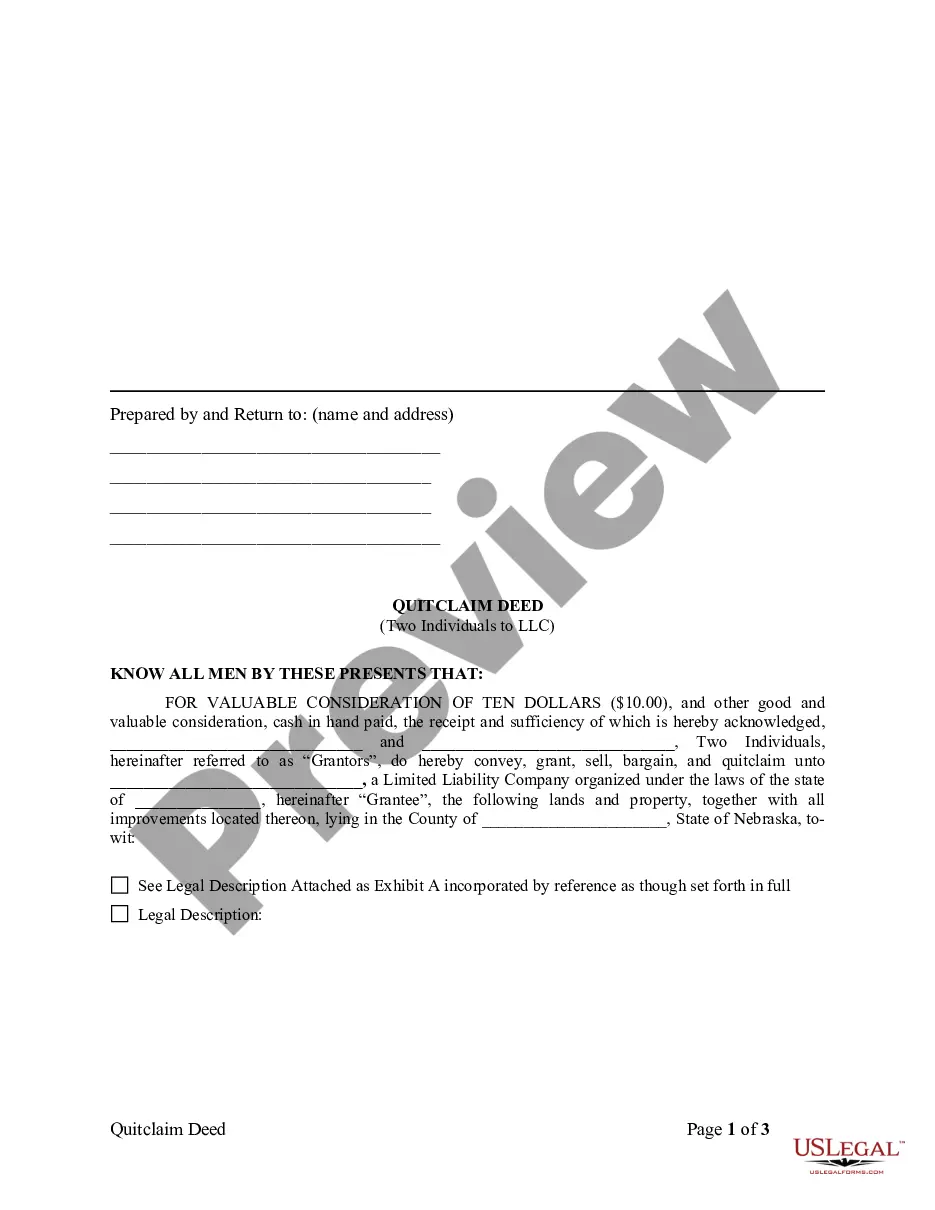

Nebraska Quitclaim Deed by Two Individuals to LLC

Understanding this form

A Quitclaim Deed by Two Individuals to LLC is a legal document that allows two individuals (the Grantors) to transfer ownership of a property to a limited liability company (Grantee). Unlike other types of deeds, a quitclaim deed does not guarantee that the title is free from claims. This form specifically conveys the property while reserving certain rights, such as oil, gas, and mineral rights if applicable. It is important for situations where the Grantors want to relinquish their interest in the property without warranty to the LLC.

