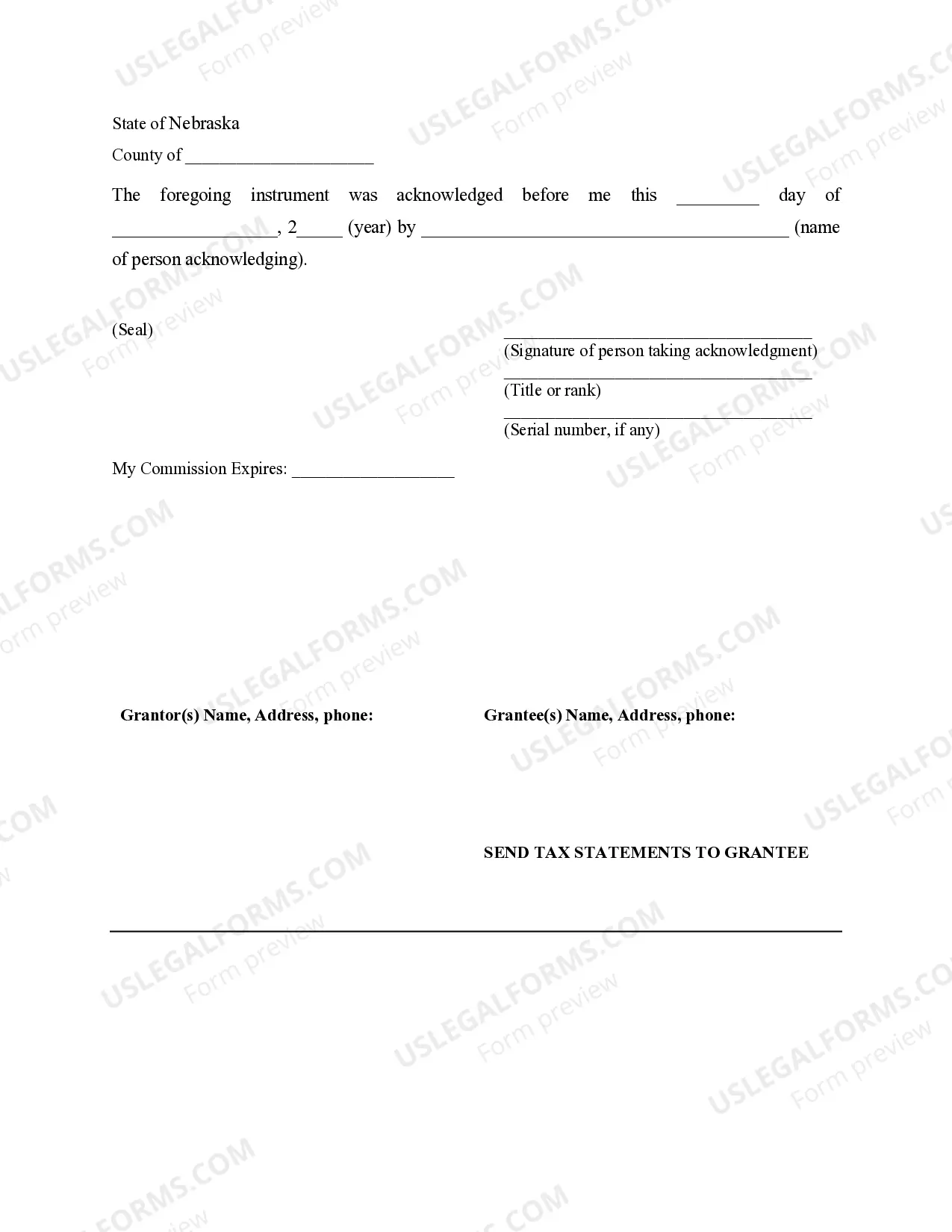

This form is a Quitclaim Deed where the Grantors are Husband and Wife, or two Individuals, and the Grantee is a Trust. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Nebraska Warranty Deed to Child Reserving a Life Estate in the Parents

Description

How to fill out Nebraska Warranty Deed To Child Reserving A Life Estate In The Parents?

Avoid costly lawyers and find the Nebraska Warranty Deed to Child Reserving a Life Estate in the Parents you need at a reasonable price on the US Legal Forms website. Use our simple groups function to find and obtain legal and tax files. Read their descriptions and preview them just before downloading. In addition, US Legal Forms provides customers with step-by-step instructions on how to download and fill out every single form.

US Legal Forms subscribers merely need to log in and obtain the particular document they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to stick to the tips listed below:

- Make sure the Nebraska Warranty Deed to Child Reserving a Life Estate in the Parents is eligible for use where you live.

