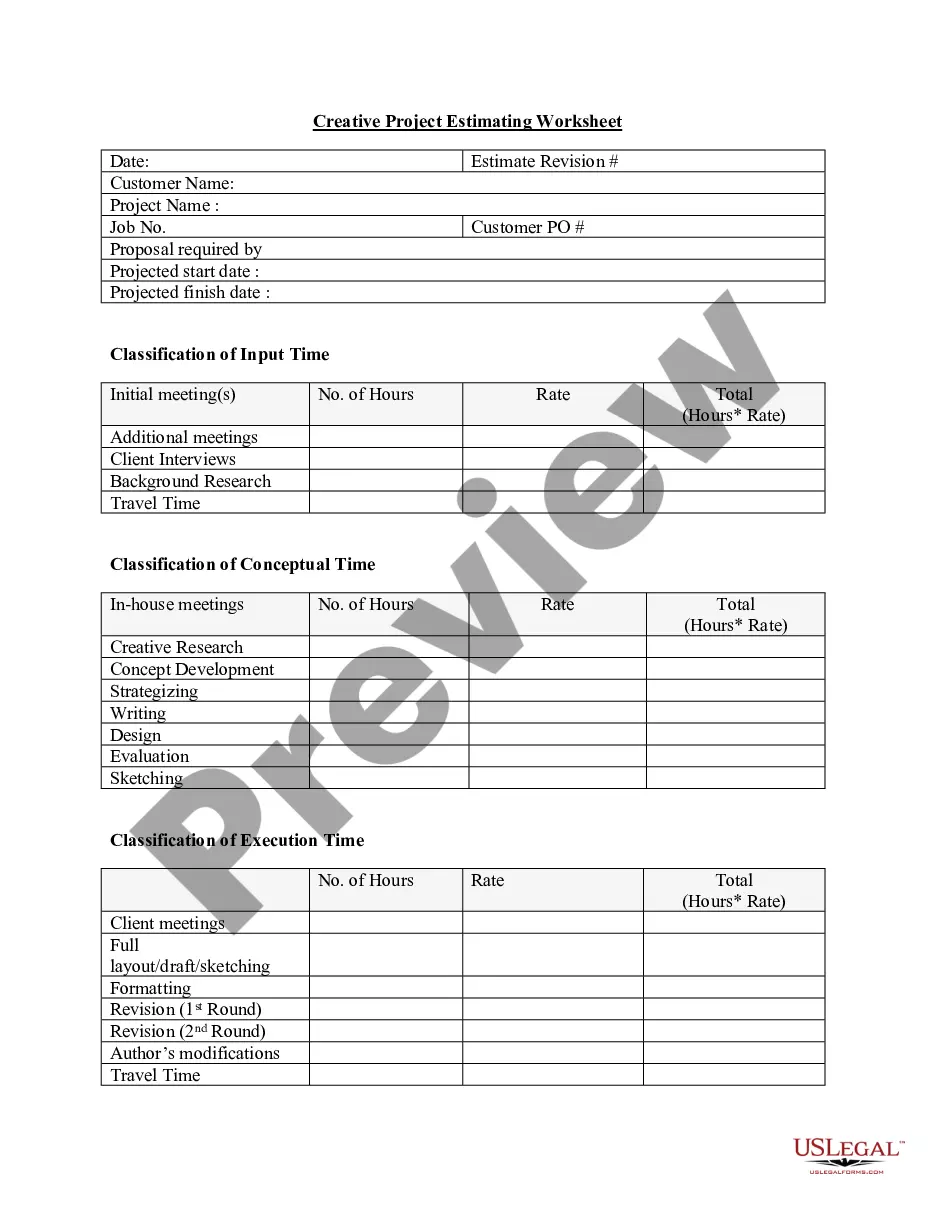

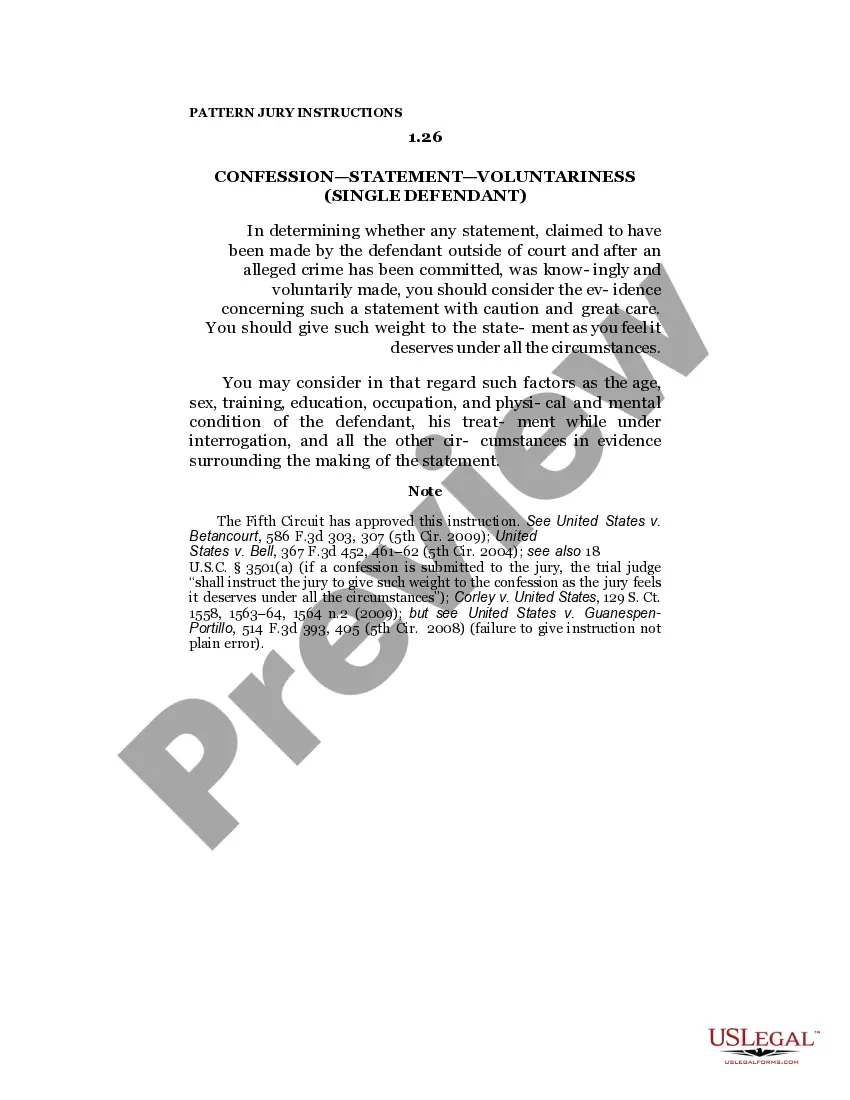

- Utilize the Review button to examine the form.

- Review the outline to confirm you have chosen the appropriate document.

- If the document does not meet your needs, use the Search feature to find a template that fits your needs and requirements.

Form popularity

FAQ

Benchmarking policy refers to the framework and guidelines that organizations follow to assess and improve their performance through benchmarking processes. This policy outlines what metrics to measure, how to compare those metrics, and how to implement changes based on the findings. For those considering New Hampshire Benchmarking Considerations, establishing a robust benchmarking policy is crucial to ensure ongoing improvements and compliance with local standards.

Finding benchmarking involves collecting data on your organization's performance and comparing it against industry standards or competitors. You can utilize online tools and databases to access relevant information. In the context of New Hampshire Benchmarking Considerations, platforms like U.S. Legal Forms can help you find templates and guidance on how to conduct effective benchmarking, ensuring compliance and promoting best practices.

The NYC benchmarking Ordinance mandates that certain buildings track and report their energy and water usage annually. This initiative aims to promote sustainability and energy efficiency. If you're exploring New Hampshire Benchmarking Considerations, you should note that similar regulations may emerge at the state level, emphasizing the importance of adhering to local guidelines for energy management.

Benchmarking, in simple terms, involves comparing your business's performance metrics with those of similar businesses. It helps you identify strong and weak points by evaluating data like energy usage or financial performance. When considering New Hampshire Benchmarking Considerations, you are assessing how your local practices stack up against established standards. This process can offer valuable insights and lead to improvements.