Form components explained

- Prepared By and Return To section for indicating the responsible party's name and address

- Identification of the Grantors (two individuals transferring the property)

- Identification of the Grantee (the limited liability company receiving the property)

- Description of the property being transferred

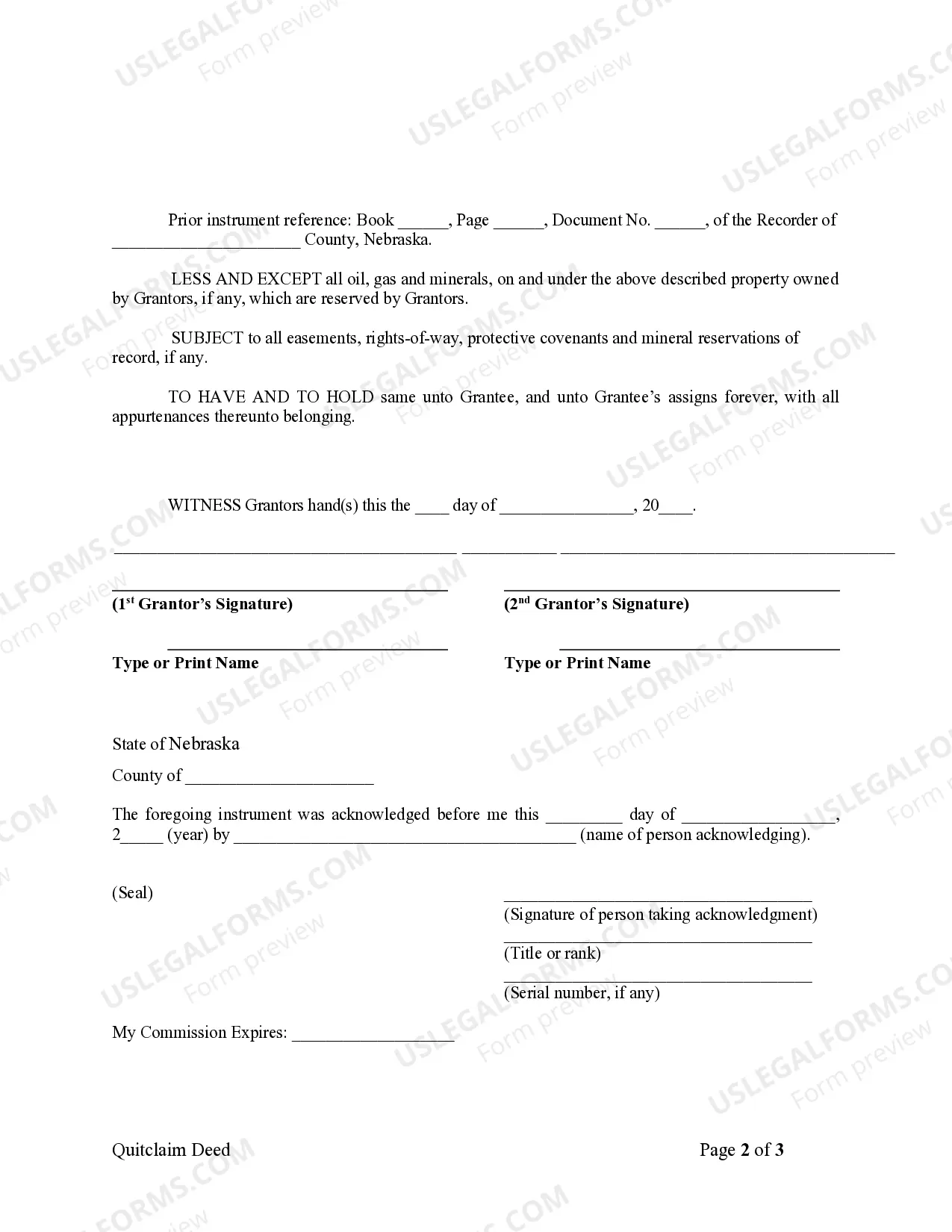

- Reservation clause for oil, gas, and minerals, if applicable

- Notary Public signature requirements for validation

State law considerations

This Quitclaim Deed complies with Nebraska state statutory laws, ensuring that it meets all legal requirements for property transfers within the state.

Common use cases

This form is used when two individuals want to transfer property ownership to an LLC. It is particularly useful in real estate transactions where the Grantors prefer a quick and straightforward method to convey their interest, especially in cases involving family trusts, partnerships, or business entities that operate as LLCs.

Who should use this form

This form is intended for:

- Individuals who jointly own a property and wish to transfer it to their limited liability company

- Members of an LLC looking to consolidate property ownership within their business structure

- Real estate professionals facilitating transactions involving multiple individuals transferring property to an LLC

Completing this form step by step

- Identify and enter the names of the Grantors (the individuals transferring the property).

- Specify the name of the Grantee (the LLC receiving the property).

- Provide a clear and accurate description of the property being transferred.

- Include any reservations for oil, gas, or mineral rights if applicable.

- Sign the document in the presence of a Notary Public for validation.

Does this document require notarization?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Common mistakes to avoid

- Failing to properly identify the Grantors and Grantee, which could lead to errors in ownership transfer.

- Not including a clear property description, which is essential for legal clarity.

- Overlooking the need for notarization, making the deed potentially invalid.

Why complete this form online

- Convenience of downloading and completing the form at your own pace.

- Editability allows for easy adjustments before finalizing the document.

- Reliability from using a template drafted by licensed attorneys, ensuring compliance with legal standards.

Form popularity

FAQ

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Laws NRS 23-1510. Recording Must be filed in the County Recorder's Office where the property is located (See County List). Signing (NRS 76-211) All quit claim deeds must be signed with the Grantor(s) being acknowledged by a Notary Public.