- If available, look through the description and make use of the Preview option prior to downloading the sample.

- If you are sure the template suits you, click Buy Now.

- In case the form is wrong, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the form to the device or print it out.

After downloading, you are able to complete the Nebraska Warranty Deed to Child Reserving a Life Estate in the Parents by hand or with the help of an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

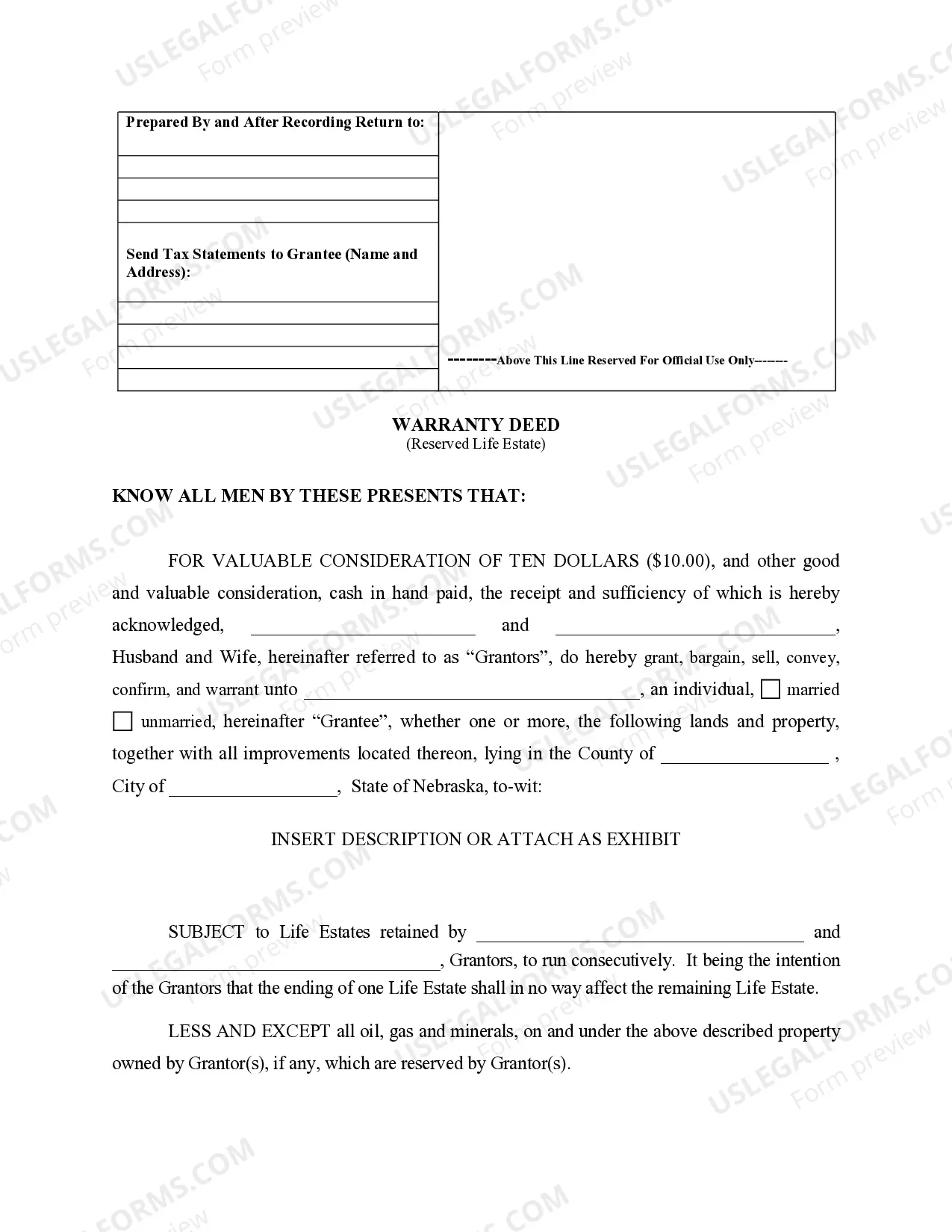

Owners of real estate sometimes transfer such property to their children while retaining the right to live in the property for the rest of their lives.

