Nebraska Demand for Collateral by Creditor

Description

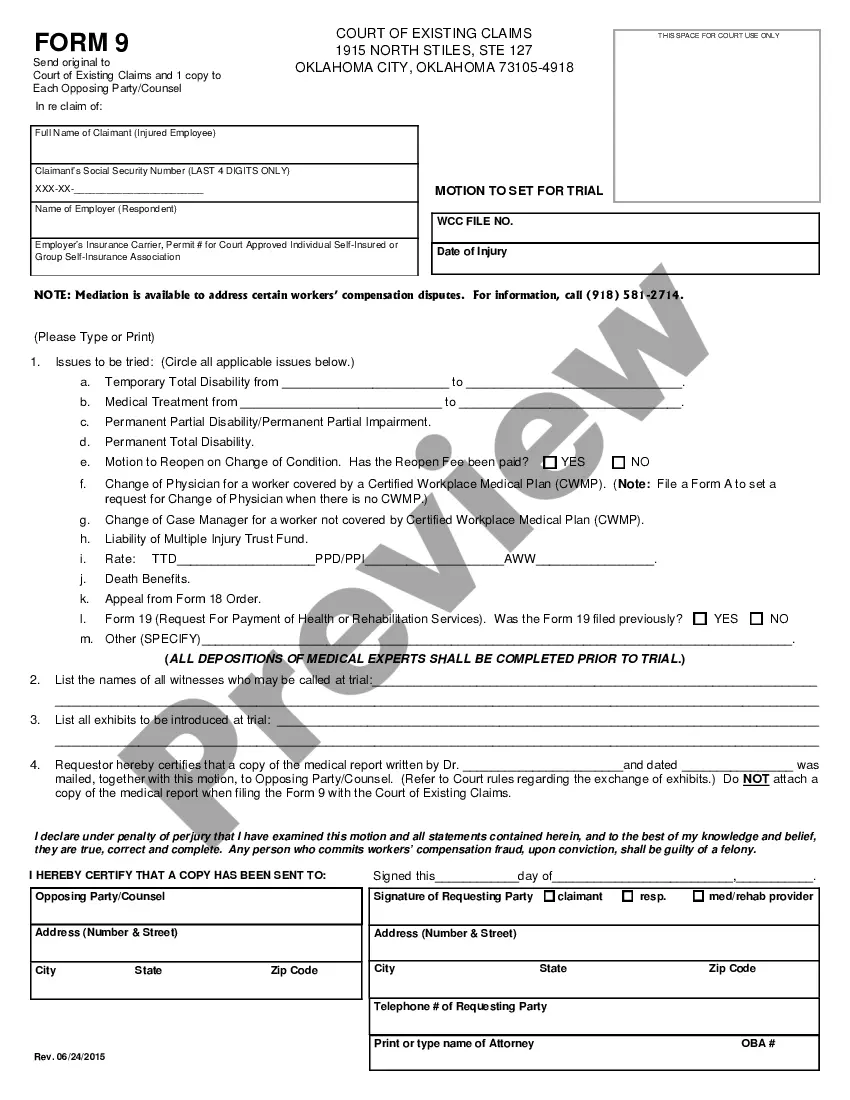

How to fill out Demand For Collateral By Creditor?

You can spend multiple hours online searching for the legal document template that complies with the federal and state regulations you need.

US Legal Forms provides an extensive collection of legal documents that are reviewed by experts.

You can easily obtain or print the Nebraska Demand for Collateral by Creditor from their services.

If available, use the Review option to take a look at the document template as well.

- If you already have a US Legal Forms account, you can Log In and then select the Acquire option.

- Next, you can complete, edit, print, or sign the Nebraska Demand for Collateral by Creditor.

- Every legal document template you obtain is yours indefinitely.

- To get another copy of the purchased form, visit the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, confirm that you have chosen the correct document template for the county/town of your choice.

- Review the form details to ensure you have selected the correct document.

Form popularity

FAQ

Yes, Nebraska allows debtors the right to cure their defaults. This means that if you are behind on payments, you can rectify the situation before any severe action is taken against you. By addressing the issue promptly, you may prevent a creditor from filing a Nebraska Demand for Collateral by Creditor. It's essential to stay informed about your rights and explore solutions tailored to your circumstances.

In Nebraska, not paying a judgment does not typically result in jail time. However, a creditor can take further legal action if you ignore the judgment. They may file a Nebraska Demand for Collateral by Creditor, which could lead to collection efforts against your assets. Understanding your options and responsibilities is important, and seeking guidance can help you navigate this situation effectively.

Yes, there is a time limit on claims for breach of contract, which varies depending on the nature of the contract. In Nebraska, the statute of limitations is typically five years for written contracts. This time frame is crucial to keep in mind when dealing with any Nebraska Demand for Collateral by Creditor, as delays can lead to forfeiting your right to claim.

Suing for breach of contract can be challenging but is often feasible if you have sufficient evidence to support your claim. Clearly outlining the terms of the contract and demonstrating the breach is essential. If you are facing a Nebraska Demand for Collateral by Creditor, consider reaching out for professional help to strengthen your case.

The statute of limitations for breach of contract in Nebraska is generally five years. This means you typically have five years from the date of the breach to file a lawsuit. Knowing this can be crucial if you are dealing with a Nebraska Demand for Collateral by Creditor, as timely action can protect your interests.

In Nebraska, a judgment is generally valid for five years from the date it is entered. After this period, the creditor may need to renew the judgment to enforce it. Understanding the timelines associated with a Nebraska Demand for Collateral by Creditor can help you manage your debts effectively.

The Fair Debt Collection Practices Act protects consumers from abusive debt collection practices in Nebraska and throughout the United States. It sets regulations on how debt collectors can communicate with you and prohibits practices like harassment and misrepresentation. Being aware of this act is essential when responding to a Nebraska Demand for Collateral by Creditor.

For a creditor to establish an enforceable security interest in Nebraska, they must have a written agreement, the debtor must have rights in the collateral, and the creditor must take possession of the collateral or perfect their interest. This process is vital in understanding the Nebraska Demand for Collateral by Creditor, as it defines a creditor's rights regarding secured debts.

Debts in Nebraska have a collection period of up to five years, which begins from the date of your last payment or acknowledgment of the debt. After this period, creditors can no longer pursue legal action to collect the debt. It is crucial to understand this period when faced with a Nebraska Demand for Collateral by Creditor.

Typically, a 10-year-old debt cannot be legally collected in Nebraska due to the statute of limitations. Creditors lose their right to sue for collection after five years. Knowing this timeframe is useful when dealing with a Nebraska Demand for Collateral by Creditor, as it reinforces the importance of timely responses to debt claims.