To determine if you need to file taxes, consider your income sources, amount earned, and New Hampshire's specific tax regulations. Resources like uslegalforms can assist you in assessing your obligations. These evaluations are central to your New Hampshire Benchmarking Considerations.

Even if you earned $5,000, your filing requirement depends on the source of that income. If it includes interest or dividends, you likely need to file. Evaluating your situation through the lens of New Hampshire Benchmarking Considerations can help clarify your tax obligations.

Yes, you can file the NH DP-10 online, making it a convenient option for businesses. The online platform streamlines the filing process and reduces paperwork. Using platforms like uslegalforms can simplify your experience and support you in meeting your New Hampshire Benchmarking Considerations.

If you have income that falls under New Hampshire's tax laws, then you must file a return. Even if your income appears minimal, compliance is vital to avoid penalties. Keep the New Hampshire Benchmarking Considerations in mind to determine your specific filing requirements.

In New Hampshire, taxable income primarily includes interest and dividends, as well as business income for corporations. Wage income is not subject to state tax, which is an important aspect of New Hampshire's tax structure. When assessing your situation, remember the New Hampshire Benchmarking Considerations for understanding this unique tax landscape.

Any corporation doing business in New Hampshire or earning income from New Hampshire sources must file the NH 1120 form. This includes local corporations and foreign corporations operating in the state. Knowing your requirements is one of the key New Hampshire Benchmarking Considerations for maintaining your business standing.