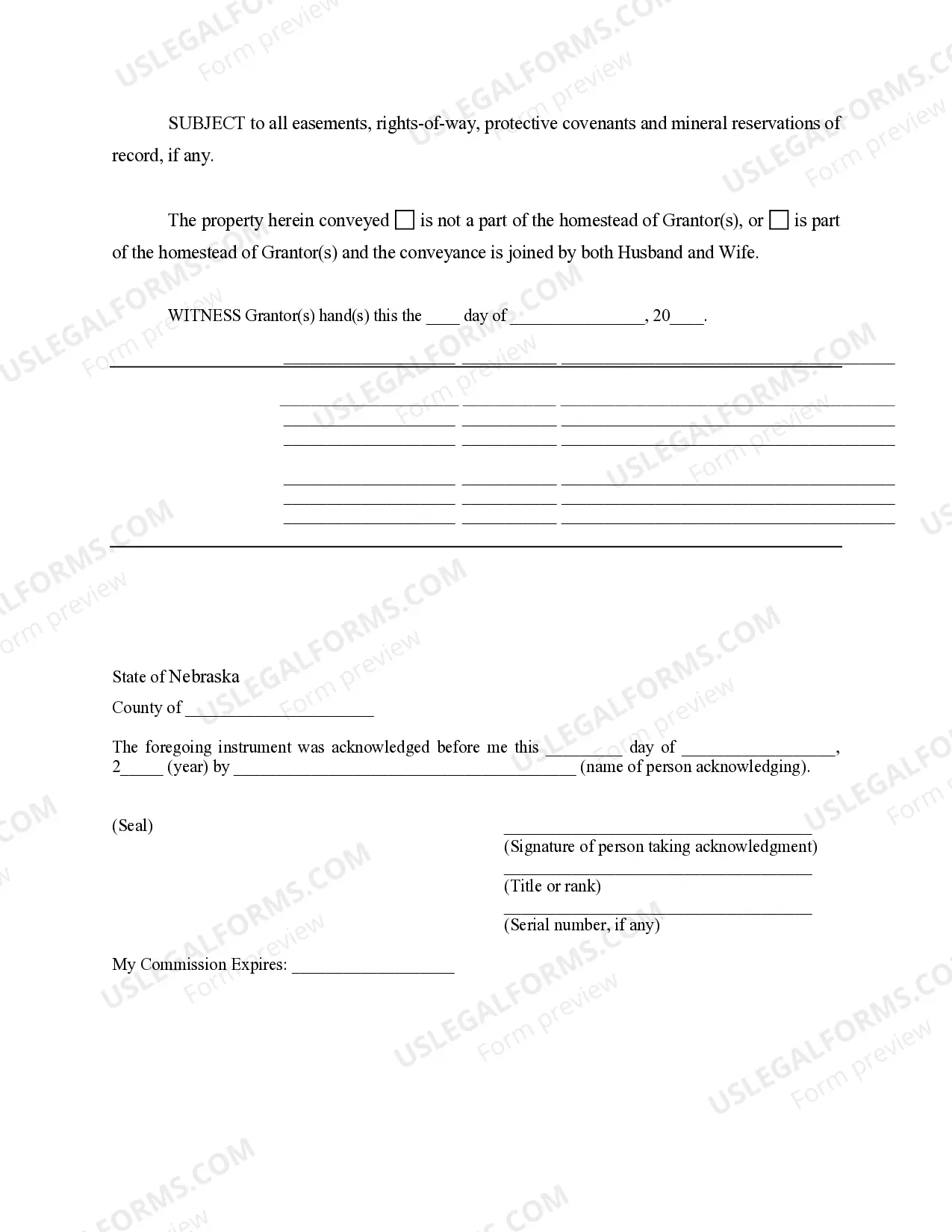

To accomplish this, you need to have the life estate deed that shows you have the right to own the property after the life estate holder dies. Using the information in this deed, along with the deceased's death certificate, you can prepare and record the required title transfer document to clear title.

Borrowing Against Life Estate If your property is owned by a life estate, you can still borrow against the property. However, you may face additional hurdles at the lender. First, bring in the appropriate documents establishing the life estate, such as your will or the deed to the property.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

Can a life estate deed be contested? The answer is YES! The Life estate is an agreeable choice, particularly where there is an advantage in having the life estate revert back to its real owner (Grantor or Life Tenant).

A California Revocable Transfer-On-Death Deed does not take effect until the property owner dies.As long as the original owner is alive, he can revoke the transfer, sell the property, add or remove beneficiaries, and otherwise maintain complete control over the property.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

Remainderman Rights and Life Estates Typically, the deed will state that the occupant of property is allowed to use it for the duration of their life. Almost all deeds creating a life estate will also name a remaindermanthe person or persons who get the property when the life tenant dies.

A remainderman may sell his interest in the property, but the buyer would take the property subject to the rights of life tenant.If the life tenant and the remainderman both agree and sign transfer documents, the property can be sold before the life tenant dies.